Can You Get Preapproval from Multiple Lenders? What Smart Buyers Need to Know Before Shopping for a Mortgage

What Is Mortgage Preapproval?

Mortgage preapproval is the process where a lender examines your financial situation—including your income, assets, debts, and credit history—to determine the loan amount and terms you are likely to qualify for. Not only does this give you a clear picture of your homebuying budget, but it also shows sellers you're a serious buyer who has the financial backing to make an offer. This can make your bid much more competitive. However, a preapproval isn't a final loan commitment; that still depends on a property appraisal and a final check of your finances at closing.

Preapproval vs. Prequalification: What’s the Difference?

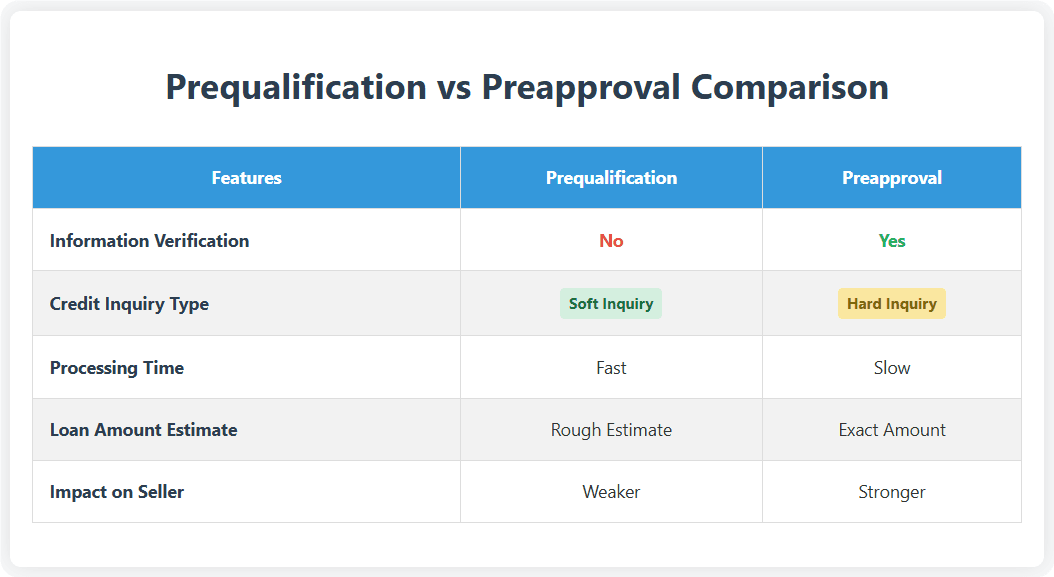

In the homebuying journey, "prequalification" and "preapproval" are two terms you'll hear a lot. They're easy to mix up, but they play very different roles in the loan application process. Prequalification is usually the first step. You provide some basic financial information, like your income, debts, and assets. The lender typically doesn't verify this information, and they may not even pull your credit report, so it has little to no impact on your credit score. Once you're prequalified, you'll get a rough estimate of how much you might be able to borrow, giving you a preliminary idea of your budget. But because none of this is verified, it doesn't carry much weight.

In the homebuying journey, "prequalification" and "preapproval" are two terms you'll hear a lot. They're easy to mix up, but they play very different roles in the loan application process. Prequalification is usually the first step. You provide some basic financial information, like your income, debts, and assets. The lender typically doesn't verify this information, and they may not even pull your credit report, so it has little to no impact on your credit score. Once you're prequalified, you'll get a rough estimate of how much you might be able to borrow, giving you a preliminary idea of your budget. But because none of this is verified, it doesn't carry much weight.

Preapproval, by contrast, is a much more formal and in-depth review. You'll need to submit detailed financial documents, such as tax returns, bank statements, and pay stubs, and the lender will pull your credit report. They will thoroughly vet everything. This process can take anywhere from a few days to a couple of weeks and involves a "hard inquiry," which might cause a slight, temporary dip in your credit score. If you're approved, you'll receive a formal preapproval letter stating the specific loan amount and terms. This not only gives you a firm grasp of your budget but also demonstrates your credibility and purchasing power to sellers, boosting your chances of success in a competitive market.

