What’s the Difference Between a Home Loan and Mortgage Loan? 2025 Guide to Rates, Terms, FHA, VA & Conventional Loans

What’s the Difference Between a Home Loan and Mortgage Loan? 2025 Guide to Rates, Terms, FHA, VA & Conventional Loans

When navigating the complex world of real estate financing, many borrowers mistakenly use the terms "home loan" and "mortgage loan" interchangeably. However, these two financial products serve distinct purposes and come with different terms, interest rates, and eligibility requirements. Understanding the difference between a home loan and a mortgage loan is crucial for making informed decisions that align with your financial goals. Whether you're a first-time homebuyer, an investor, or someone looking to refinance, this guide will break down the key distinctions, benefits, and drawbacks of each option. We’ll also explore current market trends in 2025, helping you secure the best possible financing while avoiding costly mistakes.

What Is a Home Loan? Definition, Types, and Key Features

A home loan is a broad financial product designed to help individuals purchase, construct, or renovate residential property. Unlike a mortgage loan, which is strictly secured by real estate, a home loan can be either secured or unsecured, depending on the lender and the borrower’s financial profile. For example, a personal loan for home improvements typically doesn’t require collateral, whereas a construction loan may be tied to the property being built. Banks, credit unions, and online lenders offer various home loan products, each catering to different needs—whether it’s buying land, building a house, or making upgrades.

The most common types of home loans include purchase loans (for buying an existing home), construction loans (short-term financing for building), home improvement loans (for renovations), and land loans (for purchasing undeveloped property). One key advantage of home loans is their flexibility—some options allow borrowers to access funds without pledging their home as collateral. However, unsecured home loans often come with higher interest rates and shorter repayment terms, making them less ideal for long-term financing.

What Is a Mortgage Loan? How It Works and Common Variations

A mortgage loan is a specialized type of secured loan used exclusively for purchasing or refinancing real estate. The defining feature of a mortgage is that the property itself serves as collateral, meaning the lender can foreclose if the borrower defaults. Mortgages are typically long-term commitments, with repayment periods ranging from 15 to 30 years, and they often offer lower interest rates compared to unsecured loans due to the reduced risk for lenders. The mortgage process involves strict underwriting, including credit checks, income verification, and property appraisals, ensuring that both the borrower and the home meet lending standards.

There are several types of mortgage loans, each designed for different borrower profiles. Conventional mortgages, which are not backed by the government, usually require a strong credit score (620+) and a down payment of at least 3%-20%. FHA loans, insured by the Federal Housing Administration, are ideal for first-time buyers with lower credit scores (as low as 500 with a 10% down payment). VA loans, available to veterans and active-duty military personnel, offer no down payment and competitive rates. Meanwhile, USDA loans target rural homebuyers with low-to-moderate incomes, providing 100% financing in eligible areas.

