6 Top Loan Origination Systems to Streamline Workflow in 2025

Picking the right LOS will definitely help loan officers to get a loan closed quicker and earn more commissions. Here are the list of 6 top loan origination systems that I finally picked out after trying and testing a bunch of LOS. If you're still looking for a handy helper, take a look here, and you'll definitely get it.

What is a Loan Origination System (LOS)?

A Loan Origination System represents the technological backbone that powers modern lending operations from initial application through final approval and funding. This comprehensive software platform manages every stage of the borrowing journey, including applicant verification, credit assessment, document collection, underwriting decisions, and compliance monitoring. Rather than relying on disconnected spreadsheets and manual processes, financial institutions leverage these integrated systems to coordinate activities across departments while maintaining complete visibility into each transaction.

Today's platforms increasingly incorporate artificial intelligence and machine learning capabilities that enhance accuracy in risk evaluation and streamline decision-making workflows. The technology serves diverse lending scenarios, from residential mortgages and commercial loans to consumer credit products, enabling organizations to process applications with greater speed and consistency. Modern solutions connect with third-party data providers, credit bureaus, and regulatory databases, creating a unified ecosystem that reduces redundant data entry. By centralizing information and automating routine tasks, these systems free lending professionals to focus on relationship building and strategic growth initiatives rather than administrative burden.

Why Do You Need the Best Loan Origination System?

The lending landscape has transformed dramatically, with borrowers expecting instant responses and seamless digital experiences comparable to other online services. Several market reports project rapid growth in the loan origination software market, for example, this market forecast projects growth from about USD 6.59 billion in 2025 to USD 14.66 billion by 2033 (CAGR ≈ 10.5%), reflecting strong industry momentum toward digital transformation.

Organizations operating without robust automation face competitive disadvantages: longer cycle times, higher operating costs, and elevated error rates that can harm borrower trust. Automation typically reduces processing costs and accelerates loan issuance; it also reduces regulatory risk by building audit trails and enforcing standardized rules.

During volume spikes, intelligent platforms allow lenders to scale without proportional staffing increases, and analytics from modern LOS solutions enable better pricing, underwriting, and product decisions based on real data rather than intuition.

6 Top Loan Origination Systems for You

1. Zeitro - Best Loan Origination System for Anyone

Zeitro is an AI-driven origination platform built for mortgage professionals such as loan officers, brokers, and retail/wholesale lenders, that bundles CRM, POS/1003 automation, document processing, guideline intelligence, pricing, and borrower-facing microsites in one system.

The vendor materials and your provided product notes highlight benefits such as faster pre-qualifications, high application completion rates, AI-driven guideline assistance, and a freemium pricing model. Zeitro claims to reach 2.5x faster pre-qualifications, 7+ hours saved per loan file, and 90%+ completion rate. If you became an MLO recently, Zeitro is a free option for you to set off.

