Taking Out a Second Mortgage in 2025: Your Roadmap to Smart Home Equity Access

Unlocking Your Home's Value: When Walls Become Wallet

Picture this: You’re staring at a crumbling bathroom or a college tuition bill that landed like a piano dropped from the sky. Your savings account whimpers in protest. But what if I told you your home’s been quietly building a financial safety net behind your back? That’s where taking out a second mortgage steps in. It’s not magic—it’s accessing the home equity you’ve painstakingly built. Think of it as politely asking your house, "Mind if I borrow against your value for a bit?" But listen closely: taking out a second mortgage is a heavyweight financial decision. It’s leveraging your sanctuary for access to cash, whether for that dream kitchen or escaping credit card quicksand. Let’s navigate this terrain together.

Now, let’s clear the fog around the term itself. Whisper "second mortgage" at a barbecue, and half the folks might picture you buying a beach condo. The reality? Nine times out of ten, it’s about unlocking cash from the home you already live in. We’re talking tapping home equity via two main paths: a predictable Home Equity Loan (HELOAN) or a flexible HELOC (Home Equity Line of Credit). Forget vacation homes—this guide is your compass for transforming your primary residence into a financial tool.

How Your House Becomes a Piggy Bank: The Nuts and Bolts

Your Home Equity: The Star Player

That home equity number isn’t pulled from thin air. It’s simple math: Grab your home’s current appraised value and subtract what’s left on your mortgage balance. Picture a home worth $500,000. If you owe $300,000 on the first loan? Congratulations, you’ve got $200,000 sitting quietly in home equity. Taking out a second mortgage lets you reach into that $200,000 stash. It’s your asset whispering, "Need some cash? I’ve got your back—for a price."

The Lien Ladder: Who Gets Paid First?

Here’s the gritty truth: Your sparkling new second mortgage gets stuck in line behind the original loan. Legally, it’s a junior lien or second lien. If the worst happens—foreclosure—the bank holding your primary mortgage gets every penny owed before the second lender sees a dime. This pecking order means taking out a second mortgage feels riskier to lenders. Their defense? Charging you higher interest rates. It’s the price of cutting in line.

