Mortgage Rate Predictions 2025: What to Expect in the Year Ahead

If you’re eyeing the real estate market in 2025, you’re probably wondering the same thing many of my clients ask me these days: where are mortgage rates heading? With so many mortgage interest rate predictions 2025 floating around, it’s important to get a clear picture.

Let me tell you—having been in this business for over a decade, I’ve seen how markets swing. And truth be told, 2023 and 2024 were a wild ride. Rates jumped, the Fed stayed firm, and buyers had to get creative just to close deals. But now, heading into 2025, there’s a quiet optimism brewing around the projected mortgage rates 2025.For context, explore historical mortgage rate trends since 1971.

Could 2025 finally be the year mortgage interest rates in 2025 ease up? Let’s break it down in plain terms.

What’s Going On with Mortgage Interest Rates Right Now?

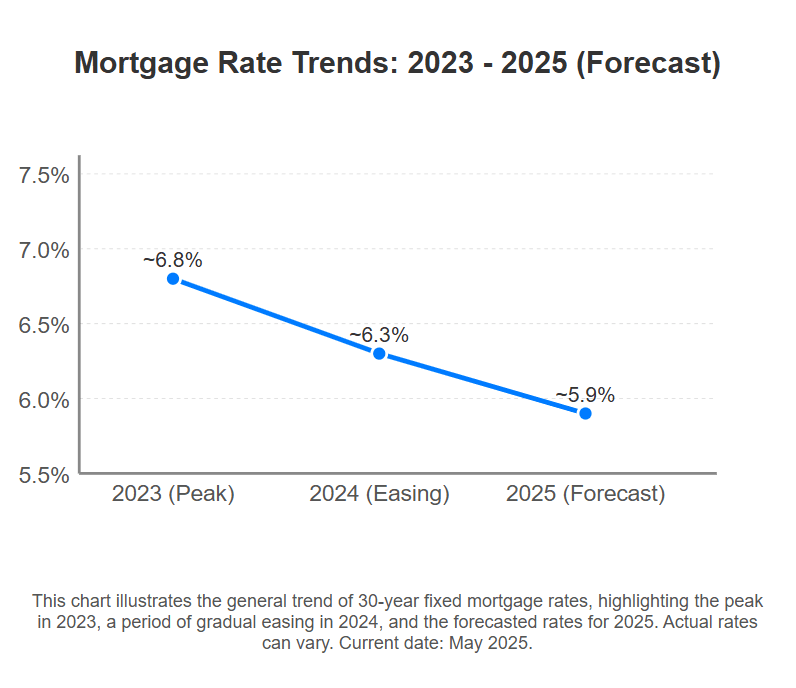

As of early 2025, mortgage rates are hovering in the mid-6% range. That’s definitely better than the late 2023 highs, but still a far cry from the ultra-low rates many of us remember from the 2010s.

So why are rates still a bit stubborn? It comes down to a few things—mainly lingering inflation, the Federal Reserve’s cautious attitude, and general uncertainty in the market. The good news? Inflation is cooling gradually, and the Fed is starting to hint at a possible shift in direction. This aligns with several interest rate predictions 2025 that anticipate a slow easing.

Will Mortgage Rates Keep Dropping in 2025?

There’s a decent chance. Most economists I follow are cautiously optimistic. If inflation continues to decline and the job market stays steady, we might see rates slide toward the low 6% range—or even dip into the high 5s by year’s end.

Fannie Mae, for example, is forecasting around 5.9% by the end of the year. That’s promising, but let’s be clear: everything hinges on how the Fed responds in the coming months. This is reflected in many mortgage rates 2025 prediction models.

What’s Driving All of This?

