Why Are HELOC Rates So High in 2025? Current HELOC Rates, Trends & Ways to Lower Your Costs

Today’s Current HELOC Rates

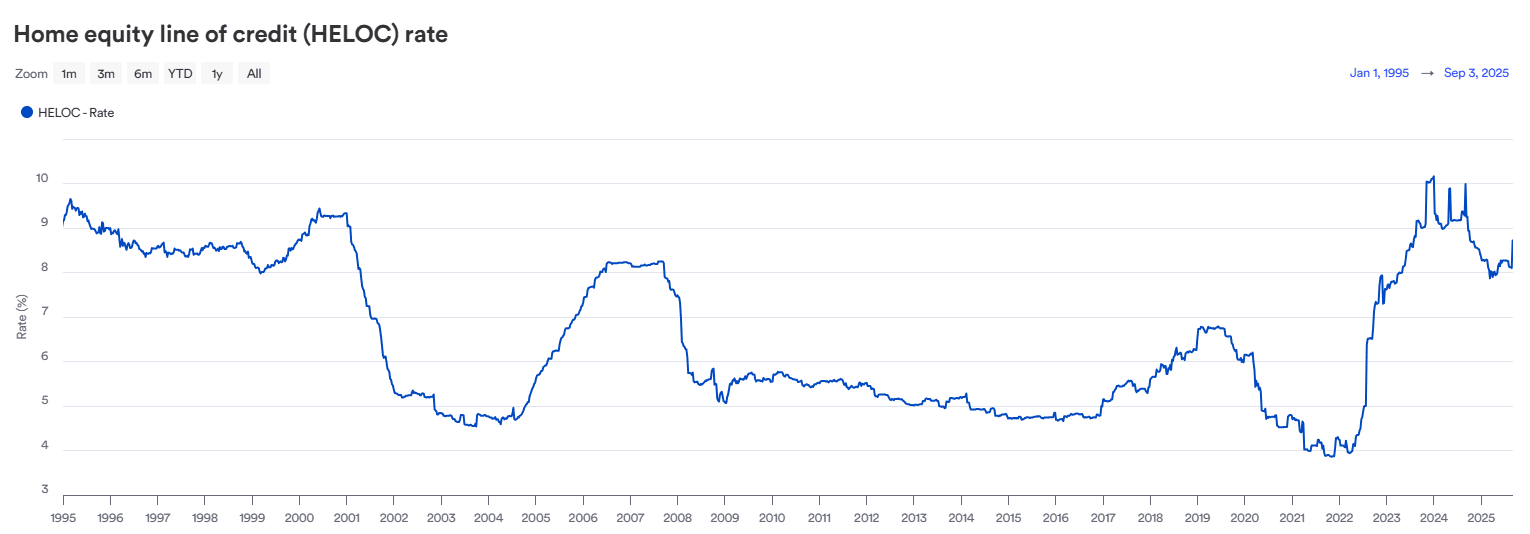

As of September 2025, the average interest rate for U.S. Home Equity Lines of Credit (HELOCs) is around 8.1%, the lowest point in the past three months. While this remains elevated compared with pre-pandemic historical levels, the recent decline has offered some relief for borrowers. The actual rate an applicant receives can vary widely: those with strong credit histories and lower borrowing amounts may see rates in the 7% range, while borrowers with average credit scores or higher debt ratios might face offers of 9% or even higher.

To better understand where today’s rates stand, it helps to look at the trend of average U.S. HELOC rates over the past 30 years.

What Affects HELOC Rates and How Often Do They Change?

