![[Solved] How to Calculate HELOC Payment? Easy-to-Understand](/_next/image?url=https%3A%2F%2Fdynamic-light-ab6e2536d6.media.strapiapp.com%2Fhow_to_calculate_heloc_payment_banner_75d02cb427.jpg&w=3840&q=75)

[Solved] How to Calculate HELOC Payment? Easy-to-Understand

When it comes to math, it troubles you and me, let alone HELOC calculations. What a big project it is! After I got the HELOC loan, I've been keeping my eyes open on the payments. Therefore, I finally decided to write down all the formulas in this post. If you don't know how to calculate HELOC payments, including monthly payments and payments of interest-only, draw period, and repayment period. Help yourself down here.

Introduction to HELOC

A Home Equity Line of Credit (HELOC) functions like a flexible, revolving credit line secured by your home's equity. Unlike a closed-end loan, HELOCs operate in two distinct phases: the draw period and the repayment period. Market averages move frequently, but Bankrate showed national HELOC averages around ~7.9% in mid-September 2025. Your actual rate depends on loan size, lender, and borrower's credit profile.

During the draw period, most commonly 10 years, though some HELOCs have shorter or longer draw windows, typically ranging roughly 5–15 years. Borrowers access funds as needed and frequently make interest-only payments on the outstanding balance. Lenders generally set combined loan-to-value (CLTV) limits (first mortgage + HELOC) commonly in the ~80%–85% range, though exact limits depend on lender and property type. HELOCs are used by homeowners for renovations, debt consolidation, bridge financing, and other purposes requiring flexible access to capital.

How to Estimate HELOC Payment?

Calculating HELOC payments requires understanding how HELOCs work. You should understand the loan phase, outstanding balance, current interest rate, and the repayment term. Market offers vary widely. Some borrowers see introductory or promotional rates lower than the national average, while borrowers with weaker credit or on non-qualified properties can receive much higher rates. Use the national averages only as a rough benchmark and always get lender quotes.