All in all, preapproval gives you a stronger advantage than prequalification, especially when you want to make a quick offer on a hot property. That said, prequalification is still a useful starting point to gauge your borrowing potential and do some initial planning. The ideal strategy is to start with a prequalification before you get serious about your house hunt and then secure a preapproval right before you're ready to make an offer.

Should You Get Preapproved by Multiple Lenders? Here’s What You Need to Know

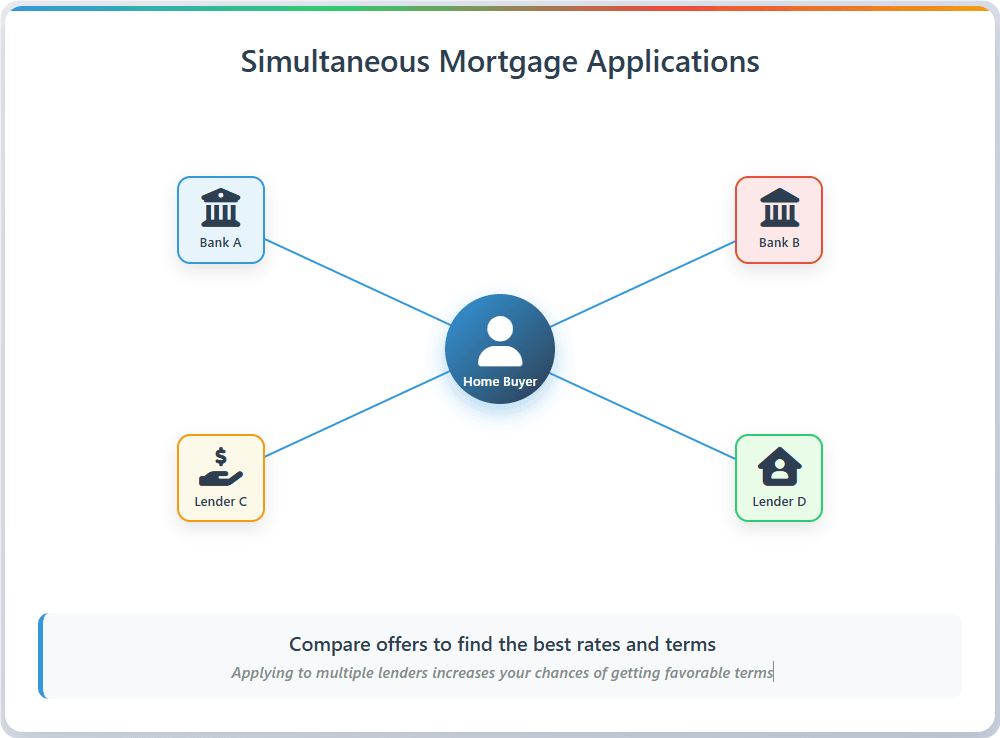

As a homebuyer, you shouldn't just settle for the first offer you get. It’s a smart move to compare rates and terms from several different lenders. Why? Because even small differences in interest rates and loan terms can have a massive impact on your total cost over the life of the loan. A fraction of a percentage point on your interest rate could save you tens of thousands of dollars over a few decades. By shopping around, you can find loans with lower rates, more transparent fees, and more flexible terms. Plus, having multiple offers in hand gives you leverage when negotiating with a bank or mortgage broker.

