How to Calculate Early Payoff of Mortgage? Formula and Penalty

Is it a good idea to pay off your home loan early? Let's learn the formulas here and calculate early payoff of mortgage to see whether it is worth it. How much penalty will you have to pay? What are the pros and cons? What happens after that? This article will help you figure out. Moreover, you can consult a loan specialist near you. Let's kick in.

What is a Mortgage Payoff?

A mortgage payoff is the total dollar amount required to completely pay off your mortgage on a specific payoff date. It normally includes:

- the remaining principal balance

- accrued interest through the payoff date (per-diem or daily interest)

- any applicable fees, escrow shortages, or prepayment penalties shown in your loan contract

The payoff amount differs from the "current account balance" because interest accrues daily, therefore the payoff figure is usually valid only through a stated "good-through" date on the payoff statement. Borrowers should request an official payoff statement, sometimes called a payoff letter, from their servicer, federal rules require servicers to respond to written payoff requests promptly, and payoff quotes are commonly valid for a limited window, which is often 10–30 days, depending on the servicer and state law. Request the payoff letter a few business days before you plan to fund so the quote remains valid at closing.

For borrowers aiming to retire their loan early, paying even small extra amounts toward principal today can shorten the term and save substantial interest over the life of the loan. Many loan officers use amortization software or calculators to model exact savings because timing, compounding, and escrow adjustments affect precise results.

What is the 2% Rule for Mortgage Payoff?

The idea of a universal "2% rule" as an industry standard is misleading. There is no single nationwide "2% rule" that always applies to mortgage prepayment penalties. Instead:

-

Some regulatory limits and industry practices cap or limit prepayment penalties in certain circumstances, for example, rules tied to high-cost mortgages or qualified mortgages set caps on penalty amounts and duration. In practice, many prepayment penalties when permitted are structured as a percentage of the outstanding balance, commonly 1–2% in early years or as a certain number of months' interest, and some rules limit penalties to a declining schedule over the first 2–3 years, according to Cornel Law School.

-

Many government-backed loans, like FHA, VA, USDA, and many conforming lender products, do not include prepayment penalties today. Lenders also disclose any penalty terms at closing. Always check your promissory note and the prepayment disclosure. You will only owe a penalty if your loan contract specifically permits it. CFPB guidance explains that whether you can be charged depends on the loan terms.

Prepayment penalties exist but are uncommon on many modern retail mortgage products, where allowed, they're typically limited in duration and amount. Read the loan agreement, and ask your servicer for the exact calculation method.

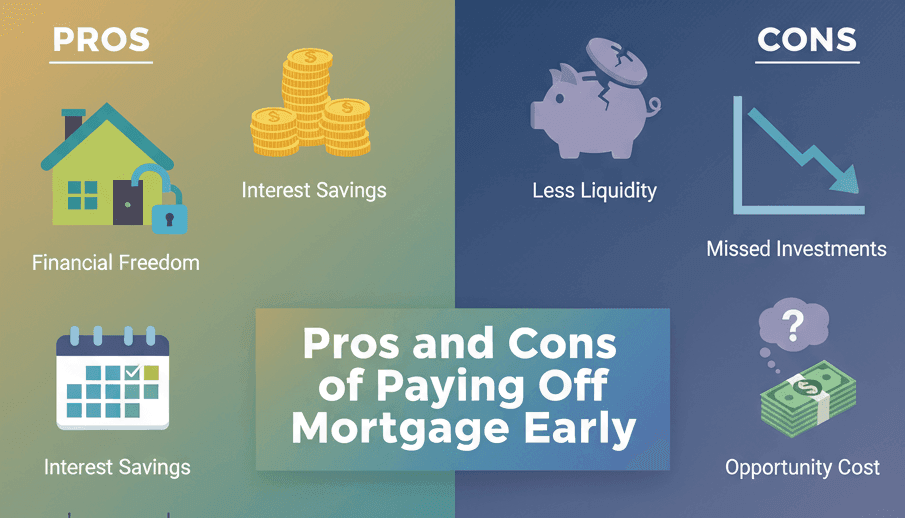

Pros and Cons of Paying Off Mortgage Early

Before you make up your mind, why not check out the benefits and downfalls when pay off your home loan early? Check it out here.

