Is Buying a House Worth It Right Now?2025 Home Market & Mortgage Insights

The U.S. housing market in 2025 stands at a pivotal crossroads. After years of post-pandemic frenzy and volatility, today’s real estate environment has settled into a tense equilibrium, marked by both genuine opportunity and daunting challenges for anyone thinking about buying a home. For most would-be buyers, the essential question isn’t just “should I buy a house now or wait?”—it’s how to navigate a market shaped by high mortgage rates, shifting home inventory, and pronounced regional differences in property value. The age of across-the-board price appreciation is over; today’s market rewards financial discipline, deep local knowledge, and a strategic, long-term mindset for buying or selling a house.

Should You Buy Now or Wait?

Pros and Cons of Buying a House Right Now

One of the strongest arguments for buying a house in 2025 is the ability to start building home equity immediately. Unlike rent, every mortgage payment on your house goes toward increasing your net worth, making homeownership an effective hedge against inflation and a foundation for generational wealth. Another major benefit is locking in housing costs for decades to come—protecting yourself from the unpredictable rise in rent and adding a layer of long-term financial stability to your property investment. The current cooling of the housing market, driven by elevated mortgage rates, has also given buyers enhanced bargaining power. With fewer competitors, prepared homebuyers can negotiate not just on house price but also for favorable sale terms, repairs, and concessions on the property.

A common expert strategy in today’s housing market is to “marry the house, date the rate”—meaning buy now while the market is less crowded, then refinance your mortgage later if rates fall. This approach leverages today’s improved inventory and lower competition, even in the face of high interest rates.

However, buying a house now is not without risks. The most prominent is affordability: mortgage rates have stabilized between 6.5% and 7.0%, pushing monthly home payments to multi-year highs and stretching budgets. Waiting could mean benefiting from lower rates in the future, and as property inventory recovers, buyers may gain even more leverage in the market. Yet, this approach is a gamble. If house prices continue to climb, or if the “best window” passes, you could be priced out altogether, negating any benefit from marginally lower rates.

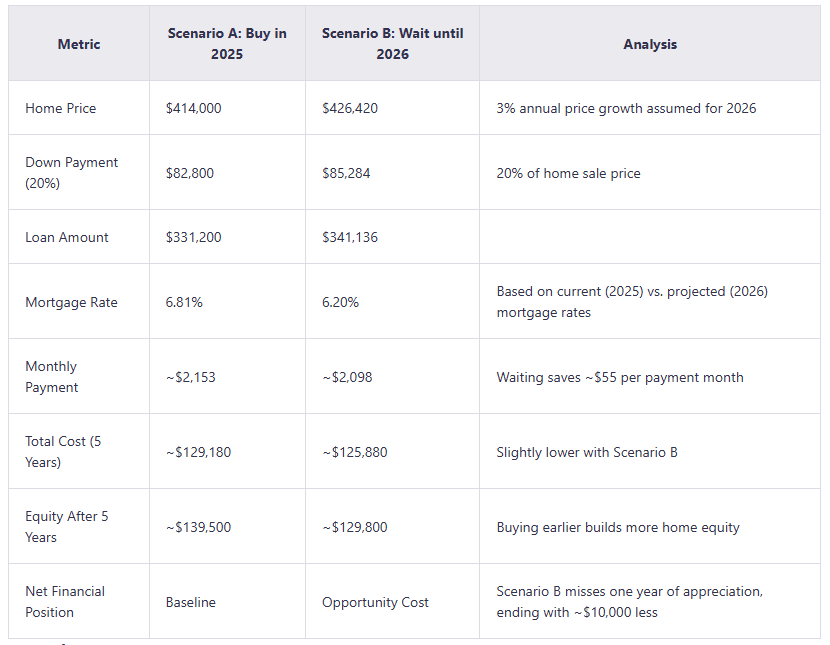

Scenario Comparison: Buy Now or Wait?

A direct financial comparison underscores the trade-offs in buying a home now or later. The table below, based on expert forecasts, illustrates the difference between buying in 2025 and waiting until 2026, considering home price, mortgage payment, and net equity:

Conclusion: While waiting may reduce your monthly mortgage payment, the rise in home prices and lost equity accumulation typically offset those savings. Time in the housing market often outweighs attempts to time the market.

But how exactly do these trade-offs play out in real numbers? To answer that, let’s take a closer look at the key market drivers shaping today’s home buying decisions.

Key Factors Affecting Home Buying Decisions

To truly weigh your home buying options, it’s essential to understand the forces driving both cost and opportunity in today’s housing market.

