First-Time Home Buyer Loans: How to Qualify Even With Low Credit or Savings

Buying your first home in Seattle's competitive market can feel like navigating a maze—especially when prices continue to rise and inventory remains tight. But here's something that might surprise you: You don't need perfect credit or a massive down payment to make it happen.

From FHA loans with low down payments to special credit union programs that accommodate self-employed buyers, there are more options than most people realize. And if you're eyeing a condo in Capitol Hill or a starter home in Shoreline, local down payment assistance programs could save you thousands.

This guide cuts through the jargon and breaks down exactly how to qualify, where to find hidden grants, and how to avoid costly mistakes—so you can stop renting and start owning sooner than you think.

People Also Read

- First-Time Homebuyer Mortgage Rates in 2025: How to Get the Lowest Rate

- HELOC vs. Home Equity Loan: Your Friendly Guide to the Smartest Choice

- Mortgage Rate Predictions 2025: What to Expect in the Year Ahead

- 30 Year Mortgage Principal and Interest Chart Explained: The Shocking Truth You Won’t See on

- APR vs Interest Rate: What’s the Difference?

Who Actually Counts as a First-Time Home Buyer?

Think you don't qualify because you owned a home years ago? Think again.

The official definition remains consistent in 2025: If you haven't owned a primary residence in the last three years, you're generally considered a first-time buyer. That's great news if you've been renting after a divorce, relocation, or financial setback.

Even better? Some programs, like USDA or VA loans, offer first-time buyer perks to veterans or rural buyers—regardless of past homeownership. In Washington State, teachers, nurses, and other essential workers can access special low-interest loans through the WSHFC Home Advantage program, no prior ownership required.

Pro Tip: Before you start house hunting, double-check your eligibility. You might qualify for benefits you didn't know existed.

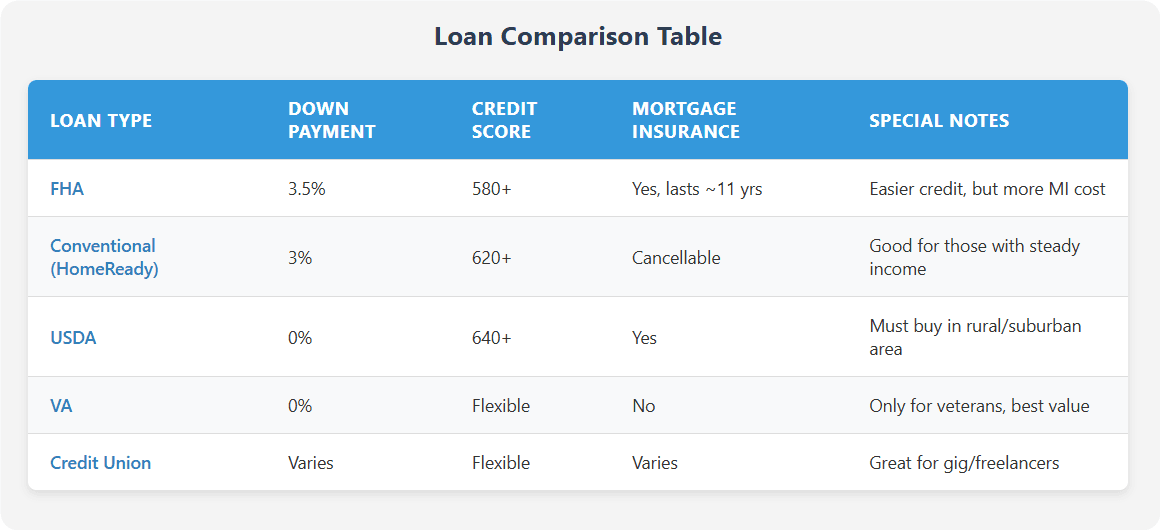

The Best Loan Options for 2025 (and Which One You Should Pick)

Not all first-time buyer loans are created equal. The right one depends on your credit, savings, and long-term plans.

FHA Loans

Great if your credit isn't perfect (minimum credit score requirement now typically 580+), but beware of mortgage insurance premiums (MIP) that generally last at least 11 years or more, depending on your down payment amount. The rules changed slightly in late 2023, reducing the lifetime MIP for some borrowers.