Pros

- Eliminates monthly mortgage payment and interest costs going forward.

- Reduces total life-of-loan interest paid.

- Increases home equity and decreases leverage risk.

Cons

- Reduces liquidity capital tied up in the home.

- Possible loss of mortgage interest tax deductions, depending on your tax situation.

- Potential prepayment penalty or loan-specific fees. This is rare on many conforming products, but possible for some loans.

- Opportunity cost is when your after-tax investment return elsewhere would exceed the effective return from prepaying the mortgage.

[Formula 1] How to Calculate Early Payoff of Mortgage?

Here's a practical formula to determind mortgage payoff amout: Payoff Amount = Remaining Principal + (Per-Diem Interest × Days to Payoff) + Fees/Adjustments

Where Per-Diem Interest = (Annual Interest Rate ÷ 365) × Remaining Principal. Multiply the per-diem by the number of days from the payoff statement's date or your last payment date to the actual payoff date, then add any stated fees or escrow shortages. This gives you the payoff figure a servicer would approximate. The servicer's official payoff letter is the authoritative figure. Many servicers compute per-diem interest this way, bank documentation and servicer guides explain the same daily interest approach.

Notes & tips:

- Use the servicer's payoff letter as the final amount, it will list the good-through date and per-diem.

- If you miss the payoff good-through date, request an updated payoff because the per-diem will change the total.

- If funds are wired, confirm the lender's required payment method and timing to avoid reconciliation delays.

[Formula 2] How to Calculate Early Mortgage Payoff Penalty?

If your loan contract permits a prepayment penalty, the loan documents will specify the exact method. Common methods are:

- Percentage method: e.g., 1% or 2% of the outstanding balance, which is more typical in the first 1–3 years

- Interest method: a set number of months of interest, for example, "six months' interest"

- Declining scale: higher penalty in year 1, smaller in year 2, and zero after year 3.

Example (percentage): 2% of a $200,000 remaining balance = $4,000 penalty if that contract term applies. Example (interest): "six months' interest" would be calculated using the monthly interest amount times six.

Always read your note and prepayment disclosure, only they determine which method applies. Regulatory rules restrict penalty size and timing for certain loan categories, so check whether your loan was originated after the Dodd-Frank/Regulation Z limits and whether program rules prohibit penalties. Most FHA/VA loans do not allow prepayment penalties.

