Mortgage Rates on Manufactured Homes: What You Need to Know About Loans, Credit, and Mobile Home Financing

What Is a Manufactured Home? Are You Eligible for Financing?

Manufactured homes are factory-built dwellings constructed after 1976, in accordance with HUD standards. Unlike mobile homes, which were generally produced before that year, or modular homes, which are assembled on-site in sections, a manufactured home is delivered in one or more sections and anchored to its final site. Industry definitions matter—misunderstanding them often leads to mistakes in the financing process.

HUD certification is non-negotiable. Your home must sit on a permanent foundation and comply with all federal building and safety requirements. If the property is a pre-1976 mobile home or is not permanently affixed to land, mainstream mortgage options are almost always out of reach.

Are you eligible for financing? Take this quick checklist: You must be a U.S. citizen or legal resident, have a minimum credit score as required by your loan type, and possess funds for a down payment. If you can say yes to these basics, you’re ready to evaluate your lending options.

People Also Read

- APR vs Interest Rate: What’s the Difference?

- Fixed Rate Mortgage Advantages vs ARMs: Which Home Loan Is Right for You?

- Mastering California Interest Rates: Your Ultimate Mortgage Guide for May 2025

- Why Are Mortgage Interest Rates So High? Understanding Today’s Housing Market

- How Does Mortgage Interest Work on Taxes? Save More with Deduction Rules, Limits, and Tax Filing Tips

Types of Manufactured Home Loans & Which Is Best for You

FHA Loans for Manufactured Homes

FHA loans are designed for accessibility. With a down payment as low as 3.5% and credit score minimums starting at 580, they’re well-suited for first-time buyers or those with moderate credit. The home itself must meet HUD and local standards, and both the structure and land are often collateralized.

Benefits include the lower entry barrier and government-backed security. Drawbacks? Borrowers pay mandatory mortgage insurance premiums (MIP) and must navigate requirements on age, condition, and foundation that some older or nonstandard homes won’t meet.

VA & USDA Loans for Manufactured Homes

VA loans enable eligible veterans and active-duty military members to buy a HUD-compliant manufactured home with zero down payment. Income, service, and property requirements are clearly defined. These loans can offer lower rates and fees than most alternatives.

USDA loans are available to buyers in qualifying rural areas. Like VA loans, USDA offers zero down payment but typically requires the home to be new and permanently installed on owned land. Not all areas are eligible, but for rural families, this is often the lowest-barrier path to homeownership.

Who benefits most? Veterans, active service members, and rural households looking for zero-down financing with competitive terms should evaluate these options first.

Conventional & Chattel Loans: Pros, Cons & Use Cases

Conventional loans suit buyers with strong credit, ample down payment funds, and a desire for flexible terms. These loans work for a range of property types and can offer faster approvals when documentation is robust.

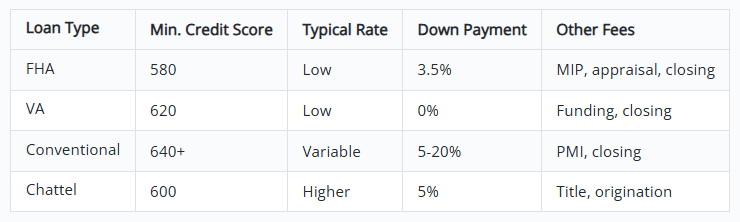

Chattel loans finance only the home itself, not the land underneath. They’re used when the home will be sited on leased land, in a park, or on a family member’s property. Rates tend to be higher and terms shorter, but the application process is often streamlined. For a side-by-side comparison, see the table below to match each loan’s requirements and use cases.

Manufactured Home Loan Rates & Fees: What Really Impacts Your Payment

Interest rates for manufactured home loans depend on several factors: your credit score, down payment, whether you’re financing the land, and the type of loan you choose. FHA and VA loans typically offer the most competitive rates, but even a small bump in your credit score can meaningfully reduce your monthly payment.

Fees aren’t just about interest. Expect to see appraisal charges, origination and closing costs, insurance premiums, and, with FHA loans, ongoing mortgage insurance. Carefully compare lenders—some fees are negotiable or may be waived during promotions.

Securing the best deal takes work. Always get multiple quotes, improve your credit score before applying, and save for a larger down payment to unlock lower rates and smaller monthly obligations.

How to Qualify for a Manufactured Home Loan

Qualifying for a manufactured home loan means hitting the right benchmarks. FHA loans require a 580+ credit score, VA loans generally want 620 or above, and conventional options may require 640 or higher. Stable documented income, a manageable debt-to-income ratio, and verifiable down payment sources are essential.