Your Two Flavors of Second Mortgages: HELOAN vs. HELOC

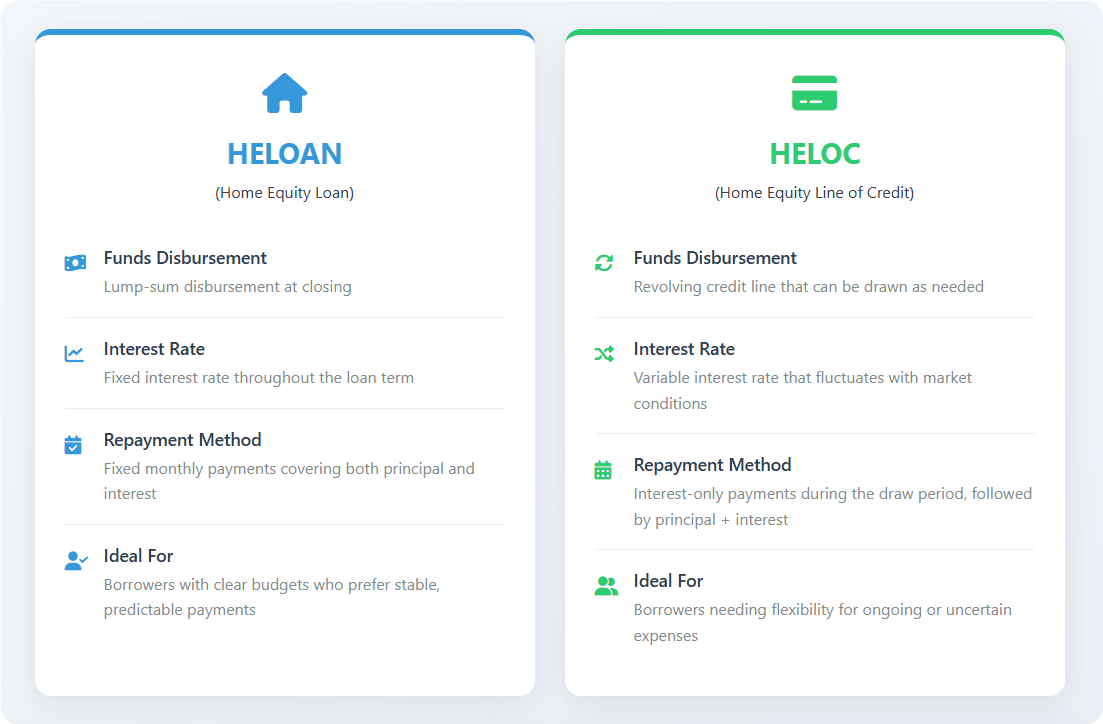

The HELOAN: Your Predictable Power Play

Imagine receiving one hefty check, deposited straight into your account. That’s the Home Equity Loan (HELOAN). You get every dollar upfront—a lump sum delivered with a handshake. The beauty? Fixed interest rates mean your monthly payments (covering both principal and interest) stay identical for the loan’s entire life. No surprises. Zero guesswork. It’s the golden ticket for projects with clear price tags: wiping out high-interest debts with debt consolidation or tackling a contractor-quoted home renovation project. Perfect when you crave certainty.

The HELOC: Your Financial Safety Net

Think of a HELOC (Home Equity Line of Credit) as your home handing you a credit card. Need $15k for a new roof now? Draw it. Surprise medical bill next year? Tap it again. During the initial "draw period" (often 10 years), you enjoy flexible access to funds up to your limit. You typically pay only interest-only payments on what you use. Heads up: The variable interest rate dances with the prime rate, meaning payments can rise. It shines for ongoing expenses—think tuition payments over semesters or unpredictable home improvement needs. Your built-in financial safety net.

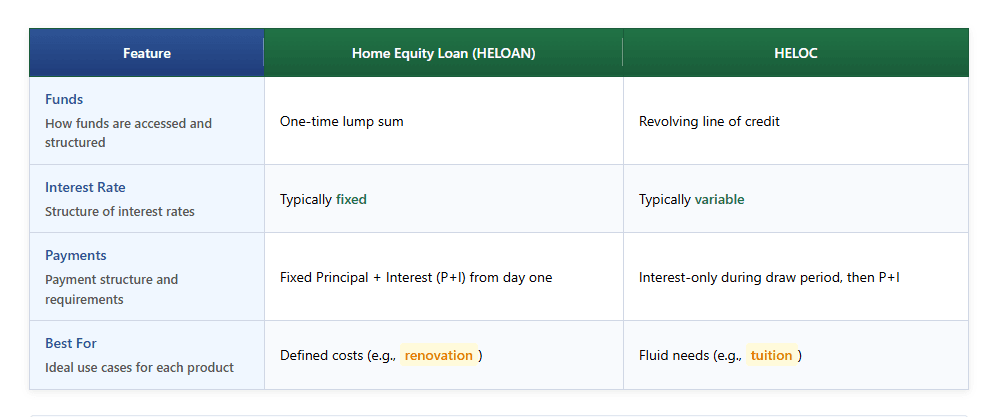

HELOAN vs. HELOC: Choosing Your Financial Weapon

So, which ally fits your battle plan? It boils down to personality. Craving stability? The HELOAN delivers a lump sum with fixed payments and sleeps soundly ignoring rate hikes. Prefer fluidity? The HELOC offers revolving credit during its draw period, demanding only interest-only payments until repayment kicks in.

Choose HELOAN for budget certainty. Choose HELOC for financial agility. Know thyself.

Do You Make the Cut? The Lender’s Checklist

Your Credit Score: The Golden Ticket

Lenders peek at your credit score first. While some might nod at 620, landing truly decent terms usually demands 680 or better. Aim for the 740+ stratosphere—that’s where lower interest rates and sweeter deals live. Qualifying for a second mortgage starts right here.

