Mortgage Broker NYC: How to Get the Best Rates & Avoid Loan Approval Disasters

Let me be honest with you: after a decade as a mortgage broker in NYC, I’ve learned that picking the right professional can mean the difference between landing your dream apartment and watching it slip away because your loan fell through.

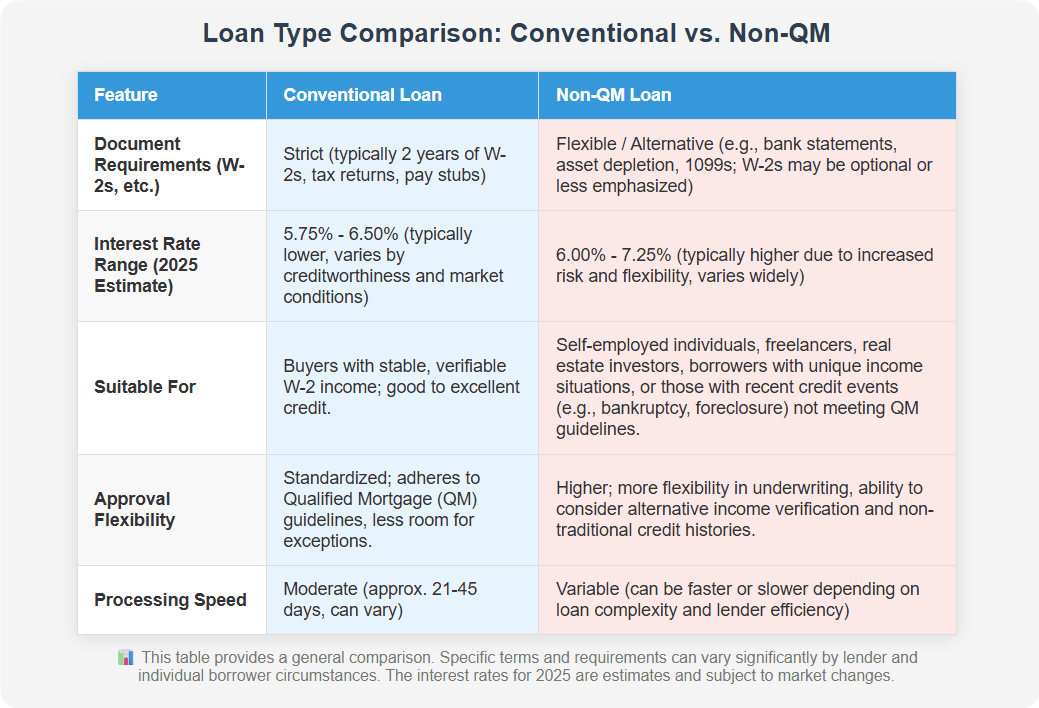

Just last month, I worked with a freelance graphic designer in Williamsburg who nearly lost a bid on a $1.2M condo because her bank insisted she needed two years of W-2s. We got it done with a non-QM loan at 6.125%—something most big banks wouldn’t even consider.

Why NYC Isn’t Like Other Markets

In most cities, you might walk into a Chase branch for your mortgage. Here? Good luck if you’re buying a co-op (and don’t get me started on those board interviews).

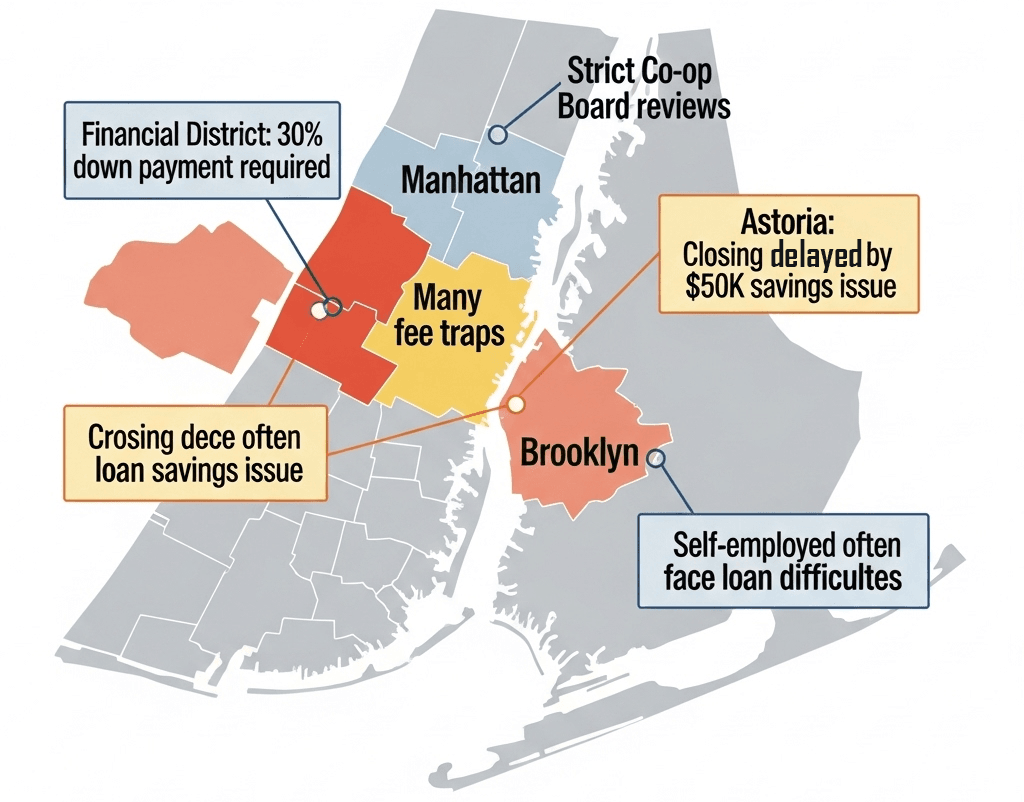

I’ve seen approvals delayed for months because brokers didn’t prep clients for the co-op’s obsession with post-closing liquidity. One client in Astoria had to scramble to move $50K into her savings account the week before closing—something we could’ve avoided if her first mortgage broker in NYC had explained the unwritten rules.

