How Much Mortgage Can I Afford? Know Your Affordability

If you're going to buy a new property, you must be curious about "How Much Mortgage Can I Afford?". When it comes to determining mortgage affordability, there are various factors that will affect it. Moreover, you might don't know some related terms and how to calculate how large of a mortgage you can afford. Just take it easy. This guide will walk you through all of this. Better yet, you want to look for local loan officers on MyMortgageRates.

Things to Know How Much Mortgage You Can Afford

Understanding your mortgage affordability is crucial before starting your home search. Your financial picture determines how much you can borrow and what monthly payment fits your budget. Lenders evaluate multiple factors, including your income, existing debts, credit score, and available funds for down payment and closing costs.

The key is finding a balance between qualifying for the loan amount you want while maintaining comfortable monthly payments. Many lenders and advisers use simple percentage-based rules (see 28/36 rule below) as a starting point to avoid overextending, but final underwriting is based on documented income, credit, assets, and DTI.

What is the 28/36 Rule?

The 28/36 rule is a conservative budgeting guideline: aim to spend no more than 28% of your gross monthly income on housing costs. That being said, it's PITI, including principal, interest, property taxes, and insurance. Also, no more than 36% of gross income on total debt obligations, which means housing and other monthly debt, such as car loans, student loans, and credit cards. Many lenders use similar front-end/back-end ratios when evaluating affordability, although specific program limits vary.

Total Homeownership Costs

Homeownership includes more than the mortgage payment. Budget for property taxes, homeowners' insurance, maintenance, utilities, and possible HOA fees. A common rule-of-thumb is to set aside about 1% of a home's purchase price per year for routine maintenance. Some advisors use 1%--2% based on age and condition. Closing costs and taxes also add upfront expenses. Plan for those as well.

Terms to Understand First

Before we go any further, there are some special mortgage terms for newbie to grasp ideas. Let's take a look.

Debt-to-Income Ratio (DTI)

Debt-to-income (DTI) is the ratio of your monthly debt payments to gross monthly income. For many conventional "general qualified mortgages," regulators and lenders historically used a 43% DTI cap as an important benchmark. However, underwriting can vary by program and lender. Lower DTI improves approval chances and access to better pricing.

Annual Household Income

Annual household income is all regular pre-tax income, including salaries, wages, bonuses, stable rental income, etc. Lenders verify income with pay stubs, W-2s, and tax returns. Self-employed borrowers usually must supply profit & loss statements and business tax returns to document stable earnings. Documentation rules vary by program.

Monthly Debt

Monthly debt includes contractual payments: minimum credit-card payments, auto loans, student loans, child support, and other installment debts. Lenders typically do not include utilities or groceries in DTI, they focus on contractual, recurring debt obligations.

Available Funds

Available funds mean cash you can document for down payment, closing costs, and reserves. Lenders will verify source, like savings, checking, gift funds, etc., and may require seasoning or documentation for large transfers.

Down Payment

Down payments vary by program. Here's some reference for you.

- FHA loans: Minimum 3.5% for borrowers with qualifying credit.

- Conventional (Fannie/Freddie) programs: Some products allow as low as 3% down for eligible borrowers.

- Others require higher down payments for the best pricing. Larger down payments reduce or eliminate PMI and lower monthly P&I.

Closing Costs

Closing costs are one-time fees tied to the transaction and typically range from about 2% to 5% or sometimes up to ~6% of the loan/purchase price, depending on state and lender, according to Fannie Mae. These include appraisal, title insurance, recording fees, lender fees and escrow items. Some fees can be negotiated or seller-paid. Rolling closing costs into the loan increases the loan balance and the monthly payment.

Credit Score

A credit score affects approval and pricing. For many conventional loans, lenders commonly look for 620+ as a baseline. Better pricing and lower rates are available with higher scores, for exapmle, 700+. Government programs (FHA, VA, USDA) have different credit and underwriting flexibilities. Always check program-specific minimums with your lender.

Mortgage Rates

Mortgage rates move with market conditions, loan term, credit, and loan program. Small differences in rate materially change monthly payment and total interest. Shop multiple lenders and consider locking once you have an acceptable rate. Rate lock rules and periods vary by lender.

Monthly Mortgage Payment

Monthly payment typically equals Principal + Interest + Taxes + Insurance (PITI). Additional items may include PMI if the down payment < 20% and HOA dues. Taxes/insurance can change over time and affect monthly escrowed payments.