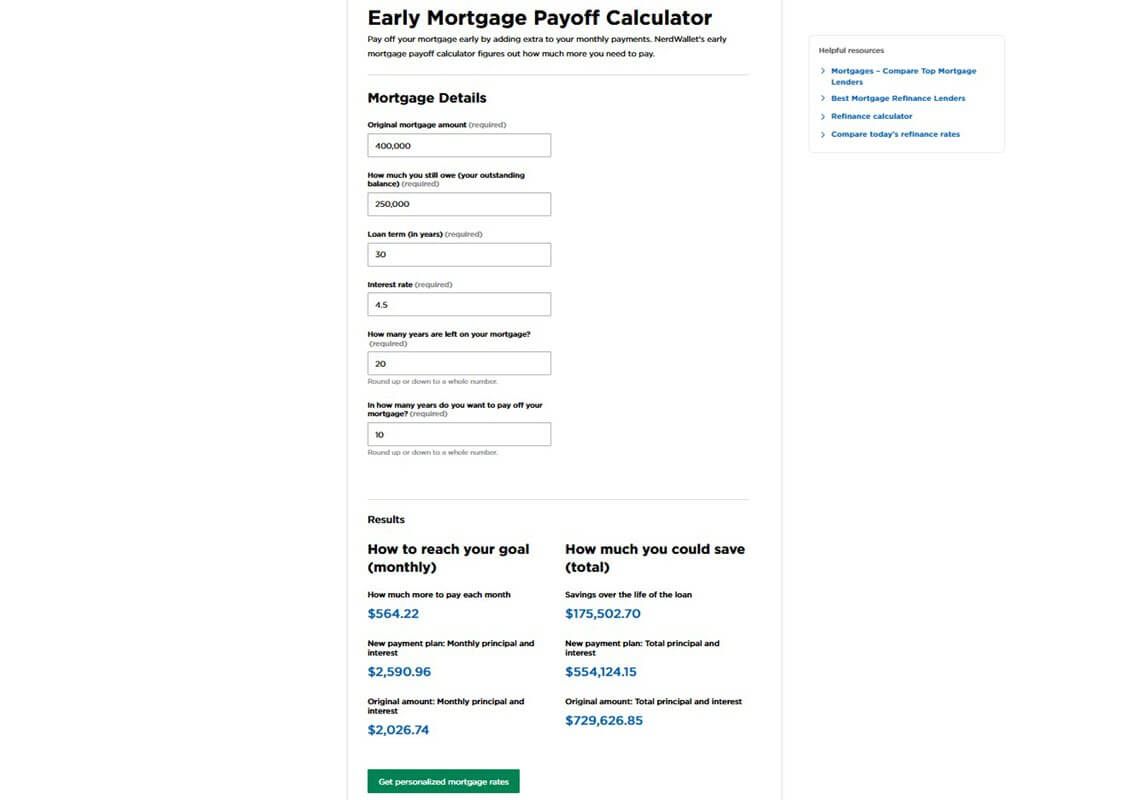

Method 1: Use NerdWallet Early Mortgage Payoff Calculator

NerdWallet Early Mortgage Payoff Calculator gives you a convenient way to figure out mortgage payoff. You just need to enter your mortgage details, including original mortgage amount, outstanding balance, loan term, interest rate, how many years are left ,and in how many years do you want to pay off your mortgage. Then, the tool will quickly estimate the result. You can see how to reach your goal monthly and How much you could save in total. This must encourage you.

