Non Qualified Mortgage and Non QM Credit Rules: Complete Borrower’s Guide

What Is a Non-QM Mortgage?

A Non-QM mortgage, also known as a nonqualified mortgage, refers to a type of home loan that does not meet the standard criteria set by government agencies for qualified mortgages.Non QM meaning simply describes any mortgage that falls outside these strict guidelines, such as those related to debt-to-income ratios, documentation requirements, or loan features.Non-QM mortgages are designed to serve borrowers who may not qualify for traditional loans, such as self-employed individuals, real estate investors, or those with unique financial situations.While these loans offer greater flexibility, they typically come with higher interest rates and more rigorous underwriting standards to account for the increased risk.

QM vs Non-QM Loans: Key Differences

What Qualifies as a QM vs Non-QM Loan?

Qualified Mortgages (QM) are loans that meet the strict standards set by the Consumer Financial Protection Bureau (CFPB).These standards require:

A maximum debt-to-income (DTI) ratio of 43%.

Points and fees are limited to 3% of the loan amount.

No risky features including interest-only payments, negative amortization, loan terms greater than 30 years.

Full documentation to verify income and assets.

Non-Qualified Mortgages (Non-QM) do not satisfy all the QM requirements, but are more flexible in nature and are intended to serve borrowers that have unique or otherwise complex financial situations, but generally come with higher interest rates and lender scrutiny.

Eligible Borrowers:

- QM: Best suited for traditional W-2 employees with consistent incomes, clean credit histories, and straightforward financials.

- Non-QM: Targeted at self-employed individuals, business owners, investors, people with significant assets but irregular income, or those with recent credit issues.

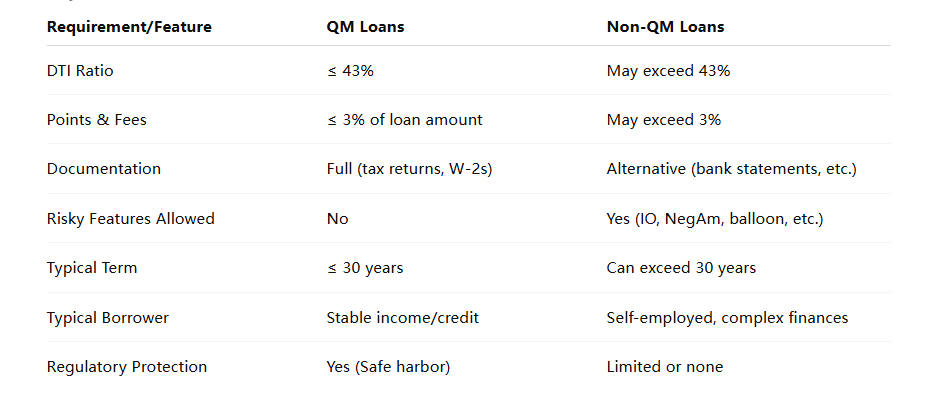

Key Differences Table

Unique Features of Non-QM Loans

Interest-Only Payments: Non-QM loans can offer interest-only periods; QM loans strictly forbid this feature.

Negative Amortization: Some Non-QM products allow borrowers to make payments that don't cover all interest due, increasing the principal.QM loans prohibit this.

Balloon Payments: Non-QM mortgages may include a large final payment at the end of the loan term, unlike QM.

Longer or Custom Terms: Non-QM loans can offer terms beyond 30 years or other unique repayment structures.

Higher DTI Ratios: Non-QM lenders may approve borrowers with DTI ratios well above the 43% QM limit.

Higher Fees: The 3% points and fees cap does not apply to Non-QM.

Flexible Underwriting: Non-QM lenders can use creative and alternative ways to assess a borrower's ability to repay, rather than strictly following QM rules.

Documentation Requirements Compared

QM Loans: Strict Documentation

Full Income Verification: QM loans require thorough documentation, including W-2s, tax returns, and bank statements.

Ability-to-Repay (ATR): Lenders must document and prove the borrower can afford the loan under regulatory standards.

