VA IRRRL Rates in 2025: How to Refinance and Save Thousands

As a real estate and mortgage advisor who’s spent years helping veterans and active-duty service members navigate home loans, I’ve seen the VA IRRRL (Interest Rate Reduction Refinance Loan, or "VA Streamline Refinance") turn financial stress into relief—sometimes freeing up hundreds of dollars a month with minimal paperwork. And right now, in 2025, with interest rates stabilizing after the chaos of the early 2020s, this little-known refinancing option is more valuable than ever.

If you’re sitting on a VA loan from 2022 or 2023—when rates were at their peak—you might be in the perfect position to slash your monthly payment without jumping through the usual refinancing hoops. Let me walk you through how the VA IRRRL works, where today’s rates stand, and how to make sure you’re getting the best possible deal.

Why 2025 Might Be Your Year to Refinance

I’ll be straight with you—interest rates today aren’t at historic lows. But if you locked in your VA loan during the 6%+ days of 2022 or 2023, even a small drop could mean serious savings. And here’s the best part: Unlike a traditional refinance, the VA IRRRL skips the appraisal, cuts down on paperwork, and often closes in weeks instead of months.

I’ve had clients who hesitated because they assumed refinancing meant starting from scratch—new credit checks, income verification, the whole nine yards. But the VA streamline refi is different. It’s designed for veterans who already have a VA loan and just want a better deal, not extra cash or a loan overhaul.

2025 VA IRRRL Rates: What You Need to Know

Let’s talk numbers. As of mid-2025, VA IRRRL rates are hovering between 5.25% and 6.00%, depending on your credit, loan size, and lender. Now, if your current rate is anywhere above that range (and I’ve talked to veterans still stuck at 6.5% or higher), this could be your chance to finally catch a break.