DTI: Your Debt Juggle Act

Your Debt-to-Income Ratio (DTI) is the cold math of your monthly obligations divided by your gross income. Lenders sweat if this climbs too high. Most draw a line at 43%, though some stretch to 50% for strong applicants. The lower your DTI, the smoother your path to approval. It shouts "financial stability."

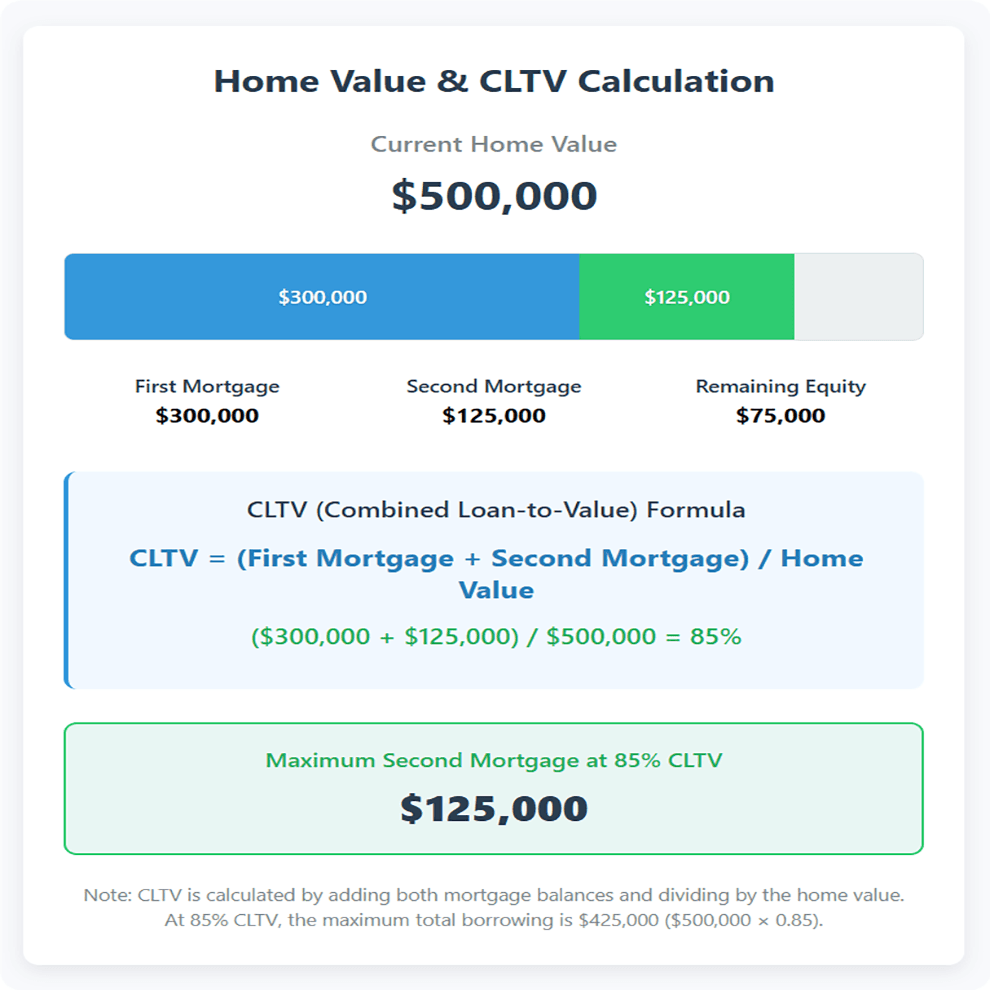

Equity & CLTV: Your Borrowing Ceiling

Lenders won’t let you drain every drop of home equity. They insist you keep skin in the game—usually 15-20% equity remaining. This translates to a max Combined Loan-to-Value (CLTV) of 80-85%. Crunch the numbers:

CLTV = (Current Mortgage Balance + New Loan Amount) / Home Value

A $500k home with a $300k first mortgage? Aiming for an 85% CLTV means you could potentially borrow against up to $125k more ($425k total debt). Your available equity sets the stage.