Explore More Features of Zeitro

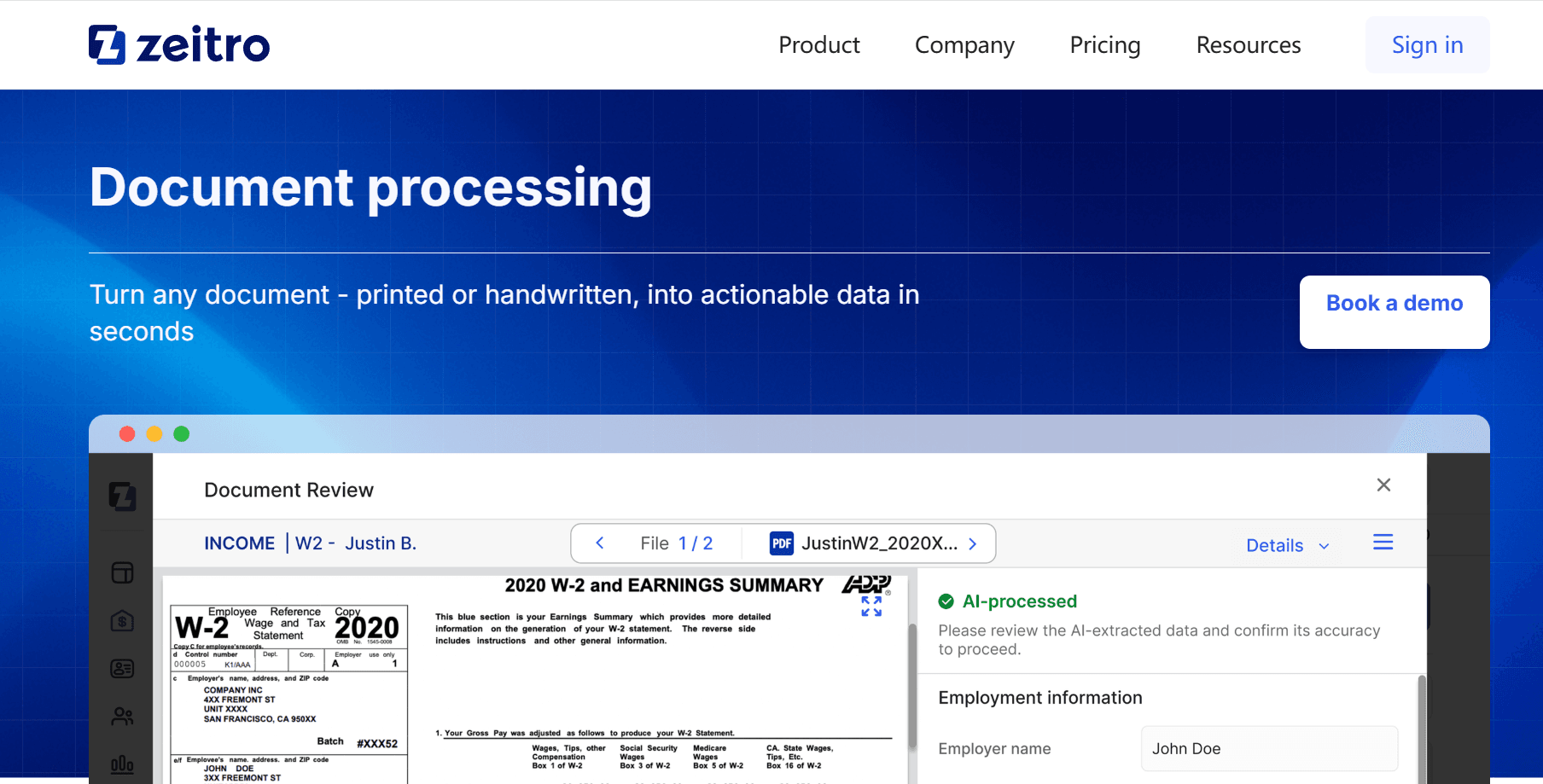

- GuidelineGPT: Natural language processing enables instant answers about FHA, VA, Fannie Mae, Freddie Mac, and USDA requirements with complete source transparency

- AI Document Review: Optical character recognition automatically extracts data from borrower documents including income statements and tax returns, organizing everything for underwriters

- Automated Condition Collection: Streamlines the gathering of outstanding requirements by tracking submissions and verifying document accuracy without manual intervention

- Digital 1003 Automation: Generates standardized loan applications with FNM 3.4 export capability while minimizing errors through intelligent data validation

- Qualified Income Calculator: Leverages artificial intelligence to achieve 85%+ accuracy in debt-to-income ratio calculations by automatically pulling financial data

- Scenario AI: Provides expert-level responses to complex borrower situations with source-backed recommendations across multiple lending programs in seconds

- Personal Website Builder: Launches branded microsites with SEO optimization, rate calculators, and lead capture tools to attract prospective borrowers

- Credit Reporting Integration: Runs instant borrower credit checks to deliver accurate pre-approval results and qualification letters

