What is a Loan Officer? Meaning, Types, Duties, and Requirements

Whether you want to become a loan officer or search for a reliable loan officer near you, you should get an idea of what is a loan officer in real estate first. In this post, you'll learn the definition, types, responsibilities, requiremnts, and job outlook here. As for borrowers, there are also tips to compare loan officers. Moreover, MyMortgageRates by Zeitro is also a marketplace for you to easily meet your ideal loan officer.

People Also Read

- [Detailed Guide] What is a HELOC? All You Should Know Here

- [Must-Read] How Does a HELOC Work? Explore Process Here

- [Solved] How to Calculate HELOC Payment? Easy-to-Understand

- How Much Mortgage Can I Afford? Know Your Affordability

- All-to-Know: How Do Mortgage Rates Impact Affordability?

Meaning: What is a Mortgage Loan Officer?

So, what is the loan officer in real estate exactly? A mortgage loan officer (MLO) guides borrowers through the home-financing process. MLOs work directly with borrowers to help them obtain financing to purchase or refinance residential properties. They gather and evaluate financial documents, explain lending products and costs, calculate debt-to-income ratios, evaluate creditworthiness, and shepherd loan applications from intake through closing.

Loan officers act as intermediaries between borrowers and the lender's underwriting and closing teams, and they frequently coordinate with real estate agents, appraisers, title companies, and closing/settlement agents to keep transactions on schedule. Beyond paperwork, they often build referral relationships with real estate professionals and provide ongoing client service.

Types of Mortgage Loan Originators

Also, you should learn that there are typical two common types for mortgage originators. Just scroll down to grasp the idea.

-

Loan officers/mortgage bankers: employed by a single financial institution (bank, credit union, or mortgage company). They offer that institution's loan products and usually provide direct access to the lender's underwriting and processing teams. They are typically paid a salary, commission, or a combination and represent a single lender's product suite.

-

Mortgage brokers: independent intermediaries who shop a borrower's file to multiple wholesale lenders to find competitive pricing or niche products. Brokers can access a wider range of lenders and programs but do not fund loans in their own name. Brokers' fees and compensation methods vary by state and by arrangement with lenders.

Duties: What Does a Loan Officer Do?

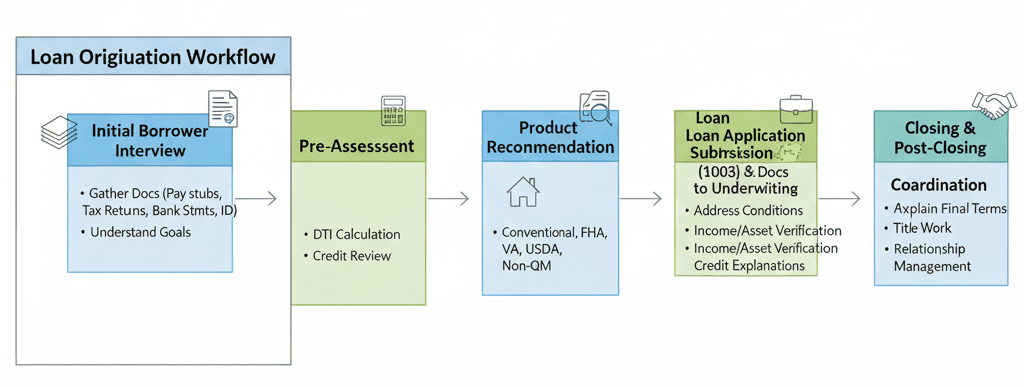

What is the job of a loan officer? The role blends sales, financial analysis, compliance, and project management. Usually, loan officers manage the origination workflow and client communications, including:

-

Initial borrower interviews to understand goals and gather documentation like pay stubs, tax returns, bank statements, ID.

-

Pre-qualification/pre-approval assessments, such as DTI calculations and credit review.

-

Recommending suitable loan products like conventional, FHA, VA, USDA, nonQM based on the borrower's profile.

-- Check here if you're looking for a conventional loan officer. -- Check here if you're looking for a FHA loan officer. -- Check here if you're looking for a USDA-RD loan officer. -- Check here if you're looking for a VA loan officer. -- Check here if you're looking for a nonQM loan officer.

-

Preparing and submitting the loan application (1003) and supporting documentation to underwriting.

-

Communicating with underwriting, addressing conditions such as additional documentation, explanations for credit items, and income verification.

-

Coordinating appraisal orders, title work, and closing logistics; explaining final loan terms at closing.

-

Post-closing follow-up and relationship management.

What is the Difference: Mortgage Broker vs Loan Officer

Many borrowers find it confusing to mortgage broker and a loan officer. Acrtually, the primary difference is product access and who ultimately funds the loan:

-

Loan officers represent and offer products from the institution that employs them with single-source.