Annual Property Tax

Property taxes are set locally and vary widely by jurisdiction and assessed value. These are recurring costs that should be included in affordability planning. Local tax rates and reassessments can materially change annual housing costs.

APR (%)

APR (Annual Percentage Rate) is a standardized measure that includes the interest rate plus certain loan fees to show a broader cost of credit. It helps compare loan offers more fairly than the nominal interest rate alone. Truth-in-Lending rules define how APR is calculated and disclosed.

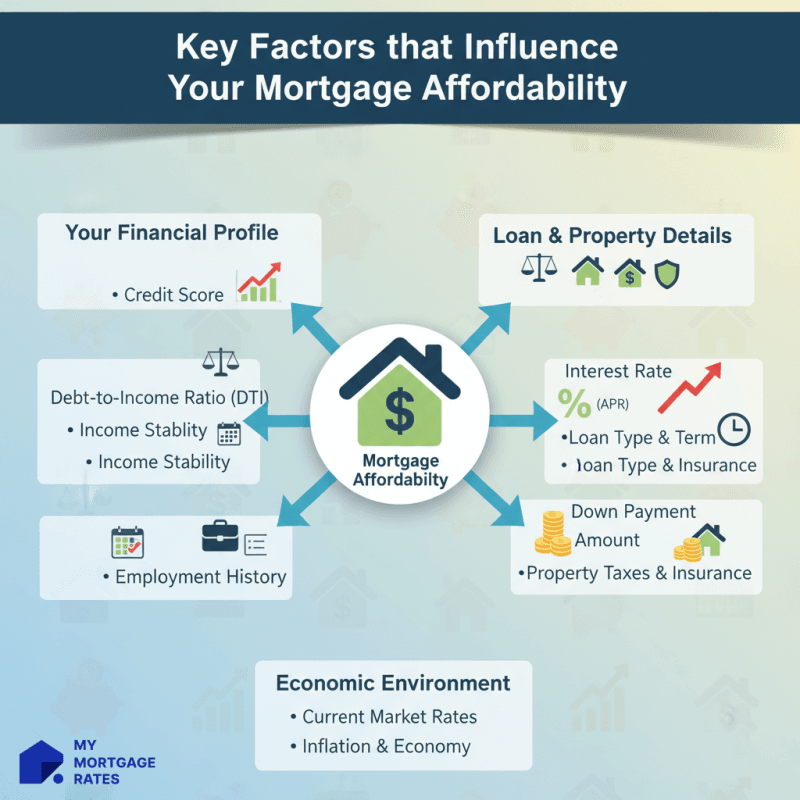

Key Factors that Influence Your Mortgage Affordability

Employment stability, consistent documented income, credit profile, type of loan program such as conventional, FHA, VA, USDA, local home prices/taxes, reserves, and current interest rates all influence purchasing power. Debt mix and payment history matter too. Lenders look beyond raw dollar totals to how reliable and stable your payments are. Finally, some programs allow compensating factors. Higher reserves and larger down payments, which can help those who otherwise marginally qualify.

How to Calculate How Much Mortgage You Can Afford

To calculate mortgage affordability. There are various ways to do the math. You can either use a simple formula or estimate it with an online house affordability calculator.

Method 1. Formula to Estimate How Much You Can Afford

Here's a simple method to determine mortgage affordability. You can compute gross monthly income × 0.28 = target maximum housing payment (PITI). Subtract estimated taxes, insurance, and PMI to estimate maximum principal & interest.

An example goes like: gross monthly income $8,000 × 0.28 = $2,240 max housing payment. If estimated taxes and insurance are $400, the available P&I ≈ $1,840.

This is a quick screen, the final qualification requires lender underwriting and DTI calculations.

