APR vs Interest Rate: What’s the Difference?

What is an Interest Rate?

In the real estate industry, an interest rate is the cost a borrower pays to a lender for using their funds, typically expressed as an annual percentage. For homebuyers, interest rates directly affect monthly mortgage payments and the total cost of the loan, while also influencing overall market activity. The higher the interest rate, the more a borrower will pay each month, and the greater the total interest over the life of the loan, which can reduce demand for housing.

Interest rates not only impact individual borrowing costs but also affect property values in the market. Higher rates may reduce investor demand for real estate, putting downward pressure on prices. Changes in interest rates also influence transaction volumes: when rates rise, purchasing power decreases, which can slow market activity; when rates fall, more buyers may enter the market, increasing the number of transactions.

As of August 2025, the average 30-year fixed mortgage rate in the U.S. is approximately 6.58%, one of the lowest points in the past ten months. However, because home prices remain high, even lower rates do not necessarily make homes more affordable for all buyers. In this environment, closely monitoring interest rate trends can help homebuyers choose the most suitable loan timing and product.

People Also Read

- Mastering California Interest Rates: Your Ultimate Mortgage Guide for May 2025

- Fixed Rate Mortgage Advantages vs ARMs: Which Home Loan Is Right for You?

- Mortgage Rates on Manufactured Homes: What You Need to Know About Loans, Credit, and Mobile Home Financing

- Why Are Mortgage Interest Rates So High? Understanding Today’s Housing Market

- How Does Mortgage Interest Work on Taxes? Save More with Deduction Rules, Limits, and Tax Filing Tips

What is an APR?

In the mortgage industry, the Annual Percentage Rate (APR) measures the total cost of borrowing. Unlike the interest rate, which only shows the basic cost of the loan, APR includes both interest and additional expenses such as origination fees, appraisal fees, credit report charges, discount points, and other required costs.

APR is presented as a yearly percentage and is designed to give consumers a more complete picture of what a loan will truly cost.

Reflects the full borrowing cost: APR captures the combined impact of interest and fees, allowing borrowers to better evaluate the real expense of a loan.

Facilitates comparison: Because APR is standardized, borrowers can compare different loan products more accurately and choose the option that best fits their needs.

Supports budgeting: Understanding APR helps borrowers anticipate future payments and plan their finances more effectively.

How Are Interest Rates Calculated?

Basic Concept of Mortgage Interest Rates

In real estate loans, interest rates determine how much a borrower needs to pay monthly, including principal and interest. Rates are usually expressed as an annual percentage rate (APR), but the actual monthly payment is calculated using an amortization formula, not by adding all interest upfront.

Mortgage interest rates are mainly divided into two types:

Fixed-Rate Mortgage (FRM)

The monthly payment stays the same throughout the loan term.

