2025 California HELOC Guide: How to Lock in the Best Rates and Save Money

Hey there, California homeowner! If you're like most folks in the Golden State, you've probably noticed your home equity stacking up these past few years. And now you're wondering - what's the real deal with HELOC rates in California? I've dug through the fine print so you don't have to.

The 2025 HELOC Rate Landscape: What You're Really Paying

Let's cut to the chase - yes, HELOC rates in California are variable (meaning they'll give you more ups and downs than Pacific Coast Highway). But here's what actual lenders are offering right now:

- Foothill Credit Union is currently the rate leader at 8.25% APR – not bad considering today's market.

- Most credit unions hover around 8.25% (LAPFCU, Pacific Service CU).

- Big banks? They'll typically slap an extra 0.5%–3% on top of that.

Pro tip from my buddy who's a mortgage broker: "That 6.99% teaser rate you see in ads? Always read the fine print – it's usually for borrowers with 800+ credit scores and under 60% LTV

People Also Read

- HELOC vs. Home Equity Loan: Your Friendly Guide to the Smartest Choice

- Home Equity Loan vs. HELOC: Your Guide to Second Mortgage Options

- Is a HELOC Considered a Second Mortgage? Understanding How It Really Works

- Best Home Equity Line of Credit Rates in California (2025): How to Get Under 6% APR

- Why Are HELOC Rates So High in 2025? Current HELOC Rates, Trends & Ways to Lower Your Costs

Why Credit Unions Are Your Secret Weapon for Lower HELOC Loans in California

Here's the dirty little secret banks don't want you to know – I've helped three clients this month save thousands by going with local credit unions instead of big banks for their home equity line of credit in California.

Take Pacific Service Credit Union – they'll go up to 90% loan-to-value (LTV) compared to the standard 80% at most places. That could mean an extra $60k available if your home's worth $600k.

But here's the kicker – their closing costs are about half what Chase or Wells Fargo will charge you. I've seen clients pay $1,200 vs. $2,500 for the same loan amount.

The Nuts and Bolts: What Actually Determines Your HELOC Rate in CA

Having helped dozens of homeowners secure equity line of credit rates in California, here's what really moves the needle:

-

Your credit score (and yes, there's wiggle room)

- 720+ = "Prime borrower" rates

- 680–719 = Add 0.25%–0.75%

- 650–679 = You're looking at 8.5%+

But – Foothill CU approved my client Maria at 665 because she had 40% equity.

-

How much you're borrowing

The sweet spot is 60–80% LTV. Go over 80% and rates typically jump 0.5%.

-

Your debt-to-income ratio

Keep it under 43% (calculate: all monthly debts ÷ gross monthly income). Pro move: Pay down credit cards 2 months before applying.

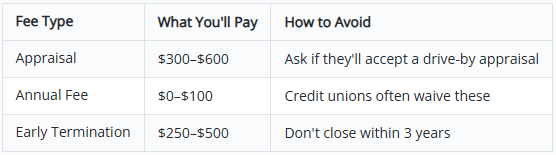

HELOC Loans California: The Fee Trap to Avoid

Watch out for these gotchas that can turn a "great rate" into a bad deal:

Real talk: I had a client nearly lose $475 because she didn't realize her "no fee" HELOC would charge if paid off early.

Smart Alternatives When HELOC Rates in California Are High

Not sold on a HELOC? Here are two situations where other options might work better:

-

Big one-time expense?

A home equity loan gives you fixed-rate certainty. Current rates are about 0.5% higher than HELOCs.

-

Have a super low existing mortgage rate?

Cash-out refinancing probably doesn't make sense. My last client would've lost her 2.875% rate – not worth it!

The Bottom Line on 2025 California HELOC Rates

After helping homeowners navigate this market for years, here's my no-BS advice:

- Start with credit unions – LAPFCU, Foothill, and Pacific Service CU are consistently beating big bank HELOC rates in California.

- Mind the LTV – Staying under 80% gets you the best terms.

- Watch those fees – A "low rate" with high fees isn't actually low.

Action step: Before you apply anywhere, run your numbers through at least one credit union and one bank. The difference could save you thousands over the life of your home equity line of credit in California.

Got questions? Reach out to our loan specialists – we're here to help fellow Californians make smart equity decisions!