Non-QM Loans: Flexible Documentation

Bank Statement Loans: Self-employed or non-traditional borrowers can qualify using 12–24 months of bank statements to show income.

Asset-Based Loans: Qualification may rely on the borrower’s assets rather than income.

No Income Verification: In some cases, Non-QM loans allow approval with minimal or alternative documentation, such as rental income analysis or “stated” income.

Manual Underwriting: Applications may be reviewed manually, allowing for more flexibility in unique scenarios.

Who Typically Uses Non-QM Loans?

Typical borrower profiles vary by credit product and risk level, but can generally be categorized by credit score, income stability, and borrowing purpose. Prime and super-prime borrowers tend to have strong credit scores, stable incomes, and a track record of responsible financial management. Subprime borrowers often have lower credit scores, higher debt-to-income ratios, or recent negative credit events, making them riskier for lenders. Some profiles focus on students with limited credit history, buy-now-pay-later users who may have more financial stress, renters (often younger or with lower income) versus homeowners (typically with more established credit), and commercial borrowers who are evaluated based on both business and personal financials. Lenders may also use character-based factors, employment history, or even alternative data to better understand a borrower's ability and willingness to repay.

Is a Non-QM Loan Right for You?

Non-QM loans are ideal for borrowers who don’t fit the strict requirements of traditional (QM) mortgages.This includes self-employed individuals, freelancers, and small business owners who have irregular or hard-to-document income; real estate investors relying on rental income; borrowers with recent credit issues (like bankruptcy or foreclosure); those with high debt-to-income (DTI) ratios; foreign nationals or those without a U.S. credit history; and anyone with complex financial situations that prevent them from qualifying for a conventional loan.Essentially, if you have non-traditional income, recent credit events, or unique financial circumstances, a Non-QM loan may offer the flexibility you need to secure financing.

Non-QM Loan Requirements & Application Process

Eligibility Criteria for Non-QM Loans

What Credit Score Do You Need for a Non-QM Loan?

Unlike traditional Qualified Mortgages, Non-QM loans typically have more flexible credit score requirements.Many lenders will consider applicants with credit scores as low as 620, and some may even go below that threshold, depending on the overall financial picture. However, borrowers with higher credit scores—such as 660 or above—are more likely to qualify for better rates and loan terms. Lenders focus not only on your credit score, but also on your ability to repay, so strong income, significant assets, or a large down payment can help offset a lower score.That said, a good credit history still strengthens your application and may be necessary for larger loan amounts or investment properties.

Down Payment Guidelines for Non-QM Loans

Down payment requirements for Non-QM loans are generally higher than those for conventional loans.Most Non-QM lenders require at least 10% down, though 15% to 20% is common, especially for borrowers with lower credit scores, self-employed income, or for non-primary residences.Some programs may allow as little as 5% to 10% down if the borrower's income or asset profile is particularly strong, but higher down payments are typical for larger loan amounts or riskier properties.For jumbo Non-QM loans or investment properties, a 20% to 30% down payment may be required to offset risk.

Additional Qualifying Factors

Non-QM lenders often look for alternative forms of income documentation.Instead of only W-2s and tax returns, borrowers can use bank statements (usually 12–24 months), 1099s, profit-and-loss statements, or even asset depletion to demonstrate their ability to repay.This makes Non-QM loans particularly attractive for self-employed individuals, freelancers, or real estate investors who may not have traditional proof of income.In addition, Non-QM loans often have more flexible debt-to-income (DTI) ratio limits, sometimes allowing up to 50% or more, depending on the borrower's overall profile. Some lenders will also require cash reserves—for example, several months’ worth of mortgage payments—to ensure you have a financial cushion. Finally, borrowers who have experienced recent credit events, such as bankruptcy or foreclosure, may still qualify after a shorter waiting period—sometimes just one or two years.

Step-by-Step Non-QM Loan Application

Applying for a Non-QM loan is a straightforward process, but it does require careful preparation and documentation.First, research and choose a lender that offers Non-QM loans, as not all banks or mortgage companies provide these products. Start with a consultation or pre-qualification, where you’ll discuss your unique financial situation—including income sources, employment status, assets, credit history, and property goals. The lender will recommend the most appropriate Non-QM loan products and advise you on the types of documentation required.

