What is Loan Origination? Meaning, Steps, Example, Requirements

It's really confusing for people to understand mortgage loan origination. If you just search "What is loan origination" in Google, you may notice that there is no single post that can explain it well. That's why I wrote down this ultimate guide to help you make it clear. What's the meaning? What are the steps? What are the requirements? Look nowhere but here.

What is Mortgage Loan Origination?

Now, let's talk about the details of loan origination. You can learn the meaning, steps of the process, the example, and requirements in the following parts. Let's kick in.

The Meaning of Loan Origination

Mortgage loan origination is the end-to-end process that takes a borrower from the first contact or application through funding and closing. It involves multiple parties, including loan officers/originators, processors, underwriters, appraisers, title companies, and closing agents, to verify credit, employment, assets, and property value to determine eligibility and set loan terms.

Timelines vary by product and complexity. Many routine residential purchase loans close in roughly 30–45 days, but some loans like new construction, lenders with high volumes, loans requiring manual underwriting, or those with title or appraisal issues can take longer.

Digital tools and integrated loan-origination systems have shortened or automated many manual steps, but regulatory checks and underwriting review remain central to the origination workflow. Clear preparation by the borrower speeds the process and reduces the chance of delays.

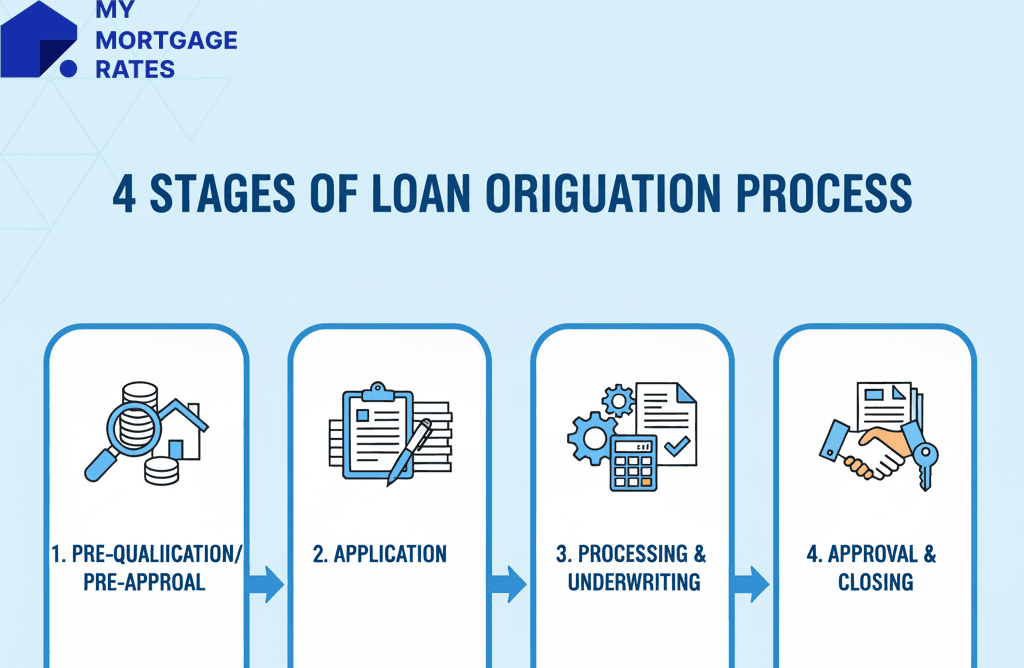

What are the Steps in the Loan Origination Process?

As a rule, there are normally 4 stages of loan origination process. Let's walk through it below. Each phase depends on accurate documentation and timely responses from borrowers, employers, appraisers, and third-party vendors.

-

Pre-qualification/pre-approval: preliminary affordability e pre-approval: preliminary affordability estimate based on borrower-provided information, and for pre-approval, a credit check and documentation.

-

Application: borrower completes a formal application, including URLA/Fannie/Freddie standardized forms in the U.S., and submits required documents like pay stubs, tax returns, bank statements, and ID.

-

Processing & underwriting: processors assemble files, order credit reports, verifications, and appraisals. Underwriters run detailed risk analysis, verify documents, and apply program guidelines.

-

Approval & closing: once the underwriter issues a clear-to-close and all conditions are met, the loan documents are prepared, signed at closing, and funds are disbursed/recorded.

