![[Ultimate Guide] Where to Find a Loan Officer Near Me?](/_next/image?url=https%3A%2F%2Fdynamic-light-ab6e2536d6.media.strapiapp.com%2Fhow_to_find_a_loan_officer_near_me_e040d559c1.png&w=3840&q=75)

[Ultimate Guide] Where to Find a Loan Officer Near Me?

Where to find loan officers near me? If you're a first-time buyer, it's really essential to find a reliable loan officer in your neighborhood. That will help you walk through the whole loan origination process smoothly and quickly. Now, you may take a look at the 4 sites below to contact professionals nearby. Also, you'll learn how to choose and what questions to ask along the way.

People Also Read

- Mortgage Loan Originator vs Loan Officer: Differences and Similarities

- 6 Best Loan Origination Software for Mortgage in 2025 [Never Miss]

- [Must-Read] How Does a HELOC Work? Explore Process Here

- 6 Top Loan Origination Systems to Streamline Workflow in 2025

- All-to-Know: How Do Mortgage Rates Impact Affordability?

What is a Loan Officer?

A loan officer is someone who evaluates, originates, and helps manage mortgage loan applications. These professionals work for banks, credit unions, mortgage companies, mortgage brokers, or as independent originators. Their core functions include assessing a borrower's creditworthiness, explaining loan options, collecting documentation, and submitting files for underwriting.

- Most U.S. mortgage loan originators must be licensed or registered through the Nationwide Multistate Licensing System (NMLS). Consumers can verify a loan officer's license and complaint history through the NMLS Consumer Access database.

- Loan officers must follow federal laws and disclosures, for example, TILA/RESPA rules, and provide required documents such as the Loan Estimate and Closing Disclosure under TRID when applicable.

- Loan officers are not automatically fiduciaries. Their duties and legal obligations depend on their role and employer type (e.g., broker vs. bank employee) and applicable state law.

- Typical processing timelines vary, but a standard purchase loan often closes in about 30--45 days. Timelines depend on property type, appraisal turn times, underwriting complexity, and how quickly documents are returned.

What Does a Loan Officer Do?

Loan officers facilitate accurate and timely completion of mortgage applications and act as the borrower's primary contact during the origination phase. Here are some job responsibilities of loan officers.

- Making initial client contact and collecting income, asset, and credit documentation.

- Explaining loan options like fixed vs. adjustable rates, loan terms, down payment requirements, in plain language.

- Producing Loan Estimates within three business days of application per TRID and ensuring the Closing Disclosure is delivered at least three business days before closing.

- Coordinating with processors, underwriters, appraisers, title companies, and closing agents to move the file forward.

- Monitoring rate movements and advising on when to lock a rate based on client needs and market conditions.

Where to Find a Loan Officer Near Me?

There are many places to find local loan officers. Each source has strengths and limitations. There are 4 websites that first-time buyers can directly get in touch with loan officers.

