![[Must-Read] How Does a HELOC Work? Explore Process Here](/_next/image?url=https%3A%2F%2Fdynamic-light-ab6e2536d6.media.strapiapp.com%2Fhow_does_a_heloc_work_b76acd0fa0.jpg&w=3840&q=75)

[Must-Read] How Does a HELOC Work? Explore Process Here

Being a term hard to understand, people often don't know how a HELOC works. If you're also curious about HELOC loans, take a look at this full guide. You'll learn how does a HELOC work, and how the Draw Period and Repayment Period work. Also, more related information is here for you. You might as well scroll down to get the rope.

What is a HELOC Loan?

Before we go any further, you must learn what a HELOC is. A Home Equity Line of Credit (HELOC) is a revolving line of credit secured by the homeowner's equity. Unlike a one-time home equity loan, a HELOC lets borrowers draw, repay, and redraw funds up to an approved limit during the draw period. Interest is charged only on the outstanding balance. HELOC rates are typically variable, commonly expressed as prime + margin, although many lenders also offer fixed-rate conversion options for part or all of a balance. According to Bankrate, the national average HELOC rate was 8.05% as of September 17, 2025.

Key Features of Home Equity Line of Credit

- Revolving credit line: Repaid amounts can usually be borrowed again during the draw period.

- Interest charged on outstanding balance only: Monthly interest is applied only to what's been drawn.

- Rate structure: Most HELOCs are variable with prime and margin. Many lenders provide the option to convert part or all of the outstanding balance to a fixed rate.

- Access & use: Withdrawals are commonly made via checks, online transfer, or a linked card.

- Typical limits: Limits vary widely by lender and borrower profile. Combined loan-to-value (CLTV) and borrower credit are primary drivers of maximum credit, according to Investopedia.

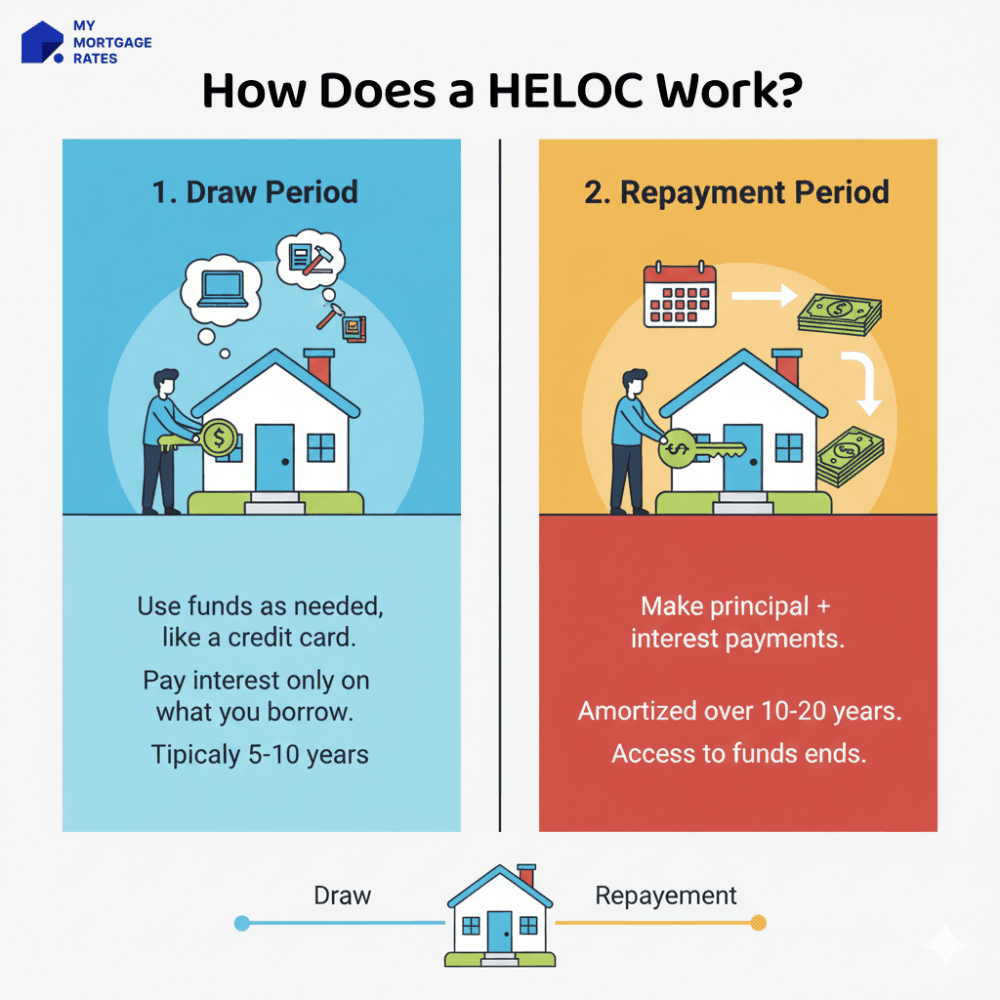

How Does a Home Equity Line of Credit Work?