Conventional Loans (HomeReady® and Home Possible®)

Only 3% down, with cancellable mortgage insurance once you reach 20% equity. Credit score requirements have tightened slightly, generally requiring 620+.

USDA Loans

Zero down payment if you're buying in qualifying rural or suburban areas. USDA eligibility maps are updated annually; always check if your desired location qualifies.

VA Loans

Still the gold standard for veterans: no down payment, no mortgage insurance, and competitive rates. VA loans remain very popular in 2025 with updated guidelines improving funding fee exemptions for disabled veterans.

Credit Union Programs

Institutions like BECU, Seattle Credit Union, and Solarity Credit Union continue to offer flexible underwriting for buyers with non-traditional income, such as freelancers or gig workers.

The Bottom Line: If you're unsure, get pre-approved for multiple loan types. Even a 0.25% lower interest rate could save you $50,000 or more over a 30-year mortgage.

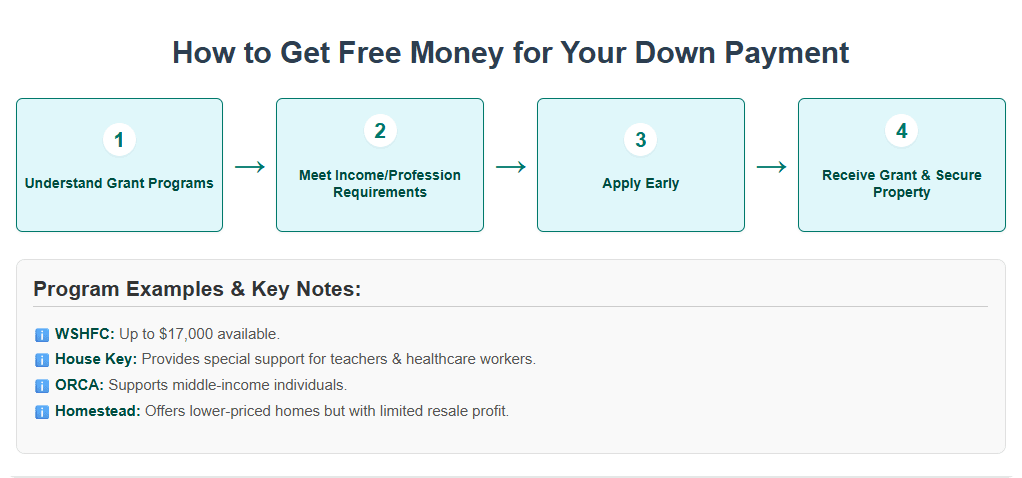

How to Get Free Money for Your Down Payment (Yes, Really)

Saving for a down payment is the biggest hurdle for most buyers—but in Washington, you don't have to do it alone.

WSHFC Home Advantage DPA

Up to $17,000 (or 4% of the purchase price), a slight increase from last year, available as a forgivable or deferred second mortgage if you live in the home for three years.

House Key Opportunity Program

ORCA Opportunity Loan

Still covers closing costs for moderate-income buyers, with updated income limits reflecting inflation and cost of living.

Homestead Community Land Trust

Offers homes at 30-50% below market value in exchange for resale restrictions to keep housing affordable long-term.

Warning: These programs have limited funding. Apply early to secure assistance.

