Mortgage for Rental Property: The Investor's Guide to Smart Financing

Investing in rental properties can be a great way to build wealth, but securing a mortgage for rental property isn't the same as financing a primary home. Lenders view rental properties as higher-risk investments, which means stricter requirements—including larger down payments, stronger credit scores, and more rigorous approval processes.

If you're exploring financing options for a rental property mortgage, this guide covers everything from loan types to qualification tips, helping you make informed decisions and avoid costly mistakes.

Types of Rental Property Mortgages (And How to Choose the Right One)

Not all loans are created equal. Here's a breakdown of the most common mortgage for rental property options:

Conventional Loans

Best for: Investors with strong credit and cash reserves

- Down payment: 15%–25%

- Credit score needed: 620+ (680+ for better rates) Pros: Competitive rates, widely available Cons: Strict debt-to-income (DTI) requirements

FHA Loans (Multi-Unit Properties Only)

Best for: First-time investors buying duplexes, triplexes, or fourplexes

- Down payment: As low as 3.5% (if owner-occupied) or 15%+ (fully rented)

- Credit score needed: 580+ Pros: Low down payment Cons: Must live in one unit for best terms

Portfolio Loans

Best for: Investors with multiple properties or unique financial situations

- Down payment: 20%–30%

- Credit score needed: 660+ Pros: Flexible underwriting, no Fannie/Freddie limits Cons: Higher interest rates

Hard Money & Private Loans

Best for: Fix-and-flip investors or those with poor credit

- Down payment: 25%–35%

- Credit score: Less critical (property value matters more) Pros: Fast approval, flexible terms Cons: Short-term, high interest (10%–15%)

Key Takeaway: A mortgage for rental property through a conventional loan is ideal for long-term investors with good credit. For flexibility or multiple properties, consider portfolio loans.

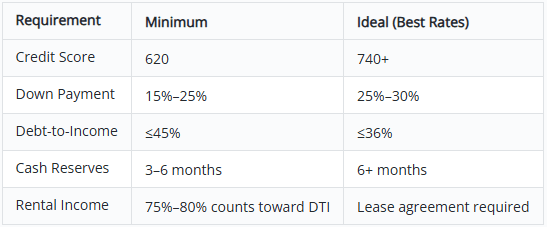

Qualifying for a Rental Property Mortgage Lenders impose stricter criteria for rental property mortgages. Here's what you'll need:

Pro Tip: New investors may need extra reserves (6+ months) to qualify for a mortgage for rental property.

How to Get the Best Rental Property Mortgage Rates Expect rates 0.5%–1% higher than primary home loans. To secure the best deal:

- Boost your credit score (740+ unlocks lowest rates)

- Put down 25%+ (larger down payments improve terms)

- Compare lenders (banks, credit unions, and online lenders vary widely)

- Consider ARMs if selling/refinancing soon

Example:

- Loan amount: $300,000

- Interest rate: 6.89%

- Monthly payment: $1,980

- Net cash flow: $497/month (after expenses)

Crunching the Numbers: Rental Property Mortgage Calculator Before buying, analyze cash flow:

- Purchase price: $400,000

- Down payment (25%): $100,000

- Monthly expenses: $2,503 (mortgage + taxes/insurance/maintenance)

- Rental income: $3,000

- Net profit: $497/month

Don't forget: Factor in vacancies (8%), repairs, and management fees.

Alternative Financing for Rental Properties If traditional rental property mortgages aren't an option:

- HELOCs: Tap home equity

- Seller financing: Owner acts as lender

- Private lenders: Higher rates, flexible terms

- Syndication: Pool funds with other investors

Common Rental Property Mortgage Mistakes

- Underestimating expenses (repairs, vacancies)

- Over-leveraging (high debt risks cash flow problems)

- Not shopping lenders (rates vary significantly)

- Ignoring loan terms (prepayment penalties, balloon payments)

Applying for a Rental Property Mortgage

- Check/fix credit reports

- Save 25%+ for down payment

- Get pre-approved (compare 3+ lenders)

- Submit documents (tax returns, bank statements)

- Close (30–45 days average)

Final Thoughts A mortgage for rental property requires preparation—higher down payments, strong credit, and thorough cash flow analysis. But with the right strategy, it's a powerful wealth-building tool.

Key Takeaways:

- Meet stricter rental property mortgage requirements

- Compare lenders for the best rates

- Prioritize cash flow to avoid over-leveraging

With smart planning, your rental property mortgage can pave the way to long-term success. Happy investing!

People Also Read

- Family Opportunity Mortgage: Secure a Home for Loved Ones in 2025 with Better Terms

- Non Qualified Mortgage and Non QM Credit Rules: Complete Borrower’s Guide

- Why a Mortgage from a Credit Union Could Be Your Best Decision

- Deep Dive into Investment Property Mortgage Rates: What’s Really Driving Them

- VA IRRRL Rates in 2025: How to Refinance and Save Thousands