A HELOC normally has two phases: the draw period, when the borrower may draw funds up to the approved limit and often make interest-only payments, and the repayment period, when draws stop and the borrower repays principal + interest. Lenders underwrite HELOCs based on property value, existing mortgages, creditworthiness, income verification, and debt-to-income (DTI). CLTV (combined LTV) works as:

CLTV = (existing mortgage balances + HELOC credit limit) ÷ appraised value

Many lenders commonly use an ~80% CLTV benchmark for underwriting decisions.

How Does HELOC Draw Period Work?

Many HELOCs use a 10-year draw period. Some products may be 5, 10, 15 years, etc. During the draw period, borrowers can withdraw, repay, and re-borrow up to the line limit.

Minimum payments are often interest-only, but payment structures vary by lender. Some require a minimum principal component or have a percentage-floor minimum payment in certain repayment modes.

How Does HELOC Repayment Work?

After the draw period ends, the loan typically enters a repayment phase that commonly lasts 10–20 years. During repayment, the borrower must make principal and interest payments. Monthly payments often increase significantly compared with interest-only payments. Some lenders allow partial fixed-rate conversions or other amortization options.

Variable Interest Rate vs. Fixed Interest Rate

What are the differences between a Variable Interest Rate and a Fixed Interest Rate? Let's explore below.

- Variable-rate HELOCs: Rates move with market benchmarks, for example, prime, so monthly payments can rise or fall. They often start lower than fixed alternatives but introduce payment uncertainty.

- Fixed-rate options: Many lenders allow converting some or all of the HELOC balance to a fixed-rate installment, which gives payment predictability but may carry a higher rate or fees. Availability and terms vary.

Fixed Interest Option

Fixed-rate conversion options let borrowers lock portions of the outstanding balance into fixed-rate installments either during the draw period or later, depending on the lender. You should check lender disclosures for conversion fees, term limits, and whether conversions require new underwriting.

HELOC Example for Dummies to Understand

Sarah owns a home valued at $400,000 with a first mortgage balance of $250,000 (equity = $150,000). If the lender allows an 80% CLTV, total secured debt cap = $400,000 × 80% = $320,000. Subtract the existing mortgage ($250,000) → theoretical HELOC capacity ≈ $70,000 (subject to underwriting).

-

Sarah draws $30,000 at 8.25% and makes interest-only payments: Monthly interest-only ≈ $30,000 × 0.0825 ÷ 12 = $206.25.

-

Later she draws another $15,000 (total outstanding = $45,000): Monthly interest-only ≈ $45,000 × 0.0825 ÷ 12 = $309.38.

-

If, after the draw period, she amortizes a $45,000 balance over 15 years at 8.25% (fully amortizing), the monthly payment is $436.56, rounded to cents. All calculations use standard monthly interest and amortization formulas. Exact payments depend on lender rounding and exact rate/compounding.

How Much Does a HELOC Cost?

Costs include both upfront third-party fees and ongoing interest. Common third-party/closing fees range from $0 up to roughly $1,600, depending on the lender and whether promotional fee waivers apply. Typical items: appraisal ($300–$700), application fees ($0–$500), title/attorney/recording fees, and possible annual or inactivity fees. "No closing cost" HELOCs exist, but may be offset by higher rates or other charges; compare total cost (fees + expected interest).

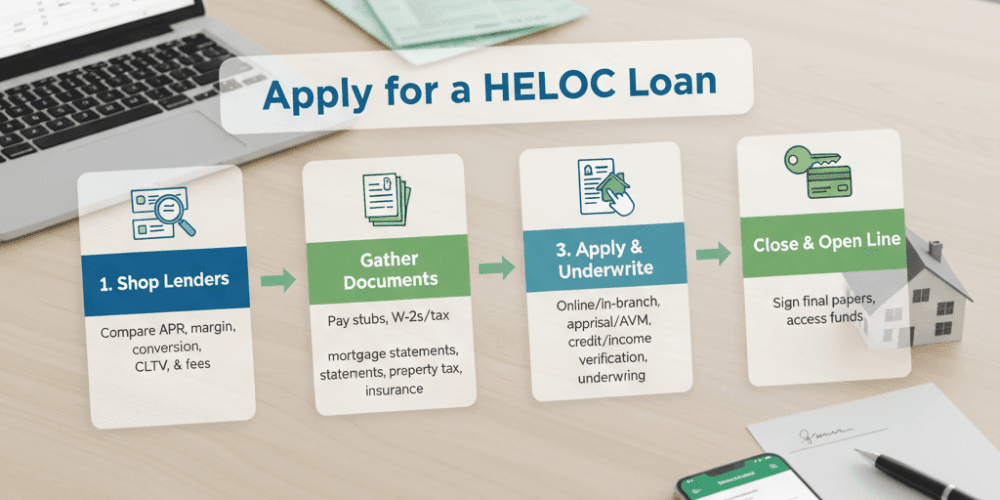

How to Apply for HELOC?

