Will Mortgage Rates Go Down in 2025? Expert Predictions & Home Buyer Advice

The Million-Dollar Question for Homebuyers

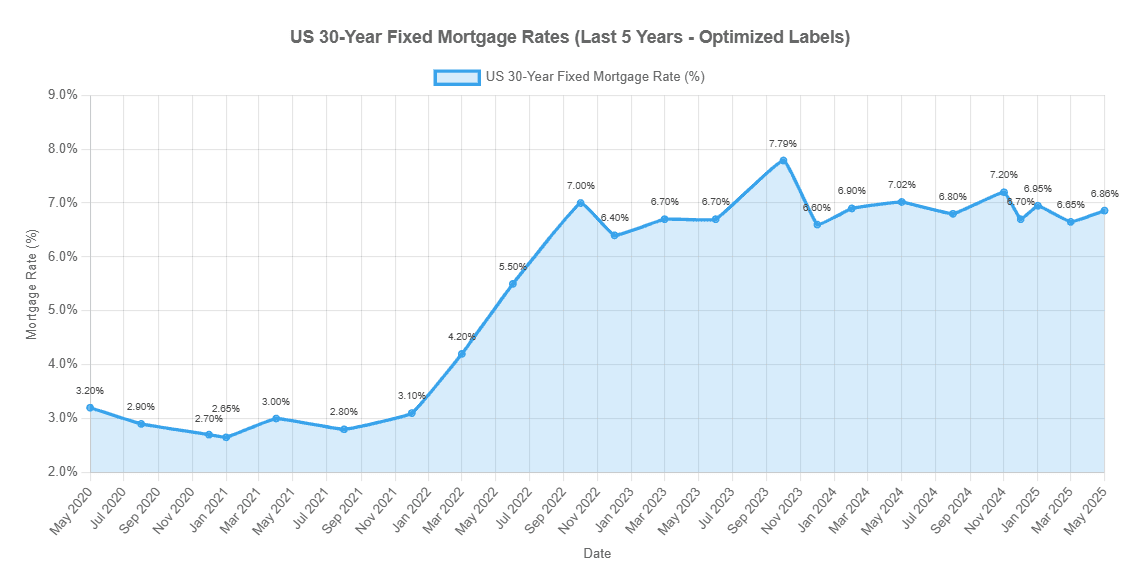

If you've been tracking mortgage rates over the past few years, you know it’s been a rollercoaster. After hitting historic lows during the pandemic, rates surged past 7% in 2023 and 2024—leaving many buyers and homeowners wondering: Will mortgage rates go down in 2025?How past cycles shaped today’s rates: Explore our complete historical mortgage rates chart.

The short answer? Most experts say yes—but not drastically, and timing is everything. Whether you're a first-time buyer waiting for the perfect moment to jump in, a homeowner considering refinancing, or an investor strategizing your next move, understanding where rates are headed—and why—can save you thousands.

In this deep dive, we’ll break down:

- The latest 2025 mortgage rate predictions from top economists and institutions

- Key factors that could push rates lower (or keep them high)

- Smart strategies—should you buy now, wait, or refinance?

- Backup plans in case rates don’t drop as expected

Let’s cut through the noise and get you the clarity you need.

1. Mortgage Rate Predictions for 2025: What the Experts Are Saying

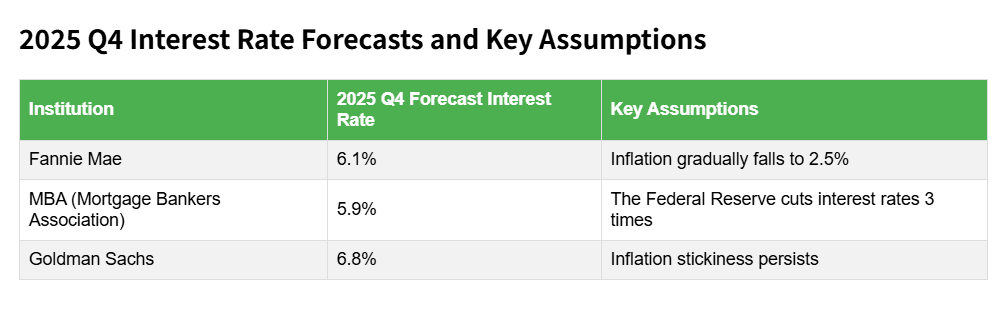

A. The Big Players Weigh In: Fannie Mae, MBA, and Wall Street

When it comes to mortgage rate forecasts, a few key institutions dominate the conversation. Here’s where they stand:

Fannie Mae predicts the 30-year fixed mortgage rate will average 6.1% by Q4 2025, down from current levels but still above the sub-4% "golden years" of 2020–2021.