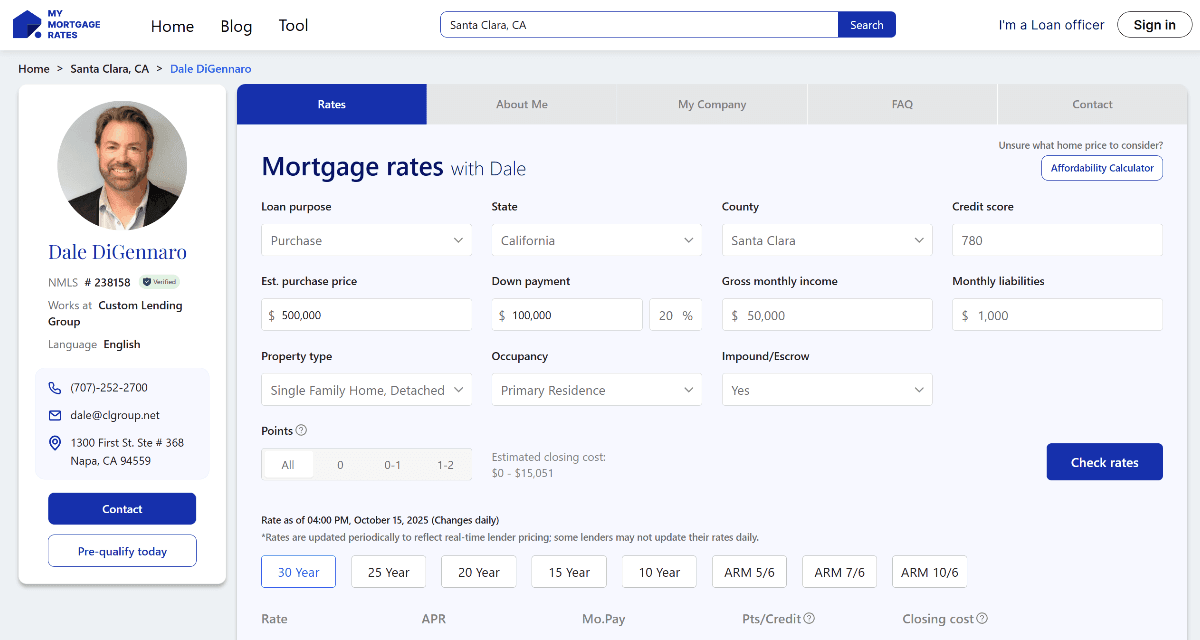

MyMortgageRates

MyMortgageRates, developed by Zeitro, is positioned as a marketplace to connect borrowers with loan officers nearby in U.S.. Also, it enables loan officers to create a personal page and get free leads with organic searches. The site covers all types of loan officers, including Conventional, FHA, VA, USDA, and NonQM.

So far, there are over 3,000 loan officers registered, and you'll definitely reach an ideal professional. Better yet, you can follow up on the whole loan process to every detail. Now, you can search for a loan specialist and enter your info to get the best rate in real time!

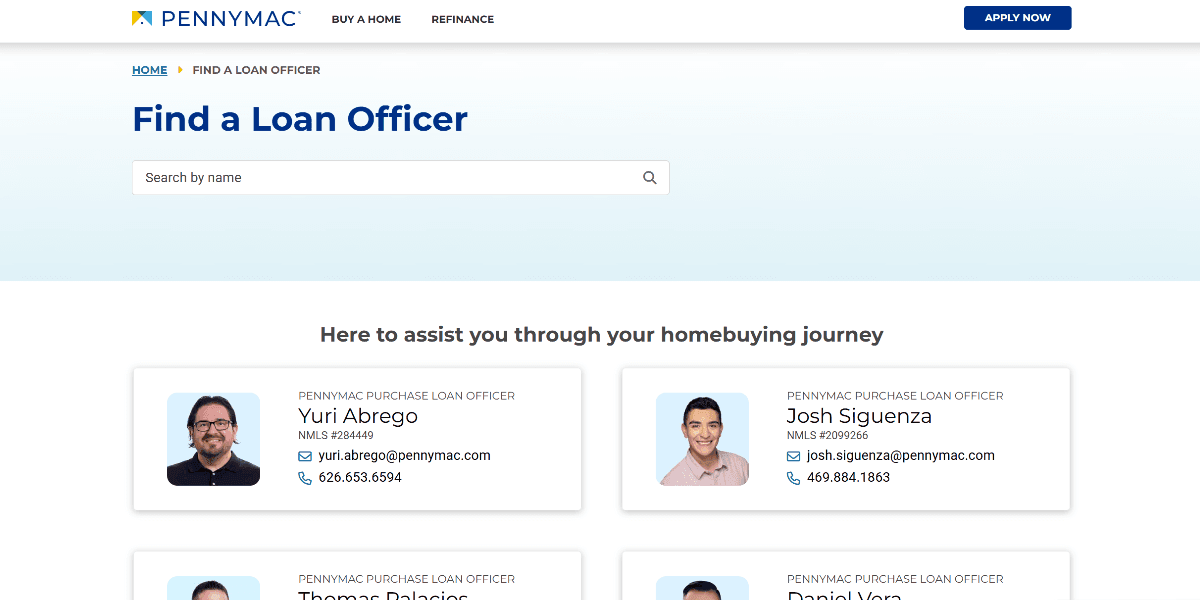

PennyMac Find Loan Officers

PennyMac is a national mortgage lender with a "Find Loan Officer" directory that helps borrowers locate company loan officers. PennyMac offers a range of loan products like purchase, refinance, FHA/VA, jumbo, etc., calculators, and borrower education resources.