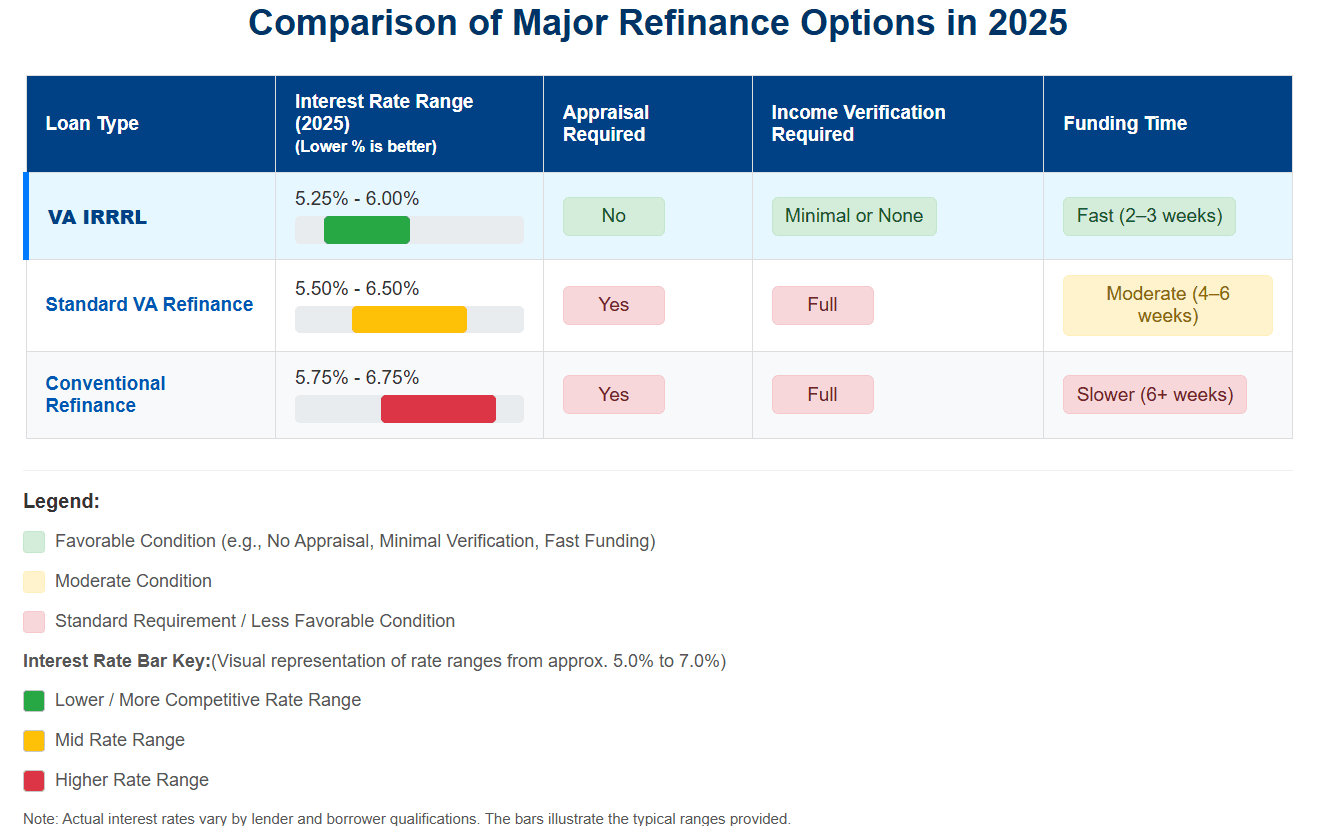

To put things in perspective, here’s how VA IRRRL stacks up against other refinancing options:

The difference? VA IRRRL is built for speed and simplicity. No scrambling for pay stubs, no waiting on an appraiser to approve your home’s value—just a straightforward rate drop.