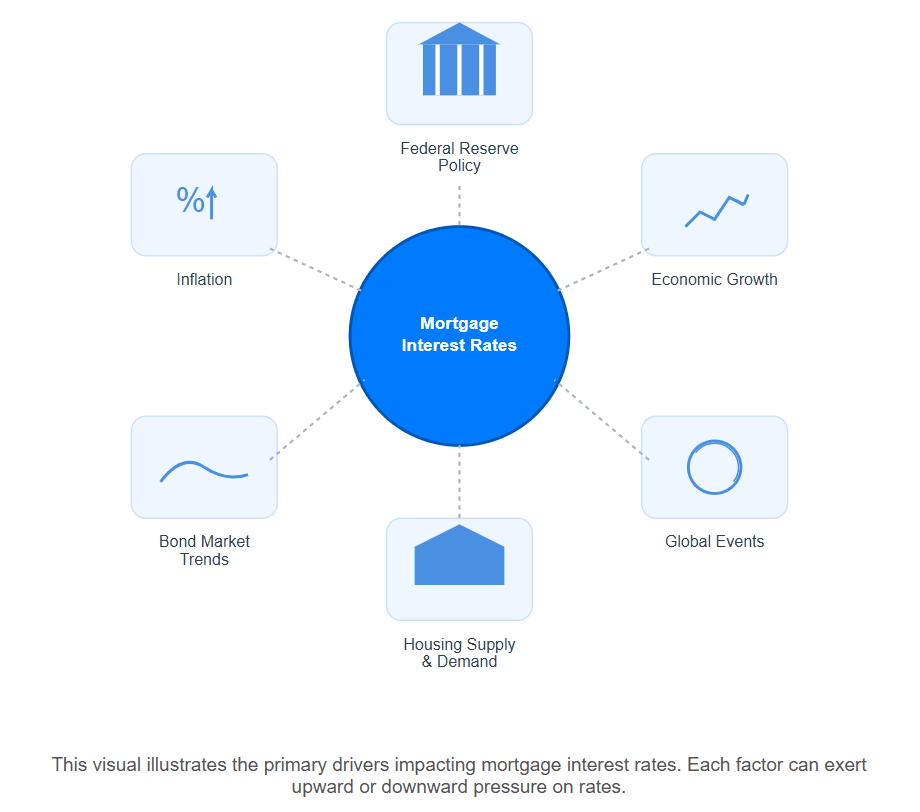

Here are the main forces I always tell my clients to watch:

- Inflation: This is the biggest driver. When inflation goes down, mortgage interest rates tend to follow.

- Federal Reserve Policy: If the Fed lowers its benchmark rate, mortgage rates usually trend lower too, which influences the projected mortgage rates 2025.

- Bond Market Trends: Mortgage rates often move in sync with the 10-year Treasury yield.

- Economic Growth: Strong growth can push rates up; slower growth usually pulls them down.

- Global Events: Things like geopolitical tensions or overseas market shifts can also influence rates here at home.

- Housing Supply and Demand: Low inventory or sudden surges in listings can nudge rates or prices around as well.

What This Means for Buyers and Homeowners

Here’s the truth I always share: no one—not even seasoned pros—can perfectly time the market. Focus on what you can control.

If you’re in the market to buy, get your finances in order and compare offers from several lenders. A slightly higher rate isn’t a dealbreaker if the property suits your needs and long-term plans.

Thinking about refinancing? Run the numbers carefully. If it makes financial sense now, it might be worth acting—even if predicted mortgage rates 2025 suggest rates could drop later. You can always refinance again down the road.

And don’t forget: closing costs, loan structure, and your bigger financial goals all matter too.

The 2025 mortgage rate predictions suggest this might be a pivotal year for mortgage rates, but don’t hold your breath for drastic drops. Stay informed, stay flexible, and make choices that support your life and financial stability today.

Chasing the lowest possible rate is fine—but the best timing is the one that works for you.

People Also Read

- When Will Mortgage Rates Go Down: 2025 Forecast and What Homebuyers Should Expect

- Will Mortgage Rates Go Down in 2025? Expert Predictions & Home Buyer Advice

- How Tariffs Are Impacting Mortgage Rates in 2025: What Homebuyers Need to Know

- South Carolina Mortgage Rates 2025: Trends, Predictions & What Buyers Should Know

- What Happens to Mortgage Rates When the Housing Market Crashes?