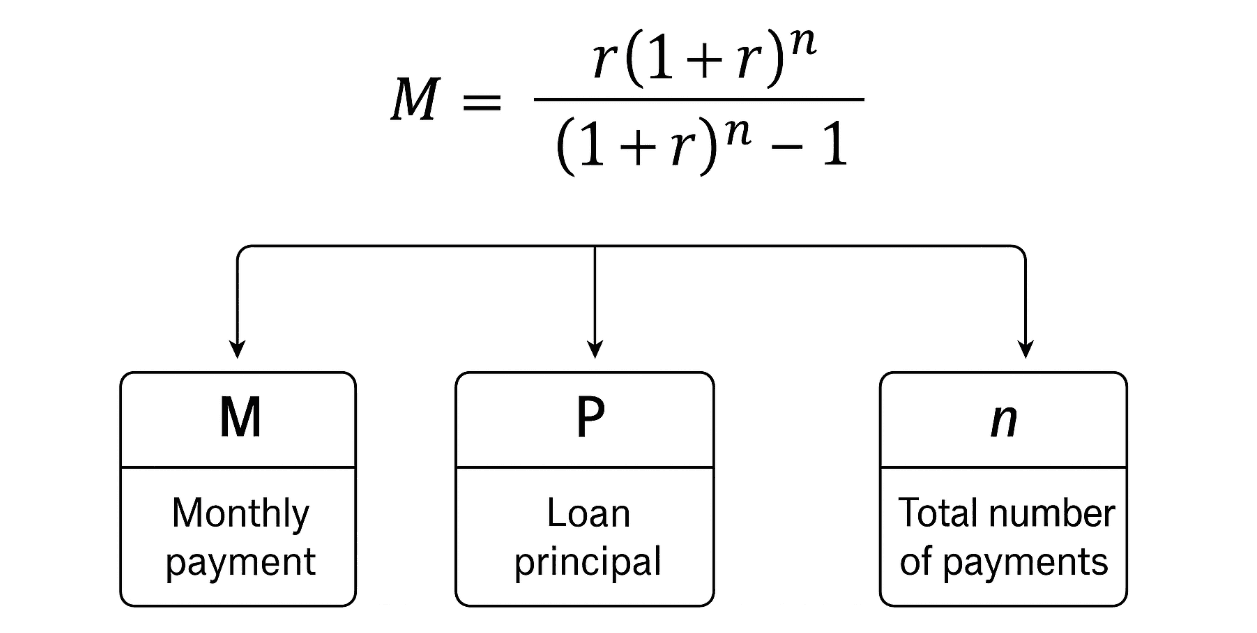

The formula (for equal monthly payments) is:

Where:

M= Monthly payment

P= Loan principal

r= Monthly interest rate (annual rate ÷ 12)

n= Total number of payments (loan term in years × 12)

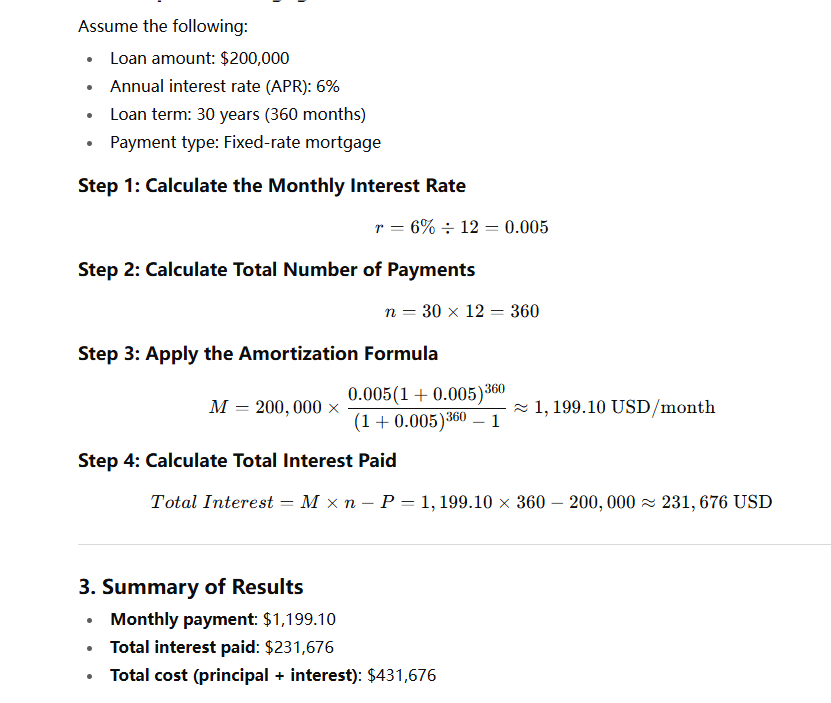

Example: Loan amount $200,000, annual interest rate 6%, term 30 years

Monthly interest rate: r=0.06÷12=0.005r = 0.06 ÷ 12 = 0.005r=0.06÷12=0.005

Total number of payments: n=30×12=360n = 30 × 12 = 360n=30×12=360

Monthly payment: approximately $1,199.10

Example of Mortgage Interest Calculation:

