Detailed Guide: How to Get Preapproved for a Mortgage Loan?

Starting your homebuying journey can feel overwhelming. Some first-time homebuyer will ask questions like How do you get pre-approved for a mortgage on Reddit and hope that people will help them out. That's a good way but sometimes they are too many comments to figure it out.

You might as well read this guide to turn that intent into a clear plan. what preapproval is, why it matters, how to get preapproved for a mortgage loan, exactly what lenders will ask for, and what to do if you're declined.

People Also Read

- All-to-Know: How Do Mortgage Rates Impact Affordability?

- How to Pay off Mortgage Faster? Pros, Cons, and 7 Ways for You

- 6 Top Loan Origination Systems to Streamline Workflow in 2025

- What is Loan Origination? Meaning, Steps, Example, Requirements

- [Ultimate Guide] Where to Find a Loan Officer Near Me?

What is Mortgage Preapproval?

Starting first to learn what is mortgage preapproval. A mortgage preapproval is a lender's conditional, written statement estimating how much it will lend you based on a review of your credit, income, assets and debts. It's stronger than a quick prequalification because the lender verifies documentation and usually runs a hard credit pull to underwrite the estimate. meaning the check can affect your credit score slightly.

Preapproval letters typically list an estimated loan amount, program types the borrower likely qualifies for, and an expiration date. they are conditional, not final loan commitments. Final approval requires full underwriting and appraisal after you have a contract.

Some fintech tools and lenders offer a soft-pull "prequalification" or an initial soft check that estimates eligibility, but the formal preapproval most sellers rely on generally involves a hard credit inquiry. If a lender promises a "preapproval" without a hard pull, ask what level of verification they performed.

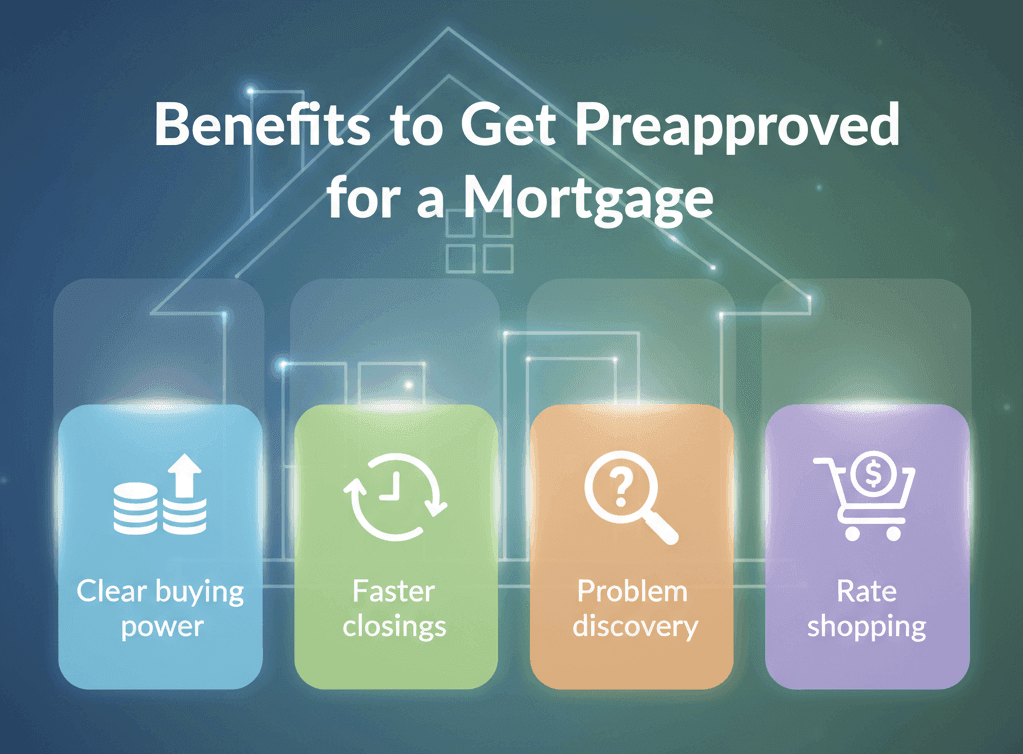

Benefits to Get Preapproved for a Mortgage

Why do you need to get preaaproved? Here's are some reasons you should learn first.

-

Clear buying power: know your price range and avoid falling in love with homes you can't afford.

-

Stronger offers: sellers and listing agents prefer offers from buyers with recent preapproval letters because they show financing is likely.

-

Faster closings: with early documentation verified, the final underwriting and closing often move quicker after an accepted offer.

-

Problem discovery: preapproval flags credit, employment, or documentation issues early so you can fix them before you're under contract.

-

Rate shopping: getting preapproved by multiple lenders within a short window helps you compare rates and terms while credit bureaus treat the inquiries as a single mortgage shopping event to minimize score impact.

