Looking for a Second Mortgage? Your Complete Guide to Eligibility, Rates & Smart Borrowing

Why Consider a Second Mortgage?

So, you're looking for a second mortgage? That spark of interest usually means you've spotted the treasure buried in your home – your hard-earned equity – and you're ready to put it to work. Maybe it’s finally tackling that kitchen renovation you’ve dreamt of, wrestling high-interest credit card debt into submission, or funding a big life goal like college tuition. If you're looking for a second mortgage, options like a Home Equity Loan (HEL) or Line of Credit (HELOC) let you access cash based on the value you've built up in your property. Think of it as unlocking a vault you already own.

Here’s the kicker many folks overlook: while refinancing your entire first mortgage (a "cash-out refi") is one way to get cash, it means waving goodbye to your current first mortgage rate. If you snagged a fantastic rate years ago, refinancing now could hurt. Opting for a second mortgage often sidesteps that pain. You keep your original low rate untouched and get the funds you need, frequently with a faster, less expensive closing process. It’s a smarter key for many situations.

People Also Read

- 2nd Mortgage Rates 2025: The Complete Guide to Saving Money

- Easy Second Mortgage Loans in 2025: Fast Approval, Low Hassle Guide

- How to Get Approved for a Second Mortgage: Key Requirements & Strategies

- Do I Need 20% Down to Buy a Second Home

- Second-Time Home Buyer Mortgages: Requirements, Programs & Strategies

Second Mortgage Requirements: Can You Qualify?

Let's get real: qualifying isn't quite as easy as your first go-round. Lenders see this as higher risk (they’re second in line if things go south). But if you're looking for a second mortgage, know it’s far from impossible if your financial picture is solid.

Minimum Eligibility Criteria: Lenders have guardrails. Generally, you’ll need a credit score comfortably in the 620+ range (higher is always better for rates). Your debt-to-income ratio (DTI) – that’s your total monthly debts divided by your gross income – needs room to breathe, typically capped around 43–50%. Crucially, you need significant home equity. Lenders usually cap the total loan-to-value ratio (LTV) – your first mortgage plus the new second mortgage – at 80–85% of your home’s value. Be ready to prove stable income with pay stubs, tax returns, and details about your existing first mortgage.

Is It Hard to Get Approved? It can be tougher than your first mortgage, yes. The biggest hurdles for those looking for a second mortgage? Stretching that LTV too thin, a credit score that’s seen better days, or a DTI straining at the seams. Don't panic! You can boost your chances. Focus on improving that credit score (pay down cards!), chipping away at other debts to lower your DTI, and crucially – shop around. Different lenders have different appetites and programs. Don’t settle for the first offer; comparing lenders is your power move.

Understanding Second Mortgage Costs & Rates

Let's talk dollars and sense. Second mortgages come with higher interest rates than your primary loan. Why? Simple risk. The lender knows if you default and the house is sold, the first mortgage gets paid off before they see a dime.