2. Turnkey Lender - Best Loan Origination System for Automation

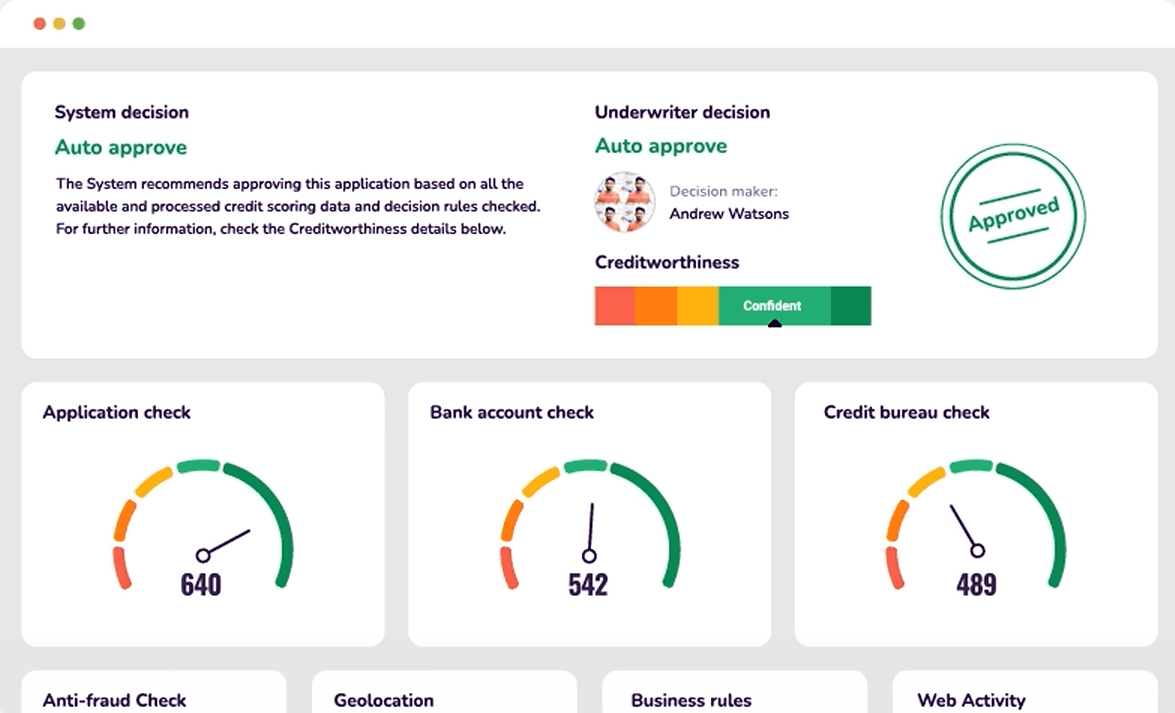

TurnKey Lender positions itself as an end-to-end digital lending automation platform with configurable application flows, AI-powered credit decisioning, straight-through processing, and extensive third-party integrations. Its materials emphasize rapid decisioning and configurable rules for many product types like consumer, BNPL, SME, etc. Present vendor claims as product positioning; exact throughput/performance metrics should be verified with TurnKey for specific SLAs.

Explore More Features of Turnkey Lender

- Configurable Loan Application Flow: Build custom online journeys with tailored fields, conditional logic, and product-specific requirements without technical expertise

- AI-Powered Credit Decisioning: Machine learning algorithms analyze traditional and alternative data to deliver instant, accurate risk assessments with full transparency

- Intuitive Borrower Portal: Provides applicants with user-friendly interfaces for managing applications, tracking progress, and accessing loan agreements digitally

- Comprehensive Underwriting Software: Performs deep risk scoring, borrower evaluation, decision rules validation, and automated loan offer generation

- Advanced Credit Risk Management: Employs analytics and automated workflows to monitor portfolio health and manage exposure throughout the lending lifecycle

- Efficient Debt Collection Software: Automates collection processes with AI-driven prioritization, delinquency management, and multi-channel communication tools

- Credit Product Builder: Creates flexible lending products with complex fee structures, interest calculations, configurable rules, and auto-generated statements

- AML and KYC Compliance: Ensures regulatory adherence through automatic identity verification, bank account validation, and fraud detection rules

