Ultimate Guide: How to Become a Loan Officer with No Experience?

I saw people asking questions like how to become a loan officer on Reddit, and decided to post this article to help anyone who wants to be an MLO. You should learn here all the steps to be a mortgage loan officer and what skills are required. Also, Zeitro offers all MLOs a marketplace to get leads from organic traffic and be reached out to by borrowers. Don't miss it.

What is a Loan Officer in Real Estate?

Before we go any further, you might as well learn what is a mortgage loan officer along with the job outlook, duties, and salary level. Therefore, you'll know whether it's a good idea to be an MLO. Let's dive in.

Definition of a Loan Officer

A loan officer, who is commonly called a Mortgage Loan Originator, or MLO, is a licensed professional who evaluates, recommends, and assists with mortgage loan applications. They collect borrower financial information, run credit checks, calculate debt-to-income ratios, explain loan terms and disclosures, and guide the loan from application through closing.

Depending on employer type, an MLO may be an employee of a bank, credit union, or mortgage company, or an independent mortgage broker who places loans with multiple wholesale lenders.

Loan Officer Job Outlook

BLS states that employment of loan officers is projected to grow about 2 percent from 2024 to 2034, and roughly 20,300 openings are expected per year over the decade due principally to replacement needs. The median annual wage for loan officers was $74,180 (May 2024). However, compensation varies widely by region, employer type, experience, and whether pay is commission-based.

Duties and Responsibilities of Loan Officer

What does a mortgage loan officer do? Here's are some regular responsibilities for your reference, including:

- Conducting initial borrower interviews and collecting documentation like pay stubs, tax returns, bank statements, and ID.

- Pre-qualifying or pre-approving borrowers by reviewing credit, calculating DTI, and assessing assets.

- Recommending suitable loan products, including conventional, FHA, VA, USDA, jumbo, and portfolio loans.

- Completing and submitting the loan application (Form 1003) and supporting package to underwriting.

- Addressing underwriting conditions such as supplemental documents, income explanations, and asset verification.

- Coordinating appraisals, title/settlement work, and closing logistics. Also, explaining the final loan terms at closing.

- Maintaining relationships with real estate agents and other referral partners.

Loan Officer Salary for Reference

Compensation ranges widely. The BLS median ($74,180 in May 2024) is a helpful anchor, but percentile ranges show large dispersion. Entry-level and low-volume originators will typically be below median, while top producers can earn substantially higher totals through commissions and bonuses. Use percentile bands (10th/50th/90th) rather than single fixed "entry" numbers to avoid misleading readers.

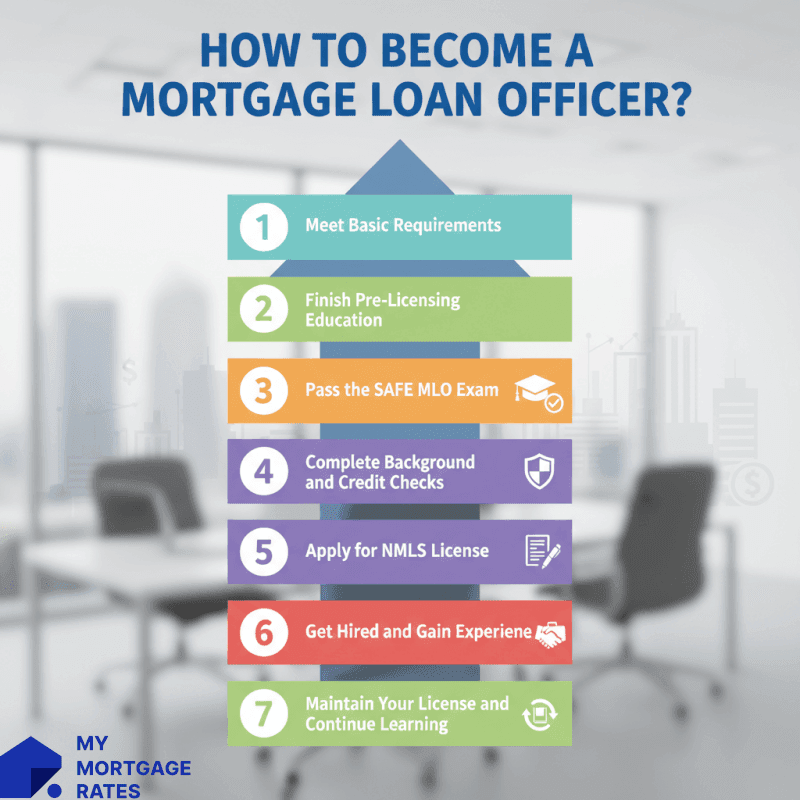

How to Become a Mortgage Loan Officer?

Breaking into mortgage origination with no prior experience follows a regulated pathway managed through the Nationwide Multistate Licensing System (NMLS) and SAFE Act requirements. State requirements vary, but the core federal components are consistent. To become a loan officer with no experience, here's all you have to go through.

1. Meet Basic Requirements

Minimum requirements generally include being at least 18 years old and having a high school diploma or GED. Applicants must demonstrate character and fitness. Regulators review criminal history and credit history to assess suitability.

Convictions for fraud, theft, or other serious financial crimes may bar licensure. States evaluate past offenses case by case under SAFE/NMLS standards. Applicants must authorize background checks and fingerprint submissions as part of the application process.

2. Finish Pre-Licensing Education

Prospective MLOs must complete 20 hours of NMLS-approved pre-licensing education, typically broken down as follows:

- 3 hours of federal law, 3 hours of ethics, including fraud/consumer protection/fair lending

- 2 hours of training on nontraditional mortgage products

- 12 hours of elective mortgage origination content.