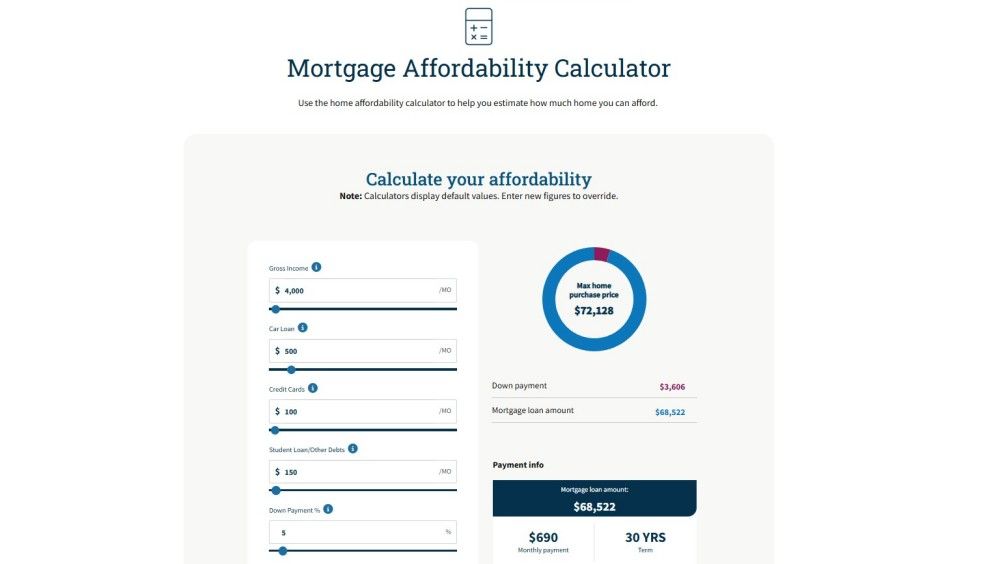

Method 2. Fannie Mae Mortgage Affordability Calculator

Fannie Mae provides affordability and mortgage calculators that factor gross income, car loan, credit cards, debts, down payment, and interest rate to produce more accurate purchase estimates. Use this tool for scenario planning and to see program-specific outcomes.

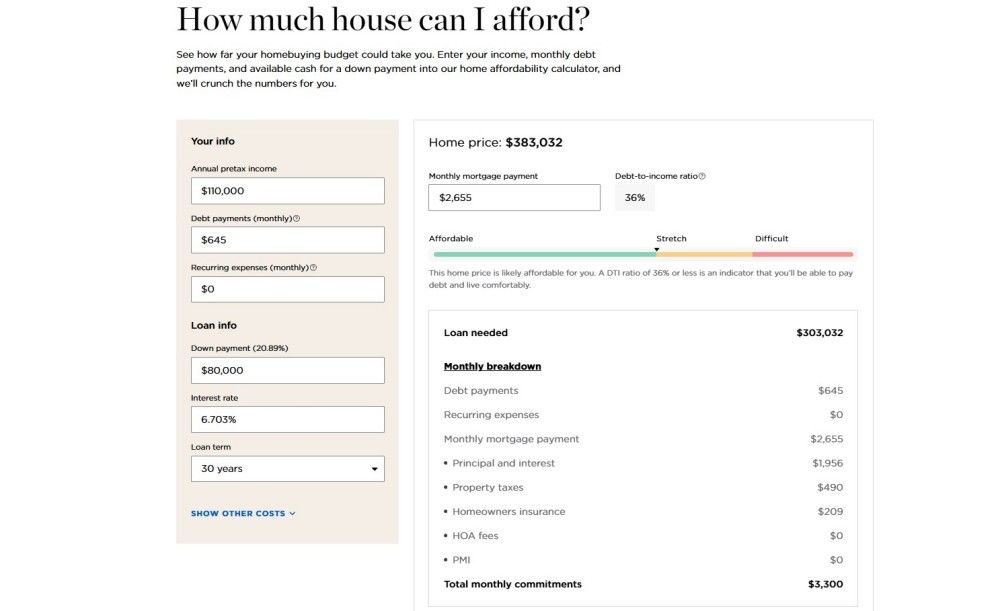

Method 3. NerdWallet How Much House Can I Afford Calculator

NerdWallet offers such a calculator that includes annual pretax income, monthly debt payments, monthly recurring expenses, and loan info like down payment, interest rate, and loan term, so borrowers can see how each variable changes buying power. This is useful for quick comparisons to see how large of a mortgage can you afford.

