Mortgage Application Requirements: Your Complete Document Checklist

Submitting incomplete paperwork when applying for a mortgage can seriously slow down your approval—or even kill the deal altogether. That's because lenders aren't just collecting documents to be picky—they need a clear picture of your financial life to make sure you're truly ready for a home loan. Every pay stub, tax return, or bank statement helps them answer a simple question: Can this person afford the loan and stay current on payments?

This guide breaks down exactly what you'll need to submit to meet all mortgage application requirements—and why it matters. We'll cover not just the what, but the why, and share some insider tips to help you avoid common pitfalls that delay approvals. From verifying income and assets to organizing ID and credit info, this mortgage application requirements checklist can save you weeks of back-and-forth with your lender.

Why Lenders Ask for So Many Documents

It might feel like overkill, but mortgage application requirements exist because lenders need to manage their risk—and your documents tell the story. One key number they look at is your debt-to-income ratio (DTI), which shows how much of your income is already committed to debts. If something's missing—like a pay stub or a side gig you forgot to report—your DTI might look worse than it actually is, which can hurt your chances of meeting mortgage application requirements.

Also, federal rules like TRID require lenders to verify everything: income, assets, gift money, even large deposits. So yes, the paperwork is serious—but it's also meant to protect you and the financial system. Think of it this way: the more organized you are with your mortgage application requirements, the faster your loan can move forward.

People Also Read

- Underwriting Process in Mortgage Complete Guide : Steps, Timelines and Tips

- Underwritten Mortgage Pre Approval: The Homebuyer’s Guide to Securing Your Offer, Moving Faster

- Your Complete Mortgage Loan Document Checklist: Don't Miss Anything for a Stress-Free Closing!

- Mortgage Underwriting 101: Your Friendly Step-by-Step to Loan Approval

- Documents Needed for Mortgage Underwriting: Complete Checklist for Pre-Approval and Final Approval

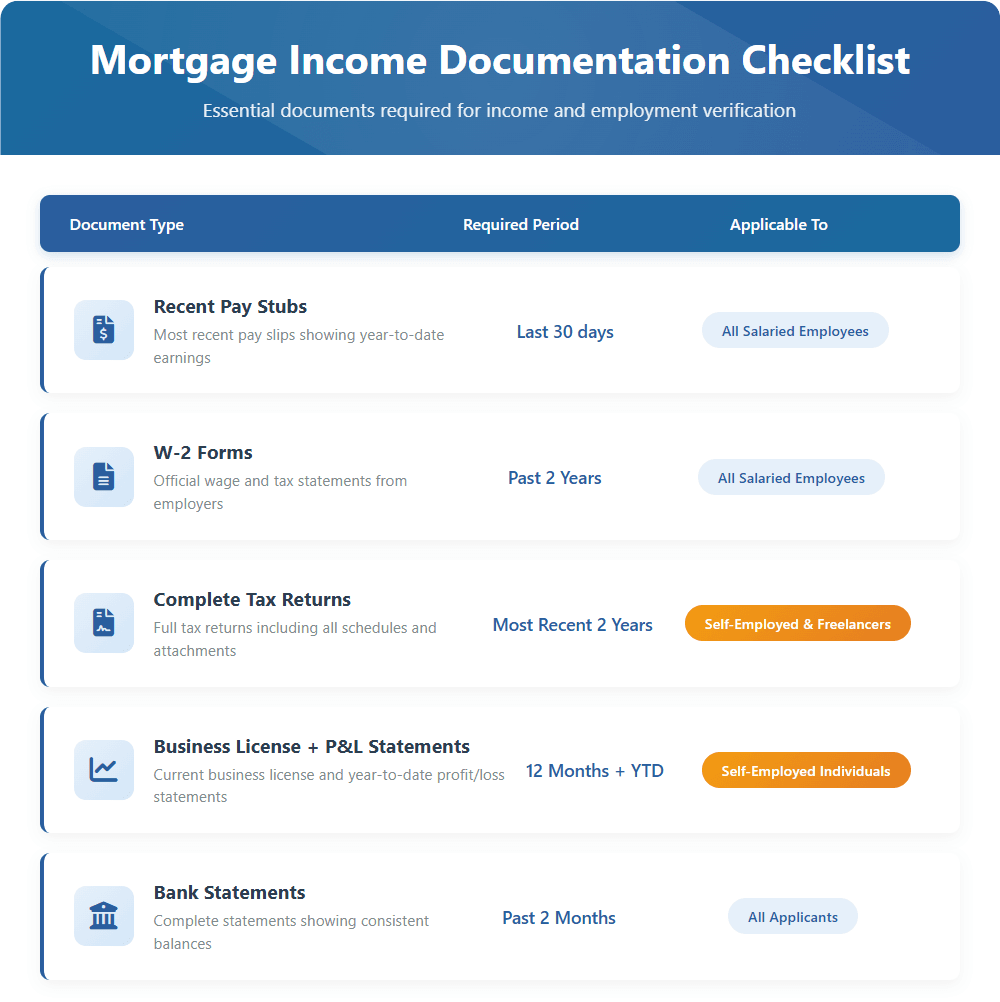

Section 1: Income & Employment Verification

Lenders want to see that you make steady money and that it's not about to dry up. So their mortgage application requirements include documents that paint a consistent, reliable income story.