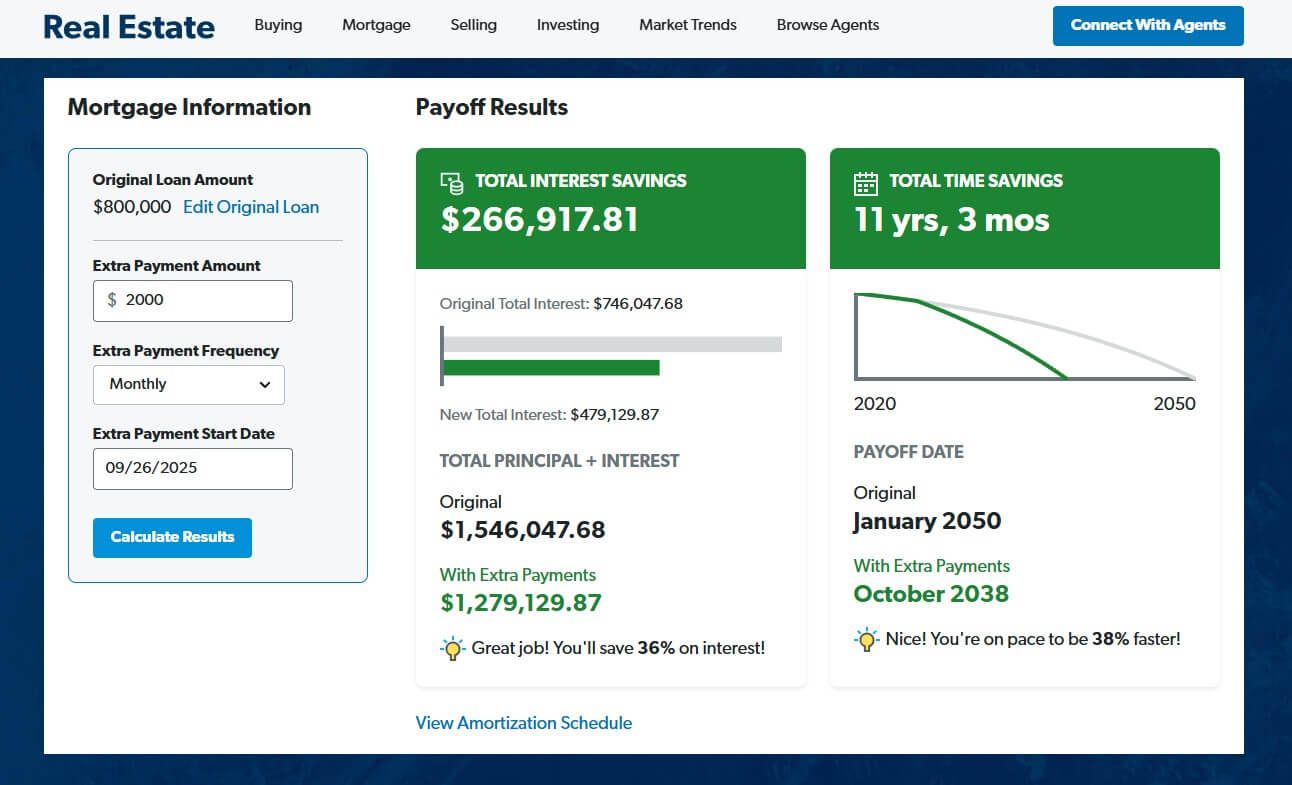

Method 2: Use RAMSEY Mortgage Payoff Calculator

RAMSEY Mortgage Payoff Calculator is a similar tool to NerdWallet. You tell the calculator your mortgage information, such as original loan amount, date of first payment, loan length, interest rate, extra payment amount, frequency, and the extra payment start date. In no time, the payoff results show up, and you don't even have to learn how to calculate mortgage payoff with extra payments.

When You Pay Off Your Mortgage, What Happens?

Now, congratulations if you pay off your mortgage loan early. What comes next? You should check out below. Please follow up to confirm the lien release is recorded. That paperwork is important if you later refinance or sell.

- The servicer should provide a satisfaction of mortgage/release of lien and if required locally file it with the county recorder.

- You should receive a paid-in-full statement and confirmation that the loan is closed.

- If you had payments escrowed for taxes/insurance, the servicer will account for any escrow surplus and return funds per the servicer's policy and applicable law.

- The lender no longer requires mortgage insurance or proof of homeowners' insurance, but you likely still want to keep insurance.

- Your home equity becomes the full market value less any other liens.

FAQs About Calculating Extra Mortgage Payments Payoff

Q1. Is it better to pay off mortgage or invest?

It depends. Compare your mortgage's after-tax interest rate to expected after-tax investment returns and consider liquidity needs, emergency reserves, and risk tolerance. Paying off a high-rate mortgage or eliminating high-interest debt often yields a guaranteed return with interest saved that may beat risky investments. You may consult a financial planner for a personalized decision.

Q2. Why is mortgage payoff higher than balance?

Because the payoff includes accrued per-diem interest from the last statement date to the payoff date, plus any fees or escrow shortages. The servicer's payoff letter shows the good-through date and per-diem used.

Q3. How to pay off a 30-year mortgage in 2 years?

This is mathematically possible but typically impractical for most borrowers. You would need to cover the remaining principal plus interest over 24 months (i.e., roughly remaining balance ÷ 24, plus monthly interest). That often requires very large payments and a large income or windfall.

Q4. How to pay off a $250,000 mortgage in 5 years?

Calculate the monthly amortizing payment for $250,000 over 60 months at your interest rate. That number, which is often several thousand dollars per month, is what you must pay to retire the loan in five years. Exact figures depend on the interest rate.

Q5. What is the most effective way to pay off your mortgage?

There are common effective tactics for you to try out. Make one extra payment per year or use the 1/12 rule), apply windfalls/lump sums to principal, make biweekly payments which equates to 13 monthly payments per year, and consistently add modest extra principal. Always confirm the servicer posts extra payments to principal, not to future payments, and that no prepayment penalties apply.

Conclusion: Should You Pay off Your Mortgage Early?

Paying off a mortgage early can be a strong, low-risk strategy for many borrowers, but only after confirming:

- whether your loan has a prepayment penalty

- whether you have sufficient emergency reserves and retirement savings

- the opportunity cost relative to other investments

If you plan to prepay, get a current servicer payoff letter to confirm exact payoff math and any fees, then model alternative uses of the same cash, such as investing, paying higher-interest debt, building reserves, to decide what best meets your financial goals.