Mortgage Prequalification vs Preapproval: All Differences in 2025

Do you get puzzled with mortgage prequalification vs preapproval like someone on Reddit? Although these terms are said to be interchangeable, they are indeed not the same. Actually, they are different stages of lender review and buyer readiness.

Now, let's make it clear through this detailed introduction and see what the difference between prequalification and preapproval is. Also, it's recommended to ask a verfied loan offcier near you for more info.

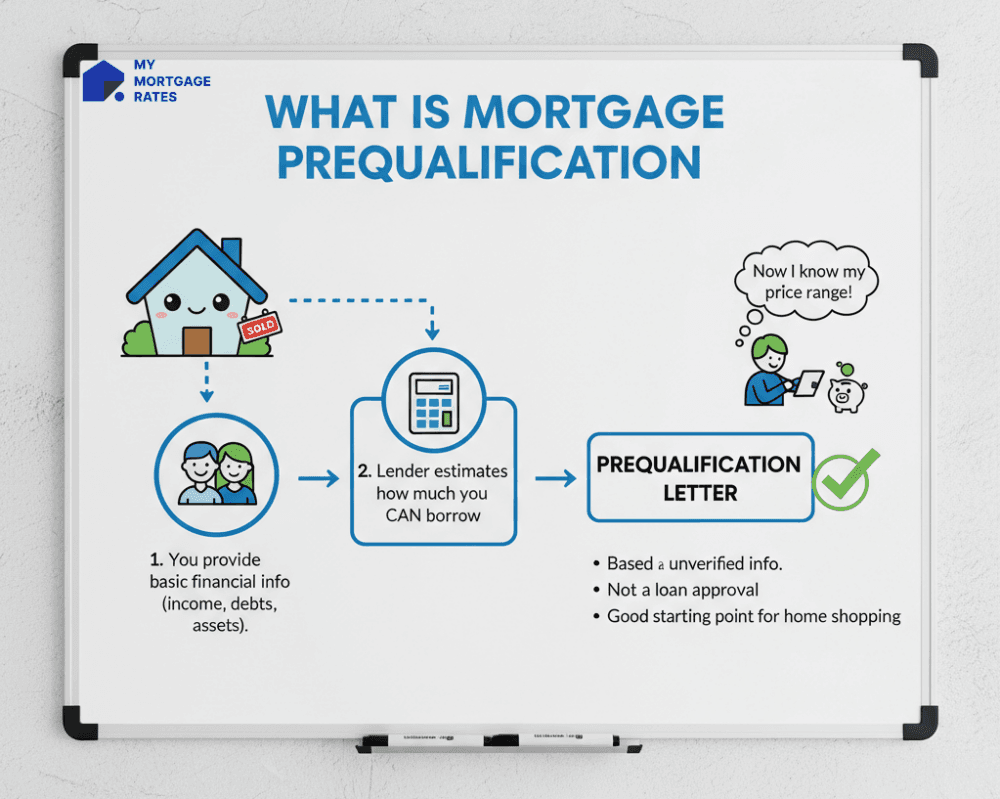

What is Mortgage Prequalification?

Mortgage prequalification is an informal, early-stage estimate of how much you might be able to borrow based on self-reported financial information like income, assets, and debts. It is typically quick in minutes to a few hours, and often used for budgeting and initial house-hunting.

Most lenders rely on a soft credit check or no credit pull at this stage, so your credit score is generally unaffected. Prequalification gives a useful ballpark figure but is not verified and therefore does not carry the weight of a preapproval when competing for homes.

Documents Needed for Mortgage Prequalification

If you want to apply for prequalification, it requires some documentation, often with no formal documents. Lenders ask for self-reported figures for:

- income and employment status

- monthly debts

- estimated down-payment funds

- approximate assets

Some lenders may perform a soft credit pull or ask for screenshots of accounts, but full documentation with paystubs, tax returns, and bank statements is not required at this stage. The process is designed to be fast and non-binding.

