2025 Construction Loans Guide:Rates, Key Tips & How They Work

So, you're thinking about building your dream home or tackling a major renovation? That's exciting! But unless you've got a pile of cash sitting around, you'll probably need a construction loan to make it happen. Unlike traditional mortgages, these loans are a bit more complex—but don't worry, we're breaking it all down in plain English.

What Is a Construction Loan?

A construction loan is a short-term, high-interest loan designed to fund the building of a new home or a major renovation. Instead of getting a lump sum upfront, the lender releases money in stages (called a draw schedule) as construction progresses.

How Is It Different from a Traditional Mortgage?

- Purpose: Traditional mortgages are for buying existing homes; construction loans are for homes that don't exist yet.

- Disbursement: Funds are paid out in phases, tied to construction milestones.

- Payments: You'll usually make interest-only payments during construction.

- Interest Rates: Construction loan rates tend to be higher than standard mortgages (we'll dive into why later).

- Loan Term: Short-term—typically 12–18 months before converting to a permanent mortgage.

Who Should Consider a Construction Loan?

- Custom home builders

- Real estate investors or developers

- Homeowners planning major renovations

- Buyers who can't find a move-in-ready home

Types of Construction Loans

Not all construction loans are the same. Here's a quick rundown of your options:

1. Construction-to-Permanent Loans

Single-close: One loan covers both construction and your permanent mortgage (saving on closing costs). Two-time close: Separate loans for each phase (more flexibility but higher fees).

2. Stand-Alone Construction Loans

Good if you haven't sold your current home yet. Lower initial fees but involves two sets of closing costs.

3. Private Construction Loans

For investors, luxury home builders, or unconventional projects. Higher construction interest rates but faster approvals.

4. Renovation Construction Loans

FHA 203(k): Government-backed, great for repairs under $35K. Fannie Mae HomeStyle: Better for pricier projects with fewer restrictions.

5. Owner-Builder Construction Loans

You act as your own general contractor (risky, but possible). Fewer lenders offer these, and you'll need serious experience.

How Construction Loans Work (Step by Step)

1. Pre-Approval & Choosing a Builder

Get pre-qualified and pick a reputable, licensed builder.

2. Loan Application & Underwriting

Submit plans, permits, and cost estimates. The lender appraises the future home value.

3. Loan Approval & Closing

Once approved, you close the loan and break ground.

4. Draw Schedule & Inspections

Money is released in stages, with inspections at each milestone.

5. Conversion to Permanent Mortgage

If you have a construction-to-permanent loan, it automatically converts.

Key Requirements & What Lenders Look For

- Credit Score: Usually 680+ (some lenders go as low as 620).

- Down Payment: Typically 20–25% (ouch, we know).

- Builder & Plans: Licensed contractor + detailed timeline and budget.

- Appraisal: Based on what the home will be worth when finished.

Pros and Cons of Construction Loans

Pros

- Custom Home: Design it exactly how you want.

- Draw Schedule: Pay only for completed work.

- Conversion Options: Roll into a permanent mortgage later.

Cons

- Higher Rates: Construction mortgage rates are usually 1–2% higher than traditional loans.

- Strict Requirements: More paperwork and hoops to jump through.

- Delays Happen: Weather, supply issues, or labor shortages can push back your timeline.

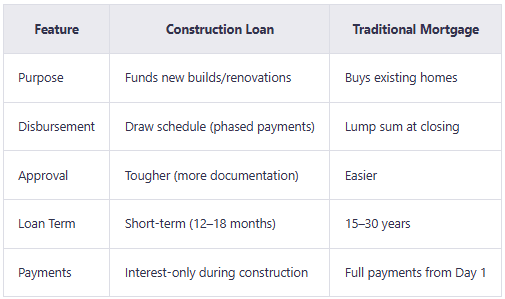

Construction Loan vs. Traditional Mortgage

How to Get the Best Construction Loan Rates

- Shop Around: Compare lenders—construction financing rates vary a lot.

- Understand the Draw Process: Make sure your builder and lender are on the same page.

- Get Everything in Writing: Avoid surprise costs or delays.

- Plan for Delays: Set aside a 10–15% contingency fund (trust us, you'll need it).

Alternatives to Construction Loans

- Home Equity Loan: If you already have equity in your home.

- Personal Loan: For smaller projects (but higher rates).

- Government-Backed Loans: FHA or USDA options for qualifying buyers.

FAQs About Construction Loans

Can I be my own builder?

Yes, but you'll need an owner-builder loan—and lenders will scrutinize your experience.

What if I go over budget?

You'll have to cover the difference (another reason for that contingency fund).

How long does approval take?

Usually 30–60 days (longer if your plans are complex).

Do I need mortgage insurance?

Yes, if your down payment is under 20%.

Final Thoughts

A construction loan can be your ticket to a custom home, but it's not for the faint of heart. Do your homework, compare construction loan rates, and work with a builder you trust.

Click here to get matched with top-rated lenders! Start by getting pre-approved and nailing down your plans. People Also Read

- Home Loan Pre Approval: Your 2025 Key to Unlocking Homeownership Success

- Co-Borrower on a Home Loan: Comprehensive Guide to Rights, Risks, and Differences vs. Co-Signer for Homebuyers

- What’s the Difference Between a Home Loan and Mortgage Loan? 2025 Guide to Rates, Terms, FHA, VA & Conventional Loans

- Underwriting Process in Mortgage Complete Guide : Steps, Timelines and Tips

- Mortgage Application Requirements: Your Complete Document Checklist