40-Year Mortgage Rates in 2025: Is a Fixed 40-Year Loan Worth It?

Let's cut to the chase: Buying a home in 2025 feels like trying to win a rigged game. Prices keep climbing, 40-year mortgage rates are hovering higher than traditional loans, and that dream house? Yeah, it's probably got a waiting list and a bidding war.

We have been in the real estate industry for many years, and lately, more people are whispering about 40-year mortgage loans like they're some kind of secret hack. Spoiler: They're not. But in today's market, a 40-year fixed mortgage might be the only way in for some buyers—if they can stomach the long-term costs.

People Also Read

- Mortgage Rate Predictions 2025: What to Expect in the Year Ahead

- How to Get a 40-Year Mortgage: Step-by-Step Guide, Pros, and Hidden Risks

- 30-Year Mortgage Rates Chart: Historical and Current Trends

- 30 Year Mortgage Principal and Interest Chart Explained: The Shocking Truth You Won’t See on

- Looking for a Second Mortgage? Your Complete Guide to Eligibility, Rates & Smart Borrowing

Here's what you actually need to know.

The 40-Year Mortgage Loan: A Quick Fix with a Nasty Hangover

At first glance, a 40-year home loan sounds like a no-brainer: Smaller monthly payments. Easier to qualify. What's not to love?

Well, let's do the math.

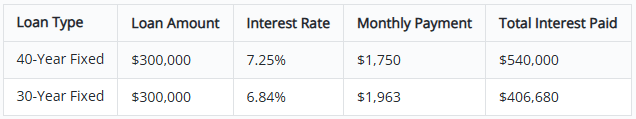

That's $133,320 extra in interest—enough to buy a luxury SUV in cash and still have change left.

So why would anyone take a 40-year mortgage?

Because in 2025, desperation beats math for a lot of buyers. I've seen three types of people go for 40-year home loans:

First-time buyers who can't qualify for a 30-year loan without fainting at the payment. Investors using a 40-year mortgage loan to improve cash flow on rental properties. High-cost market prisoners (looking at you, California and New York) where even a shoebox condo costs $800K.

But here's the ugly truth: A 40-year mortgage doesn't make a house affordable—it just makes the pain last longer.

The Hidden Traps of a 40-Year Fixed Mortgage

You'll Pay Interest Forever (Literally)

With a mortgage loan 40 years long, you're barely touching the principal for the first 10-15 years. If you sell early, you might walk away with almost no equity—especially if the market dips.

Fewer Lenders = Higher Rates

Big banks don't usually offer 40-year mortgages. You'll be dealing with credit unions or niche lenders, and their 40-year fixed mortgage rates are often 0.5%-1% higher than a 30-year loan.

Refinancing Isn't a Guarantee

A lot of people take a home loan 40 years long thinking, "I'll just refinance later!" But what if:

Rates don't drop? Your income doesn't grow? The housing market stalls?

Now you're stuck in a 40-year mortgage loan that's bleeding you dry.

When a 40-Year Mortgage Loan Might Make Sense

I'm not saying these loans are always bad. In some cases, they're a necessary evil:

Long-term rental investors who care more about cash flow than fast equity. Buyers in insane markets where a 30-year payment is just not happening. People expecting a big income jump (doctors, tech workers) who can refinance later.

But if you're banking on "maybe someday" to bail you out? That's a gamble—and the house always wins eventually.

Better Alternatives to a 40-Year Mortgage

Before you sign up for four decades of debt, consider:

Adjustable-Rate Mortgages (ARMs) – Better short-term savings than a 40-year fixed mortgage. FHA/VA Loans – Lower down payments than some 40-year home loans. Buy Now, Refi Later – Only if you're confident 40-year mortgage rates will drop.

Final Advice: Is a 40-Year Mortgage Right for You?

If you're seriously considering a mortgage 40 year term:

Compare 40-year mortgage rates—don't just look at monthly payments. Ask about prepayment penalties—some lenders punish early payoffs. Have an exit plan—refinance, sell, or hope for a miracle?

Bottom line: A 40-year mortgage loan is like putting a Band-Aid on a bullet wound. It might stop the bleeding today, but you'll still need surgery later.

Still on the fence about a 40-year mortgage?

Let's be real - this isn't a decision you should make alone. Our mortgage specialists live and breathe these numbers every day, and we'll give it to you straight: no sugar-coating, just cold hard facts. Get your free consultation now before you sign away the next four decades of your life.