The Mortgage Bankers Association (MBA) is slightly more optimistic, forecasting rates around 5.9% by late 2025, assuming inflation cools and the Fed cuts rates.

Goldman Sachs and other Wall Street analysts warn that if inflation remains sticky, we could see rates hovering near 7% for longer than expected.

Key takeaway: While most experts agree rates will trend downward in 2025, the speed and magnitude of the drop depend heavily on inflation and Federal Reserve policy.

B. Dave Ramsey’s Take: "Rates Will Drop—But Don’t Wait Forever"

Popular finance personality Dave Ramsey has been vocal about his prediction: Mortgage rates will decline in late 2024 and into 2025, but he cautions buyers against waiting indefinitely.

"If you find a house you love and can afford the payment now, buy it," Ramsey advises. "Trying to time the market perfectly is a fool’s game."

His reasoning: Even if rates drop slightly, home prices could keep rising, offsetting any savings from a lower interest rate.

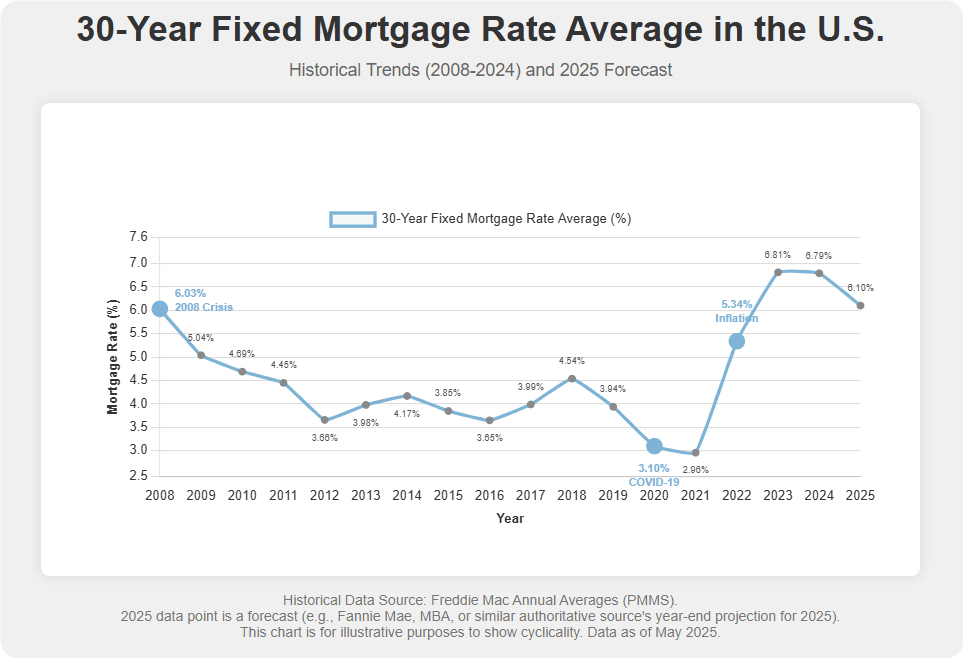

C. Historical Context: What Past Cycles Tell Us

Looking back at previous rate environments can provide valuable insight:

- 2008 Financial Crisis: Rates plummeted as the Fed slashed borrowing costs to stimulate the economy

- 2020–2021 Pandemic Boom: Record-low rates fueled a housing frenzy

- 2022–2024 Inflation Surge: The Fed’s aggressive rate hikes pushed mortgage rates to 23-year highs

The lesson: Mortgage rates are cyclical, and while they may not return to 3% anytime soon, moderate declines in 2025 are likely—if inflation cooperates.