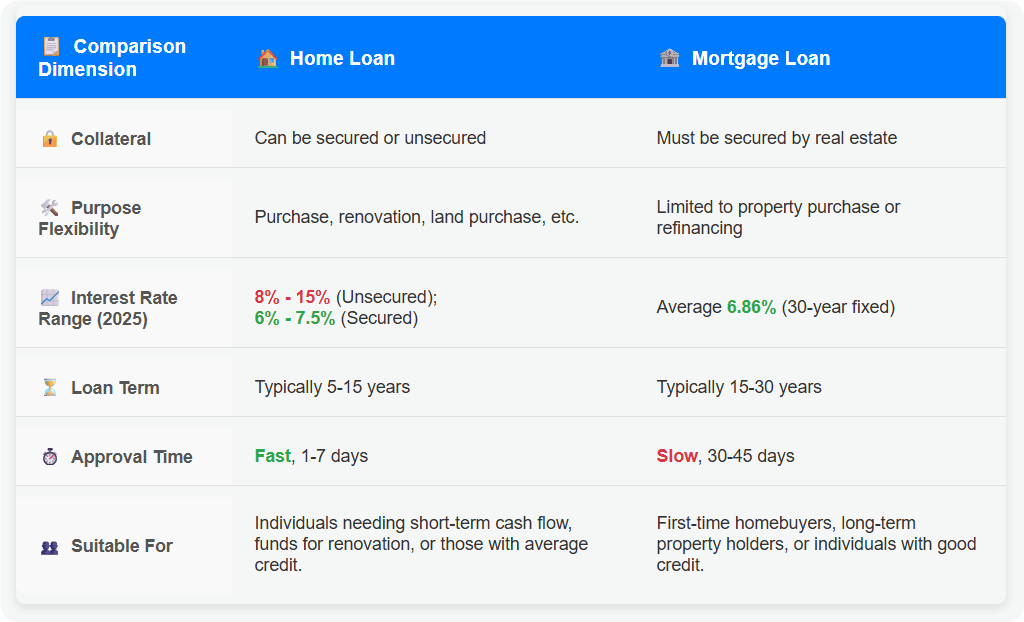

Key Differences Between Home Loans and Mortgage Loans

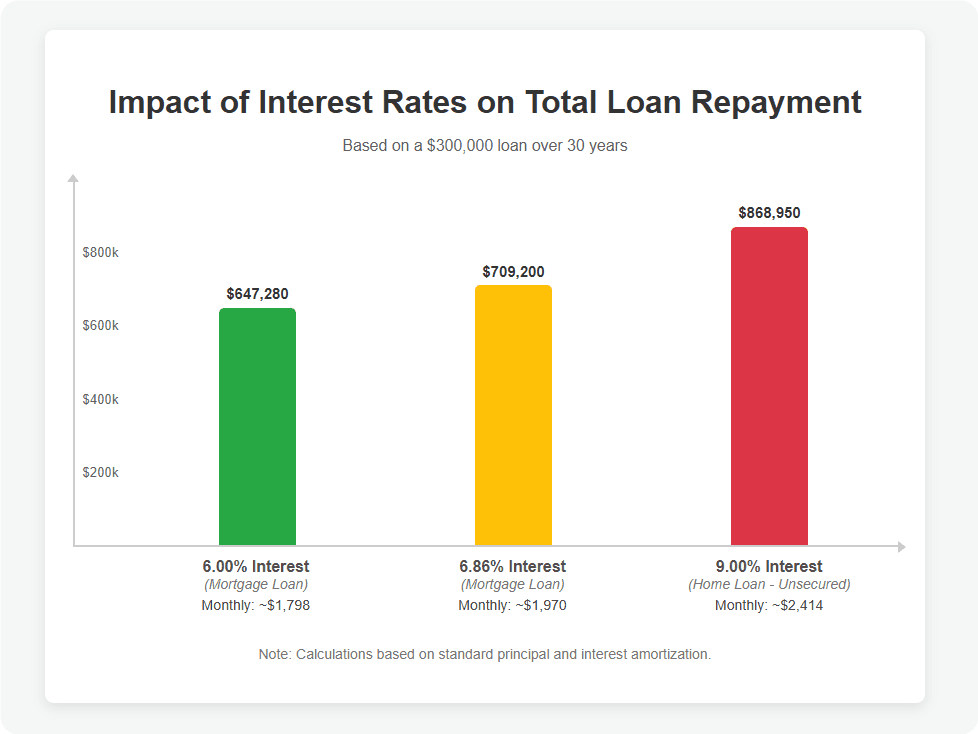

While both home loans and mortgage loans facilitate property purchases, they differ significantly in structure, eligibility, and financial impact. The most critical distinction lies in collateral requirements—mortgage loans always involve securing the debt with the property, whereas home loans may or may not require collateral. Additionally, mortgage loans are exclusively for real estate transactions, while home loans can cover broader needs like renovations or land purchases. Interest rates also vary: mortgages typically offer lower rates (currently averaging around 6.86% in May 2025) due to their secured nature, whereas unsecured home loans may carry rates as high as 8%-15%.

Another major difference is loan duration. Mortgages are long-term loans (15-30 years), allowing for manageable monthly payments, while home loans (especially unsecured ones) often have shorter terms (5-15 years), resulting in higher monthly obligations. Approval timelines also differ—mortgages involve extensive underwriting, including appraisals and title checks, which can take 30-45 days, whereas unsecured home loans may approve funds in as little as 1-7 days. For borrowers deciding between the two, the choice hinges on purpose, creditworthiness, and financial flexibility.

How to Choose the Right Loan: Factors to Consider

Selecting between a home loan and a mortgage loan depends on multiple factors, including financial goals, credit health, and property type. If you need funds for non-purchase purposes—such as renovations, land acquisition, or emergency repairs—a home loan (particularly an unsecured one) may be the better choice due to faster approval and no collateral requirement. However, if you’re buying a primary residence and want the lowest possible interest rates, a mortgage loan is almost always the superior option, provided you can meet the stricter eligibility criteria.

Key considerations when comparing loans include:

- Interest rates (fixed vs. adjustable, current market trends).

- Loan terms (short-term vs. long-term repayment).

- Fees (origination charges, closing costs, prepayment penalties).

- Credit requirements (minimum score, debt-to-income ratio).

- Down payment expectations (0% for VA loans vs. 20% for conventional mortgages).

For example, a borrower with excellent credit and a 20% down payment might opt for a conventional mortgage to secure the best rate, while someone with fair credit needing quick cash for repairs might prefer a home equity line of credit (HELOC) or personal loan.

