Home Equity Loan vs. HELOC: Your Guide to Second Mortgage Options

You’ve been paying your mortgage faithfully, watching your home equity grow like a quiet savings account hiding in plain sight. Now you’re wondering: "Could that equity actually work for me right now?" Friend, you’ve just stumbled upon the world of second mortgage options—your home’s hidden financial toolkit. Let’s explore your second mortgage options together.

What Even Is a Second Mortgage? (It’s Simpler Than You Think)

Picture this: your first mortgage is like the foundation of your house. A second mortgage? That’s the stylish renovation built on top of all the equity you’ve earned. It’s a separate loan using your home as collateral, letting you tap into that stored-up value for cash when life throws big plans (or surprises) your way.

Your Two Main Second Mortgage Options: The Predictable vs. The Flexible

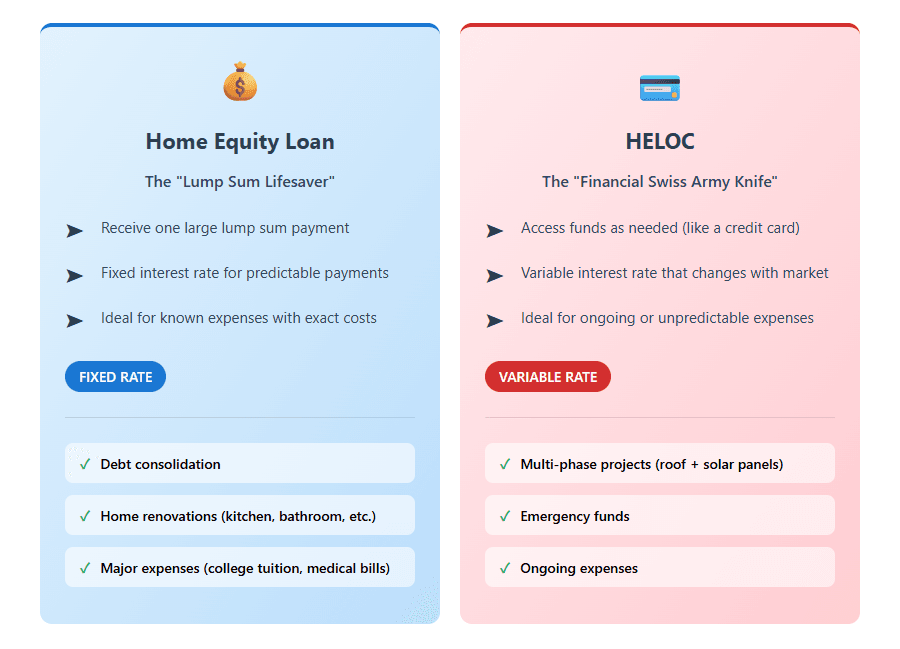

The "Lump Sum Lifesaver": Home Equity Loans

Imagine walking into the bank and walking out with one big check. That’s the home equity loan—your fixed-rate, no-surprises buddy. Perfect when you know exactly how much you need for:

- Debt consolidation (Wave goodbye to credit card chaos!)

- That kitchen renovation you’ve been dreaming about

- Medical bills or college tuition (life’s big-ticket items)

The catch? Closing costs apply, and your rate’s locked—for better or worse.

The "Financial Swiss Army Knife": HELOCs

Meet one of your most flexible second mortgage options: the HELOC (Home Equity Line of Credit). Think of it like a credit card secured by your home, with a draw period (usually 5-10 years) where you can borrow what you need, when you need it. Need $15K for a new roof now and $10K for solar panels next year? Just tap your line. During this phase, you’ll often make interest-only payments.

Watch your step: Rates are adjustable—they’ll dance with the market.

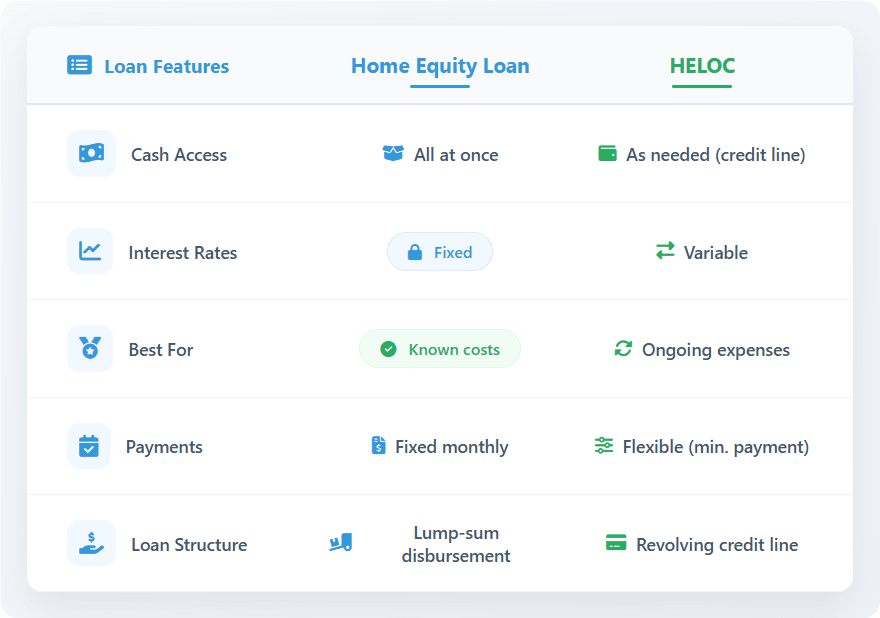

Home Equity Loan vs. HELOC: Which Side Are You On?

