Must-Read: How Long is a Mortgage Preapproval Good for?

Understanding mortgage preapproval timelines is essential for successful homebuying. Whether you're a first-time borrower or an experienced investor, knowing how long your preapproval remains active can make the difference between securing your dream property and losing out to competitors.

This guide covers everything loan officers, borrowers, and mortgage professionals need to know about preapproval validity periods, how long letters usually last, how to preserve or renew them, and what to expect if they expire. You'd better read on.

People Also Read

- All-to-Know: How Do Mortgage Rates Impact Affordability?

- How to Pay off Mortgage Faster? Pros, Cons, and 7 Ways for You

- 6 Top Loan Origination Systems to Streamline Workflow in 2025

- What is Loan Origination? Meaning, Steps, Example, Requirements

- [Ultimate Guide] Where to Find a Loan Officer Near Me?

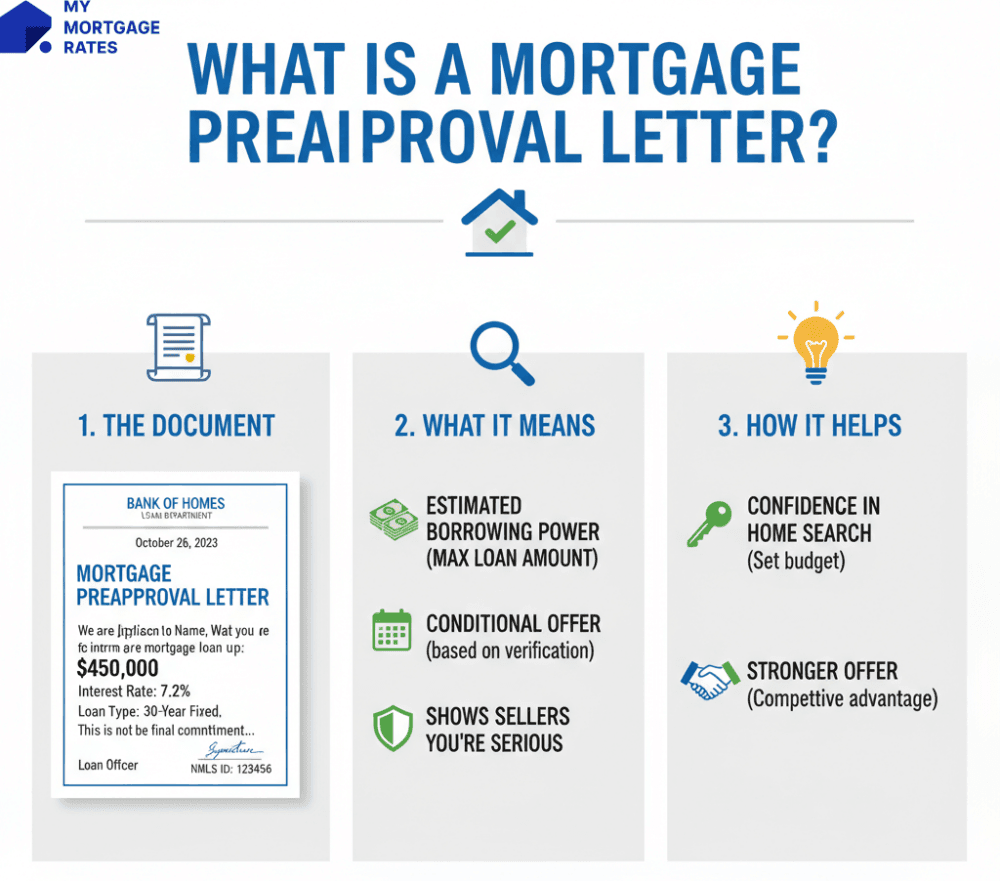

What is a Mortgage Preapproval Letter?