What is an Example of Loan Origination

To make it clear, here's an example for your reference.

A first-time buyer seeks a $400,000 mortgage. They meet a loan officer for pre-approval, provide pay stubs and bank statements, and submit a formal application after an offer is accepted. The lender orders an appraisal and title search. Underwriters check credit, verify employment, compute debt-to-income ratio and reserves, and set conditions (e.g., documentation of gift funds). After conditions are cleared, the loan receives a clear-to-close, the borrower signs loan documents at the escrow/closing, the lender funds the loan, and title is recorded to complete origination.

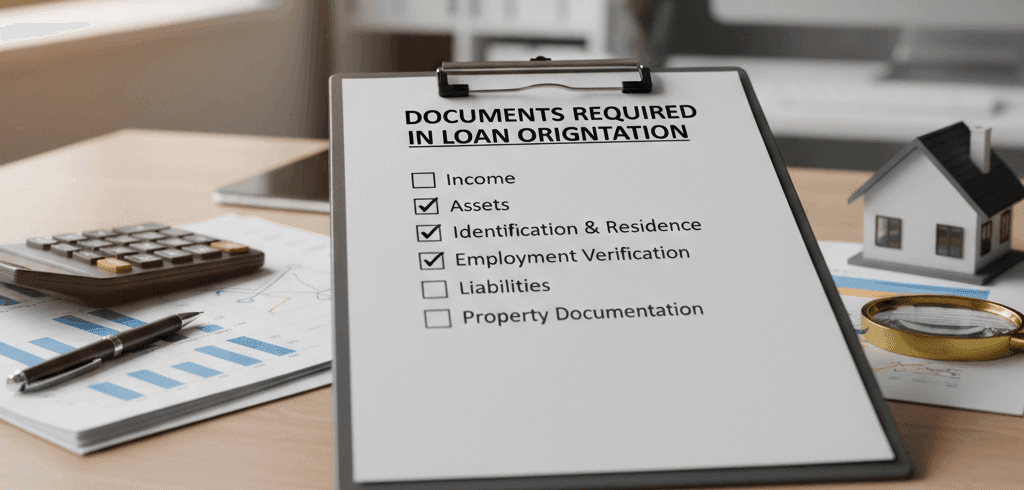

Documents Required in Loan Origination

A home loan is really a big decision in one's life, and that really needs a bunch of stuff to get ready for loan origination. Here are common documentations. Please note that lenders may request additional documentation depending on the loan program and borrower profile.

-

Income: recent pay stubs, W-2s (past 2 years), and federal tax returns for salaried or self-employed borrowers for self-employed, profit & loss statements, and business returns.

-

Assets: bank statements, which are usually the last 2–3 months, investment account statements, and retirement account statements.

-

Identification & residence: government ID, Social Security number, proof of residency.

-

Employment verification: VOE or written employer verification.

-

Liabilities: statements for existing loans, credit cards, child support, etc.

-

Property documentation: signed purchase contract, condo docs (if applicable), and appraisal report.

Why Is Loan Origination Important?

Why do you have to go through all the hassle? Because good origination protects both borrower and lender.

-

For borrowers, appropriate underwriting ensures the loan matches repayment ability and helps avoid unaffordable financing.

-

For lenders, a thorough origination process reduces default risk and ensures regulatory compliance.

Transparent origination clarifies rates, fees, and borrower obligations. Strong origination practices support sustainable lending and homeownership while reducing regulatory and reputational risk.

How Does a Loan Origination Work?

Borrowers start by contacting a lender, broker, or loan officer to discuss goals and get pre-qualified or pre-approved. After application submission, a loan processor collects documents and orders credit reports, verifications, and appraisal.

Underwriters assess risk, validate income/assets, evaluate the appraisal, and issue approval with conditions. Borrowers must clear any conditions (e.g., additional documentation, source of funds). Once conditions are met, the lender issues a clear-to-close, closing is scheduled, loan documents are signed, and funds are disbursed.

Modern loan origination systems (LOS) automate many steps—document collection, e-signatures, data feeds—but human review remains essential for complex decisions and compliance. If you're a new borrower that are unfamiliar with the loan origination process, you can get in touch with the loan officer near you and follow the steps easily on MyMortgageRates.