What Happens When a Lender Checks Your Credit

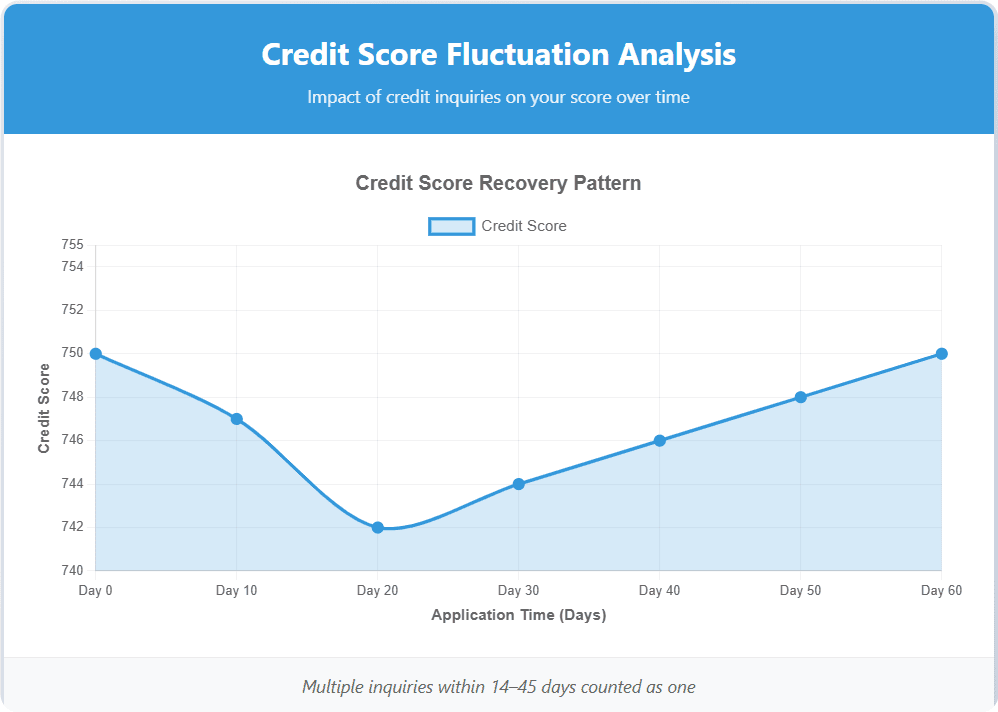

When you apply for preapproval, a lender will almost always perform a "hard inquiry" to review your credit report. This inquiry is recorded on your credit history and can cause your credit score to drop by a few points. Usually, this dip is temporary and doesn't have a major long-term impact on your overall credit health.

The Impact of Multiple Preapprovals on Your Credit Score

Applying for preapproval with several lenders at once won't drag your credit score down with each application. Credit scoring models (like FICO) are smart about this. They recognize that you're shopping for a single loan, not trying to take out multiple mortgages. As a result, they bundle all mortgage-related inquiries made within a certain time frame (typically 14 to 45 days) and treat them as a single event. This allows you to shop around for the best deal without being penalized. As long as you get all your applications in within a reasonable window, the impact on your credit is minimal. The long-term savings from finding a lower interest rate far outweigh the small, temporary dip in your credit score.

Applying for preapproval with several lenders at once won't drag your credit score down with each application. Credit scoring models (like FICO) are smart about this. They recognize that you're shopping for a single loan, not trying to take out multiple mortgages. As a result, they bundle all mortgage-related inquiries made within a certain time frame (typically 14 to 45 days) and treat them as a single event. This allows you to shop around for the best deal without being penalized. As long as you get all your applications in within a reasonable window, the impact on your credit is minimal. The long-term savings from finding a lower interest rate far outweigh the small, temporary dip in your credit score.

Getting Preapproved by Two or More Lenders

You can absolutely get preapproval letters from two or more lenders simultaneously, and it's a very common practice among savvy homebuyers. The reason is simple: different lenders have different rates, fee structures, down payment requirements, and lending terms. By comparing offers, you can get a clearer picture of the interest rates and loan amounts you actually qualify for, rather than relying on a single quote from one institution.

More importantly, having multiple preapproval letters strengthens your position when you’re ready to buy. When a seller is looking at offers, their biggest concern is whether the deal will actually close. If you can show that you have preapprovals from multiple lenders, you're signaling that you have reliable backup options even if one bank's approval gets delayed or hits a snag. This can significantly boost a seller's confidence in you and give you an edge in a competitive market.

Furthermore, different lenders might approve you for different loan amounts and terms based on their unique underwriting criteria. For example, one bank might be more strict about your debt-to-income ratio, while another might have special programs for first-time homebuyers. By comparing multiple lenders, you won't just find a lower rate—you might also discover a more flexible loan product, like one with a lower down payment requirement or more lenient income verification.