The property itself must be HUD-certified, permanently affixed to land (unless using a chattel loan), and often meet specific age or condition requirements. Homes on rented lots usually require chattel financing; homes on owned land may unlock better terms.

Documentation is crucial. Be prepared to submit photo ID, recent pay stubs or tax returns, purchase contract, proof of HUD compliance, and evidence of homeowners insurance. Organize these materials in advance to prevent approval delays.

To boost your odds, check your credit report early, pay down existing debt, and avoid large new purchases until after closing. Lenders favor applicants who demonstrate reliability and preparation.

Step-by-Step Manufactured Home Loan Application Process

Step 1: Prepare & Compare Options

Start by reviewing your credit, calculating your budget, and researching available lenders. Compare FHA, VA, conventional, and chattel products. Pre-approval is a smart move—it clarifies your price range and strengthens your negotiating position.

Step 2: Submit Application & Get Pre-Approved

Choose your lender, fill out the online or in-branch application, and upload required documentation. Double-check for completeness; missing information causes delays. Lenders assess your eligibility and may issue pre-approval within a few days.

Step 3: Home Appraisal & Underwriting

After submitting your application, the lender orders an independent appraisal to verify the property’s value and condition. Underwriting teams then review your credit, documents, and appraisal findings before issuing final approval.

Step 4: Closing & Funding

Once approved, you’ll review and sign closing documents, pay closing costs, and arrange insurance. The lender disburses funds, and ownership transfers to you. From this point, your loan repayments begin.

Step 5: Post-Purchase Considerations & Ongoing Protection

Immediately arrange for homeowners insurance and set up automatic payments if possible. Complete any required title or property registrations and stay in touch with your lender’s servicing team for future support.

Tips to Get the Lowest Rate & Fastest Approval

Improve your credit score, increase your down payment, reduce outstanding debt, and maintain steady employment. Each step translates directly into lower costs or faster approval.

Shop around—don’t just take the first offer. Look for lenders specializing in manufactured homes and scrutinize all fees, not just headline rates. Sometimes a slightly higher rate comes with dramatically lower upfront costs.

Organize your paperwork and respond quickly to lender requests. Pre-approval and rapid communication can cut your timeline and make you a more attractive borrower.

Expert Resources & Next Steps

HUD’s official website, reputable mortgage calculators, and nonprofit housing organizations provide deep dives and up-to-date standards for manufactured home loans. Use these resources to verify information and clarify eligibility.

Ready to move forward? Complete the contact form or schedule a personalized consultation to review your options, get tailored rate quotes, and ensure you’re making the best possible financial decision for your needs.

FAQ — Manufactured Home Loan Questions You Actually Care About

What are the current interest rates for mobile homes? Interest rates for mobile and manufactured homes can fluctuate with the broader market, your credit profile, and the loan type you choose. As of this writing, rates are often slightly higher than those for site-built homes, but well-qualified buyers may still access competitive terms. Always check directly with lenders for up-to-date rate quotes.

Are mortgage rates the same for manufactured homes? Generally, mortgage rates for manufactured homes are not the same as those for traditional, site-built houses. Lenders often price these loans slightly higher to account for perceived risk, especially if the home is not permanently affixed to land. However, programs like FHA, VA, and USDA may narrow the rate gap for qualified buyers.

Is it harder to finance a manufactured home? Financing a manufactured home can be more challenging than securing a loan for a conventional home. The eligibility criteria are often stricter regarding property standards, permanent foundation requirements, and loan programs available. Borrowers with solid credit and homes meeting HUD standards typically have more options and fewer hurdles.

Can I use a manufactured home loan to buy land? Some loan types, like FHA and VA, allow you to finance land and home together. Chattel loans do not; they cover the structure only. Be sure to clarify collateral requirements before committing.

What credit score do I need? FHA starts at 580, VA at 620, and conventional options usually require at least 640. If you fall below these minimums, work to improve your credit or seek lenders offering manual underwriting.

Are rates higher for manufactured home loans? Rates can be slightly higher, especially with chattel loans or when the home is not on owned land. Compare all your options; well-qualified borrowers can still secure highly competitive terms.

Can I get a 30-year term? Yes, most FHA, VA, and conventional loans offer 30-year terms for manufactured homes. Chattel loans typically max out at 15 or 20 years.

What documents are required to apply? Be ready to submit photo ID, proof of income, the purchase agreement, evidence of HUD compliance, and insurance documents. Missing or outdated paperwork can delay your approval.

Can I refinance my manufactured home loan? Many lenders allow refinancing. It can lower your rate or payment or let you tap home equity. Requirements vary by loan type and property status.