![[Detailed Guide] What is a HELOC? All You Should Know Here](/_next/image?url=https%3A%2F%2Fdynamic-light-ab6e2536d6.media.strapiapp.com%2Fwhat_is_a_heloc_35f5108d38.jpg&w=3840&q=75)

[Detailed Guide] What is a HELOC? All You Should Know Here

If you're like someone on Reddit trying to avoid borrowing money and float the budget for expenses, a HELOC (Home Equity Line of Credit) loan might be worth considering. However, is HELOC a good idea? You may learn all the things about it here, including what is a HELOC, how does a HELOC work, requirements, benefits, disadvantages, application, and FAQs. Now, let's dive in.

What is a HELOC?

First, let's figure out what a HELOC is. A Home Equity Line of Credit (HELOC) is a revolving line of credit secured by the equity in your home. Unlike a closed-end loan, a HELOC works like a credit card. You borrow up to an approved limit during a draw period, repay or re-borrow as needed, and later enter a repayment period when you must pay back principal and interest. HELOCs usually have variable interest rates that track an index such as the prime rate plus a lender margin.

Bankrate reported HELOC averages around 8.05% on Sep 17, 2025, with a slightly lower national average of 7.88% reported on Sep 24, 2025. Rates move frequently, so always check current surveys or lender quotes.

What Can You Use a HELOC for?

So, how does HELOC work to help you deal with your budget? Here are some common uses for reference.

- Home renovations and improvements, which is often the most tax-advantaged use.

- Debt consolidation to replace higher-rate consumer debt.

- Education costs and major life events like weddings, large medical expenses.

- Bridge financing for a new home purchase before the sale of the current property.

- Business or investment uses, but you should note that lenders may restrict HELOC uses, and some forms of investment borrowing can have tax/qualification implications.

How Does a HELOC Work?

How does a home equity loan of credit work? Here's the process for you to grasp the idea. Normal access methods include checks, online transfers, or a dedicated HELOC card, features differ by lender.

- Credit limit calculation: based on the home's appraised value minus existing mortgage(s). Lenders commonly allow total combined LTV (CLTV) up to about 80%--90%, though exact limits vary.

- Draw period: most HELOCs use a 10-year draw period as a standard, which some are 5 years, some longer. During this time, you can borrow, repay, and borrow again. Typically, you may pay interest only on the amount outstanding.

- Repayment period: after the draw period ends, you generally enter a repayment phase of about 10--20 years, during which principal and interest payments are required and monthly payments can rise noticeably. Some lenders allow conversion of the outstanding balance to a fixed-rate loan.

HELOC Loan Requirements You Must Know

Before you apply for HELOC loans. Here are some requirements you should check out to see whether you're eligible for HELOC.

- Credit score: according to NerdWallet, many lenders prefer scores in the 640--700+ range for competitive pricing; some will underwrite down to ~620, but at higher rates and stricter terms.

- Equity/CLTV: commonly up to 80%--90% CLTV, and the exact limit depends on the lender and property type.

- Debt-to-income (DTI): lenders generally require DTI to be within acceptable limits. Guidelines vary. For some loan products, max DTIs can be 45%--50% under automated underwriting. Student loan obligations are counted. If loans are deferred, under certain agency guidelines, lenders may use 1% of outstanding balance or the contractual payment to calculate DTI based on Fannie Mae's selling guide.

- Income & employment verification: pay stubs, tax returns, bank statements.

- Appraisal & property type: appraisal normally required; investment properties and some condo types may face stricter rules or lower CLTVs.

Pros and Cons of a HELOC

What are the HELOC benefits, and what are the disadvantages of a HELOC? Here's a quick breakdown for you.

Pros

- Flexible access to funds and re-borrowing capability.

- Interest-only payments are often available during the draw period with a lower monthly cost initially.

- Typically, lower rates than unsecured debt, like credit cards and personal loans.

- Interest may be tax-deductible if used for qualifying home improvements. You see tax rules here.

Cons

- Variable rates: payments can increase if index rates rise.

- Your home is collateral: missed payments may lead to foreclosure.

- Payment shock at repayment start when principal amortization begins.

- Possible fees: appraisal, closing/origination, inactivity or annual fees, which depend on product.

How to Get a HELOC?

To apply for a HELOC loan, you can walk through what you should prepare below.

- Estimate your equity. Simply the current market value minus outstanding mortgages.

- Shop lenders to compare margins, rate caps, draw/repayment lengths, fees, and minimum/maximum line amounts. Some lenders list min lines like $10k and maxs varying widely.

- Gather documents, including pay stubs, tax returns, and bank statements.

- Apply and schedule an appraisal. Costs commonly $300--$500 but vary.

- Underwriting & closing. Bankrate reported that the typical timeline is 30--45 days, though some online lenders can be faster, and complex files can take longer.

Is It Hard to Get a HELOC?