What is an Origination Fee on a Loan?

An origination fee compensates the lender or broker for processing and establishing the loan. It can be expressed as a percentage of the loan or as a flat fee, which is commonly around 0.5%–1.0% for many lenders, but ranges vary.

Components often described as "origination" include application, processing, underwriting, and loan-packaging costs. Some lenders advertise "no-origination-fee" loans but may offset the waived fee with a higher interest rate or other costs.

Origination fees are part of closing costs and differ across lenders and loan programs, so borrowers should compare the total cost of each loan offer (APR, fees, and rate) rather than focusing only on a single fee line item.

Are Loan Origination Fees Tax Deductible?

Some origination charges, which are commonly called "points", may be deductible as mortgage interest if they meet IRS rules for deductible points. For purchase loans, bona fide points paid as prepaid interest may be deductible in the year paid if they satisfy specific tests. They must be common in the area, properly documented, and allocable to mortgage interest.

For refinances, points are generally deducted over the life of the loan (amortized), not all at once. The IRS rules are technical. Borrowers should consult a qualified tax professional for guidance tailored to their situation.

How to Calculate Loan Origination Fee?

It is really easy to estimate loan origination fee. Just multiply the loan amount by the origination percentage or use the lender's stated flat fee. Here's the example: $350,000 loan at a 1% origination fee = $3,500 ($350,000 × 0.01).

If the lender uses a flat fee, use that flat amount. When comparing offers, convert all costs into an effective annual cost (APR) or compare total closing costs plus lifetime interest to understand true cost differences.

What is the Difference Between Loan Origination and Underwriting?

Loan origination is the full lifecycle from application to funding. Underwriting is a critical phase within origination focused on risk assessment and final approval decision. Underwriters validate credit, income, assets, appraisals, and apply program or investor guidelines (conventional, FHA, VA, USDA) to decide approval and conditions.

Origination also includes borrower intake, customer service, disclosure documents (TILA-RESPA), closing logistics, and post-closing funding/servicing setup. Functions that extend beyond underwriting's risk decision role.

FAQs About Home Loan Origination

Q1. What is a mortgage loan originator?

A mortgage loan originator (MLO) is a licensed professional who assists borrowers in finding and applying for mortgage loans. MLOs can work for banks, credit unions, or mortgage brokerages. In the U.S., MLOs must follow federal and state rules and are typically licensed and registered through the Nationwide Multistate Licensing System (NMLS). They help complete the application, explain loan options, collect documentation, and guide borrowers through closing.

Q2. What are loan origination points?

Origination points are fees charged by a lender expressed as a percentage of the loan amount (one point = 1%). Origination points compensate the lender for creating the loan. They differ from discount points, which a borrower can pay upfront to buy down the interest rate. Point amounts and uses vary by lender and loan program.

Q3. What is loan origination software?

Loan origination software (LOS) is a digital platform that automates parts of the lending workflow: application intake, document collection, automated verifications, credit pulls, underwriting rules engines, compliance checks, and disclosure generation. Modern LOS integrations with appraisal portals, credit bureaus, e-signing, and e-closing tools accelerate processing, reduce manual errors, and improve borrower experience. Adoption of LOS and digital channels has grown significantly across lenders of all sizes. If you just became a loan officer, it's a good idea to use a top loan origination system like Zeitro.

Q4. What is loan origination date?

The loan origination date is the date the lender establishes the loan, which is commonly the date of funding/closing or the date the loan is consummated. It is distinct from the initial application date or pre-approval date and matters for interest accrual, escrow accounting, and certain reporting requirements. Exact definitions can vary by program and documentation, so borrowers should confirm the origination/closing date shown on their loan documents.

Conclusion

Loan origination is the structured, multi-step process that turns a mortgage application into a funded loan. Understanding documentation requirements, typical timeline expectations, fee structures, and the distinction between origination and underwriting helps borrowers navigate the mortgage process more confidently.

To improve outcomes, work with licensed loan officers, keep financial documents organized, compare full loan offers (not just advertised rates), and consult tax or legal professionals for questions about deductibility or contract terms. Even as technology reshapes origination, the core goals remain the same: accurate verification, fair pricing, and responsible lending.

Whether you're a borrower or a loan originator, MyMortgageRates is an innovative platform to improve your loan efficiency.