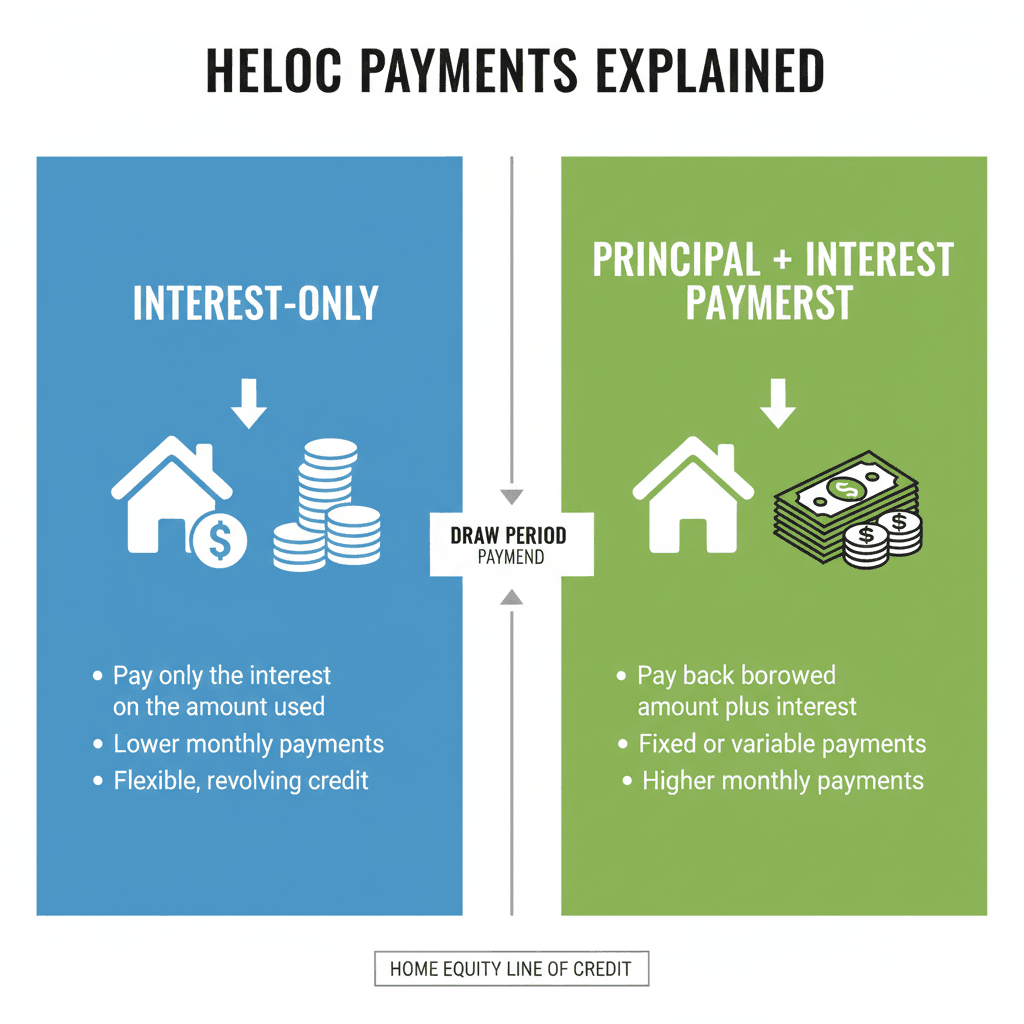

Payment calculations differ between the draw period (often interest-only) and the repayment period (principal + interest). Key inputs for any calculation are outstanding balance, annual interest rate (or margin + index), payment type (interest-only vs. amortizing), and remaining term.

Also, if you're prone to being lost in formulas, here's an easy HELOC payment calculator free to use for you. It can do all the math for you and help you get an instant result. Just give it a try.

How to Calculate Monthly Payment on HELOC?

To estimate HELOC payments, here are two formulas you should learn. The first is for calculating interest-only payments during the draw period, and the second is for calculating the monthly payments during the repayment period. Let's check them out.

Also, there are examples for you to understand the formulas. These examples assume constant interest for the amortization period. With a variable HELOC, actual payments can change if the index or margin changes.

-

Interest-only (draw period) formula: Monthly payment = (Outstanding balance × Annual interest rate) ÷ 12.

-

Example (interest-only): $60,000 balance at 8.5% APR → $60,000 × 0.085 ÷ 12 = $425 monthly (interest-only).

-

Full principal & interest (amortizing) formula: M = P × [r(1+r)^n] ÷ [(1+r)^n − 1]

-

M = monthly payment, P = principal (outstanding balance), r = monthly interest rate (annual rate ÷ 12), n = number of months.

-

Example (amortizing): $50,000 at 8% APR for 15 years → monthly payment ≈ $478. (Calculation uses r = 0.08/12 and n = 180.)

How to Calculate HELOC Interest-Only Payment?

How is HELOC interest calculated? Actually, your minimum monthly payment during an interest-only draw period is the monthly interest. Here's the formula and example.

-

Interest Payment = Balance × (Annual Rate ÷ 12).

-

Example: $100,000 at 7.5% → $100,000 × 0.075 ÷ 12 = $625 monthly (interest only).

Interest-only payments keep monthly cost lower but do not reduce principal, leaving the same balance to be amortized (or paid) later unless you make extra principal payments.

How to Calculate Draw Period Payment?

During the draw period, you pay interest on the amount you actually borrowed, not on your full credit limit. If your limit is $80,000 but you drew $30,000, interest is charged only on the $30,000.

- Example: $30,000 drawn at 8.2% APR → $30,000 × 0.082 ÷ 12 = $205 monthly (interest only). If you increase the outstanding balance by drawing more, recalculate using the new balance. Many borrowers intentionally make extra principal payments during the draw period to lower future repayment obligations.

How to Calculate Repayment Period Payment?

When the draw period ends, you typically enter a repayment phase, which commonly 10–20 years depending on the product. Payments convert to principal + interest and can jump substantially versus interest-only amounts. Use the amortization formula above with the outstanding balance at the start of repayment.