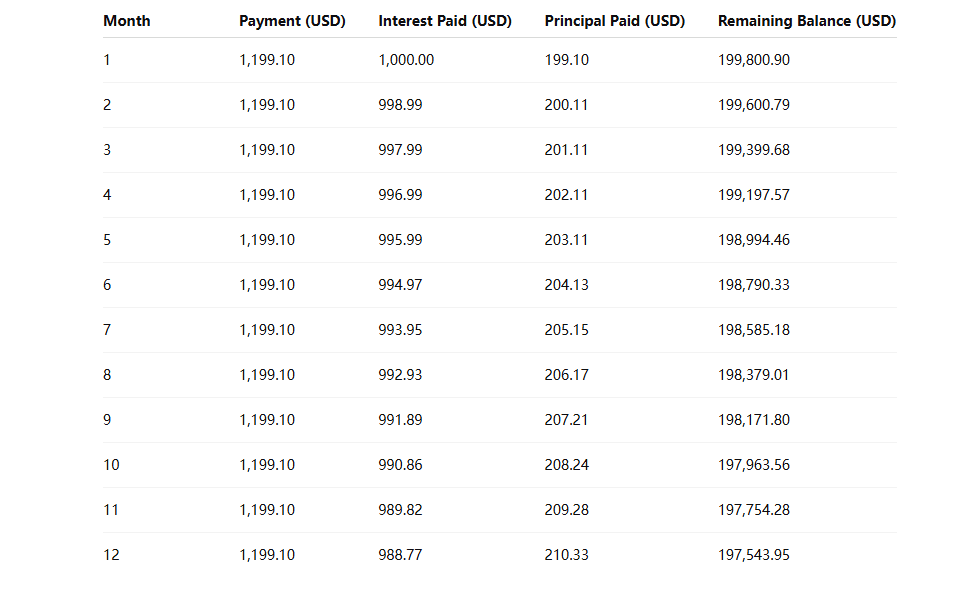

Mortgage Amortization Example (First 12 Months)

How Is APR Calculated?

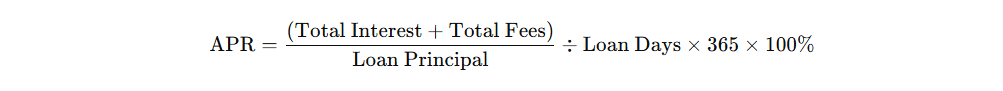

APR Calculation Formula

Total Interest: The total amount of interest paid over the loan term.

Total Fees: Includes all fees such as service fees, management fees, and loan handling fees.

Loan Principal: The initial amount of the loan.

Loan Days: The actual number of days of the loan term.

This formula standardizes the costs and interest on an annual basis, providing a uniform benchmark for comparison.

APR Calculation Example

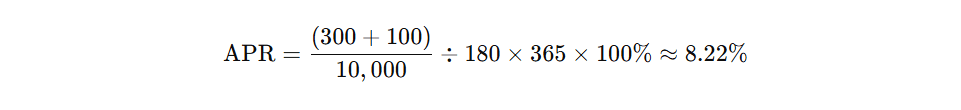

Suppose you borrow $10,000, the loan term is 180 days, total interest is $300, and total fees are $100:

What’s the Difference Between Interest Rate and APR?

The interest rate represents the baseline cost of borrowing. It only applies to the principal and does not include other expenses tied to the loan. Lenders use the interest rate to calculate monthly payments, but it doesn’t reveal the full financial burden. Relying on interest rate alone may mislead borrowers when comparing offers.

The APR, by contrast, incorporates both the interest rate and other related charges—such as origination fees, discount points, credit card annual fees, or insurance premiums. Because these costs are included, APR is typically higher than the nominal interest rate. It provides a more accurate view of the loan’s total cost, especially for mortgages, personal loans, and credit cards.

Under the Truth in Lending Act (TILA), lenders must disclose both the interest rate and APR in consumer loan agreements. This ensures borrowers can effectively compare costs across loan products. In practice, this means consumers should look at both metrics: the interest rate to understand monthly payments, and the APR to assess overall affordability.

How to Use APR and Interest Rates to Your Advantage

How borrowers weigh interest rate versus APR often depends on their time horizon. For short-term homeowners who plan to sell within a few years, securing the lowest possible interest rate is typically the priority, since it directly reduces monthly payments and eases short-term budgeting.

For long-term borrowers, APR becomes more important. Because APR accounts for upfront fees and ongoing costs, it offers a truer measure of the loan’s total expense over time.

When comparing loan products, both numbers matter. The interest rate determines monthly cash flow, while APR gives the big-picture cost. Borrowers can also lower their APR by improving credit scores, which often reduces both interest and fees. Reviewing the loan estimate carefully is also critical—make sure costs like origination fees, discount points, and closing charges are fully reflected in the APR.

APR is especially useful in products like credit cards and short-term loans, where additional fees can significantly raise the effective borrowing cost. In student loans, mandatory APR disclosure helps ensure borrowers compare offers fairly, even when repayment terms or capitalization rules differ.

Practical steps include:

- Compare APRs across lenders to find the lowest overall cost.

- Match loan selection to your time horizon—prioritize interest rate for short-term affordability, APR for long-term savings.