You'll need:

- Recent pay stubs (typically the last 30 days)

- W-2s from the past two years

- Full tax returns, including all schedules, from the past two years

If you're self-employed or a freelancer, mortgage application requirements are even stricter—lenders will scrutinize your returns and might ask for profit/loss statements. The goal is to confirm your income isn't inflated by one-time spikes. Pro tip: Make sure your bank deposits, pay stubs, and employer verifications all line up—underwriters prioritize consistency when reviewing mortgage application requirements.

Update: As of January 11, 2025, Fannie Mae's Desktop Underwriter 12.0 allows lenders to use a single 12-month asset verification report to automatically validate income and employment, streamlining the process for borrowers.

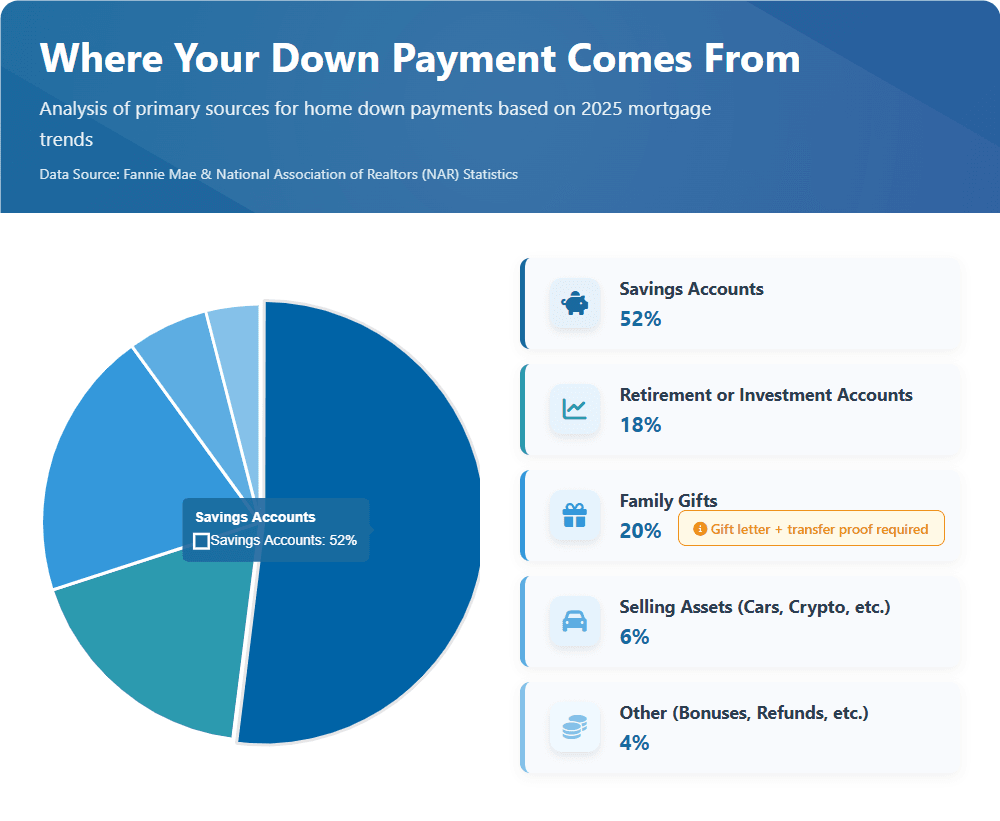

Section 2: Assets & Savings Proof

You'll also need to show that you've got enough in the bank to handle your down payment, closing costs, and at least a couple of months of reserves—all key parts of mortgage application requirements.

Documents include:

- Bank statements (last 2 months, all pages—even the blank ones)

- 401(k), IRA, or investment account statements

- Gift documentation (signed letter + proof of transfer)

Be ready to explain any big deposits. Got $10,000 from your uncle? Mortgage application requirements dictate you'll need a gift letter and a copy of the transfer. Sold a car? Save the bill of sale and deposit slip. Lenders don't like mystery money—it has to be traceable and "seasoned," meaning the funds have been sitting in your account for at least 60 days.

Update: Lenders may now request up to 12 months of bank statements to assess cash flow and verify consistent income, especially for borrowers with irregular income patterns.

Section 3: ID & Legal Status

Think of this as confirming who you are and making sure your name and identity match across all mortgage application requirements.

Bring:

- Government-issued ID (like a driver's license or passport)

- Social Security card (especially if your name appears differently on different documents)

If you're a non-citizen, mortgage application requirements may also include visa or immigration status paperwork. The key here is consistency—if one document says John A. Smith and another says Johnny Smith, it could cause delays.

Section 4: Credit History & Debt

Your credit tells lenders how you've handled past debts—and what you're still responsible for under current mortgage application requirements.