Current Mortgage and Home Loan Trends in 2025

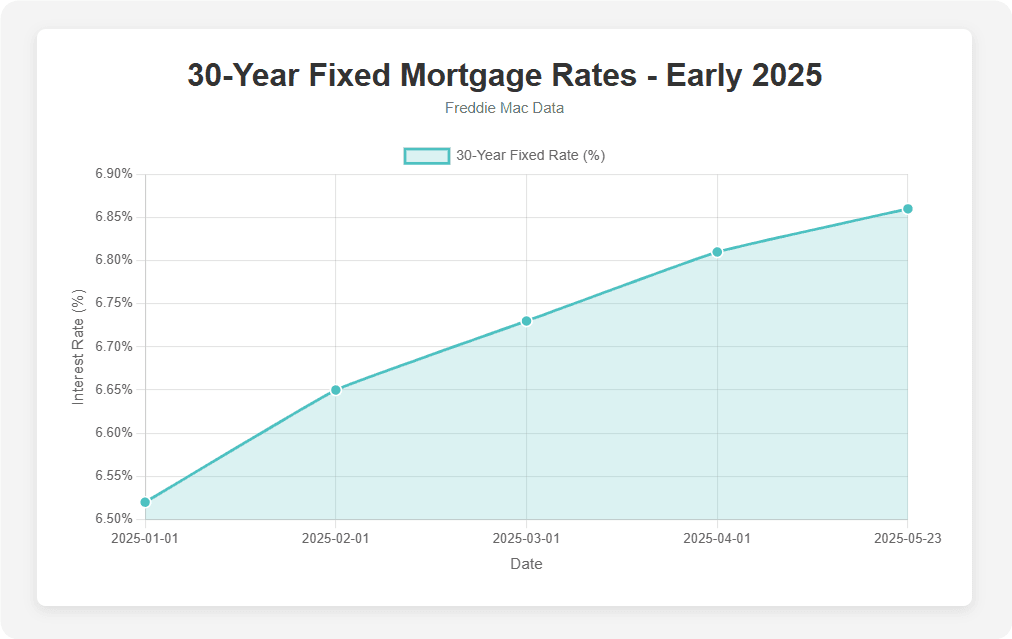

The 2025 real estate financing landscape is shaped by rising interest rates, tightening lender standards, and evolving borrower preferences. As of May 2025, the average 30-year fixed mortgage rate has risen to 6.86%, up from 6.81% the previous week, according to Freddie Mac. This increase is attributed to a volatile bond market driven by investor concerns over inflation, the U.S. government budget deficit, and a recent credit downgrade by Moody's.

Another notable trend is the growing popularity of non-traditional lenders, including online platforms offering digital mortgage approvals and alternative credit assessments. Additionally, government-backed loans (FHA, VA, USDA) remain critical for first-time and low-income buyers, with relaxed credit requirements compared to conventional mortgages. For those considering a home loan, unsecured personal loans have become pricier due to higher benchmark rates, making secured options like HELOCs more appealing for larger projects.

Common Mistakes to Avoid When Applying for a Loan

Many borrowers make avoidable errors when securing financing, leading to higher costs or rejected applications. One major misstep is failing to compare multiple lenders—rates and fees can vary significantly between banks, credit unions, and online lenders. Another pitfall is underestimating closing costs, which typically add 2%-5% to the loan amount and include appraisal fees, title insurance, and origination charges. Additionally, some borrowers opt for adjustable-rate mortgages without a long-term plan, exposing themselves to payment shocks if rates rise.

A critical yet often overlooked factor is the debt-to-income (DTI) ratio. Most lenders prefer a DTI below 43%, meaning your monthly debt payments (including the new loan) shouldn’t exceed 43% of your gross income. Exceeding this threshold can result in denial or less favorable terms. Finally, ignoring credit report errors before applying can lead to unnecessary rejections—always review your report and dispute inaccuracies beforehand.

Frequently Asked Questions (FAQs)

Q1: Can I use a home loan to buy a house? Yes, but if the loan is unsecured, it will likely have higher rates and shorter terms than a mortgage. A mortgage is almost always cheaper for home purchases.

Q2: Is a mortgage better than a home loan? It depends. Mortgages offer lower rates and longer terms but require collateral. Home loans are more flexible but costlier if unsecured.

Q3: What credit score do I need for a mortgage? Conventional loans require 620+, while FHA loans accept 500+ (with a 10% down payment). VA and USDA loans have more flexible standards.

Q4: Can I refinance a home loan into a mortgage? Yes, if you’ve built enough equity, you can refinance into a mortgage to secure better rates and terms.

Making the Right Financing Decision

Choosing between a home loan and a mortgage loan requires careful evaluation of your financial situation, property goals, and risk tolerance. Mortgages are ideal for homebuyers seeking low rates and long-term stability, while home loans provide flexibility for renovations or land purchases. In today’s rising-rate environment, locking in a fixed-rate mortgage may be wise, whereas those needing quick funds might explore HELOCs or personal loans.

Before committing, compare lenders, check your credit, and calculate total costs—not just monthly payments. Consulting a mortgage broker or financial advisor can also provide personalized insights. Ultimately, the right loan aligns with your long-term wealth-building strategy, ensuring you don’t overpay or take on unsustainable debt.

Next Steps:

- Use a mortgage calculator to estimate payments.

- Get pre-approved to strengthen your homebuying position.

- Review your credit report for errors before applying.

By making an informed choice, you’ll secure financing that supports your real estate ambitions without unnecessary financial strain.

People Also Read

- Home Loan Pre Approval: Your 2025 Key to Unlocking Homeownership Success

- Mortgage Rate Predictions 2025: What to Expect in the Year Ahead

- Co-Borrower on a Home Loan: Comprehensive Guide to Rights, Risks, and Differences vs. Co-Signer for Homebuyers

- Underwriting Process in Mortgage Complete Guide : Steps, Timelines and Tips

- Mortgage Application Requirements: Your Complete Document Checklist