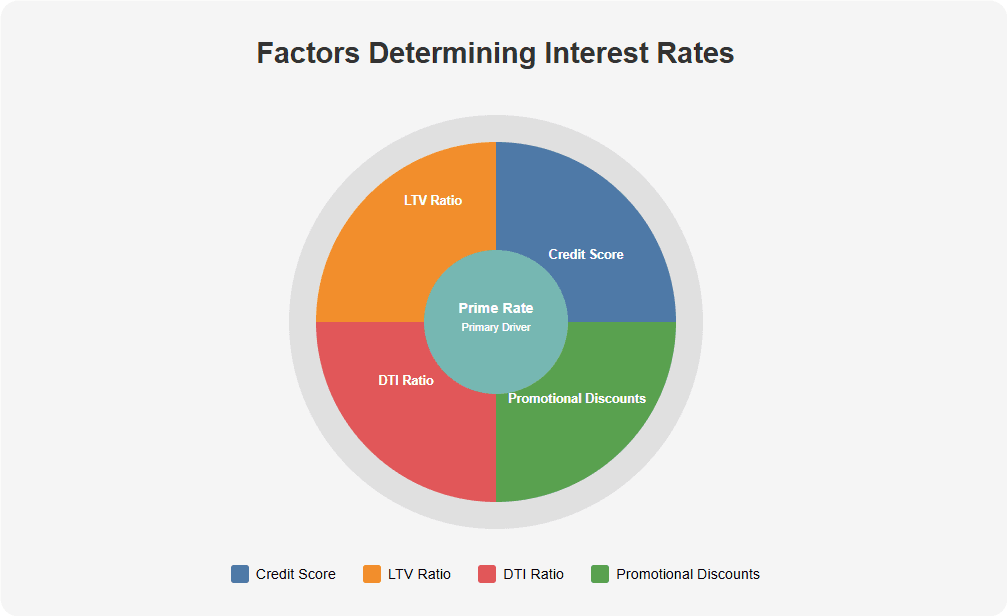

HELOC interest rates are usually variable, and the primary driver is the Prime Rate, which moves in line with Federal Reserve policy changes. When the Fed raises or lowers rates, banks typically adjust HELOC pricing in the following weeks.

Beyond that, several personal financial factors influence the final rate: credit score, loan-to-value ratio (LTV), and overall debt obligations. A credit score above 740 and an LTV below 80% usually qualify for the lowest margin added to the Prime Rate. Conversely, limited home equity or a high debt load will push rates higher.

In terms of frequency, HELOC rates most often adjust monthly, recalculated at the beginning of each month based on the updated Prime Rate. Some agreements also include a rate “cap,” which prevents interest charges from rising indefinitely, even if market rates surge.

How to Get the Best HELOC Rates

Borrowers aiming for lower HELOC rates can focus on:

Improving credit scores: Raising your score above 740 often directly reduces your rate.

Keeping LTV low: Borrowing less than 80% of your home’s value signals lower risk to lenders.

Taking advantage of promotional offers: Many banks offer fixed introductory rates for the first 6–12 months before reverting to variable terms.

Shopping around: Rate quotes vary significantly by lender. Comparing multiple offers and asking about extra discounts—such as linking a payroll account, opening a savings account, or enrolling in autopay—can make a difference.

Why Is My HELOC Interest Rate So High?

If your HELOC feels expensive, the reasons may include:

The current Prime Rate remains elevated, raising everyone’s borrowing costs.

Personal factors such as a lower credit score or high LTV increase your risk profile.

Larger loan amounts or a weaker debt-to-income position can drive rates higher.

Contract terms may include a high interest rate cap (some as high as 18%), effectively locking you into an upper range.

Are HELOC Rates Predicted to Go Down?

Market expectations suggest the Federal Reserve may begin cutting rates in the coming months. If inflation continues to ease, a lower Prime Rate could translate into reduced HELOC rates. Indeed, today’s 8.1% average is already lower than in previous months.

Still, this remains a forecast. Persistent inflation or an overheated economy could cause the Fed to hold or even raise rates, keeping HELOC costs elevated. Whether to wait for lower rates depends on your financial urgency and tolerance for risk.

Is Now a Good Time to Get a HELOC or Home Equity Loan?

The answer depends on your goals and financial position:

If you need funds to pay off high-interest credit card debt or finance a home renovation, a HELOC may still be cheaper than most credit cards despite current rates.

If you are not in urgent need of funds, waiting for further rate cuts could lower your borrowing costs.

If predictability matters most, a fixed-rate home equity loan may provide stability, protecting you from future rate fluctuations.