Next, gather and submit your documents.This usually includes bank statements (covering the last 12–24 months), proof of assets, alternative income documentation, and identification.For self-employed or non-traditional borrowers, documentation requirements may be more flexible, but thorough record-keeping is essential.Complete the loan application and provide all requested materials.The lender’s underwriting team will then review your entire profile, including credit, assets, income streams, property details, and any compensating factors.

You may receive a conditional approval pending additional information, such as an updated bank statement or a property appraisal.Once all conditions are met, the lender will issue a final approval and provide a closing disclosure outlining your loan terms and costs. The last step is the closing, where you’ll sign documents and the loan will be funded—allowing you to purchase your home or refinance your mortgage.

Throughout the process, it’s helpful to work with a mortgage professional experienced in Non-QM products.Their expertise can help ensure a smoother application experience and increase your chances of approval, especially if your financial situation is complex.

Pros of Non-QM Loans

Non-QM loans provide substantial flexibility compared to traditional Qualified Mortgages.One of the biggest advantages is expanded eligibility.These loans are designed for borrowers who might not fit the conventional mold, such as self-employed individuals, business owners, freelancers, real estate investors, or those with irregular income streams.Unlike QM loans, Non-QM lenders can consider alternative documentation, such as bank statements or asset-based qualifications, instead of only W-2s and tax returns.This flexibility allows more people to access homeownership or refinance options who would otherwise be left out.Non-QM loans also often have higher debt-to-income (DTI) limits and may accept lower credit scores, making them more accessible for borrowers with credit challenges or recent financial events like bankruptcy or foreclosure.Additionally, some Non-QM products offer interest-only payments or other creative loan structures that can provide lower initial payments and better cash flow management, especially for those with variable income or short-term investment plans.

Cons of Non-QM Loans

Despite their flexibility, Non-QM loans come with notable disadvantages. The most significant is the higher cost—interest rates and fees for Non-QM loans are typically above those of standard QM mortgages. This reflects the increased risk lenders take when approving borrowers with less traditional profiles or higher risk factors.Over the life of the loan, these higher rates can mean paying thousands more in interest.Another downside is that some Non-QM features, like interest-only payments, may result in payment shock or negative amortization if the borrower isn’t careful, leading to financial stress down the road.Non-QM loans may also require larger down payments or have stricter reserve requirements.Additionally, fewer lenders offer Non-QM products, which can limit a borrower’s options and reduce competitive pricing. Lastly, because Non-QM loans do not meet the Consumer Financial Protection Bureau’s (CFPB) “Ability-to-Repay” safe harbor, borrowers may have fewer consumer protections and should thoroughly understand the loan terms and risks before proceeding.

Regulatory Risks of Non-QM Lending

Non-QM (Non-Qualified Mortgage) loans are generally considered riskier than traditional Qualified Mortgage (QM) loans due to their more flexible eligibility criteria.These loans often allow for alternative forms of income verification, higher debt-to-income ratios, and other non-standard underwriting practices.Such flexibility, while expanding access to credit for borrowers who might not qualify under standard guidelines, also increases the risk of borrower default, especially during times of economic uncertainty or declining property values.

From a regulatory perspective, Non-QM loans do not conform to the strict standards set by consumer protection regulations established after the 2008 financial crisis.As a result, lenders offering Non-QM loans face heightened scrutiny regarding their ability-to-repay assessments and must maintain strong risk management procedures.There is also an increased risk of legal challenges if borrowers later claim they were given loans they could not reasonably afford.

Additionally, the regulatory environment for Non-QM lending is subject to change.Adjustments to federal rules or interpretations can affect loan eligibility, securitization, and overall market practices.Lenders must remain vigilant, ensuring they adapt their policies and procedures to comply with any new regulations and to mitigate potential legal or compliance risks.