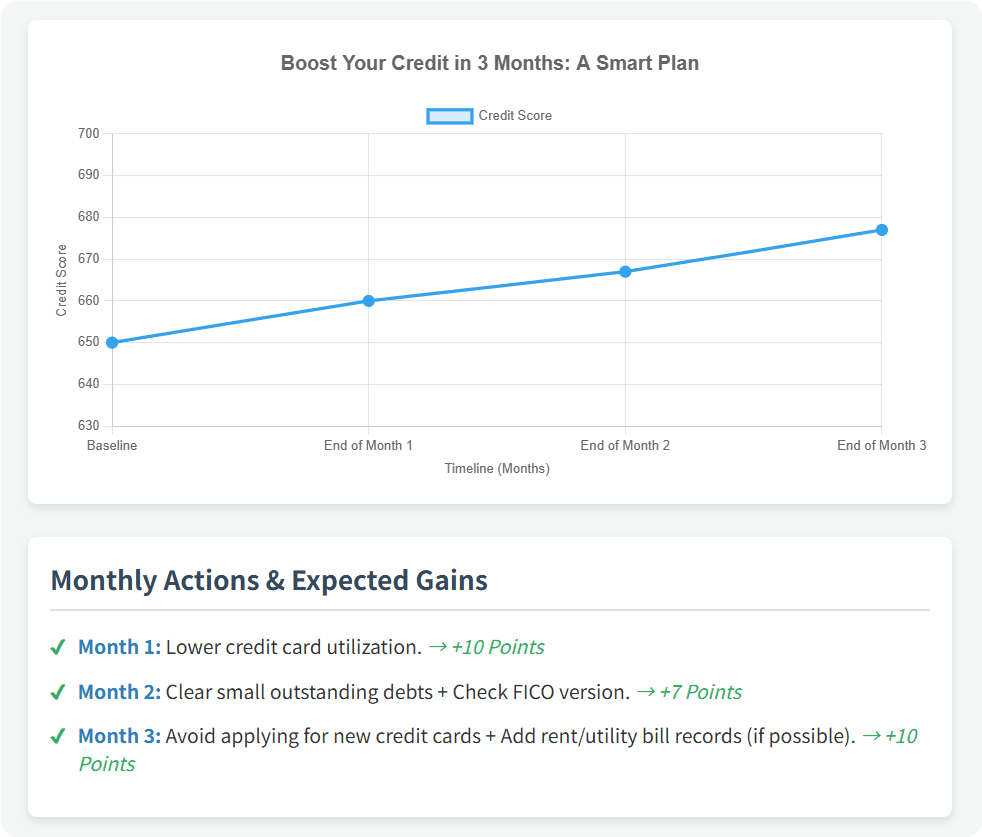

Credit Score Hacks to Get Approved Faster

Your credit score doesn't have to be perfect, but a few smart moves can make a big difference:

- Check Your FICO Scores 2, 4, or 5 – These are still the versions lenders predominantly use in 2025.

- Pay Down Credit Cards Below 30% – Even a credit score around 580 can climb to 620+ within a few months if you reduce utilization.

- Avoid New Credit Lines – Each hard inquiry can lower your score temporarily during mortgage processing.

- No Traditional Credit? No Problem. – Some lenders (including credit unions like Solarity CU) continue to accept alternative credit documentation, such as rent and utility payments.

Fun Fact: A 20-point credit score increase could drop your mortgage interest rate by about 0.5%, saving thousands over the loan term.

The Step-by-Step Homebuying Process (Seattle Edition)

- Get Pre-Qualified – A quick, no-commitment check to see what you can afford.

- Take a Homebuyer Education Class – Still required by most down payment assistance programs and incredibly useful.

- Find a Realtor Experienced with First-Time Buyer Programs – Seattle's housing market remains highly competitive, so having an agent familiar with financing incentives is crucial.

- Make an Offer with Smart Contingencies – Never waive inspections in Seattle's older housing market unless you're ready for potential $10K+ surprises.

- Close and Start Building Equity – Small additional payments toward principal can save thousands in interest and shorten your mortgage term.

Mistakes That Can Cost You Your Dream Home

- Assuming You Need 20% Down – Programs like FHA (3.5% down), Conventional 97 (3% down), and local assistance exist for a reason.

- Not Shopping Around for Rates – A difference of 0.25% in interest rate can cost you $15K+ over the life of the loan.

- Skipping Local Grants – Seattle's Homebuyer Assistance Program is essentially free money. Don't leave it on the table.

Final Tip: Talk to a HUD-certified housing counselor before you start looking. They can help you avoid these costly pitfalls.

What to Do Next

- Pull your credit reports (for free at AnnualCreditReport.com).

- Compare loan estimates from at least three lenders.

- Book a free consultation with a Seattle mortgage advisor.

The right loan could get you into a home faster—and cheaper—than you ever thought possible.

Ready to make your move? Start today.