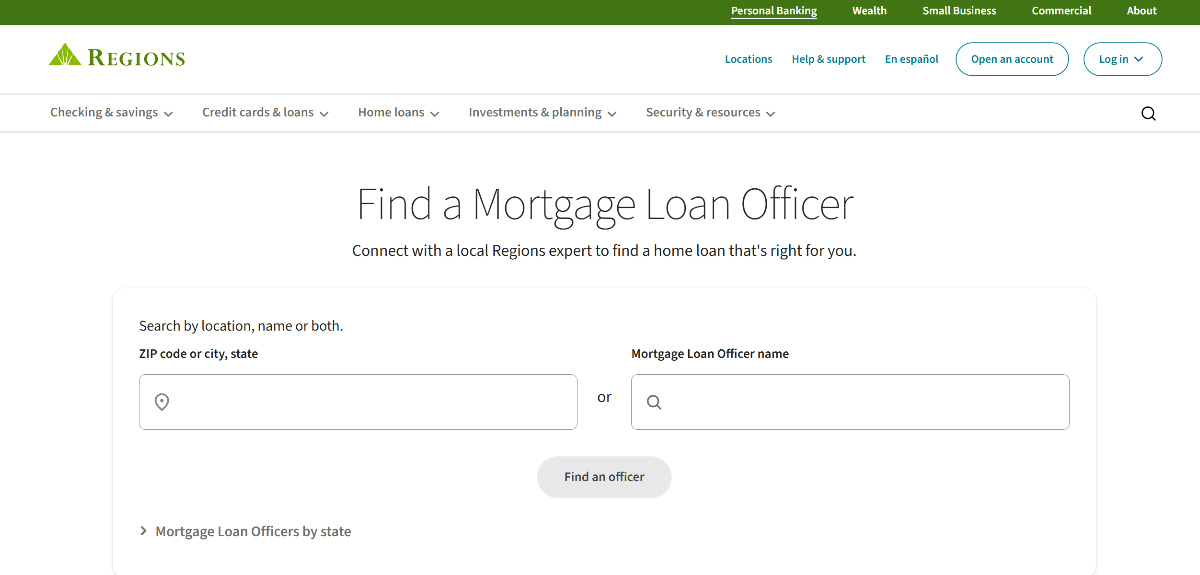

Regions Find Mortgage Loan Officer

Regions Bank offers a state- and ZIP-based directory to find local mortgage officers. Working with a local bank officer has advantages in terms of local-market knowledge and banking integration (checking/savings/closing procedures), especially when borrowers already have deposits or banking products with the institution. Please confirm whether the officer works on retail bank products only or can access broader wholesale/correspondent offerings.

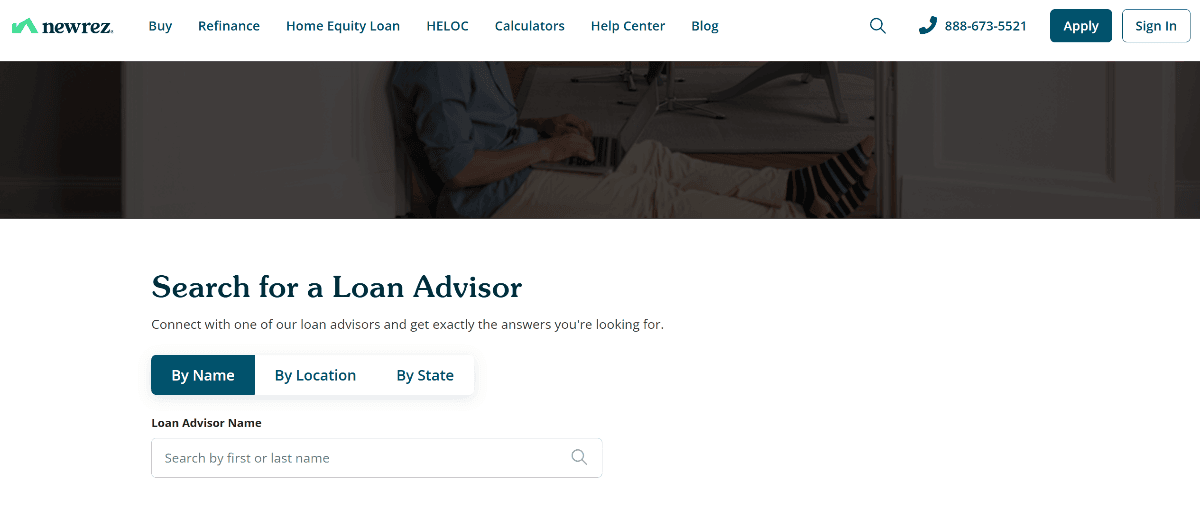

Newrez Find Loan Officers

Newrez is a national home-lender platform with online tools, loan officer directory, calculators, and consumer resources. The company sometimes markets promotional credits, for example, savings toward closing costs, for eligible purchase applications. You should always request the specific terms and eligibility criteria for any advertised promotion.

