South Carolina Mortgage Rates 2025: Trends, Predictions & What Buyers Should Know

If you’re thinking about buying a home in South Carolina in 2025, you’re not alone. From historic Charleston to the booming Upstate, South Carolina continues to attract both first-time homebuyers and seasoned investors. With its low property taxes, growing job market, and desirable climate, the Palmetto State remains one of the most appealing places to live in the Southeast.

But there’s one major factor affecting whether now is the right time to buy: mortgage rates. It is essential to compare today’s mortgage rates and annual percentage rates (APRs) to make informed decisions and ensure you secure the best possible deal. Evaluating not only the interest rate but also the APR and other terms is crucial for borrowers.

Mortgage interest rates can make or break your monthly payments — and ultimately determine how much home you can afford. Whether you’re eyeing a beach bungalow or a Columbia condo, understanding the current mortgage environment is crucial.

In This Article: 5 Key Questions

- What are the current mortgage rates in South Carolina?

- Are mortgage rates expected to go up or down in 2025?

- What types of mortgage loans are available to South Carolina buyers?

- What factors affect your mortgage rate?

- How can you qualify for the best possible rate?

What Are the Current Mortgage Rates in South Carolina?

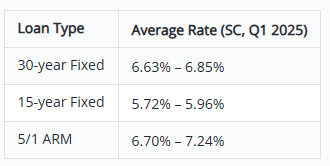

Updated Rate Overview (As of Q1 2025)

As of the first quarter of 2025, South Carolina’s mortgage rates are hovering slightly above the national average due to persistent inflationary pressure and interest rate hikes from the Federal Reserve. Here’s where things stand right now:

These rates come from aggregated data across Freddie Mac, Bankrate, and Redfin’s March 2025 housing reports.

The rate in South Carolina significantly impacts home affordability and borrowing costs, as higher rates can increase monthly payments and overall loan costs, making it crucial for potential buyers to stay informed.

Note: Current ARM rates in South Carolina offer initial lower interest rates compared to fixed-rate loans, but it’s important to understand the terms, including caps on potential rate increases after the introductory period.

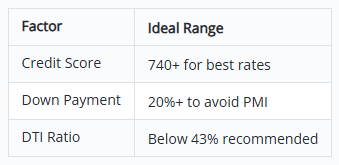

How to Qualify for the Lowest Rates

Not all buyers will receive the same mortgage rate. Here’s how to put yourself in the best position:

Credit Score: A score of 740+ typically qualifies for the lowest rates. Scores between 680–739 may pay 0.25% to 0.5% more annually.

Debt-to-Income Ratio: Maintaining favorable DTI ratios is crucial.

Loan Term: 15-year terms usually have lower rates but higher monthly payments.

Down Payment: A 20% down payment can eliminate PMI and unlock better terms.

Lender Comparison Tools: Use platforms like Redfin, Bankrate, and NerdWallet to compare offers in real time.

Mortgage Rate Trends: Is Now a Good Time to Buy?

South Carolina Rate Trends (2024–2025)

South Carolina saw one of the steepest mortgage rate hikes in 2024. According to a **Zillow Housing Market Report (Feb 2025), average 30-year fixed rates increased by 2.52% from Q1 to Q4 of 2024 — making it the 4th highest state-level increase in the U.S.

Why the Jump?

Inflation: Consumer prices rose faster in the Southeast than the national average.

Federal Reserve Hikes: The Fed raised rates three times in 2024, reaching 5.50% by December.

Bond Market Volatility: Mortgage rates follow 10-year Treasury yields, which spiked due to investor uncertainty.

Tip:Securing a rate lock can protect borrowers from fluctuations for 30 to 60 days.

Predictions for 2025

Experts anticipate moderate rate relief in the second half of 2025 if inflation cools:

MBA Forecast: 30-year rates could dip to 6.25% by Q4 2025

Freddie Mac: Expects gradual decline if the Fed pauses hikes and CPI drops below 3%

If you’re already a homeowner, monitor refinancing opportunities. If rates drop below 6%, it might be time to act.

Also consider programs like the Mortgage Credit Certificate Program from the South Carolina Housing Finance Authority, offering a tax credit of up to $2,000 per year.

What Types of Mortgage Loans Are Available?

South Carolina buyers have access to a wide range of loan products:

Conventional Loans

Eligibility: Minimum 620 credit score; 20% down to avoid PMI

Best for: Buyers with strong credit and savings

Benefits: Lower rates than FHA; no mortgage insurance if 20% down

FHA Loans

Eligibility: 580+ score with 3.5% down

Best for: First-time buyers or those with lower credit

Downside: Requires mortgage insurance (MIP) regardless of down payment

SC Perk: SC Housing offers down payment assistance and grants

VA Loans

Eligibility: Veterans, active-duty service members, and qualified spouses

Benefits: No down payment, no PMI, flexible underwriting

Backed by: U.S. Department of Veterans Affairs

USDA Loans

Eligibility: Home in eligible rural/suburban areas (much of SC qualifies)

Benefits: 0% down; reduced mortgage insurance

Income Limits: Household income under 115% of area median

What Affects Your Mortgage Rate?

Personal Factors

Example: A borrower with a 780 score + 20% down may pay 6.63%, while a borrower with a 660 score + 5% down could pay 7.5% or more.

Market & Economic Conditions

Federal Reserve Policy: Influences mortgage rates indirectly

Inflation Trends: Higher inflation = higher rates

Bond Market: Mortgage rates follow 10-year Treasury yields

Also note: The conforming loan limit in South Carolina is $806,500. Loans above this are jumbo loans, which often carry higher rates.

How to Know If You Qualify for the Best Mortgage Rates

Quick Eligibility Checklist

Is your credit score 680 or higher? Do you have 2+ years of job history and stable income? Is your DTI under 43%? Are you eligible for VA, FHA, or USDA programs? Are you aware of the relatively low home prices in SC?

Tips to Improve Loan Approval Odds

Fix Credit Report Errors: Get reports from Zeitro

Pay Down Credit Cards: Keep balances under 30% of limits

Increase Down Payment: Even 5% to 10% can cut rates

Shop Around: Compare APRs, fees, closing costs.

People Also Read

- Mortgage Rate Predictions 2025: What to Expect in the Year Ahead

- When Will Mortgage Rates Go Down: 2025 Forecast and What Homebuyers Should Expect

- Will Mortgage Rates Go Down in 2025? Expert Predictions & Home Buyer Advice

- Best Credit Union for Mortgage Rates: Top Picks for Homebuyers

- What Happens to Mortgage Rates When the Housing Market Crashes?