How to Pay off Mortgage Faster? Pros, Cons, and 7 Ways for You

If you're searching for answers for "how to pay off mortgage faster" on Reddit that brought you here, you're in the right place. This guide collects the exact, practical tips for you. Whether you're typing those queries into Google as a homeowner trying to retire your loan early or a loan officer advising clients, you'll learn ideas here. Let's get started. Moreover, MyMortgageRates can get you in touch with professional loan offers near you for more pro tips.

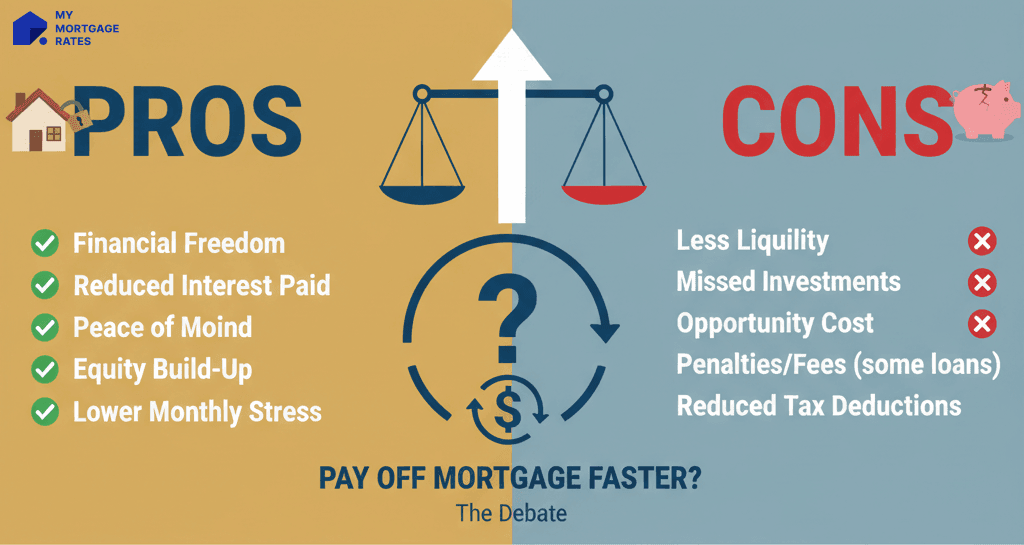

Benefits of Paying off a Mortgage Faster

Accelerating your mortgage payoff can deliver meaningful long-term savings and greater financial flexibility. Each extra dollar you apply to principal reduces the balance that accrues interest, and over many years this can add up to tens, sometimes hundreds, of thousands of dollars saved depending on loan size, remaining term, and interest rate. Early payoff also eliminates a large monthly expense, freeing cash flow for retirement savings, other investments, or living expenses. Eliminating private mortgage insurance (PMI) once you reach about 20% equity further reduces monthly housing costs for borrowers who currently pay PMI.

Downsides of Paying off Mortgage Early

Paying the mortgage off early is not always the best choice for every borrower. You should check out the key downsides, which include:

-

Opportunity cost: If your mortgage rate is relatively low, you may earn more by investing extra cash in retirement accounts or diversified portfolios after taxes and fees.

-

Liquidity risk: Home equity is illiquid, tapping it requires a refinance, HELOC, or sale, so aggressive prepayment can leave you with less cash for emergencies.

-

Loss of tax deduction: Mortgage interest can be deductible for some borrowers. paying off the loan eliminates that deduction whether it matters depends on your tax bracket and itemization.

-

Possible prepayment penalties or loan fees: Some older or nonstandard loans include prepayment penalties, check your loan documents.