What is Needed to Get Preapproved for a Mortgage?

Most lenders ask for the same core documents. You can gather them ahead of time speeds approval. There are common documents lenders request, including:

-

Government ID, driver's license or passport and Social Security number.

-

Recent pay stubs typically within 30 days.

-

W-2s (last two years) or 1099s and federal tax returns if self-employed.

-

Bank statements and investment account statements, which is usually 2 months.

-

Documentation of other income like bonuses, commissions, rental income, and child support.

-

Recent statements for current debts like auto loans, student loans, and credit cards.

-

Gift letters for down-payment funds if using gifted funds. divorce decrees or bankruptcy paperwork if relevant.

If you're a self-employed borrowers, you might expect to submit 2 years of tax returns, profit-and-loss statements, and possibly business bank statements. underwriting is more document-intensive. Also, you can ask verified loan officers nearby on MyMortgageRates.

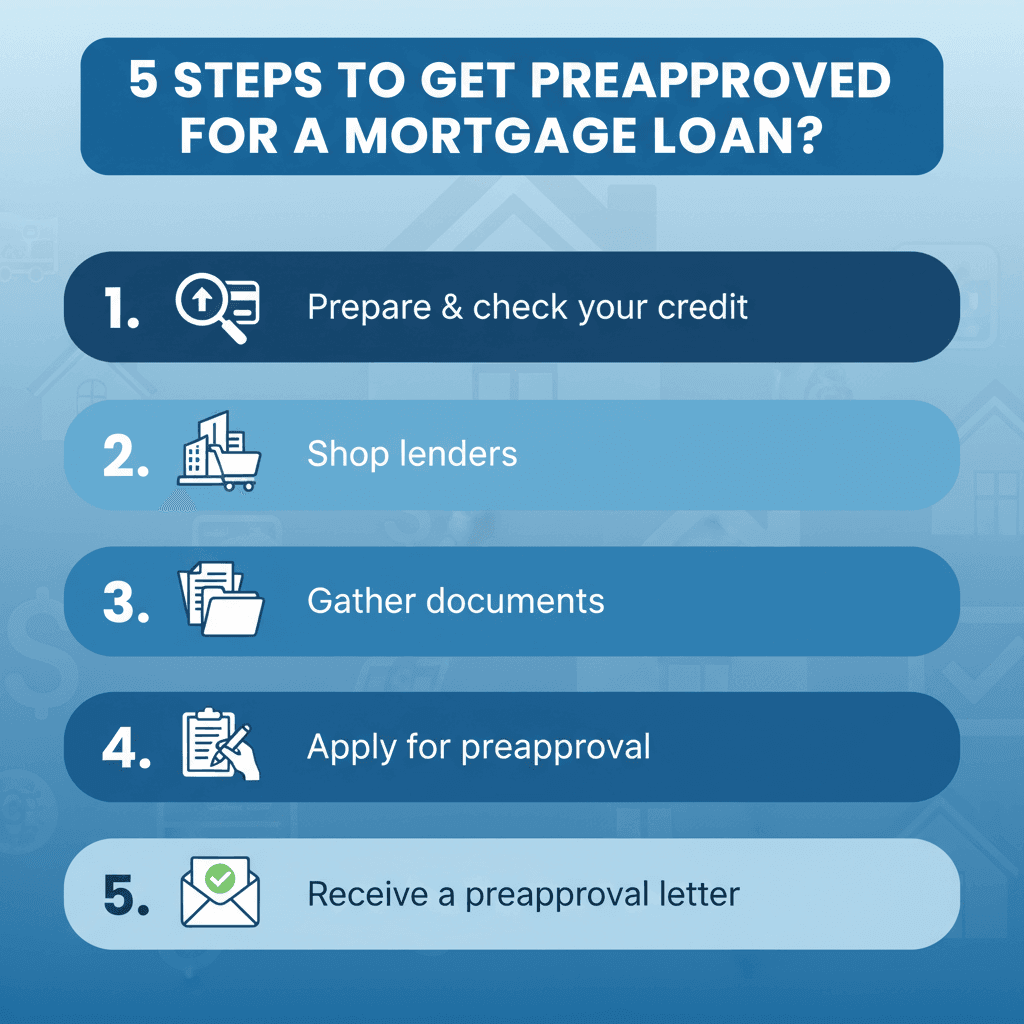

How to Get Preapproved for a Mortgage Loan?

As a rule, you have to go through a workflow in 5 steps as most borrowers do to get preaaproved for a mortgage loan. Let's take a look below.

-

Prepare & check your credit: pull your credit reports and address any errors before lenders do. this avoids unexpected denials or score surprises.