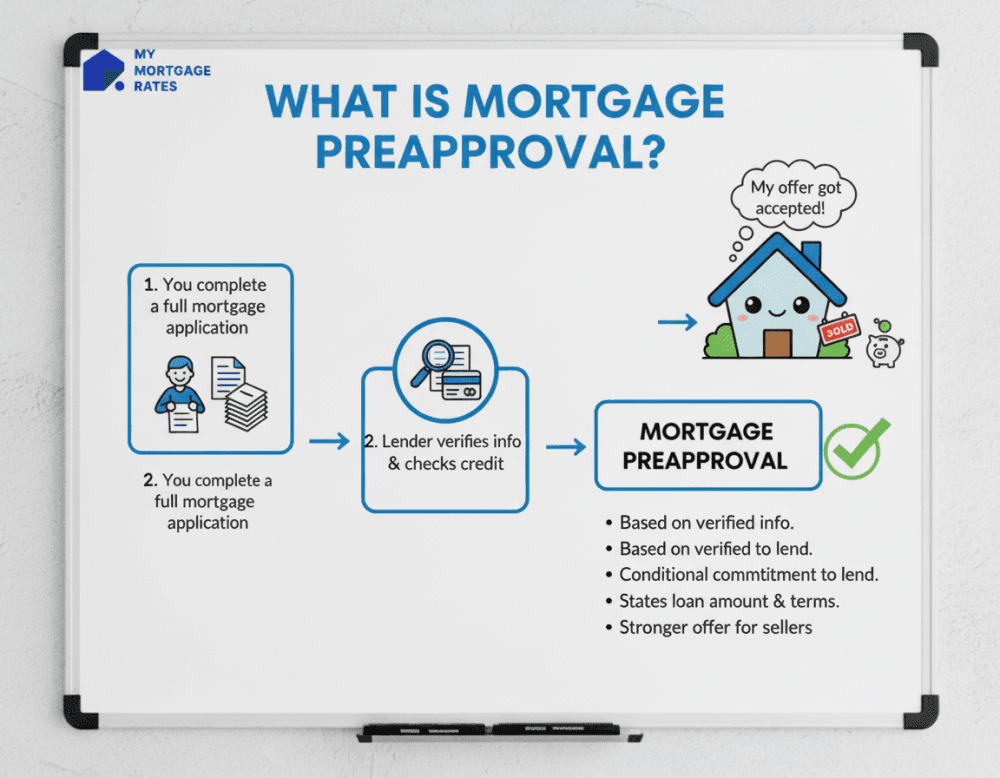

What is Mortgage Preapproval?

Mortgage preapproval is a formal, conditional offer after the lender has verified documents and run a hard credit inquiry. It shows a specific, documented loan amount, common program types, and an expiration date which is commonly 30–90 days, often 60–90 days depending on lender policy.

A preapproval carries far more weight with sellers and agents because it demonstrates verified capacity to borrow, though it's still conditional and subject to final underwriting, appraisal, title, and unchanged finances.

Documents Needed for Mortgage Preapproval

To get pre-approved for a mortgage loan, it requires documented proof of the claims you made during prequalification. Here are some typical documents include:

- government ID and Social Security number

- recent pay stubs in 30 days

- W-2s or 1099s/tax returns in 2 years commonly, more for self-employed

- bank and investment account statements commonly in 60 days

- documentation of other income like rental, bonuses, and child support

- statements for current debts like credit cards, auto, or student loans

- gift letter for gifted down payments if applicable

Self-employed borrowers typically supply 2 years of business tax returns, profit & loss (P&L) statements, and business bank statements. Lenders verify these documents before issuing a formal preapproval letter.