A mortgage preapproval letter is a lender's conditional written estimate of how much it will lend you based on verified financial documents like income, assets, employment, debts and credit. Most formal preapprovals involve a hard credit inquiry and verification of documentation. That is why they carry more weight with sellers than informal prequalifications.

However, please note that preapproval letters are conditional, not final: final loan approval requires underwriting, a property appraisal, and re-verification of financials once you have a ratified purchase contract. Industry guides and credit bureaus confirm that preapproval is stronger than prequalification and usually requires greater verification.

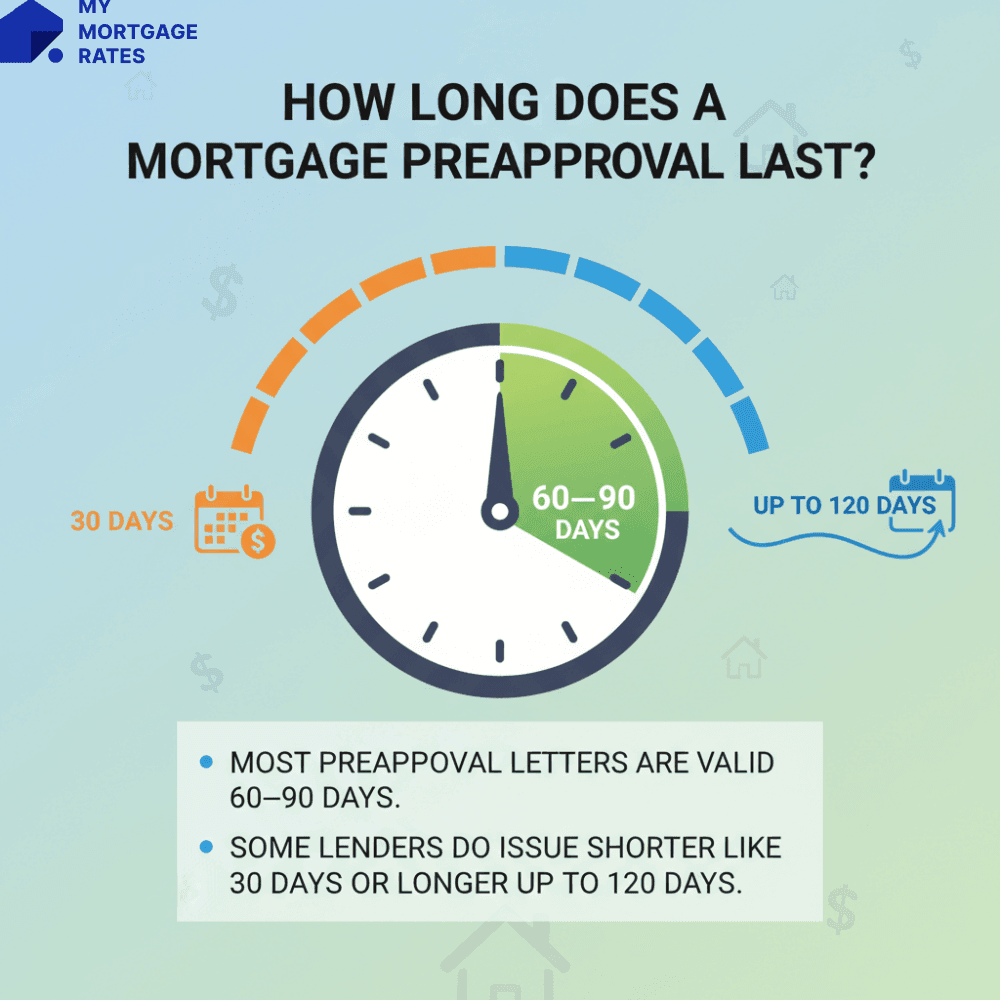

How Long Does a Mortgage Preapproval Last?

Most preapproval letters are valid 60--90 days. Lenders often set this window to ensure the borrower's income, debt and credit picture remain current. Many commonly-cited lenders use 60 or 90 days as standard.

