Your Complete Mortgage Loan Document Checklist: Don't Miss Anything for a Stress-Free Closing!

Let’s cut to the chase: applying for a mortgage is exhausting. Between the paperwork shuffle and the back-and-forth with lenders, it’s easy to feel like you’re stuck in a bureaucratic maze. And the worst part? One missing document can delay your closing by weeks.

But here’s the good news: I’ve helped dozens of homebuyers—from first-timers to self-employed folks—navigate this process without losing their sanity. Below is your ultimate mortgage loan document checklist, tailored for 2025 requirements. I’ve even thrown in some hard-won tips to keep your application moving smoothly.

People Also Read

- Underwriting Process in Mortgage Complete Guide : Steps, Timelines and Tips

- Mortgage Application Requirements: Your Complete Document Checklist

- How Much Should I Put Down on a House?

- Mortgage Underwriting 101: Your Friendly Step-by-Step to Loan Approval

- Documents Needed for Mortgage Underwriting: Complete Checklist for Pre-Approval and Final Approval

1. Personal Identification: Prove You’re You

Lenders aren’t just being nosy—they have to verify your identity. Here’s what they’ll ask for:

- Driver’s license or passport

- Social Security card (or ITIN if you’re not a U.S. citizen)

- Proof of residency (like a visa or green card, if applicable)

- Divorce decree or name-change paperwork (if your ID doesn’t match your other docs)

Pro Tip: If you’ve recently changed your name, triple-check that all your financial records (bank statements, pay stubs, etc.) reflect the update. Mismatches are a fast track to delays.

2. Proof of Income: Show Them the Money

What you need depends on how you earn your paycheck:

Salaried Employees:

- Last 30 days of pay stubs

- W-2s from the past two years (2023 and 2024)

- Employment verification letter (some lenders require this)

Self-Employed or Freelancers:

- Two years of personal and business tax returns

- Profit & Loss statements (if you own a business)

- 1099s or client contracts (to prove steady income)

Bonus/Overtime Income?

- A letter from your employer confirming it’s consistent

- Past pay stubs showing bonuses

Gaps in Employment?

- Write a quick explanation—underwriters will ask.

3. Asset & Bank Statements: Where’s Your Down Payment Coming From?

Lenders want to see you’re not pulling your down payment out of thin air. Gather:

- Last 2–3 months of bank statements (all accounts)

- Retirement/investment account statements (if you’re using these funds)

- Gift letter (if someone’s helping with your down payment)

- Explanation for large deposits (sudden big transfers raise red flags)

Pro Tip: Avoid moving money between accounts right before applying. Lenders prefer clear, traceable paper trails.

4. Credit & Debt Info: Can You Handle the Loan?

Your lender will pull your credit, but here’s how to prep:

- Check your credit report

- List all current debts (car loans, student loans, credit cards)

- Explanation letters for past issues (late payments, bankruptcies)

Fun Fact: About 34% of mortgage delays happen because of incomplete paperwork. Don’t be part of that stat.

5. Property & Purchase Documents (Almost There!)

Once you’re under contract, you’ll need:

- Signed purchase agreement

- Homeowners insurance info

- Appraisal + inspection reports

- Title insurance & property survey

Note: These are part of your mortgage closing documents checklist, so don’t wait until the last minute.

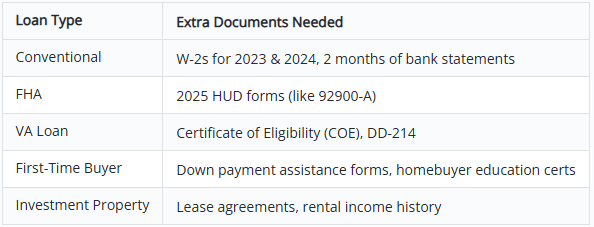

Special Cases (VA Loans, FHA, First-Time Buyers, etc.)

Digital Closing Tips (Because It’s 2025—Let’s Act Like It)

- Scan documents clearly (PDFs are best)

- Use your lender’s secure upload portal (don’t email sensitive info)

- Confirm e-signature policies (some docs may still need wet signatures)

Common Mistakes to Avoid

- Missing signatures (sounds obvious, but it happens)

- Using outdated bank statements (lenders want recent ones)

- “Forgetting” about debts (they’ll find them anyway)

- Blurry scans (underwriters hate pixelated text)

Final Mortgage Loan Document Checklist (Printable Version)

- ID & Legal: Driver’s license, SSN card

- Income: Pay stubs, W-2s (2023–2024), tax returns (if self-employed)

- Assets: 2–3 months of bank statements

- Property: Purchase agreement, appraisal, insurance

- Special Cases: VA COE, FHA forms, gift letter

FAQs (Because You’ve Got Questions)

Q: How far back do bank statements need to go? A: Usually 2 months, but self-employed borrowers may need 3–6 months.

Q: What’s the deal with gift funds for a down payment? A: They’re allowed, but you’ll need a signed gift letter confirming it’s not a loan.

Q: Can I get a mortgage with a low credit score? A: FHA loans in 2025 still allow scores as low as 580, but paying down debt first helps.

Final Thoughts

Having all your documents ready is the best way to avoid closing delays. Whether you’re going for a VA loan, FHA mortgage, or are self-employed, this 2025 mortgage loan document checklist keeps you on track.

Need help? A quick chat with a mortgage advisor can save you hours of stress. Good luck—you’ve got this!