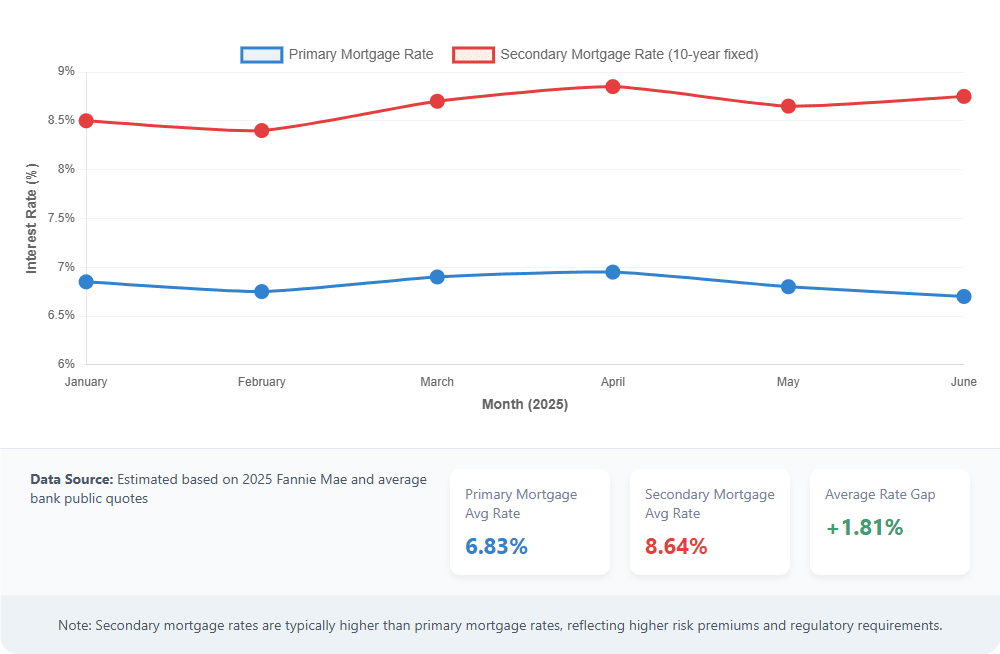

Current 2nd Mortgage Rates & Influencing Factors (2025 Update):

Rates fluctuate, but expect them to be several percentage points above current first mortgage rates (e.g., think 8.25–10.5%+ range in mid-2025, fixed or variable depending on the product). What pushes your specific rate up or down? Your credit score is king – shine it up. Your combined LTV matters (lower is better). Even the loan amount and loan term play roles, alongside the broader market interest rate environment.

Rates fluctuate, but expect them to be several percentage points above current first mortgage rates (e.g., think 8.25–10.5%+ range in mid-2025, fixed or variable depending on the product). What pushes your specific rate up or down? Your credit score is king – shine it up. Your combined LTV matters (lower is better). Even the loan amount and loan term play roles, alongside the broader market interest rate environment.

10-Year Second Mortgage Rates: A Popular Choice (2025 Data): As of mid-2025, 10-year fixed-rate second mortgages are typically averaging 8.75–9.25%, though excellent credit and lower LTVs can yield slightly better offers. You lock in that rate, guaranteeing the same monthly payment for the entire decade. It strikes a balance: shorter terms mean higher payments but less total interest, longer terms ease the monthly pinch but cost more overall. The 10-year 2nd mortgage rate offers stability without stretching payments out forever. (Remember: Actual rates change daily! Check current market offers).

Fees & Closing Costs: Don’t Get Surprised: Brace yourself – it’s not just the rate. Closing costs add up. Expect potential hits like an origination fee (the lender's admin charge), an appraisal (to confirm your home's value), title search and insurance fees, recording fees, and more. These can easily run 2–5% of your loan amount. Here’s the pro tip: Don’t just laser-focus on the interest rate. Look at the APR (Annual Percentage Rate). This magic number bundles the interest rate and most fees into one percentage, giving you the true annual cost of the loan. Comparing APRs across lenders is essential.