Some lenders do issue shorter like 30 days or longer up to 120 days validity windows depending on product type, for example, some verified preapproval or "Lock & Shop" products extend protections, lender policy, or special programs.

If you need the longest practical coverage, ask the lender whether they offer a verified preapproval/VPAL or a rate-lock while you shop. Some VPAL/Lock & Shop features provide longer effective protections.

Examples:

-

Bank of America references a 90-day preapproval window in its buyer materials.

-

SoFi's verified preapproval letters are described as 90 days in their materials.

-

Navy Federal's VPAL/Lock & Shop structure provides a different timeline (e.g., 60 days to ratify plus additional processing windows) that can extend the effective protection when paid/used.

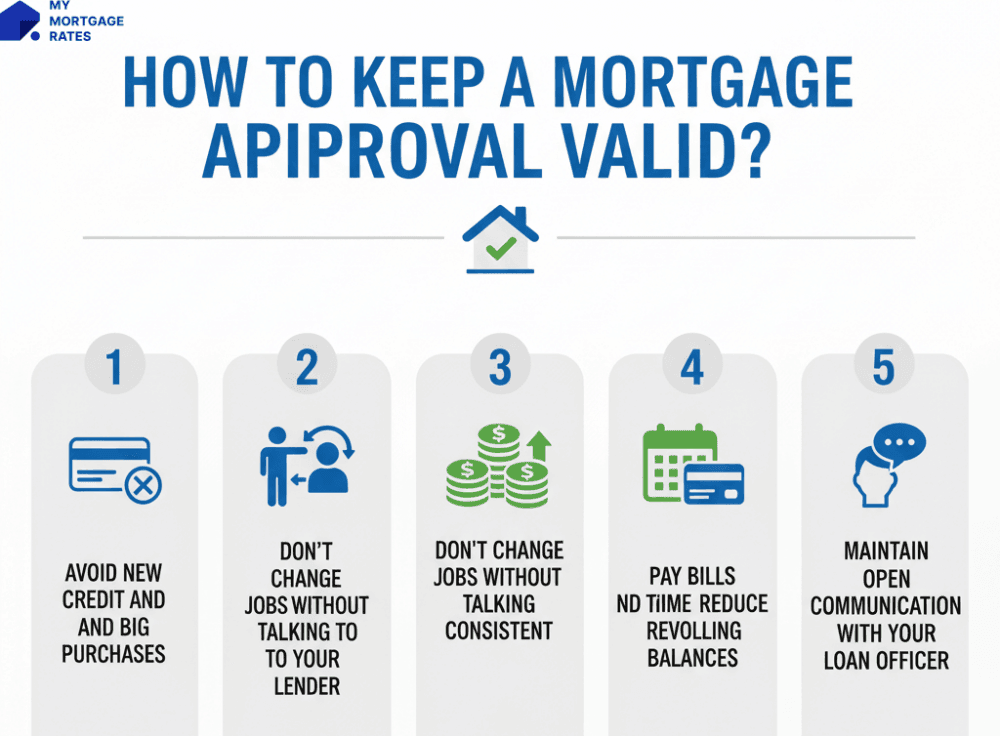

How to Keep a Mortgage Approval Valid?

Preserving preapproval validity is mostly about avoiding material changes to your finances between preapproval and closing:

-

Avoid new credit and big purchases. Opening accounts or financing cars/furniture can change your DTI or trigger new hard inquiries. Credit bureaus allow rate-shopping windows, but unrelated new credit hurts your profile.

-

Don't change jobs without talking to your lender. Employment changes can require re-verification or additional documentation and could impact income calculations.

-

Keep funds sources consistent. Large, unexplained deposits or sudden withdrawals raise underwriting questions. Document any gifts with gift letters and major transfers.

-

Pay bills on time and reduce revolving balances. Lower credit utilization and clean payment history help preserve score and eligibility.