You'll need:

- A credit report (your lender will usually pull this for you)

- List of all loans and credit accounts

- Letters of explanation for any late payments or disputes

Your debt-to-income ratio (DTI) comes back into play here. Mortgage application requirements don't care how much you owe, but rather how much you pay each month. If you have $10,000 in credit card debt with a $300 minimum payment, they only count the $300. Just make sure everything is accurate—and if you recently paid off something, get proof from the lender.

Update: Fannie Mae's Desktop Underwriter 12.0 now considers first-time homebuyer status as a mitigating factor, potentially benefiting applicants with limited credit history.

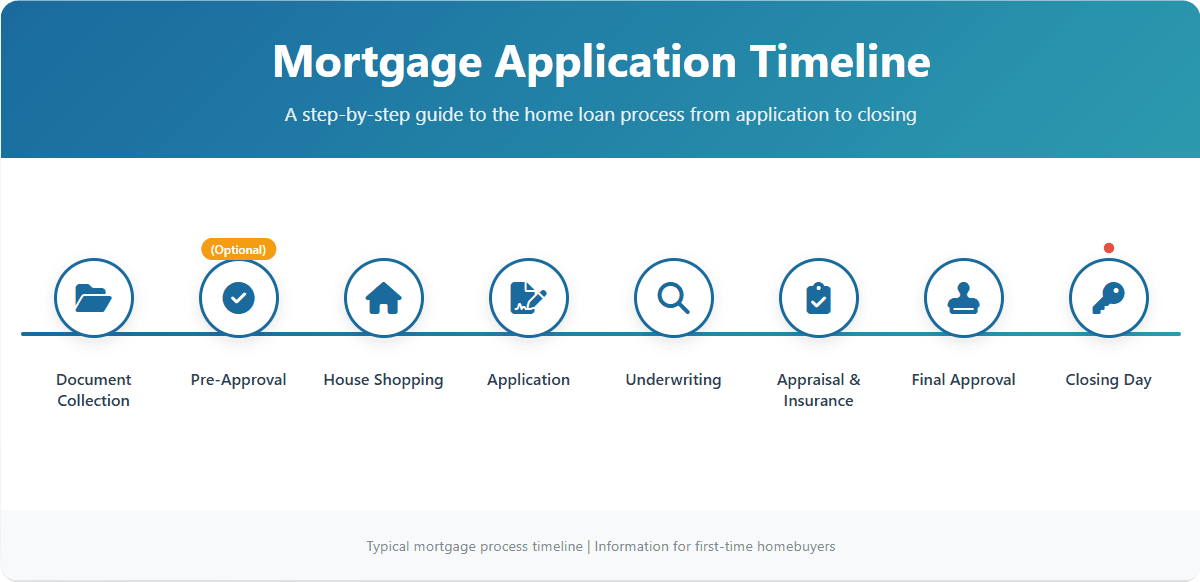

Section 5: Property Info (Once You're Under Contract)

After your offer is accepted, mortgage application requirements expand to include evaluating the home itself. That's when you'll submit:

- A signed purchase agreement

- Homeowners insurance estimate

- Appraisal (usually ordered by the lender)

If the property turns out to be in a flood zone, for example, that might change your insurance costs or loan eligibility—so it pays to address these mortgage application requirements early.

Update: As of Q1 2025, Fannie Mae has increased the eligible loan-to-value (LTV) ratios for appraisal alternatives, potentially reducing the need for traditional appraisals in certain scenarios.

Special Circumstances: Self-Employed, Gifts, Divorce, and More

If you're self-employed or work on 1099 contracts, mortgage application requirements will demand extra paperwork:

- Profit & loss statements

- Recent quarterly tax receipts

- Business license

Using gift funds? Mortgage application requirements specify your gift letter must include the donor's relationship, contact info, and a clear statement that the money doesn't need to be repaid.

If you're divorced, be ready to show your divorce decree—especially if child support or alimony is involved. These can affect how underwriters interpret your mortgage application requirements.

Update: Lenders may now utilize a 12-month asset verification report to assess income and employment, potentially simplifying the documentation process for self-employed individuals.

Tips for Submitting Documents

Treat your mortgage application requirements like a project. Label each file clearly—"Smith_W2_2023.pdf" is far better than "scan_2839.pdf." Submit everything through a secure portal (your lender will provide this)—not over regular email.

And don't forget to keep your file updated. If you're still waiting to close and a new pay stub or bank statement comes in, upload it immediately. Mortgage application requirements demand the most current info available.

FAQs

Do digital pay stubs meet mortgage application requirements?

Yes, as long as they clearly show your employer, pay date, year-to-date income, and deductions. Payroll app screenshots usually work—just don't edit or crop them.

How recent should my bank statements be for mortgage application requirements?

You'll need the most recent 2 months, and every page counts—even the blank ones. Any big deposits need to be explained.

What if I forget something in my mortgage application requirements?

If anything's missing, your loan could be delayed or sent back for more review. Better to overprepare than underdeliver.

Final Thoughts

Getting approved isn't just about having good credit—it's about thoroughly understanding and meeting all mortgage application requirements. If you stay organized and proactive with your documents, you'll save yourself time and stress.

When in doubt about mortgage application requirements, consult your loan officer. A quick review can catch potential issues before they delay your closing.