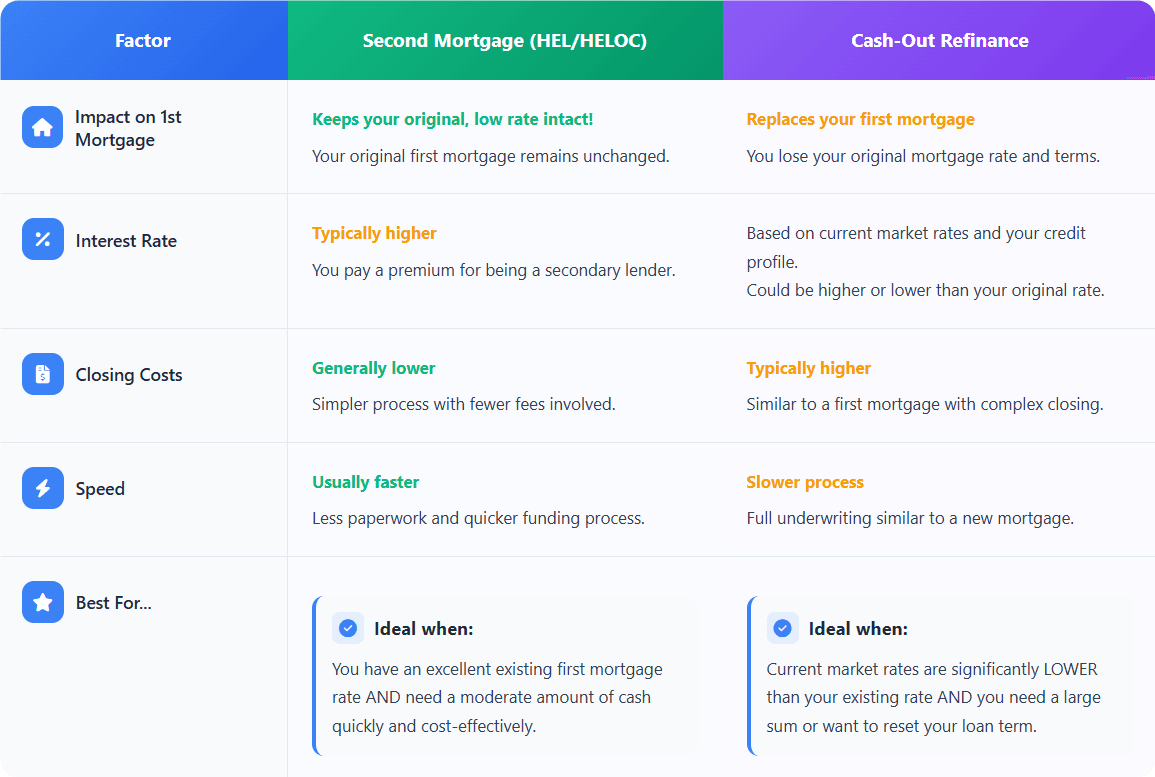

Second Mortgage vs. Cash-Out Refinance: Choosing Wisely

This is the million-dollar question (sometimes literally!) when looking for a second mortgage. Both tap your equity, but they play very different games:

The verdict? If you love your current first mortgage rate and just need a chunk of cash (not a full refi amount), a second mortgage is often the sleeker, more cost-effective tool. If today's rates are dramatically lower than your first mortgage and you need substantial cash or want to change your loan term, cash-out refinancing might win.

How to Find & Apply for Your Second Mortgage

Ready to roll up your sleeves in your search for a second mortgage? Smart borrowing starts with smart shopping.

Comparing Lenders: Key Questions to Ask: Don't just take the first handshake. Grill potential lenders! Get specific:

- "Show me the full fees breakdown – every single charge."

- "What's the total APR, not just the interest rate?"

- "Is there a prepayment penalty if I pay this off early?" (Avoid these if possible!).

- "Do you offer a rate lock? What's the cost and how long does it last?"

- "What's the realistic approval timeline from start to finish?"

- "Will you provide a standardized Loan Estimate within 3 days of my application?" (They legally must!).

Shopping around isn't just smart; it can save you thousands.