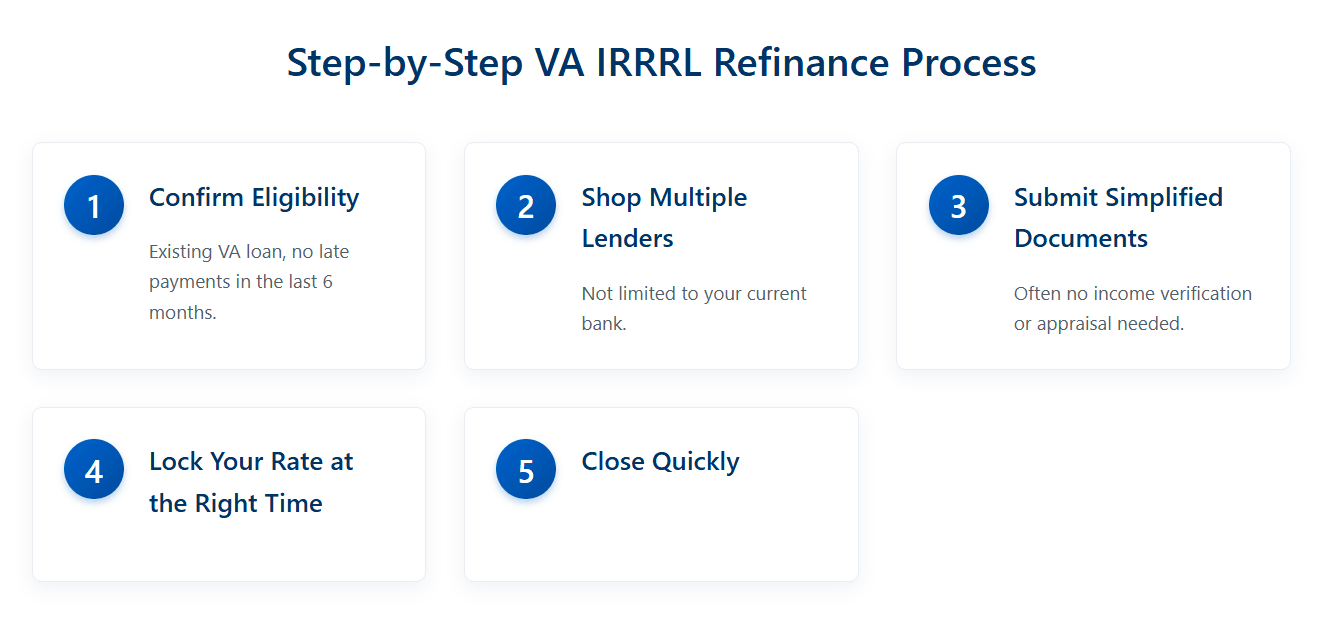

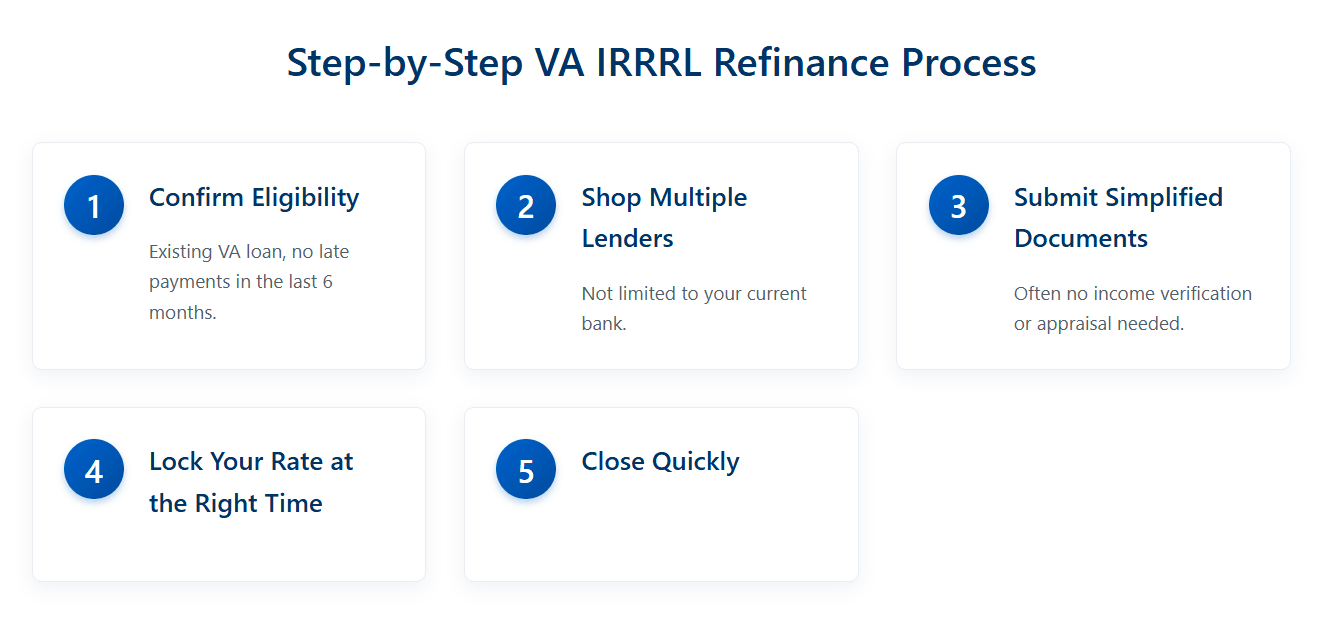

How the VA IRRRL Works (Step by Step)

Now, if you’re like most of my clients, you’re probably wondering: “Okay, this sounds great—but what’s the catch?” The truth? There really isn’t one, as long as you meet the basic requirements. Here’s how it plays out:

1. Check Your Eligibility

You’ll need an existing VA loan (no surprises there) and a solid payment history—meaning no late payments in the last six months. If you’ve got that, you’re already halfway there.

2. Shop Around for Lenders

This is where I see veterans leave money on the table. Just because your current lender offers VA IRRRLs doesn’t mean they’ll give you the best rate. Credit unions like Navy Federal often have competitive offers, but you won’t know unless you compare.

3. Skip the Paperwork Hassle

One of my favorite things about the VA streamline refinance? Most lenders won’t ask for proof of income or employment. (Yes, really.) As long as your mortgage payments are up to date, they’ll take your word for it.

4. Lock Your Rate at the Right Time

Rates fluctuate daily, and timing matters. I always tell my clients: “Don’t wait for the ‘perfect’ rate—lock in when you see a number that works for you.”

5. Close Fast and Start Saving

Because there’s no appraisal and minimal underwriting, VA IRRRLs can close in as little as two weeks. Compare that to a conventional refinance, where you might wait over a month just for the appraisal to be scheduled.

Who Should (and Shouldn’t) Consider a VA IRRRL in 2025?

Not every refinance makes sense. But if any of these sound like you, it’s worth a closer look:

You’re sitting on a rate above 6%. Even a 0.5% drop could save you $100+ per month.

You have an adjustable-rate VA loan (ARM). Switching to a fixed rate now could protect you from future hikes.

You don’t need cash out. The IRRRL is strictly for lowering your rate, not tapping equity.

You hate paperwork. No income checks, no home appraisal—just a faster, simpler refi.

On the flip side, if your current rate is already below 5%, or you’re planning to move soon, the closing costs might not be worth it.

