How Tariffs Are Impacting Mortgage Rates in 2025: What Homebuyers Need to Know

The Unseen Hand: How Tariffs Quietly Shape Mortgage Rates

Tariffs are like a stone dropped in a pond – the ripples spread out, affecting inflation, nudging overall economic growth (or lack thereof), and ultimately influencing the big decisions coming out of the Federal Reserve. While tariffs may seem like a distant concern—mostly headlines about foreign policy or manufacturing—they can quietly reshape the mortgage landscape you rely on.

When import costs rise due to tariffs, inflation tends to tick up. That forces the Fed to act—usually by maintaining or raising rates to cool things down. Even though mortgage rates aren't set directly by the Fed, the broader economic environment, especially investor confidence in U.S. Treasury bonds, has a direct effect. In this climate, tariffs and mortgage rates have become more interconnected than ever.

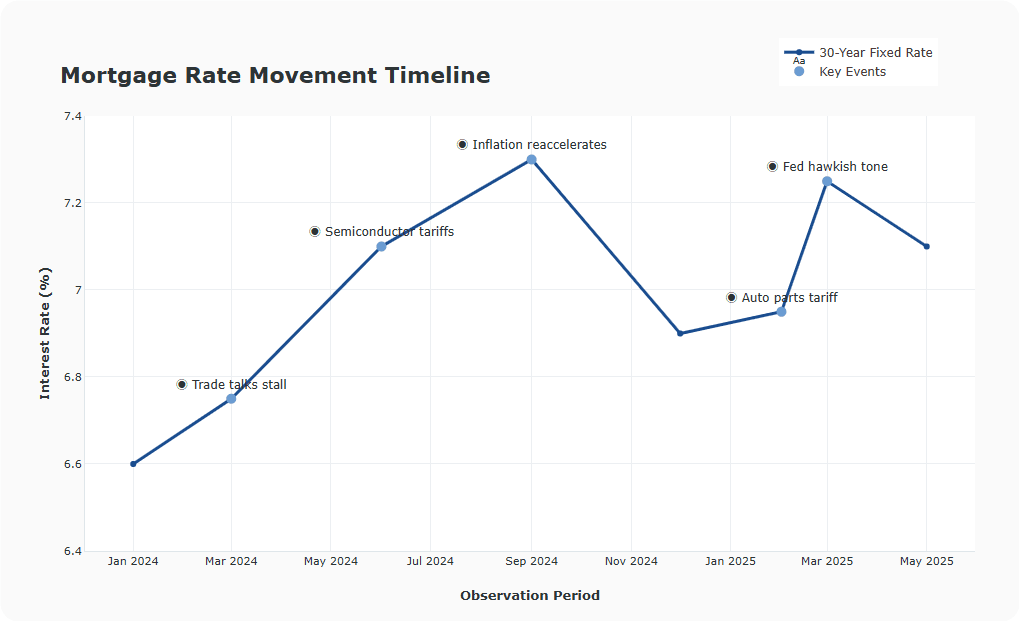

Mortgage Rates and Tariffs: A Volatile Mix in May 2025

In May 2025, mortgage rates are still feeling the weight of global trade tensions. Recent announcements of expanded tariffs between major economies—particularly the U.S. and China—have reignited market concerns. These trade restrictions have added pressure on consumer goods prices, pushing inflation above target in some sectors.

That inflation, in turn, is complicating the Federal Reserve’s rate strategy. With inflation still sticky and tariffs driving up import prices, markets are betting that the Fed will hold off on any aggressive rate cuts. And when the Fed stays cautious, so do mortgage lenders.

The result? As of mid-May 2025, 30-year fixed mortgage rates are hovering around 7.2%–7.5%, depending on the lender and region—still far above the historic lows we saw in 2020–2021. It’s a reminder that tariffs and mortgage rates are no longer distant economic concepts; they’re now part of every buyer’s reality.

Understanding the Tariff Impact on Mortgage Rates and Homebuying

It’s not just current homeowners who are affected. First-time buyers and real estate investors also need to be watching this space closely. A sudden escalation—or resolution—of trade tensions could send mortgage rates moving quickly in either direction.

Here's how:

- More tariffs = higher inflation = less chance of rate cuts

- Fewer tariffs or trade deals = downward inflation pressure = possible rate relief

- Market uncertainty = bond market volatility = unpredictable mortgage pricing

As these variables shift, understanding the relationship between mortgage rates and tariffs gives buyers a competitive edge. You're no longer just tracking local housing supply—you’re watching global economics.

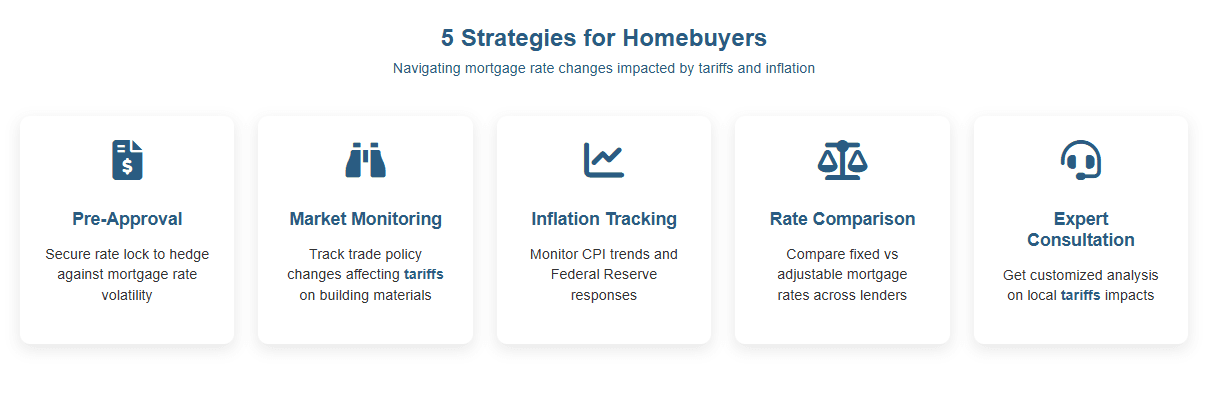

Your 5-Step Guide to Navigating Mortgage Rates Amid 2025 Tariff Pressures

- Get pre-approved now: Locking in a rate protects you from sudden market swings.

- Track tariff news: Especially U.S.–China and U.S.–EU trade policy updates—they’re market movers.

- Watch inflation reports: Tariffs often show up here first, before they hit mortgage quotes.

- Compare lenders weekly: Even small shifts in lender expectations on tariffs can mean rate differences.

- Talk to a mortgage broker: A good broker understands both rate markets and the macroeconomic backdrop—including how mortgage rates and tariffs interact.

Final Thought: Stay Smart, Stay Nimble

The connection between global trade policy and your next mortgage may not be obvious at first—but it’s real. As 2025 unfolds, tariffs and mortgage rates will continue to influence everything from monthly payments to housing market momentum.

Staying informed about this dynamic can help you avoid surprises—and spot opportunities—whether you're buying your first home, refinancing, or investing. In a market shaped by both interest rates and international policy, clarity is power. People Also Read

- Mortgage Rate Predictions 2025: What to Expect in the Year Ahead

- When Will Mortgage Rates Go Down: 2025 Forecast and What Homebuyers Should Expect

- Will Mortgage Rates Go Down in 2025? Expert Predictions & Home Buyer Advice

- South Carolina Mortgage Rates 2025: Trends, Predictions & What Buyers Should Know

- What Happens to Mortgage Rates When the Housing Market Crashes?