-

Maintain open communication with your loan officer. If anything changes, like new debt, change in income, or large deposits, disclose immediately so you can avoid last-minute denials.

What Happens if My Mortgage Preapproval Expires?

If your preapproval expires, lenders typically require updated documentation and often will perform another credit check before issuing a renewed preapproval. Renewals commonly take a few business days to about a week once you submit current pay stubs, bank statements and any required tax paperwork. Timing depends on lender workload and whether your file needs additional underwriting.

During renewal your qualifying amount or terms can change if your credit score, income or debts changed since the original preapproval. In active markets an expired letter can make offers less competitive until you obtain a fresh, current preapproval.

How to Renew Your Mortgage Preapproval?

If your mortgage preapproval got expired, here's how to renew it. Let's take a look.

-

Check the expiration date on the letter and contact your lender well before it lapses. Many lenders accept renewal requests. Timing helps avoid gaps.

-

Provide updated pay stubs and recent bank statements, last 30--60 days per lender guidance. If your situation changed, update tax returns or other records.

-

Expect another credit check in many cases, but some lenders may grant short extensions without a hard pull if no material changes occurred. Ask the lender whether the renewal will trigger a hard inquiry.

-

Submit renewal at least 1--2 weeks before expiration when possible to avoid becoming inactive while you're negotiating offers.

-

Ask about "verified" preapprovals or Lock & Shop products (VPAL, verified preapproval, or similar) if you expect a longer search. These may require more up-front underwriting but can reduce the chance of expiration while shopping. Navy Federal and other lenders publish product examples.

FAQs About Mortgage Preapproval

Q1. Is it worth getting pre-approved for a mortgage?

Yes. A preapproval clarifies your budget, strengthens offers with sellers, and surfaces issues early so you can fix them before a contract. Sellers and agents generally prefer offers from buyers with recent, documented preapproval letters.

Q2. How many preapproval letters should you get?

Rate-shop, but concentrate inquiries into the credit-bureau "shopping window", which is typically 14--45 days depending on model, so multiple mortgage hard inquiries are treated as a single event by scoring models. Practically, many borrowers get 3 preapprovals (bank, online lender, credit union/broker) and then pick a lead lender for the purchase.

Q3. When should you apply for mortgage preapproval?

Apply when you're ready to actively look. Typically 30--90 days before you expect to make an offer so the letter remains current. In highly competitive markets, earlier verified preapprovals (or VPAL/Lock & Shop) can be useful.

Q4. How quickly can you get pre-approved for a mortgage?

Simple cases with easy documentation can get pre-approved for a mortgage loan within same day to 1--3 business days. More complex cases including self-employed, multiple income streams, and verified preapprovals, often take several days to 1--2 weeks. Online lenders sometimes provide quick initial decisions, but full verification still takes time.

Q5. Does preapproval hurt your credit score?

A formal preapproval usually involves a hard credit inquiry and can lower your score a few points temporarily. However, credit scoring models treat multiple mortgage inquiries within a short time window as a single inquiry, so concentrated rate shopping minimizes impact.

Q6. Can you extend your mortgage preapproval?

Many lenders will grant extensions or a renewal if your financial situation remains stable. Terms vary. Some lenders require updated documentation and a new credit check, while others offer short extensions without re-pulling credit. Ask your lender early and in writing. For buyers who need longer protections, verified preapproval or paid "Lock & Shop" products may be worth discussing.

Conclusion

Most mortgage preapprovals are valid 60--90 days, with variations from 30 up to 120 days depending on lender policy, product type, and whether you purchase a verified/VPAL product. To maximize your preapproval's usefulness: avoid new credit or big purchases, document large account changes, shop lenders within the 14--45 day rate-shopping window, and communicate proactively with your loan officer about renewals or extensions.

If your preapproval expires, renew early like a few business days to a week is typical for a straightforward renewal, but prepare for updated documentation and a likely credit check. If you want more help, you can consider contacting a professional loan officers near you on MyMortgageRates.