3. Pass the SAFE MLO Exam

Candidates must pass the SAFE Mortgage Loan Originator Test (national component; state components may apply). Key facts commonly referenced:

- The national test contains 120 multiple-choice questions, which is approximately 115 scored + 5 pretest items, and the time limit is 190 minutes.

- A 75% score or higher on the national component is required to pass.

- Testing fees and retake policies are set by NMLS/Prometric; expect registration fees, which is commonly around $110, and standard retake waiting periods.

4. Complete Background and Credit Checks

Applicants must submit fingerprints through NMLS's authorized vendor for an FBI criminal background check and typically authorize a credit report. Regulators use these checks to evaluate character, financial responsibility, and any disqualifying history. Some states require additional documentation or may impose waiting periods for certain offenses.

5. Apply for NMLS License

After completing education, passing exams, and satisfying background/credit checks, applicants file the state license application through the NMLS portal or MU4 form for individuals. Applications include employment history, disclosures of regulatory/legal actions, and payment of state/system fees.

Processing times vary by state and complexity. You can apply to multiple states via NMLS if you intend to be licensed in more than one jurisdiction.

6. Get Hired and Gain Experience

Many new MLOs begin at banks, credit unions, or larger mortgage companies that offer structured onboarding, lead support, and internal processing teams. Highlight transferable skills like sales, customer service, and financial literacy on applications. Early success depends on building referral networks including real estate agents, builders, and CPAs to learn internal systems, and consistently follow up with prospects.

7. Maintain Your License and Continue Learning

State-licensed MLOs must complete a minimum of 8 hours of NMLS-approved continuing education (CE) annually, typically including 3 hours of federal law, 2 hours of ethics, 2 hours of nontraditional mortgage products, and 1 hour of electives. CE completion and license renewal deadlines vary by state, so plan renewals and CE well before the state-imposed deadline.

What Skills Are Needed to Be an MLO?

After you become an MLO, you'll still have to strengthen yourself to stand outstanding from your competitors. How to be a successful MLO? You should take a look at the following. Also, Zeitro provides loan officers a convenient tool, Scenario AI, to gain instant answers from a ton of guidelines, which can reduce manual hassle and improve your efficenncy to get quick closes.

-

Customer Service: Timely, clear communication and empathy help turn stressful transactions into positive client experiences and generate referrals.

-

Sales Ability: Prospecting, objection handling, and building a steady pipeline are essential in commission-driven environments.

-

Decisiveness: MLOs must make timely recommendations about product selection and rate-lock strategies while balancing borrower circumstances and regulatory constraints.

-

Communication: Explaining complex mortgage terms in plain language and coordinating among borrowers, underwriters, and settlement agents reduces friction.

-

Documentation: Meticulous document management prevents underwriting delays and reduces the risk of missing conditions.

-

Analytical: Understanding DTI calculations, asset/liability analysis, tax returns (for self-employed borrowers), and loan program overlays is required for accurate product recommendations.

-

Time Management: Managing multiple files and deadlines, including appraisal windows and rate locks, keeps transactions on schedule.

Tips for You to Become an MLO

Besides, here I conclude some tips for new starters if you want to become a loan officer in real estate. Better check these out.

- Choose NMLS-approved pre-license providers that include practice exams.

- Start networking before licensure by attending local real-estate events and joining mortgage associations.

- Consider joining a larger shop that provides leads and mentorship.

- Build a 12–18 month business plan with target market, marketing budget, activity goals.

- Specialize in VA, FHA, and self-employed borrowers to differentiate yourself.

- Maintain high ethical standards because reputation matters.

FAQs About Being a Loan Officer

Q1. How long does it take to become a loan officer?

Realistically 2–3 months is a common timeline to finish pre-licensing, pass the SAFE exam, and clear background checks; some people complete everything in 4–6 weeks if all steps go smoothly and the exam is passed on the first try, but delays of exam scheduling, state processing, or retakes often extend that timeframe.

Q2. Do you need a degree to be a loan officer?

No federal degree requirement exists. A high-school diploma or GED is the minimum. Many employers prefer candidates with degrees in business, finance, accounting, or economics, but practical experience and successful completion of NMLS requirements matter most.

Q3. Is being a loan officer hard?

The licensing process is achievable with preparation, but building a reliable book of business, coping with income variability, and managing high-pressure closing timelines are common challenges.

Q4. Do loan officers work on weekends?

Many do. Evenings and weekends are common to accommodate borrowers and agents. Schedule flexibility depends on the employer and personal choices.

Q5. How fast can you become a loan officer?

Minimum theoretical time is about 4–6 weeks under optimal conditions. However, you should allow 2–3 months as a practical planning horizon.

Q6. How to start off as a loan officer?

Complete NMLS pre-licensing education, pass the SAFE exam, file your MU4 through NMLS, and pursue roles at institutions that offer training and lead support. Build referral relationships early.

Q7. Is a loan officer a high-stress job?

It can be especially for commission-driven originators and during busy market periods. Strong processes, team support, and realistic expectations reduce stress.

Conclusion

Becoming a mortgage loan officer in California/Texas/Florida or other states with no experience is doable if you follow the regulated pathway: complete 20 hours of NMLS-approved pre-licensing education → pass the SAFE MLO exam → complete fingerprinting/background & credit checks → submit your NMLS state license application → join an employer that supports new originators.

Maintain annual CE and check state rules for variations. Use practice exams and mentor shadowing to improve your odds of early success. Also, you can join Zeitro and gain natural leads from MyMortgageRates without doing anything. That definitely can help you quickly be a successful MLO.