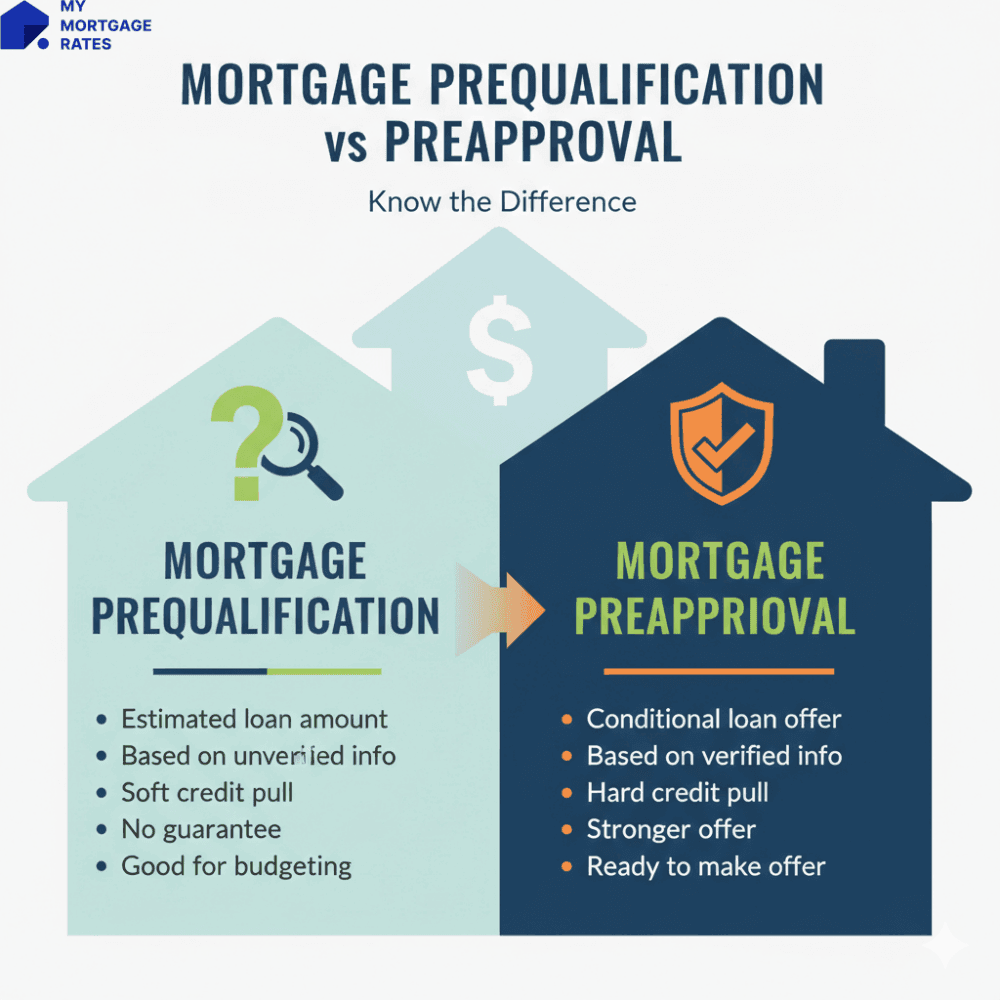

Comparison Between Mortgage Preapproval vs Prequalification

To help you figure out all the differences bettween mortgage preapproval and prequalification, let's break down to 9 aspects and drill down for more details.

Purpose

- Prequalification: Exploratory. Sets a rough budget and helps you deciets a rough budget and helps you decide whether to start looking.

- Preapproval: Competitive. Demonstrates verified financing readiness to semonstrates verified financing readiness to sellers and agents.

Benefits

- Prequalification: Fast, no documents, no hard pull, good for early planning.

- Preapproval: Stronger bargaining position, speeds up closing, identifies issues early.

Process

- Prequalification: Self-report → estimate. Minutes to hours.

- Preapproval: Submit docs → lender verifies → hard credit pull → conditional letter. Days from 1 to 10 days depending on complexity.