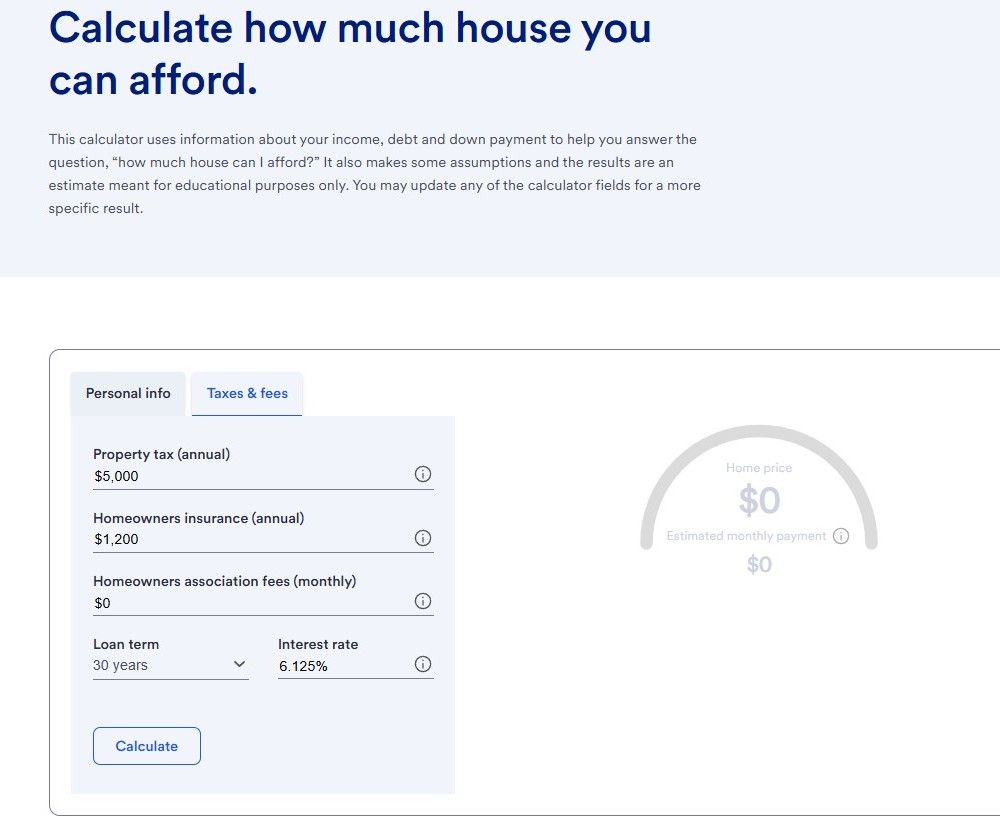

Method 4. USBank Home Affordability Calculator

Bank and lender calculators apply standard rules and local rate data to estimate prequalification amounts. These tools are useful to get a lender-specific prequalification and connect with loan officers. They generally use the same front/back ratios and program rules, but may apply different overlays.

US Bank offers a mortgage affordability calculator for potential homebuyers to calculate how much house you can afford. Just input personal info, including annual income, current monthly debt, down payment and taxes & fees like annual property tax, annual homeowners insurance, and monthly association fees. Then, the calculator will do the rest.

[Differences] Types of Mortgage Loans

Program rules vary on DTI, reserves, and credit requirements. You should confirm details with your loan officer for each product.

- Conventional loans typically require stronger credit and reserve profiles but offer competitive rates.

- FHA allows lower credit/lower down (3.5%) for qualified borrowers.

- VA and USDA offer special benefits like zero down for eligible veterans or eligible rural buyers under USDA rules.

- Jumbo loans exceed conforming limits and have stricter credit/down payment requirements.

