Best Home Equity Line of Credit Rates in California (2025): How to Get Under 6% APR

If you're a California homeowner looking to tap into your home's value, understanding home equity line of credit rates in California is key. Whether you're planning renovations, consolidating debt, or covering major expenses, a HELOC offers flexibility—but only if you get the right rate. Here's what you need to know to make an informed decision (without the financial mumbo-jumbo).

Current HELOC Rates in California (April 2025 Update)

Right now, home equity line of credit rates in California average around 8.03% APR, slightly lower than last year's peak. But here's the catch—not all lenders offer the same deal. Local credit unions and online lenders often have more competitive rates, especially if you're an existing member.

For example:

- Los Angeles Police Federal Credit Union (LAPFCU) offers an introductory rate of 5.74% APR for the first year (then adjusts to a variable 8.25% APR).

- San Francisco Federal Credit Union provides a fixed-rate home equity loan at 7.875% APR—ideal if you prefer stable payments.

Pro Tip: Always check if that attractive rate is just temporary. Some lenders hike up the APR after the introductory period, so read the terms carefully!

How to Qualify for the Best HELOC Rates in California

Your credit score, loan-to-value (LTV) ratio, and debt-to-income (DTI) ratio all impact the home equity line of credit rates in California you'll be offered. Here's how to improve your chances:

✅ Boost Your Credit Score – A FICO score of 720+ will help you secure the lowest APR. Below 650? You might still qualify, but expect higher rates.

✅ Increase Your Home Equity – Most lenders prefer an LTV under 80%. The more equity you have, the better your rate.

✅ Lower Your Debt – Keeping your DTI below 43% shows lenders you can manage payments responsibly.

Insider Hack: If you're already a member of a credit union (like LAPFCU), ask about relationship discounts—sometimes just having a checking account with them can lower your rate.

Watch Out for Hidden Fees

A low rate is great, but extra fees can add up. Before you apply, ask about:

- Annual fees (50–**50–**100)

- Early closure penalties (e.g., LAPFCU charges $500 if you close within 2 years)

- Appraisal costs (300–**300–**600)

- Inactivity fees (if you don't use the credit line)

Smart Move: Some lenders waive fees if you borrow a certain amount—always negotiate!

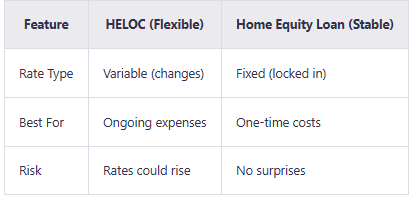

HELOC vs. Home Equity Loan: Which Is Right for You?

Not sure whether a HELOC or a fixed-rate home equity loan is better? Here's a quick comparison:

If you prefer predictability, a fixed-rate home equity loan might be safer. But if you need flexibility (like for a long renovation), a HELOC could be the better choice.

How to Apply for a HELOC in California

Ready to get started? Follow these steps:

- Check your credit score (use free tools like Credit Karma).

- Calculate your home equity (current value minus your mortgage balance).

- Compare lenders—credit unions, big banks, and online lenders all have different perks.

- Get pre-approved (a soft credit check won't affect your score).

- Submit documents (pay stubs, tax returns, mortgage statements).

Most approvals take 2–4 weeks, but some online lenders can move faster.

Final Tips for Securing the Best HELOC Rates in California

- Shop around—Local credit unions like LAPFCU often offer better rates than big banks.

- Improve your credit score before applying.

- Ask about discounts (some lenders lower your APR for autopay or multiple accounts).

- Consider fixed-rate options if you're worried about rising interest rates.

Next Steps:

- Use online rate comparison tools to see real-time offers.

- Consult a financial advisor if you need personalized advice.

FAQs: Quick HELOC Answers

Q: Can I get a HELOC with bad credit in California?

A: It's possible, but tougher—most lenders want 650+. Some credit unions may be more flexible.

Q: Will a HELOC affect my California property taxes?

A: Not directly, but major renovations could increase your home's value—and potentially your taxes.

Q: What's the fastest way to get a HELOC?

A: Online lenders can approve you in days, but compare rates—they're sometimes higher.

Bottom Line

With the right strategy, you can secure competitive home equity line of credit rates in California and make the most of your home's equity. Just do your research, watch for fees, and choose the lender that fits your needs.

Ready to apply? Start comparing rates today! People Also Read

- 2025 California HELOC Guide: How to Lock in the Best Rates and Save Money

- Is a HELOC Better Than a Mortgage? How to Decide Which Works for You

- HELOC vs. Home Equity Loan: Your Friendly Guide to the Smartest Choice

- Is a HELOC Considered a Second Mortgage? Understanding How It Really Works

- Why Are HELOC Rates So High in 2025? Current HELOC Rates, Trends & Ways to Lower Your Costs