Let’s settle this PAS star ("second mortgage vs home equity loan") once and for all:

What’s the Damage? Current Second Mortgage Rates

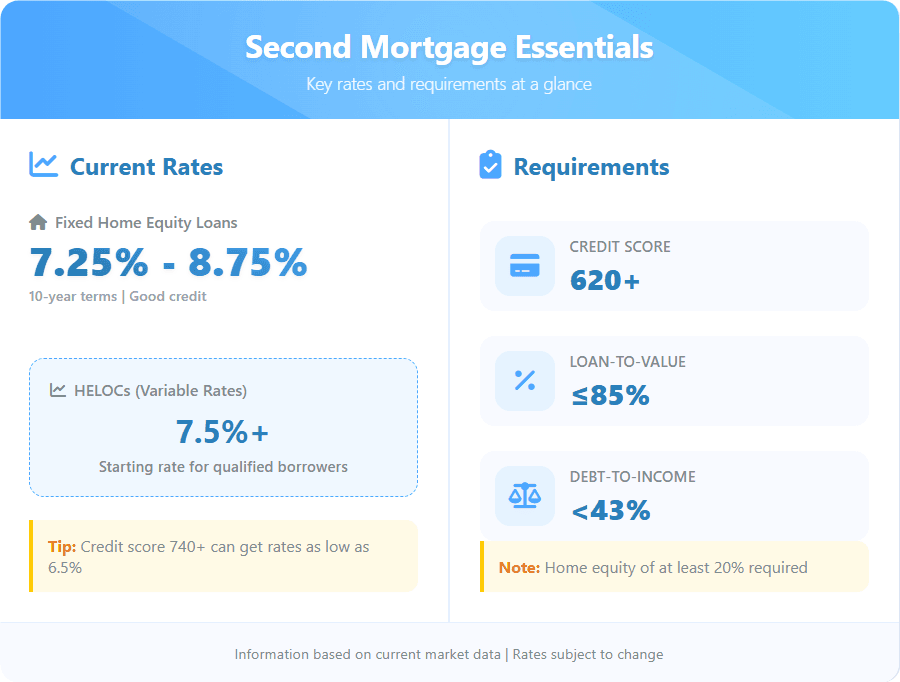

Let’s talk numbers. As of 2025:

- Fixed home equity loans: Hovering near 7.25%-8.75% for 10-year terms (your PAS "10-year 2nd mortgage rates" query answered!).

- HELOCs: Starting around 7.5%, but remember—they’ll wiggle.

Pro tip: Rates love your credit score. The higher it climbs, the lower they dip.

The Gateway Test: Second Mortgage Requirements

Lenders aren’t just handing these out. To qualify, you’ll need:

- Credit score: 620+ (740+ gets the confetti)

- Loan-to-value (LTV) ratio: Usually ≤ 85% (Your equity’s your VIP pass)

- Debt-to-income (DTI) ratio: Under 43% (Prove you’re not juggling chainsaws)

Play With Numbers: The Second Mortgage Calculator

Don’t guess—calculate your second mortgage options. Plug your numbers into a calculator (yes, that PAS darling!). See how a $50K loan at 7.5% over 10 years = ~$593/month. Suddenly, cash out feels less abstract.

The "Uh Oh" Moments: Risks & Escape Hatches

The Elephant in the Room: Foreclosure Risk

Here’s the raw truth: Second mortgages use your home as collateral. Miss payments? You risk foreclosure—losing the roof over your head. This isn’t a credit card. Treat it like the serious financial power tool it is.

Plan B Alert: Cash-Out Refinance

Before diving into a second mortgage, peek at this alternative: A cash-out refinance replaces your first mortgage with a bigger loan, pocketing the difference. When it shines: When current rates are lower than your original loan. The catch? You reset the clock on your mortgage.

Your Game Plan: Finding the Right Lender

Ready to explore? Skip the cold calls. Second mortgage lenders range from big banks to local credit unions. Compare:

- Their interest rates (even small differences add up)

- Fees (origination, appraisal, closing costs)

- Eligibility quirks (Some adore self-employed folks; others flee)

Start local. Often, community banks offer surprising flexibility.

The Takeaway? Your Home’s Equity is a Tool—Not a Toy

Second mortgage options—whether the steady home equity loan or nimble HELOC—unlock real power. They can fund dreams, crush debt, or rescue you from chaos. But they demand respect. Crunch the numbers with a calculator, eye those rates, and never forget: your home is on the line.

Feeling ready? Talk to a mortgage pro (not just a chatbot). Ask how these second mortgage options fit YOUR life. Bring your credit score, home value, and that big "what if" energy. Your equity’s waited years for this moment—make it count. People Also Read

- 2025 California HELOC Guide: How to Lock in the Best Rates and Save Money

- Is a HELOC Better Than a Mortgage? How to Decide Which Works for You

- Is a HELOC Considered a Second Mortgage? Understanding How It Really Works

- Best Home Equity Line of Credit Rates in California (2025): How to Get Under 6% APR

- Why Are HELOC Rates So High in 2025? Current HELOC Rates, Trends & Ways to Lower Your Costs