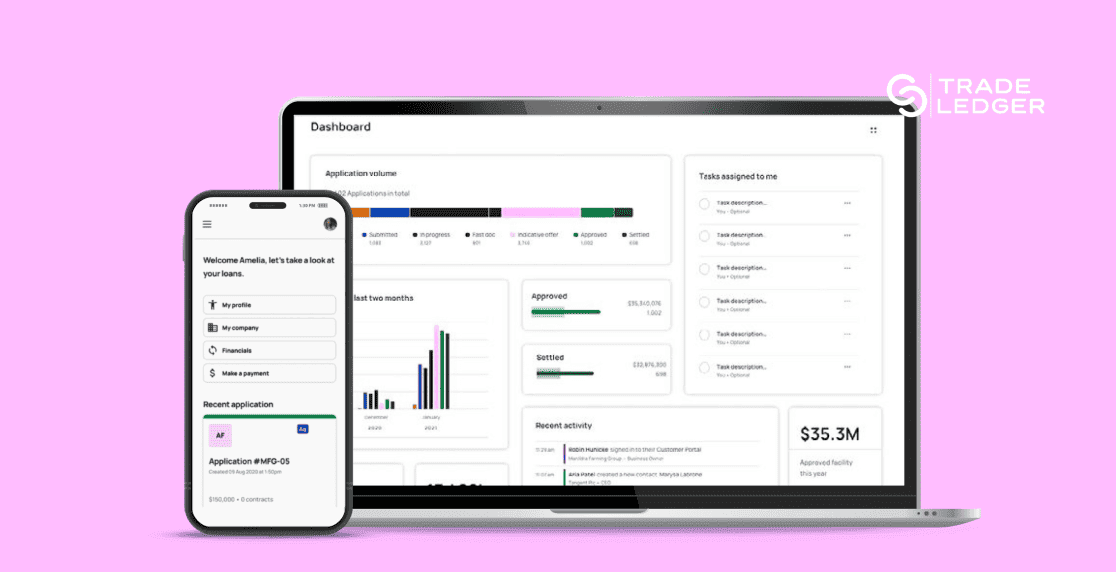

3. Trade Ledger - Best Loan Origination System for Real-time Insights

Trade Ledger focuses on digital business credit and working capital lending with a composable architecture and a unified data model that enables real-time updates across products and facilities. The platform is designed for complex multi-product commercial lending and emphasizes templates, API connectivity, and in-life monitoring features. Use Trade Ledger for working-capital and corporate credit workflows where data consistency and triggers are essential.

Explore More Features of Trade Ledger

- End-to-end Digital Business Credit Management: World's first platform designed specifically for working capital lending with full lifecycle coverage

- Digital, Composable Architecture: Provides flexibility to build and manage credit products efficiently while remaining adaptable to future technological advances

- Unified Data Model: Connects products and processes to real-time data sources, standardizing complex relationships and eliminating duplicate entry

- Credit Suite: Central hub for originating and maintaining all credit products with templates, automatic documentation, and proactive monitoring

- Configurable Workflows: Automates and orchestrates activities across the credit lifecycle based on triggers, enabling concurrent processing

- Extensive API Library: Secure connections enable effortless data flow between systems with automatic form population and synchronization

- Multi-Product Facility Support: Structure and manage complex facilities with multiple entities, products, and limits within unified arrangements

- Onboarding & Origination Module: Reduces dropout rates and enables faster risk decisions through digital origination for multi-product facilities