-

Brokers shop multiple lenders and present options from different funding sources often with multi-source.

Both must follow federal and state regulations and, when applicable, register with NMLS. Which route is better depends on whether the borrower prioritizes a single-lender relationship with convenience, direct underwriting path or a broader shop of options that offers potentially more choices.

Requirements to Become a Loan Officer

How to become a loan officer? If you're looking forward to being a mortgage loan officer, here's what you need to prepare.

Education

What education is needed to become a loan officer? In fact, there is no federal degree requirement to become an MLO. Employers may prefer candidates with bachelor's degrees in business, finance, economics, accounting, or real estate, but many successful loan officers enter from related fields like banking, sales, real estate, and gain licensing via NMLS pre-licensing education and on-the-job training.

Licenses, certifications, and registrations

Under the SAFE Act and current federal rules, individuals who originate mortgage loans for compensation must meet minimum licensing requirements administered through the Nationwide Multistate Licensing System (NMLS). Key federal requirements include:

-

20 hours of NMLS-approved pre-licensing education, including at least 3 hours federal law, 3 hours ethics, and 2 hours nontraditional mortgage training according to Consumer Financial Protection Bureau.

-

Passing the SAFE Mortgage Loan Originator Test (the NMLS/SAFE MLO Test). The national test component is 120 multiple-choice items with 115 scored and 5 pretest items. Candidates are allotted 190 minutes to complete it. State-specific components may apply depending on jurisdiction.

-

Background checks and fingerprinting: Applicants must submit fingerprints for an FBI criminal background check and typically authorize an independent credit report; states may have additional or recurring background-check requirements.

-

Continuing education: After licensure, MLOs must complete annual continuing education. the NMLS model requires 8 hours, though check state variations through National Mortgage Professional.

Job Outlook of Loan Officer in Real Estate

Based on the U.S. Bureau of Labor Statistics (BLS), employment of loan officers is projected to grow about 2 percent from 2024 to 2034, which is slower than average. The BLS also reports roughly 20,300 openings per year over the decade due to replacement needs. The median annual wage for loan officers was $74,180 in May 2024; actual compensation varies widely by production, market, geography, and employer.

Tips to Shop Around Loan Officers (If You are a Borrower)

If you're first-time homebuyer that want to get a home loan, remember that always compare different loan officers before you make up you mind. Here're some tips for you.

-

Interview at least 2--3 loan officers or brokers and request Loan Estimates for the same loan scenario.

-

Verify NMLS license numbers and check for disciplinary actions using the NMLS Consumer Access.

-

Ask about their production volume, experience with your loan type, and typical timeline to close.

-

Compare total cost including rate, points, origination fees, third-party fees, and service quality. The lowest advertised rate may hide fees or lower service levels.

-

Ask whether pricing is locked or floatable, who manages the file day-to-day, and whether the officer will be available during underwriting/closing.

FAQs About Loan Officers

Q1. Can I get a loan without a loan officer?

Yes, many lenders provide online, automated mortgage applications that can complete straightforward loans without a dedicated officer. Complex files like self-employment, credit issues, and nonstandard income, usually benefit from an MLO's assistance.

Q2. What is a junior loan officer?

An entry-level MLO who assists with packaging files, document collection, and initial borrower interviews under supervision. Typically compensated at a lower rate until proven production capability.

Q3. What is a senior loan officer?

A seasoned originator who handles complex scenarios, mentors juniors, and typically generates higher production volumes with commensurate compensation.

Q4. What is the salary for a loan officer?

The BLS median (May 2024) is $74,180, but total pay depends on base salary and commissions/bonuses. Entry-level salaries can be lower ($40k--$50k), while experienced producers in strong markets often exceed six figures.

Q5. What education is needed to be a loan officer?

No specific degree is required by federal law; many employers prefer degrees in business, finance, accounting, economics, or real estate, but practical experience plus NMLS pre-licensing education is typically sufficient.

Q6. What is the typical commission for a mortgage loan officer?

Compensation models vary, including salary, salary + commission, or commission-only. Commission rates commonly cited for loan officers range roughly 0.5%--1.0% of the loan amount, though structures vary widely by employer and market; brokers' compensation/fees may follow different ranges and state rules. Always ask the officer to explain how they're paid and for any origination or broker fees that affect the total cost.

Conclusion

Mortgage loan officers are central figures in home-financing: they combine document management, product expertise, compliance, and client communication to move loans from application to closing. Licensing through NMLS, passing the SAFE exam, pre-licensing education (20 hours), background checks, and ongoing continuing education are the core regulatory milestones. When choosing an MLO, compare written estimates, check credentials, and weigh service quality as well as price.

Last but not least, MyMortgageRates is a platform that bridges borrowers and loan officers, you can always search for the loan officers near you with the best rate here!