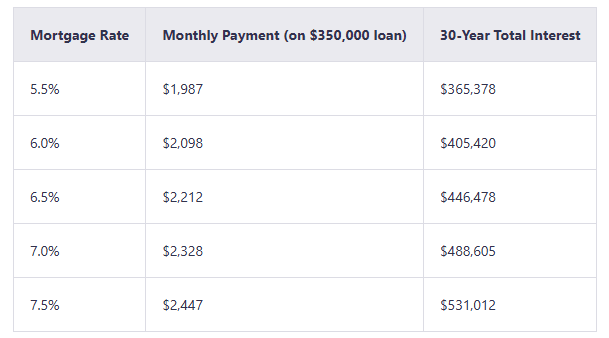

Current Mortgage Rates and Their Impact

As of mid-2025, the average 30-year fixed mortgage rate is hovering between 6.7% and 6.9%. Experts forecast mortgage rates will stay in the 6–7% range through most of the year, with only a mild decline projected by late 2026. Even a half-point shift in rates can have a dramatic impact on both monthly mortgage payments and total interest paid for your home:

Thus, while today’s mortgage rates are high, their relative stability compared to the post-pandemic rollercoaster has allowed buyers to plan with more confidence—even if home affordability remains stretched.

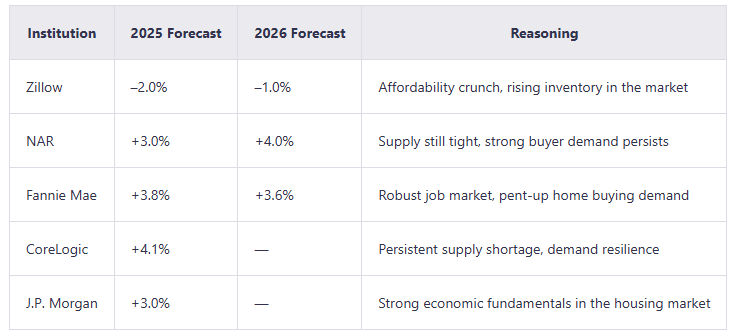

Housing Price Trends and Predictions

There is significant disagreement among major institutions regarding the future direction of home prices:

Most experts agree there is no housing bubble. Tighter lending standards, high levels of home owner equity, and the absence of widespread risky lending mean the 2008-style real estate crash is extremely unlikely. Instead, expect either modest gains or a gentle correction, highly dependent on local market dynamics and property trends.

Market Conditions: Inventory, Buyer/Seller Dynamics

Of course, numbers tell only part of the story—what’s equally important is the broader context shaping these results in the real estate market.

Inventory is rising nationally (+24.8% year over year), and houses are staying on the market longer, but regional differences are stark. For example, property inventory has surged over 30% in the West and over 25% in the South, leading to strong buyer markets in cities like Austin, Phoenix, and Denver. In contrast, the Midwest and Northeast remain tight and tilted toward sellers. The so-called “lock-in effect”—homeowners with low-rate mortgages reluctant to sell—continues to constrain supply and support prices in many regions.

Down Payment Pressure and Requirements

While the ideal down payment is 20% (to avoid private mortgage insurance), many mortgage programs allow for as little as 3% (conventional loans) or 3.5% (FHA loans) on a house. However, with median prices above $400,000, even these smaller down payments can be challenging to save. Buyers need to balance the benefits of lower upfront costs against the long-term burden of higher monthly mortgage payments and insurance fees.

Mortgage Qualification Standards

Conventional loans generally require a minimum credit score of 620 and a debt-to-income ratio (DTI) under 45% (sometimes up to 50% for very strong applicants). FHA loans are more lenient, with scores as low as 580 (for 3.5% down) or even 500 (for 10% down), but they come with permanent mortgage insurance costs. VA and USDA loans offer zero-down options for qualifying buyers but are restricted to specific groups. The key is not just qualifying for a mortgage loan, but ensuring you can afford the home payment without undue stress, especially at today’s interest rates.

Expert Opinions and Economic Forecasts

Across all expert commentary, the core advice is clear: the best time to buy a house is when your personal finances and long-term goals align—not when headlines declare a “perfect” market. Attempting to time the housing market for short-term gains is risky; discipline, planning, and understanding local conditions matter most.

Rent vs Buy: Cost and Lifestyle Comparison

With these fundamental drivers in mind, let’s compare how the numbers and realities stack up when renting versus buying a house in the current market.