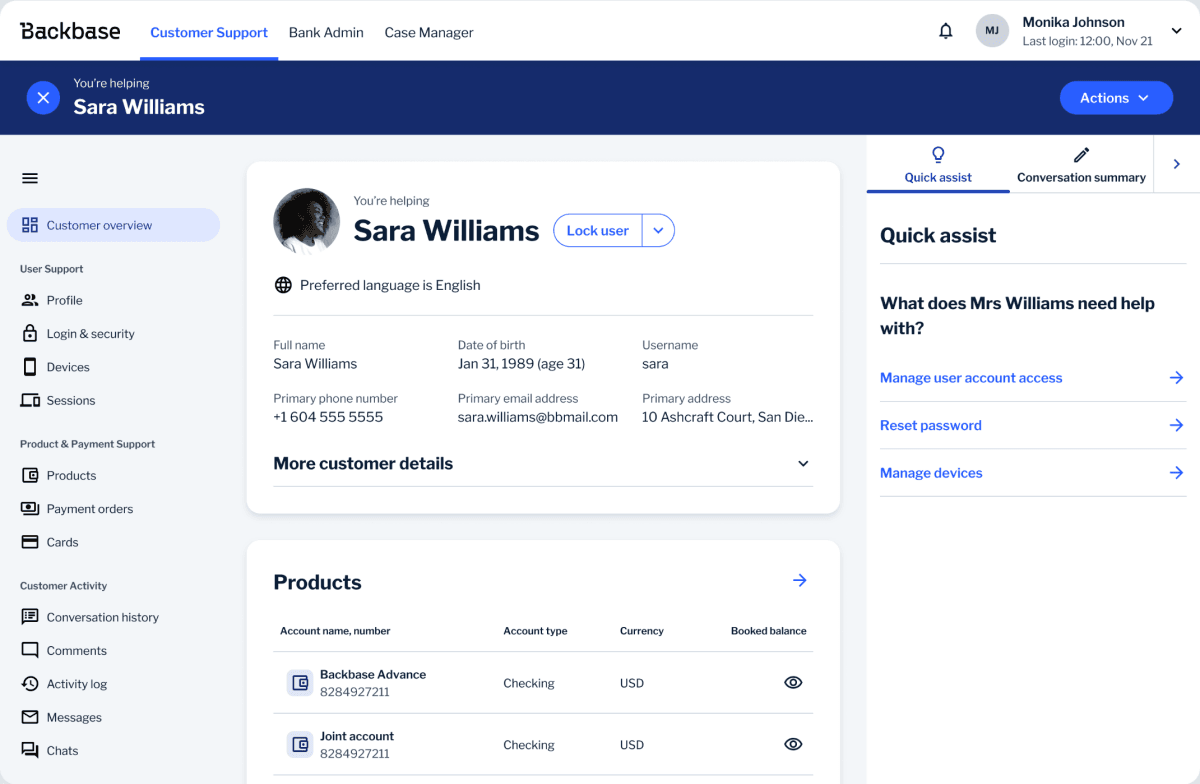

4. Backbase - Best Loan Origination System for Banks

Backbase emphasizes bank-grade loan origination, channel-agnostic customer journeys, and a composable approach aimed at retail, small business, and commercial segments. Its messaging focuses on creating frictionless, personalized application experiences and deep back-office integration for banks seeking to modernize existing stacks.

Explore More Features of Backbase

- Frictionless Applications: Streamline origination across channels with the ability to start, pause, and resume without data loss

- Dynamic Journey Composition: Utilize pre-built capabilities, templates, and flexible workflows that integrate with back-office systems

- Personalized Experiences: Design, configure, and scale tailored journeys while reusing capabilities across products and channels

- Unified Cross-Product Approach: Ensure consistent, efficient origination processes across retail, small business, and commercial offerings

- Retail Loan Origination: Digital-first origination for personal loans, auto loans, credit cards, and mortgages with instant approvals

- Small Business Origination: Fully digital access to unsecured loans and lines of credit with automated compliance and credit scoring

- Commercial Loan Origination: Digitize complex commercial processes with automated workflows and seamless multi-party collaboration

- Plug-and-play Integrations: Library of API-driven, fintech-powered capabilities for adding cutting-edge experiences to applications

5. NetOxygen LOS - Best Loan Origination System for Consulting

NetOxygen (Wipro Gallagher) is positioned as an enterprise LOS with outcome-based SaaS pricing, multichannel support, OCR/document recognition, and strong implementation/consulting services. The vendor highlights per-transaction outcome pricing and Azure-based SaaS scalability for large lenders seeking a managed enterprise solution.

Explore More Features of NetOxygen LOS

- Award-winning Enterprise Solution: Drives profitability and customer-centric lending across multiple channels and loan types

- End-to-end Digital Mortgage Experience: Automates the complete lending journey from point-of-sale through closing with digital tools

- Multichannel Support: Enables expansion into retail, consumer, wholesale, correspondent, and construction lending channels

- Digital Extensions with Launchpad: Provides integrated tools and borrower portal for enhanced application intake and tracking

- Configurable Workflows: Tailors processes to specific needs with third-party integrations and web-based APIs

- Automated Straight-Through Processing: Reduces manual errors and cycle times through intelligent automation based on loan parameters

- Outcome-Based SaaS Pricing: Success-based model including document management, imaging, hosting, and compliance services

- OCR and Document Recognition: Automates document indexing and management for improved efficiency and accuracy