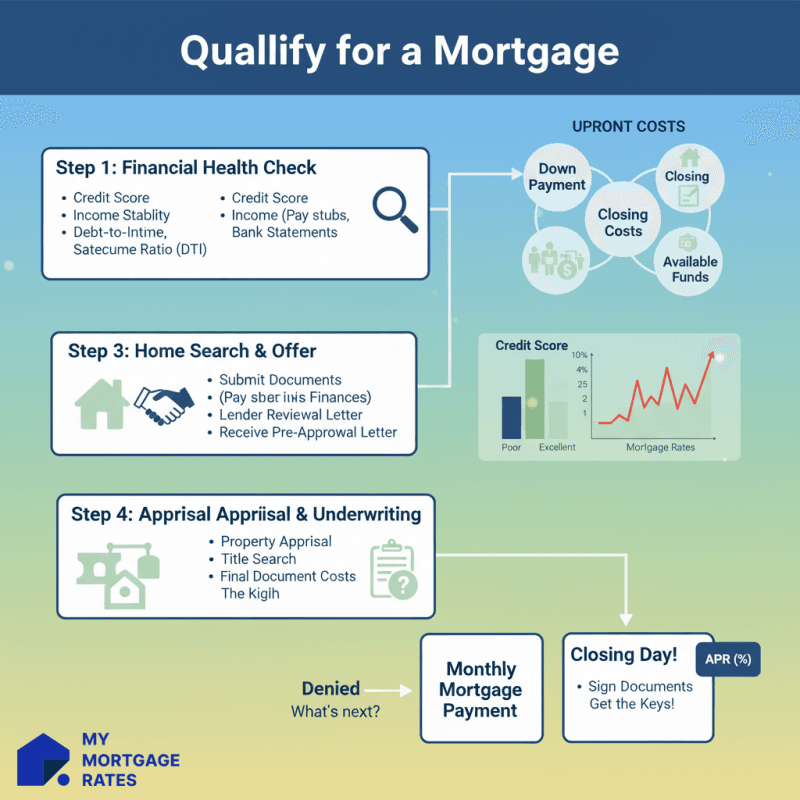

How to Qualify for a Mortgage?

Qualification requires documentation of income, assets, employment, and acceptable credit. Preapproval typically includes a credit check and documentation review and results in a conditional letter stating an estimated loan amount. Final approval depends on property appraisal, title review, and that your financial situation hasn't materially changed between preapproval and closing.

FAQs About Determining Mortgage Affordability

Q1. Can I afford a 500k house on a 200k salary?

Possibly, but it depends on down payment, interest rate, other debt, taxes, and reserves.

Here's a detailed example:

- Annual gross income = $200,000 → monthly gross = $16,667.

- 28% front-end rule → max housing payment ≈ $4,667/month for PITI.

- Example purchase: $500,000 home with 20% down ($100,000) → loan = $400,000.

- If mortgage rate = 6.5% (30-yr fixed), monthly P&I on $400,000 ≈ $2,528. (Calculation: standard amortization.)

- That leaves roughly $2,139 for taxes, insurance, and any PMI/HOA to stay under $4,667 front-end target.

If property taxes + insurance + HOA exceed that remainder, the 28% guideline is breached. Also check back-end DTI: total monthly debt (including this mortgage payment) should generally stay near or below program limits, often 36%--43% depending on loan type and lender overlays. So a $500k home on $200k salary can be affordable in many markets with 20% down if taxes and other debts are reasonable. in high-tax areas or with large monthly debts it may not be.

Q2. How much can I buy a house for if I make 200k?

There's no single answer. With $200k income, the affordable purchase range varies widely by: down payment size, locational taxes and insurance, interest rate environment, and other monthly debt.

As a rough planning range, households with that income and moderate debts often qualify for homes in a broad band, e.g., roughly $600k--$900k, depending on the down payment and local costs, but this is a very rough band. The correct approach is to run numbers with your actual DTI, desired down payment, and current rates, or use the lender calculators listed above.

Q3. What is the monthly repayment on a $200,000 mortgage?

Monthly P&I depends on rate and term. Here are examples with a 30-year fixed:

- 7.0% → monthly P&I ≈ $1,330.60.

- 6.5% → monthly P&I ≈ $1,264.14.

These figures are P&I only, add taxes, insurance, PMI/HOA for full monthly housing cost. I computed these with standard mortgage amortization.

Q4. What salary to afford a 300k house?

A useful rule: use the 28% front-end rule. If total housing costs for a $300,000 house with a 20% down payment come to ~$2,000 monthly, multiply by ~3.6 to 4.0 to get an indicative gross annual income, this gives a typical range of $75,000--$100,000 depending on taxes, insurance, and other debt. Exact figures depend on down payment, local taxes and the interest rate.

Conclusion

Affordability is a function of income, debts, credit, down payment, local taxes/insurance, and current interest rates. Use the 28/36 rule as a conservative starting point, then run lender calculators and get preapproval to see your program-specific buying power.

Always confirm program rules (FHA/Veteran/USDA/conventional) with your loan officer and consult a tax professional about deductions or local tax impacts. You can also reach out for reliable loan specialists on MyMortgageRates with personalized rates.