What I Tell Friends Looking for a Mortgage Broker in NYC

Check their NMLS number—but also their last 3 deals

Last year, a couple came to me after a “broker” (turns out he was just a loan officer at a sketchy storefront) promised them a 5.5% rate on a $900K loan. The guy vanished after collecting a $2,500 “processing fee.”

Real mortgage brokers in NYC? We get paid at closing, and we’ll show you actual lender rate sheets. Pro tip: ask to see closed loans from the past 60 days with similar profiles to yours.

The best mortgage brokers fight for half-points

Mortgage rates change daily, but here’s what most buyers don’t realize: brokers have leverage. Two weeks ago, I squeezed a 6.375% rate down to 5.875% for a doctor in Murray Hill by playing two credit unions against each other.

If your mortgage broker in NYC isn’t giving you hourly updates when the 10-year Treasury dips, they’re not hustling.

Avoid the “yes-men”

I once had to clean up after a broker who told an artist with an $80K income they could "definitely" qualify for a $1.5M loan.

Spoiler: they couldn’t. A good mortgage broker in NYC will tell you hard truths upfront—like how that adjustable-rate mortgage (ARM) could gut you when it resets in 5 years.

2025’s Wild Card: Condo Inventory

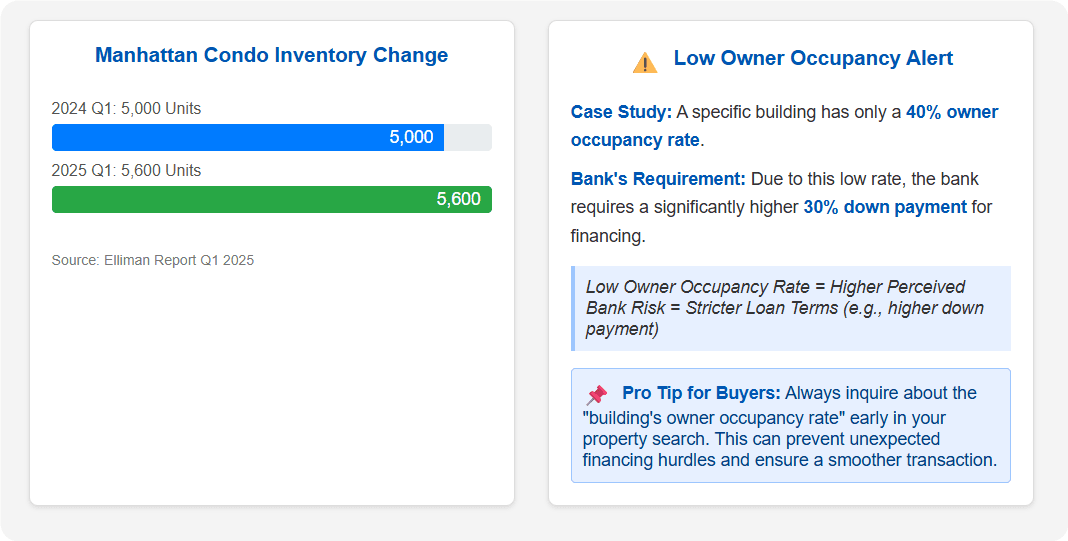

With Manhattan condo inventory up 12% from last year (Elliman report, Q1 2025), some buyers think they hold all the cards.

But here’s the catch: lenders are skittish about buildings with low owner-occupancy rates. I just closed a deal in a Financial District tower where the bank demanded 30% down instead of 20% because only 40% of units were primary residences.

Your mortgage broker in NYC should warn you about these quirks before you fall in love with a building.

A Quick Story About Fees

A teacher in Queens almost signed with a broker charging 2.5% (yes, really). Turns out the guy was padding his commission with a “processing fee” and a “lender coordination fee.”

Standard in NYC? 1–1.5%, max. We found her a better deal at 0.75% through a community bank relationship I’ve cultivated since 2017.

Final Advice (The Kind Your Aunt Would Give)

- If a broker’s office is just a Gmail address, run.

- Ask: “What’s the worst loan you’ve seen this month?” Their answer tells you everything.

- For co-ops, beg/borrow/steal to get 12+ months of mortgage payments in reserves post-closing. Boards have rejected buyers for less.

Need a Mortgage Broker in NYC Who Actually Fights for You?

Whether you're buying a condo in Manhattan, navigating co-op board requirements, or exploring refinance options, our loan experts know the NYC market inside out. No pressure—just real mortgage solutions tailored to your needs.

Have questions? Reach out today for honest, no-nonsense advice.

"People Also Read

- Stop Stressing! How the Best California Mortgage Brokers Make Home Buying Easier (and Cheaper!)

- When Do You Shop for Mortgage Lenders? Your Guide to Getting the Best Home Loan Rates in 2025

- Can You Get Preapproval from Multiple Lenders? What Smart Buyers Need to Know Before Shopping for a Mortgage

- How Much Does a Loan Officer Charge Compared to a Mortgage Broker?

- Mastering California Interest Rates: Your Ultimate Mortgage Guide for May 2025