Best Credit Union for Mortgage Rates: Top Picks for Homebuyers

As mortgage rates vary, many homebuyers are turning to credit unions to lock in lower rates and obtain more personalized service. Credit unions, unlike banks, typically offer lower rates, more flexible terms, and are more accessible to members. This guide outlines the top 5 credit unions offering the best mortgage rates in 2025, helping you find the best credit union to fit your needs.

Benefits of Using Credit Unions for Your Mortgage

Credit unions have several advantages for homebuyers:

- Nonprofit Status: Credit unions are nonprofit lenders that focus on better loan terms, lower rates, and more personal service than banks.

- Competitive Rates: Many borrowers find credit unions offer more affordable home loans compared to banks, especially for first-time homebuyers, veterans, or those refinancing an existing mortgage.

You can easily compare mortgage products from top credit unions using My Mortgage Rates. We help borrowers make informed decisions based on their specific situations. Whether you are buying your first home, refinancing, or looking to take advantage of market rates, our comparisons are easy to understand, reliable, and beneficial.

Key Factors to Consider When Choosing a Credit Union Mortgage

Here are some important aspects to evaluate when choosing a credit union for your mortgage:

What is a Credit Union

Credit unions are member-owned, nonprofit financial institutions that offer a variety of financial products, including home loans. They often provide lower mortgage rates and fewer fees compared to banks.

Membership Requirements

Membership criteria are generally simple:

- Members of a local community

- Employees of a specific employer

- Members of a specific profession

Mortgage Products Offered

Credit unions offer a range of mortgage products:

- Fixed-rate mortgages

- Adjustable-rate mortgages (ARMs)

- Specialized loans and refinancing for first-time buyers or veterans

It’s always important to compare the terms of different credit union mortgage products.

Online Application and Pre-Approval

Many credit unions allow you to complete the entire mortgage application and receive pre-approval online. My Mortgage Rates provides easy access to online credit unions to streamline the application process and offer fast pre-approval, giving you confidence in your decision.

Loan Rates and Fees

Credit unions are known for offering low mortgage rates. However, it’s important to compare additional fees related to the loan commitment. My Mortgage Rates allows you to compare customized mortgage rates from credit unions, helping you avoid hidden fees and secure the best possible option.

Best Credit Unions for Mortgages in 2025

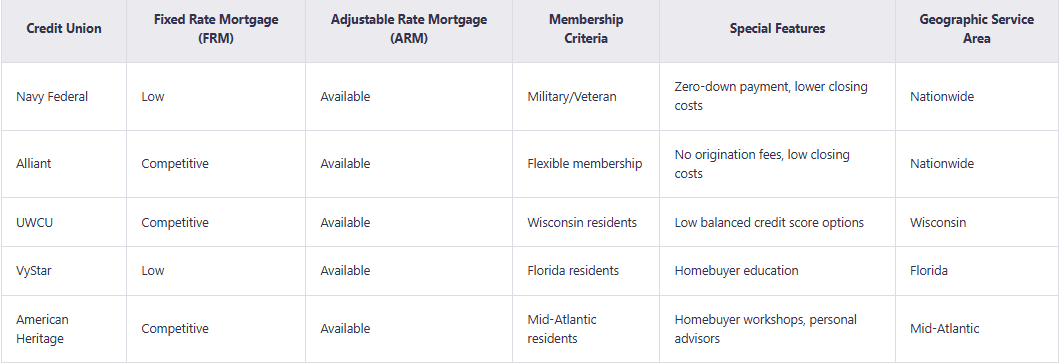

Here are the top 5 credit unions offering competitive mortgage rates in 2025:

1. Navy Federal Credit Union

Best for: Military families and veterans

Why choose Navy Federal: Navy Federal Credit Union is known for offering some of the lowest mortgage rates available, particularly for military families. They provide creative programs, such as zero-down payment loans, to meet the specific needs of military families.

Mortgage Products and Rates:

- Fixed-rate and adjustable-rate mortgages (ARMs)

- Among the lowest rates for eligible borrowers

Special Features:

- Zero-down payment loans for military families

- Discounted closing costs for veterans

2. Alliant Credit Union

Best for: Digital experience and membership across the U.S.

Why choose Alliant: Alliant Credit Union offers some of the most competitive mortgage rates and a user-friendly digital application process, available from anywhere in the United States.

Mortgage Products and Rates:

- Fixed-rate mortgages

- ARMs

- Jumbo loans with competitive rates

Special Features:

- No origination fees on several mortgage products

- Low closing costs

3. UW Credit Union

Best for: First-time homebuyers in Wisconsin

Why choose UW Credit Union: UW Credit Union focuses on providing clear guidance and competitive mortgage programs for first-time homebuyers.

Mortgage Products and Rates:

- Competitive fixed-rate and adjustable-rate mortgage options

- Low-down payment mortgages ideal for new buyers

Special Features:

- Homebuyer education and online tools for first-time buyers

4. VyStar Credit Union

Best for: People buying homes in Florida

Why choose VyStar: VyStar Credit Union offers a comprehensive range of mortgage products and competitive home loan rates to those buying homes in Florida.

Mortgage Products and Rates:

- Fixed-rate mortgages

- ARMs

- FHA loans

Special Features:

- Homebuyer education and tools to simplify the mortgage process

5. American Heritage Credit Union

Best for: People buying homes in the Mid-Atlantic region

Why choose American Heritage: American Heritage serves the Mid-Atlantic region and offers personalized mortgage services for borrowers in Pennsylvania and surrounding states.

Mortgage Products and Rates:

- Conventional mortgages

- FHA and VA loans with competitive rates

Special Features:

- Homebuyer workshops

- Personal mortgage advisors to guide you through the loan process

Additional Mortgage Options Comparison

Frequently Asked Questions

- How do I become a member of a credit union

Membership usually requires you to live in a specific area, work for a specific employer, or belong to a specific profession. Visit the credit union's website for membership criteria.

- Can I apply for a mortgage online

Yes, many credit unions offer an easy online application process. Whether you're at home, at Costco, or traveling abroad, you can apply and get pre-approved for a loan.

- What mortgage loans do credit unions offer

Credit unions offer a variety of mortgage options, including fixed-rate, adjustable-rate, and specialty loans (such as VA, FHA, and jumbo loans).

- Do credit unions charge fees for mortgages

Most credit unions charge minimal fees. For example, Alliant doesn't charge origination fees. Always review the fee structure before committing to a loan.

Choosing the right credit union to finance your mortgage could save you thousands of dollars over the life of the loan. Whether you’re a first-time buyer, refinancing, or taking advantage of low mortgage rates, credit unions offer more affordable financing compared to traditional banks.

By comparing rates and products, you can find the best deal and lowest mortgage rate for your needs. Start comparing mortgage rates now by visiting My Mortgage Rates to get personalized mortgage rates and connect with a trusted mortgage loan officer to guide you through the process.

People Also Read

- When Will Mortgage Rates Go Down: 2025 Forecast and What Homebuyers Should Expect

- Will Mortgage Rates Go Down in 2025? Expert Predictions & Home Buyer Advice

- How Tariffs Are Impacting Mortgage Rates in 2025: What Homebuyers Need to Know

- South Carolina Mortgage Rates 2025: Trends, Predictions & What Buyers Should Know

- Can You Lock in a Mortgage Rate? How Rate Locks & Float-Down Options Work