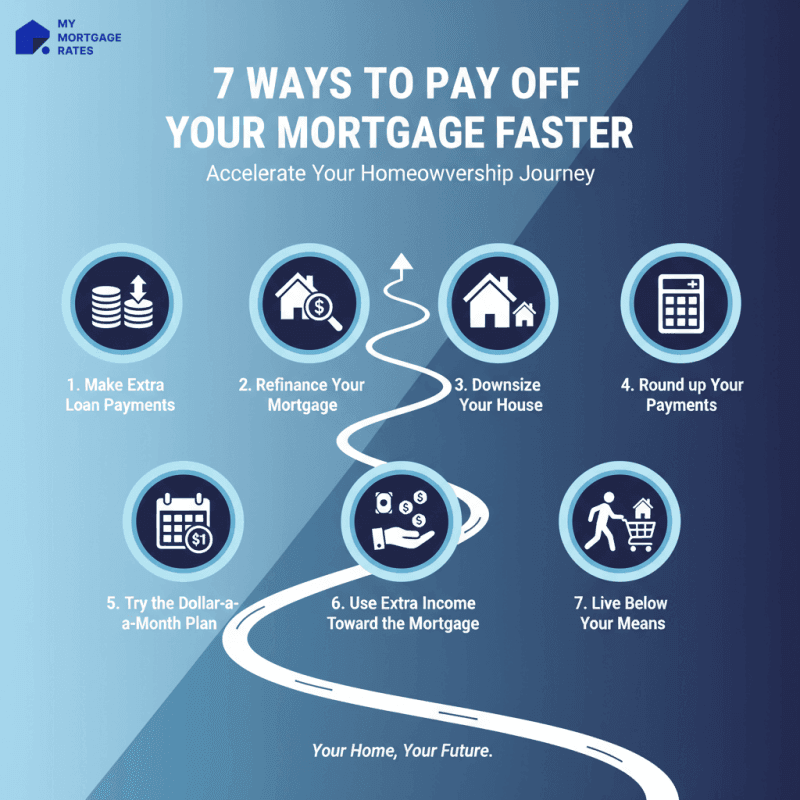

7 Ways to Pay off Mortgage Faster

If you still want to retire your loan, here are 7 ways to pay off a mortgage early for you. You might as well see which one suits for you.

1. Make Extra Loan Payments

Making extra payments directly to principal is the simplest and most effective way to shorten your mortgage and cut interest costs. Every dollar applied to principal immediately reduces the balance that accrues interest, so earlier extras produce the largest savings. Do this correctly by instructing your servicer in writing or via their online portal to apply any additional funds specifically to principal.

Otherwise, the servicer may post the funds to future scheduled payments or escrow. Automate the habit with a small recurring transfer (for example $50–$200/month) and keep confirmation records showing the servicer posted payments to principal. when you make large lump-sum payments, request an updated amortization snapshot so you can see the impact. Before you accelerate payments, confirm there is no prepayment penalty and that your emergency fund remains intact so you do not trade liquidity for theoretical savings.

2. Refinance Your Mortgage

Refinancing to a lower rate or shorter term can dramatically reduce total interest paid and accelerate payoff, but it's a tradeoff that requires careful calculation: compare the new monthly payment and closing costs to the expected savings and compute the break-even time (closing costs ÷ monthly savings) to decide if refinancing makes sense. Shop multiple lenders, collect Loan Estimates to compare APRs and fees, and include any prepayment penalty on your current loan in the analysis.

If the break-even period is comfortably shorter than the time you expect to remain in the home, refinancing often pays off. Consider refinancing to a shorter term, for example, 15 years, only if the new payment is affordable, or refinance to a similar term with a lower rate and deliberately apply the monthly savings to principal for a flexible acceleration approach. Finally, choose a refi product with no prepayment penalty and clear principal-posting rules if your goal is to pay off early.

3. Downsize Your House

Selling a larger home and buying a smaller, less expensive property can be an efficient way to eliminate or drastically reduce mortgage debt while lowering ongoing housing costs, but it requires a clear plan and non-financial considerations. Net proceeds after commissions and closing costs should be modeled against the costs of buying and moving, and you should compare the new home's total monthly carry, including PITI, HOA, utilities, and maintenance, to ensure a genuine cash-flow improvement.

Time the sale and purchase carefully, secure preapproval for the smaller home before listing ,and consider contingencies or a bridge solution to avoid temporary shelter gaps, and weigh the emotional and lifestyle impacts in terms of community, commute, and space. For many empty-nesters and downsizers, the financial benefits combine with lifestyle simplification, but thorough net-proceeds modeling and timing are key.

4. Round up Your Payments

Rounding up your mortgage payment to the next $50 or $100 is a low-friction way to make consistent additional principal contributions without a major budget shock. for example, turning a $1,847 payment into $1,900 adds $53 to principal every month and compounds into meaningful term reduction over time. Set up an automated transfer for the rounded amount and explicitly instruct your servicer to post the extra to principal.

Confirmation of posting matters because interest savings hinge on how quickly the payment reduces the principal. This behavioral approach is psychologically effective because it codifies a small, manageable increase as a default habit. check your amortization annually to measure progress and adjust the rounded amount as your budget permits.

5. Try the Dollar-a-Month Plan

The dollar-a-month plan is a progressive, low-pain strategy that adds a small incremental principal contribution each month, for example, $1 on month one, $2 on month two, through $12 on month twelve, producing a modest but cumulative extra principal each year that compounds over the mortgage term. Because the increases start tiny, this method is easy to maintain and scales well.

If the base progression feels too small, use larger increments, such as $5, $10 to amplify impact while keeping the gradual cadence. Automate the transfers or calendar reminders and always tell the servicer to apply the added amounts to principal. combined with rounding or annual lump sums, the dollar-a-month plan forms a gentle, reliable acceleration strategy for wary borrowers.

6. Use Extra Income Toward the Mortgage

Direct windfalls and incremental income, tax refunds, bonuses, raises, side-gig cash, or inheritance, to principal for outsized acceleration effects, since lump sums immediately reduce the outstanding balance and the base that accrues future interest. If you worry about liquidity, use a split strategy, for example, 50% to mortgage principal, 30% to an emergency fund, 20% to investments, so you reap payoff benefits without compromising reserves.

Alternatively, park the windfall in a high-yield savings account for a few weeks while you confirm there's no prepayment penalty and then apply the funds. When you make a lump-sum payment, get written confirmation that it was applied to principal and request an updated amortization schedule so you can quantify months and interest saved.