- Example: $75,000 entering repayment at 8.5% APR over 15 years → monthly payment ≈ $739. That increase from interest-only to fully amortizing is a frequent source of borrower "payment shock."

How to Calculate HELOC Loan with Extra Payments?

Extra principal payments reduce the outstanding balance and cut total interest and payoff time. To model extras: compute the standard amortizing payment, then subtract the additional principal you pay each month and recalculate the remaining term, or use an amortization spreadsheet/calculator.

- Example: $50,000 at 8% over 15 years → regular payment ≈ $478. Adding $100/month toward principal reduces the payoff period and interest substantially. Exact savings depend on timing and rate.

[Tips] How to Pay off a HELOC Loan?

If you want to pay off your HELOC loan early, you can get rid of the burden. That's really a fantastic idea. Here are some practical payoff tactics you can try.

-

Build a budget and prioritize payments. target extra principal when possible.

-

During the draw period, pay more than the interest-only minimum to reduce the balance before repayment begins.

-

Consider the avalanche method, focusing on the highest rate debt or snowball, smallest balance first, depending on psychology and rates.

-

Evaluate refinancing into a fixed-rate home equity loan or a cash-out refinance if you want predictable payments and interest-rate protection. Compare closing costs vs. expected savings.

-

Check your HELOC agreement for prepayment or early-closure fees. Some lenders charge early closure/inactivity fees within certain windows. Typical HELOC closing/appraisal and related fees vary by lender. According to Bankrate, many borrowers pay appraisal or closing costs in the low hundreds to a few thousand dollars, depending on product and lender policies.

Remember that HELOC interest may be tax-deductible only if the funds are used to buy, build, or substantially improve the home that secures the loan. See IRS guidance and consult your tax advisor.

FAQs About Calculating HELOC Payment

Q1. What is the formula to calculate a HELOC payment on Excel?

Use Excel's PMT function for amortizing payments: =PMT(rate, nper, -pv). For interest-only payments: =(Balance*Annual_Rate)/12.

Example: =PMT(0.08/12,180,-50000) yields ≈ $478 for $50,000 at 8% over 15 years.

Q2. Can you pay off HELOC early?

Yes. Many HELOCs allow early payoff. However, some lenders include early-closure, inactivity, or other fees. Review your loan agreement. Paying early reduces interest expense and exposure to rising variable rates.

Q3. Is a HELOC a rip-off?

Not inherently. HELOCs are useful for flexible financing but carry variable-rate risk and collateral exposure, in this case, your home. Compare total costs, like fees, margin, rate caps, and alternatives like home equity loans or cash-out refinance.

Q4. Is a HELOC tax-deductible?

Potentially, interest is deductible only when funds are used to "buy, build, or substantially improve" the secured home and is subject to mortgage interest limits. Check IRS Publication 936 and consult a tax professional for your circumstances.

Q5. What is the monthly payment on a $50000 HELOC?

Now, we can calculate the payments during the draw period and repayment as follows.

-

Interest-only at ~8% APR: $50,000 × 0.08 ÷ 12 = $333.33 monthly.

-

Fully amortized at 8% over 15 years: ≈ $478 monthly. Actual payments depend on your specific APR, which varies by creditworthiness, CLTV, and lender.

Q6. Is a HELOC better than a home equity loan?

It depends. HELOC and home equity loans are different. HELOCs suit ongoing or uncertain costs with flexible draws and initial interest-only payments. Home equity loans are better for fixed, one-time needs with a predictable rate and payments. Choose based on project type, rate outlook, and tolerance for variable payments.

Conclusion

Understanding the difference between draw and repayment phases, knowing how to calculate HELOC payments, and planning for potential payment increases are essential when using a HELOC. Shop multiple lenders, get current rate quotes, confirm CLTV limits and underwriting requirements, including credit score, DTI, appraisal, and consult tax/professional advisors for deductions or refinancing decisions. Typical HELOC timelines range from about one to six weeks, depending on the lender and file complexity. Plan accordingly.