No Closing Cost Refinance: Should You Refinance Without Closing Costs

If you've been keeping an eye on mortgage rates lately, you've probably heard about no-closing-cost refinancing. On the surface, it sounds like a no-brainer: refinance your mortgage without paying thousands in upfront fees. What’s not to love?

But here's what most lenders won't tell you upfront: that mortgage refinancing with no closing cost could end up costing you tens of thousands more over time. Let’s break down how this deal really works and when it might (or might not) make sense for your situation.

How No-Closing-Cost Refinancing Actually Works

When lenders offer no-closing-cost refinance options, they’re not actually waiving those fees—they're just moving them elsewhere. Typically, you'll see one of these approaches:

Higher Interest Rate: The lender increases your rate by 0.25% to 0.5% to cover the costs Rolled Into Loan Balance: Closing costs get added to your principal, increasing what you owe Lender Credits: The lender provides a credit to offset costs, but often with trade-offs

Whether it’s branded as a zero closing cost refinance, no cost refinance, or no fee refinance, the math behind it is what really matters.

Real-World Example: The Math Behind the "Free" Refinance

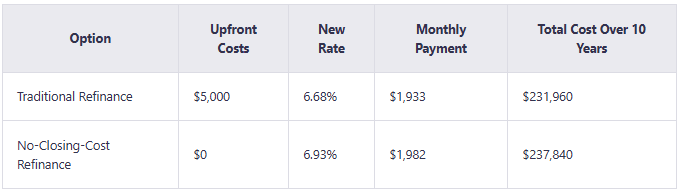

Let’s say you're refinancing a $300,000 mortgage:

At first glance, skipping the $5,000 in closing fees seems smart. But when you run the numbers, you’ll actually pay $5,880 more over a decade with the “free” option. And if you keep the loan longer? The gap widens significantly.

When It Actually Makes Sense

Mortgage refinancing with no closing cost isn’t always a bad deal—it just depends on your situation:

You’re Short on Cash Right Now If unexpected medical bills, job loss, or other financial hurdles make paying closing costs impossible, refinancing without closing costs provides breathing room.

You’re Selling Soon (Within 5 Years) The higher interest rate hurts less if you won’t keep the loan long enough for the extra costs to pile up.

You Need Immediate Monthly Savings If the refinance lowers your payment today—even with a slightly higher rate—it might be worth it for short-term relief.

The Hidden Costs You Can’t Afford to Ignore

The Long-Term Interest Trap That 0.25% rate increase might seem small, but on a $300,000 loan, it adds about $15,000 to $17,000 in extra interest over 30 years.

Reduced Home Equity When costs get rolled into your loan, you start with less equity. If home values dip, you could owe more than your house is worth.

Prepayment Penalties Some no cost refinance loans include sneaky clauses that charge fees if you pay off the loan early—exactly when you’d hope to benefit.

Smart Questions to Ask Your Lender

Before signing anything, get clear answers to:

Exactly how much higher is this rate compared to a standard refinance? Which specific fees are being waived versus rolled into my loan? Are there any prepayment penalties if I sell or refinance again? Can you show me a side-by-side comparison of total costs over 5, 10, and 15 years?

Better Alternatives to Consider

If a no-closing-cost refinance doesn’t quite fit, these options might work better:

Low-Cost Refinancing: Pay some fees to get a better rate Lender Credits: Accept a modest rate bump for partial fee coverage FHA/VA Streamline Refinances: Government-backed options with reduced fees

The Bottom Line

Mortgage refinancing with no closing cost works like a financial seesaw: you get relief today by accepting higher costs tomorrow. For short-term situations, it can be a smart tool. But if you’ll keep the loan more than 5–7 years, you’ll almost always save more by paying standard closing costs.

Your Next Step

Thinking about a no-closing-cost refinance? Don’t navigate the numbers alone.

Contact our experienced mortgage specialists today—we’ll help you:

Evaluate your potential savings with a no fee refinance Compare break-even points with traditional refinancing Understand total costs based on your homeownership timeline

In the mortgage world, “free” usually means “pay later.” Let our experts walk you through the details so you can make the right decision with confidence.

Reach out now—we’re here to provide clear, honest guidance and outstanding service.

People Also Read

- How Does Refinancing a Mortgage Work? The Complete 2025 Guide

- Underwriting Process for Refinance: How Long Does the Mortgage Underwriting Process Take and What to Expect

- VA IRRRL Rates in 2025: How to Refinance and Save Thousands

- 15-Year FHA Streamline Refinance Rates and APR Guide for Homeowners in 2025

- Looking for a Second Mortgage? Your Complete Guide to Eligibility, Rates & Smart Borrowing