Real Savings: What a VA IRRRL Could Do for You

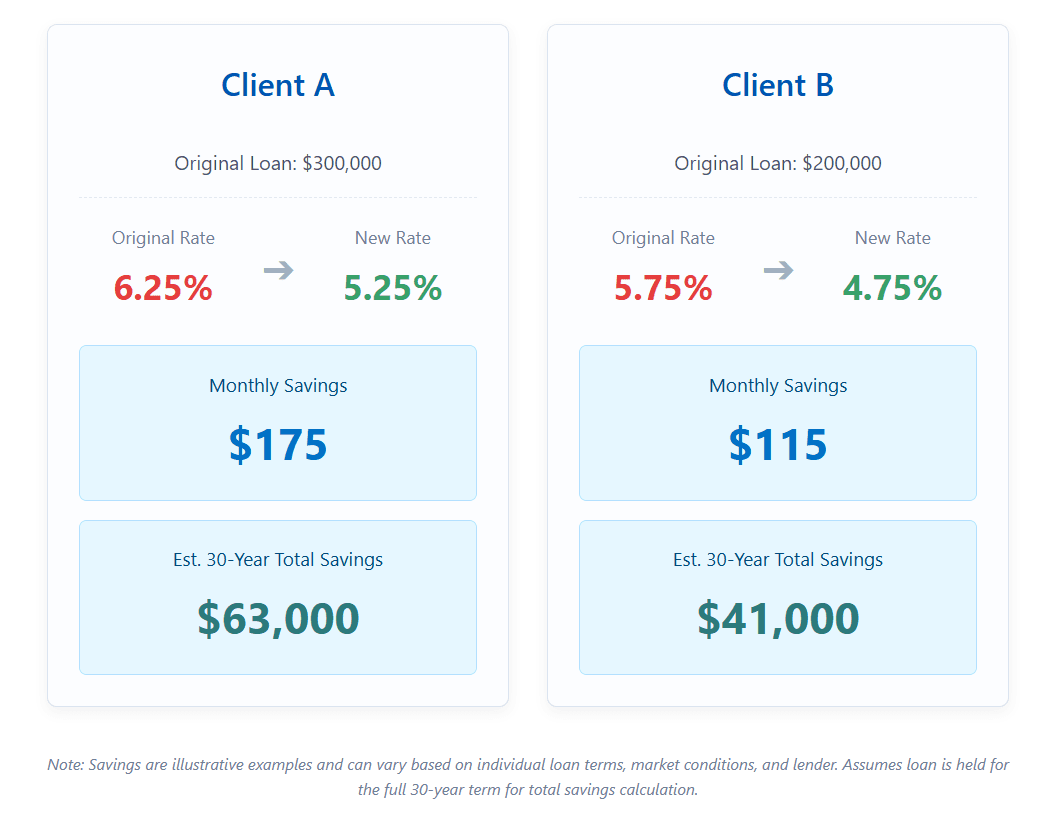

Let’s cut through the abstract numbers and look at two real-world examples from my own clients this year:

That’s not just pocket change—it’s real money that could go toward car payments, college funds, or even an extra vacation every year.

Common Questions (From Real Veterans Like You)

1. “Do I need an appraisal for a VA IRRRL in 2025?”

Almost never. The VA waives it specifically to make this process easier.

2. “Will applying hurt my credit score?”

A small, temporary dip—maybe 5-10 points—but nothing catastrophic.

3. “What about closing costs?”

They’re usually lower than a standard refinance, and most lenders let you roll them into the loan.

4. “What if rates drop again after I refinance?”

You can always refinance again later, but waiting for the “perfect” rate usually costs more in the long run.

Final Advice: How to Get the Best Deal

If you’re ready to explore a VA IRRRL, here’s what I tell my own clients:

Check your credit first. Even a 20-point boost could snag you a better rate.

Compare at least three lenders. Don’t just go with your current bank—credit unions and online lenders often have lower fees.

Use a VA IRRRL calculator. Plug in your numbers to see exactly how much you’d save.

Don’t overthink it. If the math works, pull the trigger. Waiting for rates to drop further is a gamble, not a strategy.

Is VA IRRRL the Right Move for You?

The VA IRRRL is one of the most underused tools in veterans’ financial toolkits. If you’re paying more than today’s rates (and especially if you’re above 6%), a few phone calls could put thousands back in your pocket over time.

Still unsure? Grab your latest mortgage statement, run the numbers, and reach out to a VA-approved lender. Or shoot me an email—I’ve helped hundreds of veterans refinance, and I’m happy to point you in the right direction.

Because here’s the truth: You served your country. Now it’s time to let your home loan serve you.

People Also Read

- Family Opportunity Mortgage: Secure a Home for Loved Ones in 2025 with Better Terms

- Non Qualified Mortgage and Non QM Credit Rules: Complete Borrower’s Guide

- Mortgage for Rental Property: The Investor's Guide to Smart Financing

- Why a Mortgage from a Credit Union Could Be Your Best Decision

- Deep Dive into Investment Property Mortgage Rates: What’s Really Driving Them