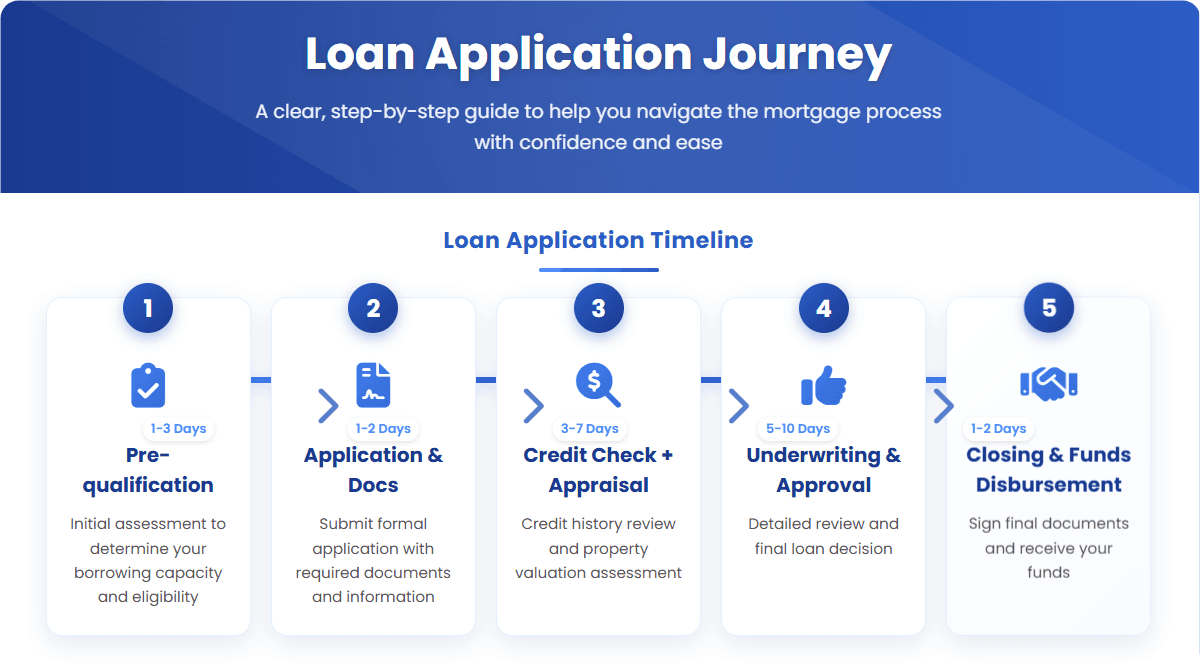

The Application Process Simplified: Once you pick a lender for your second mortgage, it is fairly straightforward to apply for a second mortgage online:

- Get Pre-Qualified/Pre-Approved: A soft look giving you borrowing power estimates.

- Formal Application & Documentation: Submit the full application and paperwork (income proof, tax returns, asset statements, ID, details on your first mortgage).

- Credit Check & Appraisal: Lender pulls your credit (expect this!) and orders a professional appraisal to confirm your home's value.

- Underwriting & Final Approval: The lender dives deep into your finances and the property details.

- Closing: Sign the mountain of paperwork, pay any remaining closing costs, and the funds are yours! The approval timeline varies wildly – from a few weeks for simpler cases to a couple of months.

Important Risks & Final Considerations

Let’s not sugarcoat it. A second mortgage uses your home as collateral. That means serious stakes when you're looking for this type of loan:

- Foreclosure Risk: If you can't make the payments, you could lose your house. This risk is amplified because you now have two mortgage payments.

- Increased Monthly Burden: Factor that new payment into your budget – rigorously. Can you truly afford it, even if the car breaks down or the roof leaks?

- Depleting Your Equity: You're spending the financial cushion you've built. This reduces your safety net and future borrowing power.

Before you leap:

- Be crystal clear why you need the money. Is it a true investment (like a renovation adding value) or just financing lifestyle creep?

- Crunch those monthly numbers. Be brutally honest about affordability. Build in wiggle room.

- Seriously consider talking to a fee-only financial advisor. An independent pro can help you weigh if pursuing a second mortgage is truly the best move for your unique situation.

Looking for a second mortgage can be a powerful financial strategy, unlocking opportunities tied to your biggest asset. But tread carefully, understand the costs and risks, shop fiercely, and borrow wisely. Your home’s equity is a fortress – make sure you’re using the right key to open the gate.