- Build credit to qualify for better rates and lower fees.

- Watch for hidden costs or promotional APRs that may reset higher.

- Pay down high-APR debt early, particularly credit cards and other high-interest loans.

How to Lower Your Loan Costs

How to Get a Lower Interest Rate

Improving your credit score is one of the most effective ways to qualify for a lower mortgage rate. Lenders use credit scores to gauge risk, and higher scores usually translate into better terms. Steps such as paying bills on time, reducing debt-to-income ratios, keeping credit utilization under 30%, and correcting errors on your credit report can all make a difference. Even a modest increase—say, 20 points—may push you into a more favorable rate tier.

Another way is to increase your down payment. A higher down payment lowers the loan-to-value (LTV) ratio, making the loan less risky for lenders and often unlocking lower rates. For example, a 20% down payment not only helps avoid private mortgage insurance (PMI) but can also improve overall loan terms.

Choosing a shorter loan term can also reduce your rate. Fifteen-year fixed mortgages typically carry lower rates than 30-year loans. While monthly payments are higher, total interest paid over time is significantly less. For borrowers who can handle the payments, this option saves substantial money.

Borrowers may also consider mortgage discount points—paying an upfront fee (usually 1% of the loan amount) in exchange for a reduced rate. Each point often lowers the interest rate by about 0.25%. For those planning to stay in the home long term, this upfront cost can generate significant future savings.

Other tactics include opting for a shorter rate-lock period, using a temporary buydown offered by sellers or builders, negotiating seller concessions to purchase points, or selecting an adjustable-rate mortgage (ARM) for short-term ownership. Adding a co-borrower with stronger credit can also help. Finally, always shop around. Rates and fees vary widely by lender, and multiple offers often reveal opportunities for meaningful savings.

How Can I Lower My APR?

Lowering credit card APR requires a different approach. A simple but often effective tactic is to ask the issuer directly. Calling customer service and requesting a lower rate—armed with reasons like a strong payment history or competing offers—can yield results. Persistence helps; if denied, try again later or escalate the request to a supervisor.

Raising your credit score is another proven way to reduce APR. Stronger credit makes you a lower-risk borrower, prompting banks to offer more favorable terms.

For those carrying balances, a balance transfer to a card with a 0% or low introductory APR can provide temporary relief. However, borrowers should watch out for transfer fees and the rate that applies once the promotional period ends.

Exploring products from credit unions may also be worthwhile, as they often offer lower APRs than major banks. Actively paying down balances can strengthen your negotiating position as well, showing issuers that you’re financially stable.

In more complex debt situations, debt consolidation loans or working with nonprofit credit counseling agencies can help lower average APRs and create a more manageable repayment plan.

What Is a Good Interest Rate and What Is a Good APR?

Mortgage rates vary depending on loan type and borrower profile. As of mid-2025, average rates for a 30-year fixed mortgage fall between 6.5% and 7%, while 15-year fixed loans average around 5.5% to 6%. These benchmarks generally apply to borrowers with strong credit scores—740 or higher.

Broadly speaking, a 30-year fixed rate under 6.5% is considered favorable, while a 15-year fixed below 5.5% is highly competitive. Borrowers with stronger credit, larger down payments, or lower-risk profiles may qualify for even better terms.

Factors influencing mortgage rates include credit score, down payment size, loan type, amount, and term length. Higher scores and larger down payments typically lower rates. Fixed-rate and adjustable-rate loans also differ, with shorter terms usually offering lower rates than longer ones.

As of August 2025, the national average APR for a 30-year fixed mortgage is about 6.73%, with the corresponding interest rate near 6.58%. For 15-year fixed loans, the average APR is roughly 5.94%, with rates around 5.69%. In this environment, an APR below 6.5% is considered good, while around 5.5% is viewed as very competitive.

Like rates, APRs are shaped by credit score, loan type, down payment, and term length. Borrowers with higher credit scores often secure lower APRs. Conventional, FHA, and VA loans all carry different APR structures. Larger down payments and shorter terms typically reduce APR, while smaller loans or longer terms may increase it.

Bottom line

By now, you should have a clear understanding of mortgage rates and APR.If you have any questions about your own mortgage rate or APR, or want to know which loan option is best for your situation, feel free to consult our team of expert loan officers. They can provide personalized guidance based on your circumstances and help you find the most suitable loan solution, making your home-buying decisions much simpler.