7. Live Below Your Means

Adopting a disciplined, lower-spending lifestyle and channeling the savings into extra mortgage payments is one of the most reliable long-term acceleration strategies. You can start with tracking expenses for 30–60 days so as to identify recurring costs to trim, such as unused subscriptions, dining out, premium services. Then, route the freed cash into a dedicated "mortgage-boost" transfer immediately after payday so you never spend it.

Small consistent cuts add up, and automating the process turns temporary sacrifice into a sustainable habit, but maintain the priority of a 3–6 month emergency fund and continue at least employer-matched retirement contributions before allocating all incremental savings to the mortgage. Consider short-term frugality challenges fo 30/60/90 days to jump-start the habit, then scale up the saved amount as you hit milestones.

Tips to Prepare For Paying off 15/30 Year Mortgage Faster

What's more, grasp these 3 tips if you really want to pay off your mortgage early.

1. Build a Emergency Fund

Build a 3–6 month emergency fund or larger if your situation warrants before accelerating mortgage payments. This prevents you from tapping equity or high-cost debt if unexpected expenses arise.

2. Improve Your Credit

Higher credit scores can produce lower refinance rates and better loan options. Pay down revolving balances, correct report errors, and maintain on-time payments to improve your score.

3. Set a Detailed Plan

Calculate exactly how much extra you must pay each month to reach your target payoff date, set milestones, and track progress. Use an amortization calculator to model scenarios and ensure prepayments are applied to principal.

[Formula] How to Calculate Early Mortgage Payoff?

Now, let's take a look at the basic overview of how to calculate early payoff payments.

-

Per-payment approach: New Payment = Regular Payment + Extra Principal.

-

Time saved: compute a new amortization schedule using New Payment, then Months Saved = Original Term (months) − New Term (months).

-

Interest saved: Interest Savings = Original Total Interest − New Total Interest.

For precise math use the present-value relationship for an amortizing loan: PV = PMT × [1 − (1 + r)^−n]/r

- PV = loan balance

- PMT = monthly payment

- r = monthly rate

- n = remaining months.

- Changing PMT and recomputing n yields the accelerated payoff term.

Moreover, here' an precise example calculation for you to learn it better.

- If you have a $300,000 loan at 6.00% (30-yr fixed), the standard monthly principal & interest is about $1,798.65. If you add $1,000 extra to the principal each month (so you pay $2,798.65), the loan will be paid in 154 months (≈12.8 years) instead of 360 months (30 years). Total interest paid falls from about $347,514.57 to about $130,841.11, saving roughly $216,673 in interest and shortening the term by about 17.2 years.

FAQs About Paying off Mortgage Faster

Q1. How much is the penalty when paying off mortgage faster?

Prepayment penalties are not universal. Many modern conforming and government loans (FHA, VA, USDA) disallow prepayment penalties. Where penalties are permitted, they are governed by the loan contract and by federal/state rules.

When allowed, penalty structures commonly used historically include percentage methods, for example, 1–2% of outstanding balance in early years, a set number of months' interest, or a declining schedule over the first few years. Federal rules and consumer protections limit penalty size and timing in many contexts, you must check your note and the prepayment disclosure to know whether a penalty applies.

Q2. What happens if I pay an extra $1,000 a month on my mortgage?

Applying an extra $1,000 to principal each month reduces interest paid and the loan term dramatically. See the example above: roughly $216k interest saved and payoff in about 12.8 years versus 30 years. Exact savings depend on remaining balance, current rate, and when payments are applied.

Q3. What's the fastest way to pay off a mortgage?

Combining strategies is fastest. You can refinance to a lower-term if rates and costs make sense, and make large principal lump sums. Also, switch to biweekly or add 1/12 of the payment each month to make an extra payment annually, and consistently apply windfalls.

Q4. What is the 10/15 rule for mortgages?

The "10/15 rule" is a simple guideline. If you have 10 years or less left, consider focusing on payoff. If you can comfortably afford 15-year payments, the 15-year term often yields large interest savings and is a useful replacement for a 30-year schedule with extra payments. It's a heuristic for deciding between investing extra funds vs. using them to shorten your mortgage, not a legal or technical rule.

Q5. How to pay off your 30 year mortgage in 7–10 years?

This aggressive goal requires very large extra payments, which often double or triple the typical 30-year payment, depending on loan size and rate. You may consider:

- Calculate the exact monthly payment required using an amortization calculator

- Redirect bonuses and windfalls to principal

- Reduce discretionary spending

- Refinance to a lower rate or shorter term if doing so reduces the total cost after closing fees.

Conclusion: Is It a Good Idea to Pay off Mortgage Faster?

Whether to accelerate mortgage payoff depends on your interest rate, investment alternatives, tax situation, liquidity needs, and long-term goals. Borrowers with high mortgage rates, minimal high-return investment opportunities, and solid emergency reserves commonly benefit most from accelerating payoff.

Those with low-rate mortgages who can earn higher after-tax returns elsewhere may prefer to invest additional cash. Always check for prepayment penalties, retain a healthy emergency fund, and consider consulting a financial loan professional.