How to get a HELOC loan? Here's the process for your reference. According to Bankrate, many HELOCs take ~2–6 weeks (about 30–45 days) from application to close, though timelines vary by lender and market conditions.

- Shop lenders, compare APR, margin, conversion options, CLTV limits, and fees.

- Gather documents: pay stubs, W-2s/tax returns, mortgage statements, property tax records, and proof of insurance.

- Apply online or in-branch. Lender typically orders an appraisal or uses an AVM, verifies credit and income, and underwrites the file.

- Close and open the line.

HELOC Eligibility Requirements

You may check out the requirements for a HELOC loan first and see whether you are qualified for it.

- Credit score: Some lenders accept scores in the low-to-mid 600s. Around 620 is often considered a common minimum threshold for some products, while the best rates are typically reserved for borrowers with scores well above 700.

- DTI: Lenders generally prefer DTI ≤ ~43%, though acceptable limits vary.

- CLTV/equity: Common CLTV caps are ~80–85%, dependent on product and lender.

- Property type: Primary homes and many second homes qualify. Investment properties, condos under certain conditions, and manufactured homes may face restrictions or different pricing.

How to Calculate HELOC Payment?

You can estimate the HELOC monthly payment through the ways below. Better yet, the quickest way is to use an online HELOC monthly payment calculator to get an instant answer.

-

Interest-only (draw period): Monthly ≈ (outstanding balance × annual interest rate) ÷ 12. Example: $50,000 at 8% → $50,000 × 0.08 ÷ 12 = $333.33/month.

-

Amortizing (repayment period): Use the standard amortization formula (monthly rate, number of months).

-

Example: $50,000 at 8.25% over 15 years ≈ $485.07/month (rounded). Payment amounts change if the interest rate changes (variable-rate HELOC).

What is the monthly payment on a $50,000 home equity line of credit?

Let's take this question as an example to start the calculation.

- Interest-only example at 8.25%: $50,000 × 0.0825 ÷ 12 ≈ $343.75/month.

- Amortizing example at 8.25% over 15 years: ≈ $485.07/month. These are illustrative, actual product terms, and interest adjustments affect real payments.

FAQs About HELOC

Q1. What are the disadvantages of a HELOC?

Variable interest rates can cause payment uncertainty. Payment shock when the loan moves from interest-only to principal + interest. The home is the loan security, missed payments can lead to foreclosure. Lenders may freeze or reduce credit limits if home values fall or borrower credit worsens.

Q2. What is a better option than a HELOC?

Here are some of the other loans that you can take into consideration.

- Home equity loan (fixed-rate, lump sum): Better for one-time, known expenses and predictable payments.

- Cash-out refinance: Replaces the first mortgage and pulls equity, can be efficient if first-mortgage rates are attractive.

- Personal loans or credit cards: No home collateral but typically higher rates. Suitable for smaller amounts. Choice depends on amount, timing, and borrower risk tolerance.

Q3. Can I get a HELOC for any type of property?

Primary residences commonly qualify. Second homes often qualify depending on lender policy. Investment properties, some condos/co-ops, and manufactured/mobile homes may have additional restrictions or higher pricing. Check lender eligibility rules.

Q4. How much HELOC can I get?

HELOC credit limits depend on CLTV, borrower credit, income, and lender policy. Many lenders underwrite up to ~80–85% CLTV, so available HELOC = (allowed CLTV × appraised value) − existing mortgage(s). Limits commonly start at $10,000–$15,000 and can go much higher for well-qualified borrowers.

Q5. Can you sell your house if you have a HELOC?

Yes. A HELOC is a lien on the property and must be paid off or subordinated/assumed if agreed at closing. Title/closing agents coordinate payoffs so the buyer receives a clear title.

Q6. Are there closing costs on a HELOC?

Yes, appraisal, title/attorney, and recording fees are common. Many lenders offer fee waivers or "no-closing-cost" options that are often offset by a higher interest rate or other charges. Always compare total holding cost with fees + expected interest.