Of course, timing is key when applying with multiple lenders. Since preapprovals typically involve a hard credit inquiry, it's best to submit all of your applications within a two-to-four-week window. That way, the credit scoring models will count the multiple inquiries as a single event, minimizing the impact on your credit score.

Can Different Lenders Approve You for Different Amounts?

Yes, it’s very common for different lenders to preapprove you for different loan amounts. This happens because every lending institution has its own unique underwriting standards and appetite for risk. For instance, one bank might place a heavy emphasis on your debt-to-income (DTI) ratio, while another might be more focused on your credit score. Some may even offer special programs that attract first-time homebuyers. These differences directly influence the final preapproval amount.

Lenders also use different models and assumptions when calculating how much you can afford. One institution might estimate your future property taxes and homeowners' insurance to be on the higher side, which would result in a lower preapproval amount. Another might use more lenient assumptions, giving you a higher number. This explains why you can receive noticeably different results from different banks, even with the exact same financial profile.

For a homebuyer, these differences are actually an opportunity. By applying for preapproval with multiple lenders, you not only find out who will offer you the highest amount, but you also gain a more complete understanding of your own purchasing power. Most importantly, it gives you the leverage to compare and negotiate, helping you lock in the best possible loan for your situation.

Getting Preapproved by Multiple Lenders: How to Apply for a Mortgage with Multiple Lenders

Let's walk through how to apply for a mortgage with multiple lenders at the same time. The process is pretty straightforward. You'll typically need to gather one set of documents, including proof of income, asset statements, credit history, and employment information. Then, you submit these materials to the different lenders within a short period. This ensures that each lender is working with the same financial snapshot and also minimizes the impact on your credit score, since the credit bureaus will treat the multiple inquiries as a single search. Here are the steps to follow:

How to Get Preapproved for a Mortgage

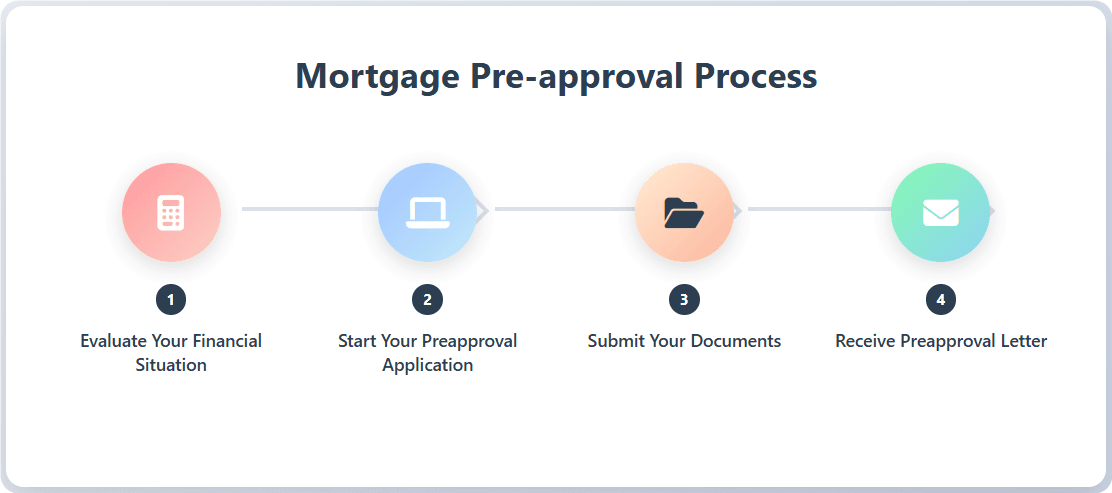

Now that you know what mortgage preapproval is all about, let's break down the application and approval steps to make the process crystal clear. The whole thing is relatively simple, but it requires you to be organized.

Now that you know what mortgage preapproval is all about, let's break down the application and approval steps to make the process crystal clear. The whole thing is relatively simple, but it requires you to be organized.

1. Evaluate Your Financial Situation

Before you even apply, take a good look at your own finances. This means understanding your income, debts, savings, credit score, and job stability. Lenders pay close attention to your debt-to-income (DTI) ratio and your credit history, so it’s a good idea to check your credit report beforehand and correct any errors you find. Doing this will help you present the strongest possible case for your ability to repay the loan.