How to Choose the Right Loan Officer?

It's really hard to find the best loan officer who has high expertise and reliable communication at a time. To learn how to choose from countless loan officers, check out the following 6 aspects.

Experience in the Industry

Look for experience in the specific loan type you need, such as FHA, VA, jumbo, Non-QM, bank statement loans, etc. Experience matters for complex files, especially for self-employed borrowers, large deposits, and investment property. You should ask about recent transaction history and examples of similar loans they've closed.

Knowledge of Different Types of Home Loans

A good officer explains differences in down payment, mortgage insurance, eligibility, and occupancy rules across Conventional, FHA, VA, USDA, Jumbo, ARM, and specialty programs. You can ask them to walk you through the pros/cons for your scenario and show how each affects monthly payment, closing costs, and long-term cost.

Attention to Details

You can dill down to the details to verify how they collect and track documents. Do they use secure portals, checklists, or task managers? Confirm who on the team will handle document follow-ups (loan processor, assistant) and how you'll be notified of outstanding items.

Problem-Solving Ability

Also, you may ask for an example of a file with underwriting or appraisal issues and how they were resolved. Remember that good officers proactively flag risks early and explain contingency plans.

Strong Communication Skills

You can check out responsiveness during initial contact. For example, ask how they prefer to communicate through phone, text, or email, and how often they'll provide status updates. What's more, request expected timelines for typical milestones.

Good Reputation and Reviews

Reputation matters a lot. You should verify the NMLS license and search for complaints using NMLS Consumer Access, and check consistent patterns in reviews. Multiple complaints about the same issue (late closings, poor communication) are a warning sign. Better yet, ask for references or recent client contacts if you want direct feedback.

10 Questions to Ask Loan Officers

There are also 10 questions to help you figure out which loan officer is more professional to choose from.

-

What loan programs do I qualify for based on my financial profile? Get them to explain the realistic options for your credit score, income, and down payment.

-

What interest rate and APR can you offer me today? Ask whether the quote is conditional on credit or property, and if it assumes a rate lock.

-

How much will I need for my down payment and closing costs? Request an itemized estimate or sample Loan Estimate showing lender fees and third-party costs.

-

What documentation will you require from me? Ask for a written checklist so you know what to gather.

-

How long does your typical loan process take from application to closing? Ask for milestone timelines of appraisal, underwriting review, and clear-to-close.

-

Will my loan be sold or serviced by another company after closing? If yes, get specifics about who may service the loan and how that affects payments and customer service.

-

What are your lender fees, and how do they compare to industry averages? Request a Loan Estimate so you can compare total costs, not just rate.

-

How accessible will you be throughout this process? Ask how quickly they respond and who covers when they are out of the office.

-

Can you explain how rate locks work and when you recommend securing one? Confirm lock length options and any float-down rules and fees.

-

What happens if issues arise with my application or underwriting? Ask them to describe the escalation path and backup plans.

FAQs About Loan Officers Near Me

Q1. How to find clients as a loan officer?

Successful loan officers use a mix of referral relationships, digital marketing, and community outreach. If you just became a loan officer with no experience, you can register and post yourself on some sites like MyMortgageRates for free.

Q2. Is it better to work with a broker or a lender?

Mortgage brokers shop multiple lenders and can show a broader set of products. helpful for borrowers with unique situations or who want many options. Direct lenders underwrite and fund loans in-house, which can mean more consistent processes and sometimes faster turn times.

Q3. Is a loan officer the same as a banker?

Not exactly. Loan officers focus on originating mortgage loans while bankers have broader roles like deposits, business banking, investments, and may handle mortgages as part of a larger set of services. Dedicated mortgage loan officers typically have deeper, specialized knowledge about mortgage products and underwriting than generalist bankers who split responsibilities.

Conclusion

Finding the right loan officer near you is a critical step toward successful homeownership. You can look for loan officers near you on MyMortgageRates, PennyMac, Regions, and Newrez. Please remember to verify credentials (NMLS), compare Loan Estimates, interview multiple officers, and look for consistent reviews and local expertise.

The lowest advertised rate is not always the best overall value. Responsiveness, transparency, underwriting experience, and alignment with your financial goals matter just as much.