Types of Home Equity Line of Credit Rates

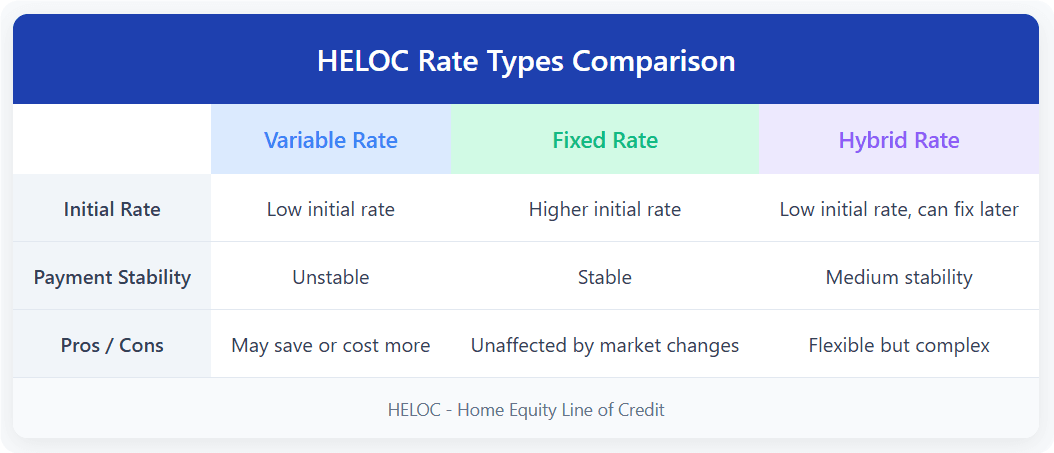

When evaluating a HELOC, understanding rate structures is critical. Different rate types directly affect monthly payments and overall borrowing costs. HELOCs generally come in three forms: variable, fixed, and hybrid rates.

When evaluating a HELOC, understanding rate structures is critical. Different rate types directly affect monthly payments and overall borrowing costs. HELOCs generally come in three forms: variable, fixed, and hybrid rates.

Variable HELOC Rates

Variable rates are the most common type. They are tied to a benchmark index such as the Prime Rate and adjust in line with market movements.

Pros:

Typically start with lower initial rates.

Payments may decrease if market rates fall.

Cons:

Payments can rise unpredictably.

Budgeting is less predictable.

Best suited for borrowers comfortable with rate fluctuations or those planning short-term use.

Fixed HELOC Rates

Fixed rates allow borrowers to lock in interest for a set period, ensuring predictable monthly payments.

Pros:

Stable, predictable payments.

Protection from rising interest rates.

Cons:

Initial rates are generally higher than variable rates.

No benefit if market rates decline.

Well-suited for those seeking payment stability and protection from volatility.

Hybrid HELOC Rates

Hybrid rates combine elements of both structures. Borrowers may begin with a variable rate and later convert part or all of the balance to a fixed rate.

Pros:

Lower initial rates save interest costs.

Flexibility to lock in stability later.

Cons:

More complex to understand and manage.

Conversion may involve fees or restrictions.

Good for those who want initial savings but also value long-term certainty.

Why a HELOC Can Be the Better Choice Today

HELOC Rates Are Variable

HELOCs carry variable rates, which means they adjust with the Prime Rate. While variability adds uncertainty, it also provides flexibility—borrowing costs can fall as market rates decline. Unlike fixed-rate loans, which lock in a rate even if it is high, HELOCs allow borrowers to benefit from a downward rate cycle.

HELOC Rates Could Drop Soon

Recent economic data and the Fed’s policy direction suggest rates may fall in the coming months. Choosing a fixed-rate loan now could mean missing out on the potential savings from declining variable rates.

Home Equity Loans Will Need to Be Refinanced

With fixed-rate home equity loans, the only way to benefit from future rate reductions is through refinancing. That process comes with extra costs, paperwork, and time. HELOC borrowers, on the other hand, automatically benefit from lower market rates without refinancing, offering greater flexibility.