Documentation

- Prequalification: Minimal/no paper proof.

- Preapproval: Full documentation like paystubs, tax returns, bank statements, etc.

Financial Data

- Prequalification: Self-reported. Not verified.

- Preapproval: Verified by lender. Used to calculate DTI and ability to repay.

Credit Check

- Prequalification: Soft pull or none with no score impact.

- Preapproval: Typically a hard pull with a small, temporary score impact. Multiple mortgage hard inquiries within a short shopping window are grouped by scoring models. CFPB/FICO note a 14–45 day shopping window depending on model. CFPB uses 45 days as the consumer protection framing.

Application Fee

- Prequalification: Generally free.

- Preapproval: Usually free with lenders, though some brokers or specialty products may have fees. Please always confirm up front.

Estimated Down Payment

- Prequalification: You give an estimate. Not verified.

- Preapproval: Lender requires proof of funds like bank statements, and gift letters.

Valid Period

- Prequalification: No industry standard expiration. it's informal. If you need an updated estimate, re-run it.

- Preapproval: The valid period of mortgage preapproval is typically 30–90 days. Many lenders use 60–90. Some products/verified programs can extend to ~120 days. If it lapses you'll need to update docs and likely undergo another credit check.

Should I Get Prequalified or Preapproved? Which to Choose?

If you're casually exploring homeownership or are months away from buying, start with prequalification to understand budget without affecting your credit.

If you plan to make offers soon or are in a competitive market: get preapproved or a verified preapproval if offered, so sellers and agents take your offers seriously. Aim to time preapproval so the expiration window covers your active search, for example, get preapproved 1–2 weeks before beginning showings.

According to myFICO, many borrowers obtain a prequalification first, then move to 2–3 preapprovals (bank, credit union, online lender, or broker) within the rate-shopping window so they can compare offers while minimizing credit score impact.

How Does Prequalification and Preapproval Affect Credit Score?

Prequalification is usually a soft pull or no pull. That will have no effect on your credit score. Soft inquiries are visible to you but not factored into most scoring models.

While mortgage preapproval is a hard pull, it usually causes a small, temporary drop, like a few points. Hard inquiries remain on your report for two years and affect scores for ~12 months. Rate-shopping rules group multiple mortgage inquiries into one if made within the scoring model's window (FICO: ~14–45 days. CFPB guidance often uses a 45-day window).

FAQs About Mortgage Prequalified vs Preapproved

Q1. Does prequalified mean you will be approved?

No. Prequalification is an informal estimate that is not verified. Final approval requires documented verification, underwriting, and an appraisal.

Q2. Can you be denied after being pre-qualified?

Yes. Because prequalification is unverified, the full application can reveal shortfalls. Different lenders will have different results.

Q3. What are the risks of pre-qualification?

The main risk is overestimating buying power and touring homes outside your true budget, or relying on an informal letter in a competitive offer. Sellers favor verified preapprovals.

Q4. Does pre-approved mean I will get the loan?

Not guaranteed. Preapproval is conditional and relies on unchanged finances, a satisfactory appraisal, a clear title, and final underwriting. It is, however, a strong indicator of approval if conditions remain stable.

Q5. Is pre-approval a guarantee of final approval?

No. Final underwriting can still deny or change terms based on appraisal, title issues, employment changes, new debt, or other post-preapproval changes.

Conclusion

Mortgage prequalification vs preapproval serve different but complementary roles.

- Prequalification is a low-friction way to learn your approximate budget.

- Preapproval is the verified, conditional commitment that sellers respect.

For most buyers, start with prequalification, then get preapproved when you're serious about shopping. Timing the preapproval so its expiration window aligns with your search. Shop multiple lenders within the mortgage shopping window to compare rates while minimizing credit-score impact. Keep finances stable while your loan is active to avoid surprises in final underwriting. If you're still confused, look for a loan officer near you and have a talk.