In summary, while Non-QM loans can help broaden access to homeownership, they come with significant risks related to borrower default, market volatility, and evolving regulatory requirements.Successful Non-QM lenders must combine flexible lending practices with careful risk assessment and ongoing compliance monitoring to manage these challenges effectively.

How Non-QM Loans Affect Your Credit

Non-QM loans have a unique impact on credit score and borrower eligibility.Unlike traditional mortgages, Non-QM lenders are often willing to accept applicants with lower credit scores, sometimes in the mid-500s or even lower.Instead of relying solely on credit scores and standard documentation, these lenders use alternative methods such as bank statements, proof of assets, or cash flow analysis to assess a borrower's overall financial health.This flexibility makes Non-QM loans accessible for self-employed individuals, business owners, or those with complex financial situations who may not qualify for conventional loans.However, while a lower credit score will not automatically disqualify a borrower, it may result in higher interest rates and less favorable loan terms.Additionally, Non-QM lenders may be more forgiving of past credit issues like bankruptcies or missed payments, often requiring shorter waiting periods.Overall, Non-QM loans can expand homeownership opportunities for those with less traditional credit profiles, but borrowers should be aware that poor credit still increases the cost and risk associated with these loans.

Current Non-QM Mortgage Rates

Non-QM mortgage rates are generally higher than those of traditional Qualified Mortgages (QM), reflecting the increased risk profile of non-traditional borrowers.According to data from multiple industry sources, the average Non-QM 30-year fixed rate typically ranges from about 6.7% to over 8% in recent years.For example, Sun West Mortgage lists Non-QM 30-year fixed rates at approximately 7.125% to 7.149%, while sample scenarios from other lenders, such as MIGOnline, show rates between 7.6% and 8.3% APR depending on the loan purpose and borrower profile.CoreLogic data reported by National Mortgage Professional indicates the average initial Non-QM 30-year rate in 2024 is around 6.7%, slightly higher than QM loan rates, which average 6.4% in the same period.Most sources agree that Non-QM loans usually carry interest rates that are 1-2 percentage points higher than comparable prime loans.Factors such as credit score, down payment, income documentation, and property type will all influence the final rate offered to each borrower.Despite higher rates, many Non-QM borrowers are more focused on loan accessibility and flexibility than the rate itself, as Non-QM products fill an important gap for self-employed, investors, and other non-traditional borrowers.

Non-QM Market Trends and Outlook

The Non-QM mortgage market is experiencing steady growth and is expected to expand further in the coming years.Currently, Non-QM loans account for about 5% of all new mortgages, but this share is projected to increase as more self-employed borrowers, real estate investors, and people with non-traditional incomes seek flexible financing options.Lenders are introducing new products and using advanced underwriting to reach a broader range of borrowers.At the same time, institutional investors are showing increased interest in Non-QM-backed securities, supporting market liquidity and innovation.Overall, the Non-QM sector is becoming a key part of the mortgage industry and is poised for significant growth as the needs of modern borrowers continue to evolve.

Choosing the Best Non-QM Lender

When searching for the best non qualified mortgage lenders, start by comparing product offerings and eligibility requirements, since not all lenders provide the same loan types or accept the same borrower profiles.Pay attention to minimum credit score requirements, necessary down payments, acceptable forms of documentation (such as bank statements, DSCR, asset depletion, or ITIN loans), and the types of properties they finance, including primary residences, investment properties, or mixed-use buildings.Next, evaluate interest rates and total loan costs by reviewing the annual percentage rate (APR), all origination and processing fees, as well as any potential prepayment penalties or hidden charges. It’s equally important to assess customer service and responsiveness—choose lenders who reply promptly to inquiries, offer clear and honest information, and proactively recommend products that fit your needs. Finally, ensure that the lender is properly licensed and regulated, maintains transparency throughout the application process, and is willing to provide clear disclosures and sample documents before you make a commitment.

In addition to comparing and researching on your own, you are always welcome to connect with our experienced loan specialists.We are dedicated to offering you professional Non-QM mortgage services and helping you find the best solution for your specific needs.