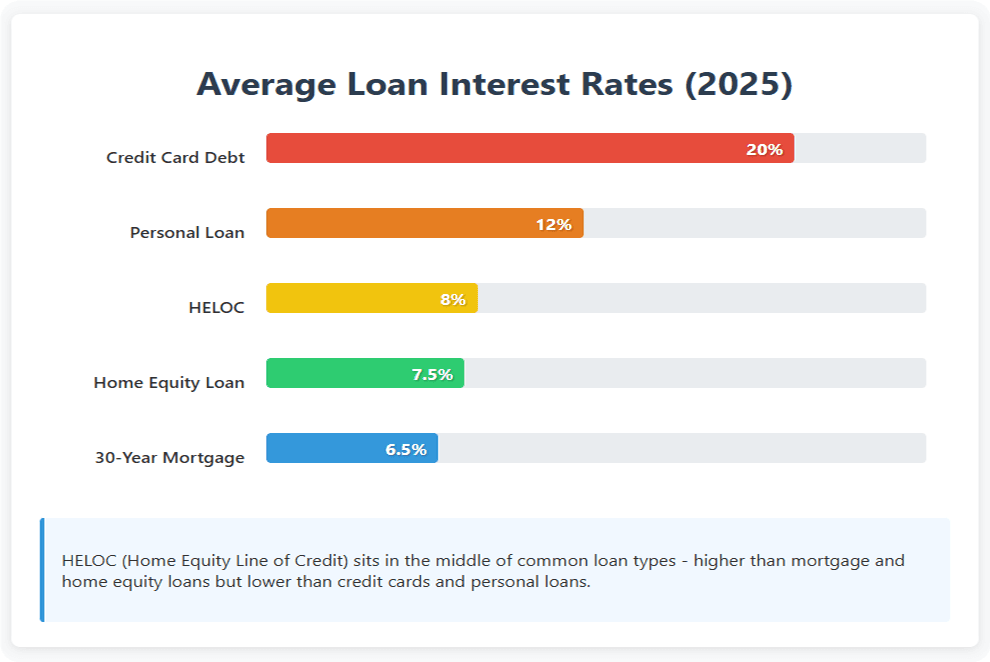

How HELOC Interest Rates Compare to Other Loan Types

Comparing HELOC and Home Equity Loan Rates: Which Costs Less?

HELOCs typically use variable rates, while home equity loans are fixed. In a falling-rate environment, HELOCs may cost less, while home equity loans appeal to those prioritizing predictability. Cost efficiency often depends on the direction of rates and personal budgeting needs.

HELOC vs Mortgage Refinance Rates: When One Makes More Sense

For homeowners with an existing mortgage, refinancing locks in a new fixed rate but involves closing costs such as application and appraisal fees. A HELOC offers flexible access to equity without refinancing, making it better for short-term or flexible borrowing. Refinancing makes more sense for those wanting long-term lower payments.

HELOC vs Personal Loan Rates: Understanding the Interest Difference

Personal loans, being unsecured, usually carry higher rates since lenders take on more risk. HELOCs are secured by home equity, which lowers risk and leads to more competitive rates. For larger sums or home-related expenses, HELOCs tend to be more cost-effective.

How HELOC Rates Stack Up Against Standard Mortgage Rates

HELOC rates are generally higher than existing fixed mortgage rates but lower than credit card or unsecured loan rates. For homeowners, HELOCs provide a flexible funding source for renovations, education, or emergencies. Though slightly higher than mortgage rates, their draw flexibility and repayment options offer unique financial advantages.

The Takeaway

HELOCs remain a versatile tool for tapping into home equity. Their variable rates can provide cost savings in a declining-rate environment, while their flexibility and lower costs compared to personal loans or refinancing make them attractive. Still, the choice between a HELOC, a fixed-rate home equity loan, or another borrowing method depends on your financial situation, objectives, and risk tolerance. Understanding the differences across loan types allows you to make the most of your home equity and align borrowing with long-term financial goals.

People Also Read

- 2025 California HELOC Guide: How to Lock in the Best Rates and Save Money

- Is a HELOC Better Than a Mortgage? How to Decide Which Works for You

- HELOC vs. Home Equity Loan: Your Friendly Guide to the Smartest Choice

- Is a HELOC Considered a Second Mortgage? Understanding How It Really Works

- Best Home Equity Line of Credit Rates in California (2025): How to Get Under 6% APR