Depends on profile and market conditions. Borrowers with good credit (≈700+), steady income, and meaningful equity usually find it straightforward. Self-employed borrowers or those with recent credit events may face extra scrutiny. Property types such as condos, manufactured homes, or investment properties often face stricter rules.

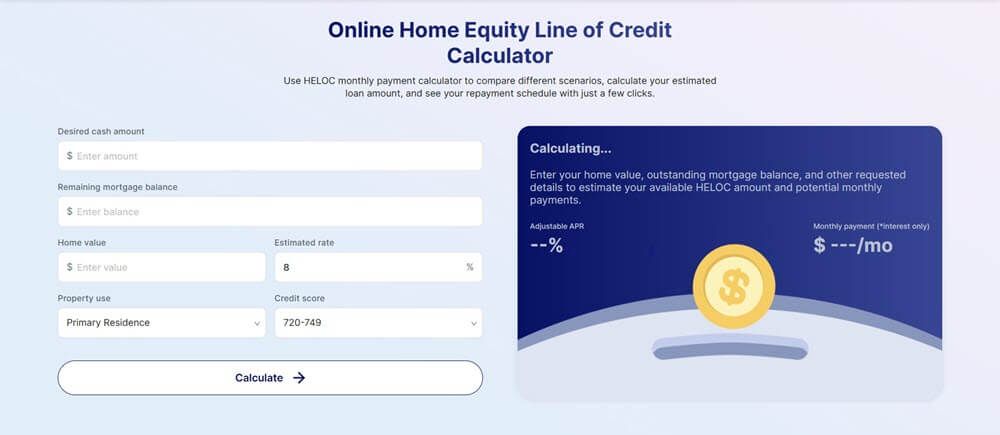

How to Estimate HELOC Payment

Here's the formula for you to calculate HELOC payment. Also, you can use the best HELOC payment calculator to get the math done instantly.

- Draw period (interest only): monthly ≈ (outstanding balance × APR)/12.

- Example: $50,000 balance at 8% → ≈ $333/month interest.

- Repayment period: use amortization over remaining term (principal + interest). Many lender calculators let you model rate changes and repayment conversions. Consider cap provisions and plan for higher payments if rates rise.

Differences: HELOC vs Home Equity Loan

What are the differences between HELOC and Home Equity Loan? You may choose HELOC for ongoing/uncertain needs and home equity loan when you need a known lump sum with rate stability.

- HELOC: revolving line, usually variable rate, draw period then repayment with flexible uses.

- Home equity loan: closed-end, lump sum, fixed rate for predictable payments.

HELOC or Home Equity Loan, Which is Better?

Depends on purpose, rate outlook, and tolerance for rate risk. For multi-phase renovations or flexible cash flow needs, HELOC is often better. For one-time large expenses or if you need fixed payments, consider a home equity loan.

FAQs About Home Equity Line of Credit

Q1. Is a home equity line of credit a good idea?

It can be, when used for value-adding home improvements or to replace higher-rate debt. But it carries collateral risk and rate variability; consult a financial advisor if unsure.

Q2. Can you refinance a HELOC?

Yes, options include refinancing into a new HELOC, converting to a fixed-rate home equity loan, or a cash-out refinance of your first mortgage. Consider closing costs and whether rate/term changes justify expenses.

Q3. How long does a HELOC take?

Typical timeline 30--45 days, though quick online offerings can close in 2--3 weeks; complex cases may take longer.

Q4. Is HELOC interest deductible?

Interest is potentially deductible only if the funds are used to buy, build, or substantially improve the home that secures the loan. The overall mortgage interest deduction is subject to limits which is generally $750,000 combined mortgage cap for most borrowers after Dec 15, 2017. Consult IRS Publication 936 or a tax professional for specifics.

Q5. Can you get a HELOC with bad credit?

Challenging but possible. Some lenders accept lower scores (~580--620) with compensating factors like large equity, low DTI, though rates/terms will be worse. Better credit yields better pricing.

Q6. Can you use a HELOC for a down payment?

Often yes, but many mortgage lenders require the HELOC to be seasoned, open for some months, and will scrutinize combined obligations. Carrying multiple mortgages increases qualification difficulty, assess DTI and reserves carefully.

Q7. Who offers HELOC on investment property?

According to The Mortgage Reports, fewer lenders offer HELOCs on non-owner-occupied properties. Those that do often require higher credit scores, lower CLTVs (commonly 70%--75%), and stronger reserves. Major banks and specialty lenders vary, and you'd better shop around.

Q8. Are student loans considered as debt when getting a HELOC?

Yes, lenders include student loan payments in DTI. If loans are deferred, agency guidelines may allow using 1% of the outstanding balance as the qualifying payment or the contractual payment if specified. Check lender underwriting rules.

Q9. What is the draw period on a HELOC?

Most commonly 10 years, and you can withdraw up to your credit limit and often pay interest only, though some products use shorter or longer draw periods, like 5--15 years, depending on the product. After the draw period, you enter repayment, which is often 10--20 years.