-

Shop lenders (3+): compare a mix of banks, credit unions, online lenders, and brokers. during a short window, multiple mortgage inquiries are usually treated as a single inquiry by credit bureaus.

-

Gather documents and upload them to each lender's secure portal or give them to your loan officer.

-

Apply for preapproval: the lender reviews documents and typically runs a hard credit pull for an official preapproval. Timing varies by lender and case complexity. Expect 1--3 business days for straightforward cases. 5--10 business days for self-employed, complex income, or Verified/underwriter-level reviews.

-

Receive a preapproval letter: it will state an estimate of loan amount, loan type, and expiration window. Read the fine print. The rate is usually an estimate and will lock only when you choose to do so.

What to Do If You Got Declined for Mortgage Preapproval?

However, things are not always on track. If you're denied, you may consider doing the following.

-

Ask the reason. Underwriting will usually point to credit score, DTI, documentation, or job history.

-

Fix correctable problems. Dispute credit-report errors, pay down revolving balances, and gather missing paperwork.

-

Increase down payment or add a co-borrower if feasible. this reduces loan-to-value (LTV) and can improve eligibility.

-

Try a different lender or a mortgage broker. Underwriting overlays differ. One lender's deny can be another's approve.

-

Consider government programs. FHA, VA or USDA have different overlays and may be more flexible for certain borrowers but have program-specific rules.

Pre-Qualification vs Preapproval vs VPAL

First-time buyers may find it confusing among pre-qualification, pre-approval, and VPAL. Therefore, let's see what are the differences here.

-

Prequalification: informal estimate based on self-reported info and typically a soft credit check. good for early budgeting but carries little weight with sellers.

-

Preapproval: lender verifies documents and often runs a hard credit pull. the resulting preapproval letter is meaningful to sellers and agents. Validity is conditional and typically 30--90 days.

-

VPAL/Verified Approval/Verified Preapproval/VAL (terminology varies by lender): a higher-confidence product some lenders offer where underwriters have already reviewed and verified documents (sometimes allowing a longer rate-lock or a "Lock & Shop" feature). These typically take longer to issue (several days) but provide stronger seller assurance. Navy Federal and large lenders publicize variants of this product like Navy Federal's VPAL Lock & Shop, and Rocket's Verified Approval Letter.

FAQs About Getting Preapproved for a Mortgage

Q1. How long to get preapproved for a mortgage?

Most straightforward cases receive a preapproval in 1--3 business days once documents are submitted. Complex cases like self-employed, multiple income streams, manual underwriting, or verified/VAL products, often require 5--10 business days. Online lenders sometimes issue an initial decision faster, but full verification still takes time.

Q2. How long does a preapproval last?

Preapprovals commonly last 30--90 days. 90 days is typical for many lenders. If it expires you can renew by updating documents and re-running the credit check. always check the exact expiration on the letter.

Q3. If you're preapproved for a mortgage will you get the loan?

No. preapproval is conditional, not guaranteed. Final approval requires underwriting after you have a signed purchase contract, including employment verification, asset re-verification, and a property appraisal. Changes in your credit, job, bank balances or a low appraisal can change the outcome.

Q4. How far in advanced should I get pre-approved for a mortgage?

Apply when you're ready to actively house hunt. not months before. so your letter won't expire mid-search. For most buyers, getting preapproved 1--2 weeks before touring homes is a reasonable window. if you expect a short search, you can time it closer to listing tours. Use the lender's validity window around 30--90 days to plan.

Q5. How much income do you need to be approved for a $400,000 mortgage?

This depends on interest rate, down payment, property taxes/insurance, and whether you target a front-end housing ratio (often ~28%) or lender back-end DTI (commonly 36--43% as a guideline). Example (assumptions shown):

-

Assume a 30-year fixed mortgage at 6.0% → principal & interest ≈ $2,398/month. (Calculation: standard amortization formula.)

-

Add property taxes + homeowner's insurance (estimate $300--$700/month depending on location). That gives PITI ≈ $2,698 -- $3,098/month.

Using a 28% housing-cost rule, annual gross income needed ≈ $115,600 -- $132,800 (depending on taxes/insurance).

Using a 36% back-end DTI rule, the annual gross income needed ≈ $89,900 -- $103,300.

These are illustrative. Exact qualification depends on your other debts, credit score, loan program limits, and lender overlays. Also, you can check here to see how much mortgage can you afford.

Conclusion

Preapproval is a high-value, practical step. It reveals buying power, uncovers issues early, and makes offers stronger. For best results: check your credit and correct errors, gather documents ahead of time, shop several lenders (use a broker if you prefer consolidated shopping), and be mindful that preapproval letters are conditional and time-limited.

If denied, ask why, correct the fixable issues, and consider different lender channels or government loan programs. Use the checklist and timescales above to plan an efficient, informed home search. To get real-time information, you can contact a verfified loan officer near you.