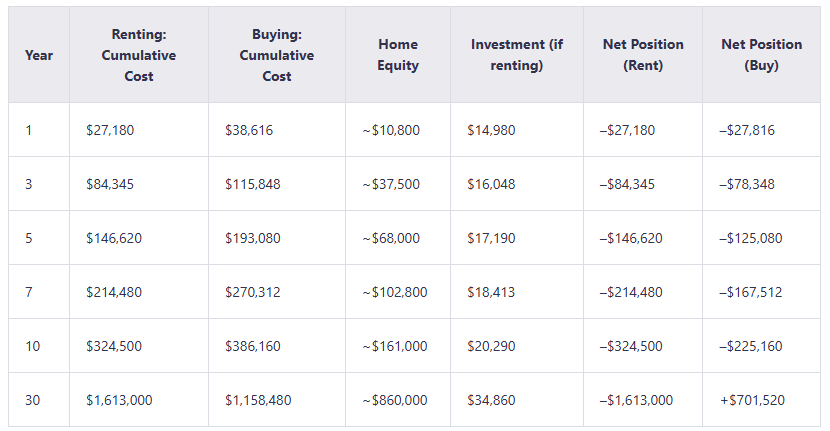

Long-term vs. Short-term Cost Analysis

A side-by-side comparison of renting versus buying a home demonstrates the importance of time horizon and opportunity cost. The following model (based on a $400,000 house with FHA financing, 3.5% down, at 6.8% interest; $2,200/month rent; 3% annual rent increases; 3% home price appreciation; and 7% opportunity cost on investments) lays out cumulative costs and net position over time:

Takeaway: In the early years (up to 5–7), rent payments result in lower total cash outflow. However, over the long term, homeownership pulls ahead thanks to accumulated equity and home price appreciation. The “break-even” typically occurs around year 7–10, proving that buying only makes financial sense if you plan to stay put for the medium- to long-term.

Flexibility vs. Financial Security

Renting provides maximum flexibility and lower upfront cost, ideal for those who may need to move or who want to avoid maintenance hassles on their property. Buying a house offers stability, pride of homeownership, and a forced savings mechanism, but at the cost of liquidity and flexibility. Both routes involve trade-offs in cost and property rights; the right choice depends on individual circumstances.

Special Considerations & Regional Analysis

Beyond national averages, where you buy a home can matter as much as when you buy. Regional differences in property values and house sale prices have never been more pronounced.

Is Buying a House Worth It Right Now in the USA?

At the national level, the real estate market is “neutral to buyer-friendly,” with inventory rising and home price growth slowing or even modestly reversing in some areas. However, averages mask tremendous local variation in both house prices and market demand.

Is Buying a House Worth It Right Now in California?

California is a microcosm of market complexity. Median house prices remain the highest in the nation, but 2025 saw a rare moment of softening—inventory is up more than 50% year over year, and median sale prices declined 2.3% in May. The window for buyer leverage has widened, but home affordability remains a major hurdle, and outcomes depend heavily on the specific metro or region.

Is Now a Good Time to Buy a House with Cash?

In a high-rate environment, cash buyers wield immense power: faster, more certain closings, and the potential to negotiate meaningful price discounts (often 6–17%) on a property sale. The downside is tying up capital in an illiquid property and forgoing potential gains from alternative investments. Strategic buyers may opt for a large down payment (e.g., 50%) instead of going all-in, balancing leverage and liquidity on their real estate investment.

Regional and State Examples

- Sunbelt Cities (Austin, Phoenix, Denver): Inventory surges have flipped these real estate markets in buyers’ favor. Aggressive negotiation is possible for homes for sale.

- Wisconsin & Midwest: Remain tighter and seller-leaning, with no evidence of widespread price drops, more likely to see stability or modest growth in property value.

Given all these moving pieces in the housing market, many buyers still have practical, personal questions. Here are some of the most common—answered with today’s data in mind.

Frequently Asked Questions (FAQ)

Is it smart to buy a house right now?

Yes, if you’re financially prepared for long-term homeownership (5+ years), have minimal high-interest debt, a solid emergency fund, and monthly mortgage payments well within your comfort zone. It’s not smart if you’re hoping to flip the real estate market for quick gains or if your finances are not secure.

Are we suckers if we buy a house right now?

No—provided your reasons are sound (stability, family, long-term investment), not driven by FOMO. Overextending yourself in a local price bubble without a long-term plan would be unwise, but negotiating a fair sale price in today’s less competitive real estate market is not being a “sucker.”

Can I afford a $300k house on a $70k salary?

It’s possible, especially with FHA financing. A $300k house (assuming 3.5% down, 6.8% interest rate) would require a monthly payment (PITI+MIP) of roughly $2,417—about 41% of your pre-tax monthly income. While this may qualify, it leaves little room for other debt and is a financial stretch for most buyers.

What salary do you need for a $400,000 house?

Using a conservative 28% housing ratio, you’d need a gross monthly income of ~$11,500 (annual salary ~$138,000) for comfort. Many lenders will go lower, but true affordability for a $400k home is generally in the $115,000–$140,000 salary range. The property cost and required payment play a major role.

Are Wisconsin home prices dropping?

No strong evidence. The Midwest housing market remains tight, with low inventory and competition. Home prices are likely to be stable or see modest gains.

Are home prices dropping in Wisconsin?

Current data does not indicate a significant drop. While home price appreciation has slowed, the state’s real estate market is more likely to experience stability than a downturn.

People Also Read