2. Start Your Preapproval Application

Once you have a handle on your finances, you can start filling out applications. You can contact banks and credit unions directly or use an online mortgage platform. At this stage, the lender will ask for some basic personal and financial information to get a preliminary sense of your profile.

3. Submit Your Documents

For a formal preapproval, you'll need to provide a series of supporting documents. This usually includes recent pay stubs, tax returns, bank statements, proof of employment, and details on any existing debts. These documents allow the lender to verify the financial data you provided and assess the loan amount and terms you qualify for. The completeness and accuracy of your documents will directly affect the speed and outcome of your approval.

4. Receive Your Home Loan Preapproval Letter

Once the lender has finished their review, they will issue you a preapproval letter. This letter will clearly state the maximum amount you can borrow, the loan conditions, and an expiration date. For sellers, this letter is a powerful signal that you’ve already passed a financial review by a bank and are a serious, qualified buyer. In a competitive market, this letter can make your offer far more persuasive.

Now that you’ve learned how preapproval works and why comparing multiple lenders matters, you might still have practical questions about timing, documentation, or what happens if things change along the way. The following FAQs address the most common concerns, giving you clear guidance for each step of the preapproval process.

FAQ

What if My Preapproval Letter Expires?

Preapproval letters usually have an expiration date (typically 60–90 days). If it expires, you'll need to resubmit your most recent financial documents so the lender can review your file again. They do this because your income, debt, or credit situation may have changed.

How Long Does a Preapproval Last?

Most preapproval letters are valid for 60 to 90 days. This timeframe is based on the lender's assumptions about your financial stability and current market conditions. If your house hunt takes longer, you may need to get it renewed.

Can You Extend a Mortgage Preapproval Letter?

Yes, you can usually extend a preapproval. You'll need to provide updated documents (like recent pay stubs or bank statements). The lender will re-verify your financial standing and then issue a new letter.

What Happens if Rates Rise After I Get Preapproved?

A preapproval letter does not lock in your interest rate. If market rates go up, the final interest rate on your loan will likely be higher than what was estimated in your preapproval. However, once you have a property under contract, you can ask your lender for a "rate lock" to protect you from further rate increases.

What Is Required for Mortgage Preapproval?

Lenders will ask for detailed financial information, including proof of income, tax returns, bank statements, employment history, a list of your existing debts, and your credit report. These documents give them an accurate picture of your ability to repay a loan.

What Is a Good Timeline for Mortgage Shopping?

Ideally, you should start shopping for a mortgage a few months before you plan to seriously look for a home. This gives you enough time to evaluate different lenders and rates so you can act quickly when you find the right house. It's generally recommended to complete most of your home search within the preapproval's validity period.

Will Multiple Mortgage Applications Affect My Credit Score?

When you submit multiple mortgage applications within a short window (usually 14–45 days, depending on the scoring model), they are typically treated as a single inquiry. This means the impact on your credit score is limited. Shopping around is encouraged, as it helps you find the most competitive loan.

When Should I Apply for a Mortgage?

You should apply for preapproval before you start seriously touring homes. This will give you a clear budget to work with and allow you to make a strong, competitive offer as soon as you find a property you love.

Does Getting Preapproved by Multiple Lenders Hurt Your Credit?

No, it won't significantly hurt your credit. As long as you submit all your applications within a short time frame, credit scoring models will bundle them into a single inquiry. The benefit of finding a lower interest rate from multiple offers far outweighs the minor, temporary fluctuation in your credit score.

People Also Read

- Stop Stressing! How the Best California Mortgage Brokers Make Home Buying Easier (and Cheaper!)

- Mortgage Broker NYC: How to Get the Best Rates & Avoid Loan Approval Disasters

- When Do You Shop for Mortgage Lenders? Your Guide to Getting the Best Home Loan Rates in 2025

- How Much Does a Loan Officer Charge Compared to a Mortgage Broker?

- Mastering California Interest Rates: Your Ultimate Mortgage Guide for May 2025