The Highs and Lows: Is This Ride Worth It?

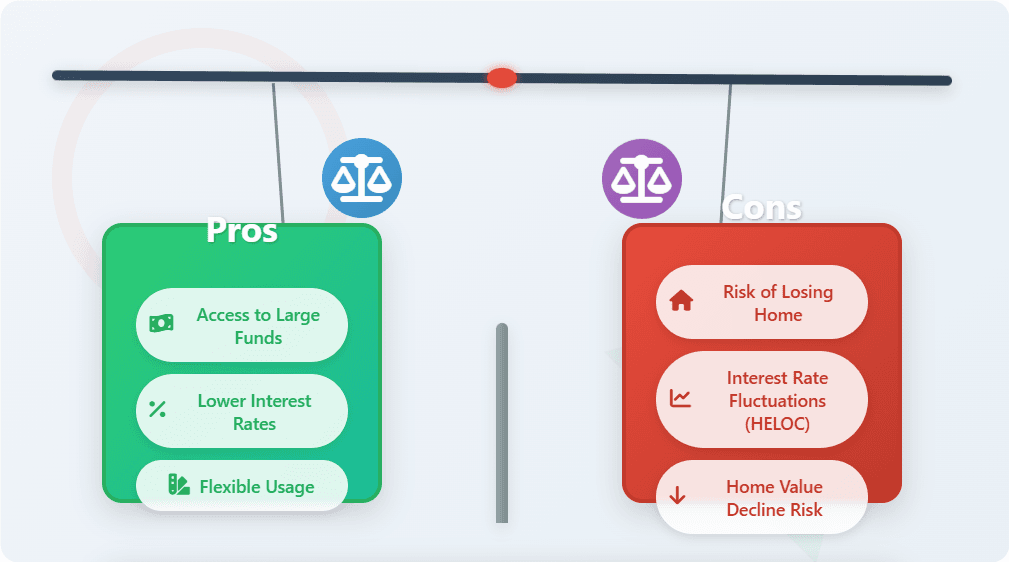

The Bright Side: Why It Shines

Done right, taking out a second mortgage packs serious perks:

- Access to significant cash: Turn your dormant home equity into liquid funds.

- Lower interest rates: As a secured loan, rates typically crush credit cards or personal loans.

- Freedom of use: From debt consolidation to home improvements, the cash is yours to deploy.

The Shadow Side: Proceed With Extreme Caution

Foreclosure risk isn’t abstract—it’s the giant red alarm. Default on your second loan, and you could lose your home, period. Even if your first mortgage is pristine. Other pitfalls? Straining your budget with higher monthly payments, sweating variable rate risk on HELOCs, and the nightmare of your home’s value diving below what you owe.

Paperwork, Pennies, and the Taxman

The Application Journey

Brace for paperwork, but don’t fear it. Applying for a second mortgage mirrors the first: application, documents (pay stubs, tax returns), home appraisal, underwriting, then closing. Budget several weeks.

Closing Costs: The Fine Print

Yes, you’ll face closing costs again—typically 2%-5% of the loan amount. Expect appraisal fees, origination fees, and title fees. Beware "no-cost" loans—those fees often just morph into a higher rate.

Will the IRS Help?

Tax deduction rules are strict: Interest is deductible only if funds buy, build, or "substantially improve" the home securing the loan. Pay off cards or fund a vacation? No deduction. And remember the $750k total mortgage debt cap. When in doubt, call a tax pro—this is too important to wing.

The Million-Dollar Question: Is This Your Move?

Taking out a second mortgage is potent finance. It unlocks doors but carries the weight of your home as collateral. We’ve walked through the mechanics, the risks, and the rewards. Don’t rush this. Honestly dissect your financial situation. Could those home improvements wait? Is there a cheaper way? If you lean towards "yes," arm yourself: Compare lenders fiercely. Sit down with a financial advisor who’s seen the scars and the successes. This isn’t just borrowing—it’s strategically betting on your future using the roof over your head. Make that bet wisely.