2. What Will Drive Mortgage Rates in 2025? The 3 Key Factors

A. The Federal Reserve’s Next Moves

The Fed doesn’t directly set mortgage rates, but its policies heavily influence them. Here’s what to watch:

- Rate Cuts: The Fed has signaled three potential rate cuts in 2024, with more possible in 2025 if inflation keeps falling

- 10-Year Treasury Yield: Mortgage rates typically follow the 10-year Treasury yield. If bond investors believe inflation is under control, yields (and mortgage rates) will drop

Bottom line: The Fed wants a "soft landing"—lower inflation without a recession. If they succeed, mortgage rates should ease.

B. Inflation Trends: The Make-or-Break Factor

Inflation is the number one driver of mortgage rates today. Here’s why:

- CPI and PCE Reports: If inflation cools faster than expected (toward the Fed’s 2% target), rate cuts will follow

- Wage Growth and Employment: A strong job market could keep inflation (and rates) higher for longer

Watch this: The December 2024 and Q1 2025 inflation reports will be critical for mortgage rate trends.

C. Housing Market Dynamics: Supply, Demand, and Geopolitics

- Inventory Shortages: If home supply remains tight, prices may stay high even if rates dip

- Global Events: Oil price shocks (like those caused by Middle East conflicts) could reignite inflation fears

Pro tip: Keep an eye on new housing starts and existing home sales data—they’ll signal whether supply is catching up to demand.

3. Should You Buy a House or Refinance in 2025?

A. For Buyers: "Wait or Buy Now?"

Wait if:

- You expect rates to drop at least 0.75%–1% within your timeline

- You’re in a buyer’s market (high inventory, low competition)

Buy now if:

- You find a great deal (distressed sale, motivated seller)

- You can lock in a rate now and refinance later

The math: On a $400,000 loan, a 1% drop in interest rate could save you around $250/month. But if home prices rise 5% in the same period, you’ll pay $20,000 or more for the same house.

B. For Homeowners: "Is 2025 the Year to Refinance?"

- The 0.5% Rule: Refinancing usually makes sense if you can drop your rate by at least 0.5%

- Break-Even Calculation: If refinancing costs $4,000 and saves you $200/month, you’ll break even in 20 months

Alternative strategy: Consider an ARM (Adjustable-Rate Mortgage) if you plan to move before the fixed period ends.

4. What If Rates Don’t Drop? Your Backup Plan

A. Alternative Loan Options

- FHA Loans: Lower credit score requirements (as low as 580)

- VA Loans: 0% down payment for eligible veterans

- Seller Concessions: Ask the seller to pay for a rate buydown

B. Improve Your Loan Terms

- Boost your credit score: A 740+ FICO score gets you the best rates. Note that lenders often tighten standards when rates are high. Learn how to navigate mortgage underwriting challenges in high-rate environments

- Larger down payment: Putting down 20% or more avoids PMI and improves loan pricing

C. Long-Term Mindset

If rates stay high, focus on:

- Building equity through extra principal payments

- Paying down debt to qualify for better terms later

Conclusion: Your 2025 Mortgage Game Plan

While most experts predict mortgage rates will go down in 2025, the drop may be gradual—and timing the market perfectly is nearly impossible.

Your best moves:

- Stay informed—track Fed meetings and inflation reports

- Run the numbers—use a mortgage calculator to compare buying now vs. waiting

- Have a backup plan—explore FHA, VA, or ARM loans if rates don’t fall as expected

While experts predict mortgage rates may decline in 2025, the best strategy is to stay informed and make decisions based on your personal financial situation. If you need tailored advice, consult a trusted lender to explore your options.

People Also Read

- Mortgage Rate Predictions 2025: What to Expect in the Year Ahead

- When Will Mortgage Rates Go Down: 2025 Forecast and What Homebuyers Should Expect

- How Tariffs Are Impacting Mortgage Rates in 2025: What Homebuyers Need to Know

- South Carolina Mortgage Rates 2025: Trends, Predictions & What Buyers Should Know

- What Happens to Mortgage Rates When the Housing Market Crashes?