6. LendingPad - Best Loan Origination System for Teamwork

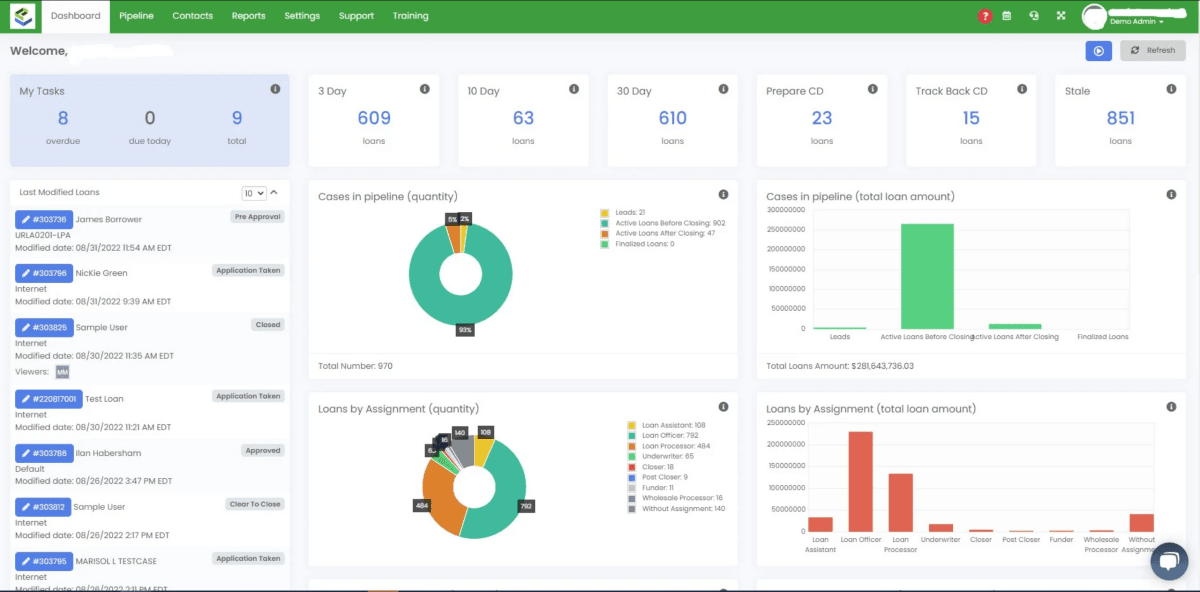

LendingPad offers a cloud-native, web-based LOS focused on collaboration, broker workflows, and marketplace integrations for the residential mortgage channel. Its strengths are broad marketplace connectivity, broker/lender editions, and a POS that supports online borrower intake and real-time pipeline tracking.

Explore More Features of LendingPad

- Unified Mortgage Platform: End-to-end web-based system covering the complete residential mortgage process from application to closing

- Cloud-Based Accessibility: Access the platform from anywhere with internet connectivity for flexibility and mobility

- Fast Implementation: Quick setup process enabling users to start originating loans promptly without lengthy deployment

- Cross-Departmental Collaboration: Supports multiple users with real-time updates and secure information sharing across teams

- Seamless Borrower Experience: Complementary POS system for online applications, document uploads, and loan progress tracking

- Extensive Integrations: Connects with top industry partners, wholesale lenders, and third-party services through a robust marketplace

- Automated Compliance: Built-in tools and centralized technology ensure regulatory adherence and facilitate report generation

- Broker Edition: Simplified screens with direct wholesale integration for efficient pricing, AUS findings, and rate lock management

How to Choose the Ideal Loan Origination System?

Selecting the right LOS requires evaluating current and future product needs, technical capability, integration requirements, security/compliance posture, total cost of ownership (including implementation and training), and vendor track record.

Request demos that use your real data and scenarios, compare SLAs for uptime and performance, validate third-party integrations (credit bureaus, pricing feeds, fraud/KYC vendors), and obtain customer references from similar organizations. Prioritize vendors that provide clear upgrade paths and transparent pricing.

Conclusion

The loan origination landscape has reached an inflection point where manual processes and disconnected systems can no longer support the speed and digital expectations borrowers demand. Organizations that adopt modern LOS platforms gain advantages in speed, cost, and accuracy. The six solutions profiled represent different approaches and target audiences, from Zeitro's AI-first mortgage offering to Backbase's bank-grade orchestration and Trade Ledger's commercial credit focus.

The best choice depends on your product mix, organizational structure, integration needs, and growth trajectory. Investing time in vendor evaluation, pilot projects, and reference checks pays dividends during deployment and in long-term operations. Zeitro is now free to use for new starters, and you can give it a shot if you want to level up your mortgage career.