Texas Credit Union Mortgage Rates: A Complete Guide to Finding the Best Home Loan

Buying a home in Texas? If you're like most buyers, you're probably asking the big question: “How do I find the best mortgage rate without getting overwhelmed?”

The good news is — Texas credit unions are offering some of the most competitive home loan rates in 2025, often beating traditional banks. Whether you're a first-time buyer or looking to refinance, understanding Texas credit union mortgage rates could save you thousands over the life of your loan.

At My Mortgage Rates, we specialize in helping you navigate this process — making it simple to compare rates, understand your options, and lock in the perfect loan for your needs. Let’s dive into everything you need to know.

Why More Homebuyers Are Choosing Credit Unions

Credit unions are not-for-profit institutions, which allows them to offer:

- Lower mortgage interest rates

- Reduced fees

- Flexible loan terms

- Personalized, member-focused service

Compared to traditional banks, Texas credit unions often pass savings directly back to borrowers. We work to make this savings even more accessible by helping you compare credit union mortgage offers quickly and easily, so you can make a confident decision.

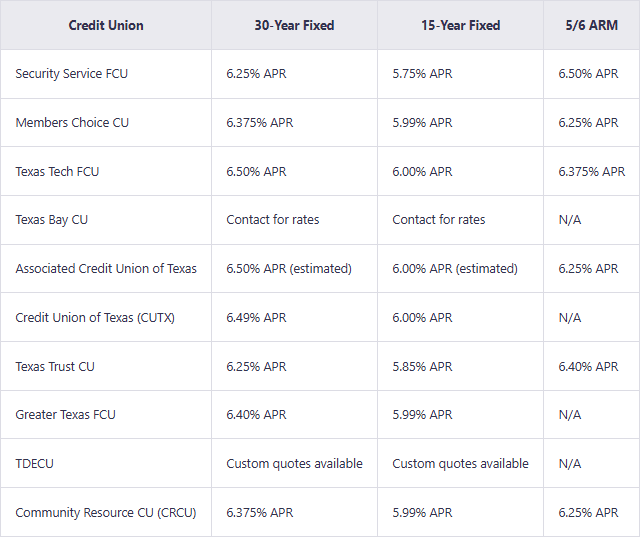

Current Texas Credit Union Mortgage Rates (April 2025)

Here’s a snapshot of the latest available rates:

Rates are for informational purposes only and may vary based on credit profile, down payment, and property type.

We make it easy to review, compare, and connect with credit unions offering the rates that best match your situation — saving you time and stress.

Common Types of Mortgage Loans Offered by Texas Credit Unions

Texas credit unions provide a broad selection of home loan options, including:

- 30-Year Fixed-Rate Mortgages: Offers stability with consistent monthly payments over the life of the loan.

- 15-Year Fixed-Rate Mortgages: Ideal for buyers who want to pay off their homes faster and save on interest.

- Adjustable-Rate Mortgages (ARMs): Lower initial rates that adjust over time, perfect for short-term homeowners.

- Home Equity Loans and HELOCs: Tap into your home’s value for renovations, debt consolidation, or major expenses.

- First-Time Homebuyer Programs: Lower down payments, flexible credit requirements, and educational resources.

As part of our services, we help you match your goals with the right loan product — whether you need lower upfront costs, faster payoff options, or maximum flexibility.

How to Join a Texas Credit Union for a Mortgage

You typically need to become a member of a credit union before applying for a mortgage. Eligibility often includes:

- Living or working within a certain area

- Being employed by a partner company

- Having a family connection to an existing member

- Making a small donation to an affiliated organization

Through our platform, we help you identify which credit unions you're eligible to join, making the path to lower mortgage rates simpler than ever.

The Mortgage Process with a Credit Union

Securing a mortgage through a Texas credit union generally follows these steps:

- Become a member of the credit union.

- Gather documentation such as pay stubs, tax returns, and credit history.

- Get pre-approved, strengthening your position as a buyer.

- Submit your mortgage application after finding your home.

- Complete closing and finalize your loan.

Our team at My Mortgage Rates provides the tools and expert guidance to walk you through every stage of the journey — ensuring you’re always a step ahead.

Helpful Tools for Texas Homebuyers

Many credit unions offer online tools like:

- Mortgage payment calculators

- Affordability estimators

- Rate comparison charts

We centralize these resources so you can plan smarter, estimate your monthly payments, and feel confident as you move forward.

FAQs About Texas Credit Union Mortgage Rates

Are credit union mortgage rates better than banks'?

Often, yes. Credit unions typically offer lower rates because they prioritize members over profits.

Can anyone join a credit union?

Most people can find a credit union they’re eligible to join — and we help you navigate the options quickly.

How fast can I close on a home loan?

On average, closing with a credit union takes 30–45 days, depending on documentation and loan type.

Start Comparing Texas Credit Union Mortgage Rates Today

At My Mortgage Rates, we’re dedicated to helping you find the most competitive Texas credit union mortgage rates — without the hassle. Our simple tools and expert insights allow you to compare offers, understand your choices, and connect with the right lenders for your homeownership goals.

Ready to get started? Compare mortgage rates now and take the first step toward your new home.

👉 Find Your Best Mortgage Rate Today

People Also Read

- Mortgage Rate Predictions 2025: What to Expect in the Year Ahead

- When Will Mortgage Rates Go Down: 2025 Forecast and What Homebuyers Should Expect

- Will Mortgage Rates Go Down in 2025? Expert Predictions & Home Buyer Advice

- Best Credit Union for Mortgage Rates: Top Picks for Homebuyers

- What Happens to Mortgage Rates When the Housing Market Crashes?