Is a HELOC Considered a Second Mortgage? Understanding How It Really Works

In most cases, a Home Equity Line of Credit (HELOC) is considered a type of second mortgage. But it isn’t exactly the same as a traditional second mortgage. Let’s break down why a HELOC is classified this way, and what makes it unique.

What Makes a HELOC a Second Mortgage?

A HELOC is generally seen as a second mortgage because of how it’s secured and structured.

First, like any mortgage loan, it’s backed by your home equity. This means if you fail to make payments, the lender has the right to foreclose on your home to recover what you owe. But since it’s not your primary mortgage, it’s considered a subordinate loan. In other words, if your home were foreclosed and sold, the first mortgage lender would get paid first, and the HELOC lender would only be repaid after that.

Second, a HELOC adds another layer of debt. Even though it offers flexible access to funds — letting you borrow, repay, and borrow again during the draw period — it still increases your overall financial obligations.

So, when you put it all together — collateralized by your home, secondary in repayment order, and adding extra debt — that’s why a HELOC is viewed as a second mortgage. It can be a valuable way to access funds, but it also requires careful money management to avoid overextending yourself.

Understanding the Key Characteristics of a HELOC

A HELOC is a flexible financial tool that combines features of both a credit card and a traditional mortgage. But with that flexibility comes some responsibility and risk. Here are the key traits you should know before applying.

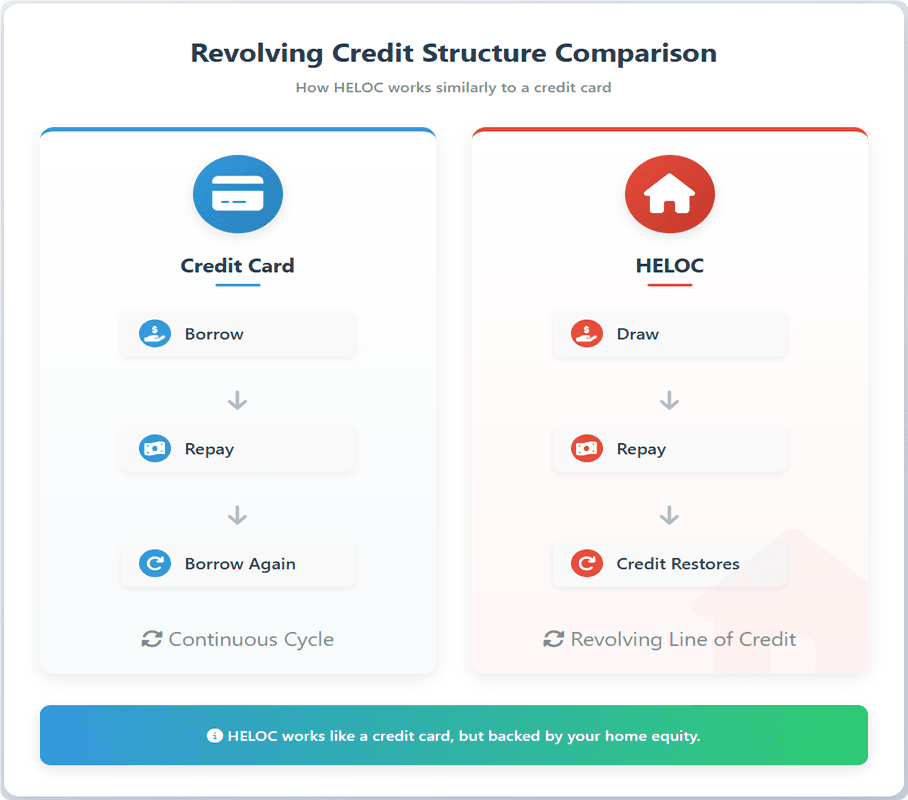

Works Like a Credit Card

A HELOC operates on a revolving credit system. During the draw period, you can borrow and repay funds as often as you like, up to your credit limit. Once you pay some of it back, that credit becomes available again. This means you can use the money as needed, without reapplying for a new loan each time.

Backed by Home Equity

Your home serves as collateral for the loan. Because of this security, HELOC interest rates are usually lower than unsecured loans. However, it also means that missed payments could put your home at risk of foreclosure.

Financial Risks

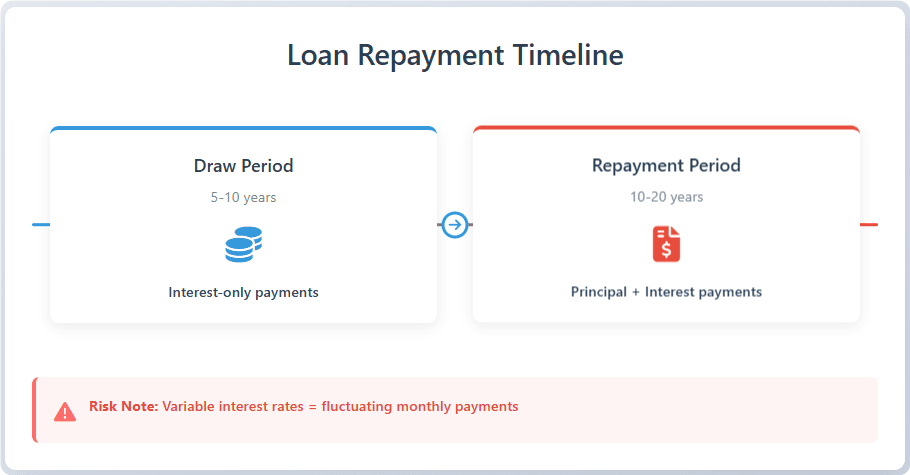

HELOCs usually come with variable interest rates. That means your monthly payments can change as market rates rise or fall — making it harder to predict your costs. On top of that, changes in your home’s value could affect how much you’re able to borrow. If you’re not careful, unexpected costs can creep up quickly.

Repayment Terms

Most HELOCs have two phases: the draw period and the repayment period. During the draw period, you’re often only required to pay interest (though you can choose to pay down principal too). Once the repayment phase begins, you’ll need to pay both principal and interest, which usually makes monthly payments higher.

Most HELOCs have two phases: the draw period and the repayment period. During the draw period, you’re often only required to pay interest (though you can choose to pay down principal too). Once the repayment phase begins, you’ll need to pay both principal and interest, which usually makes monthly payments higher.

Flexible Use of Funds

One of the biggest advantages of a HELOC is how you can use the money. Whether it’s home improvements, tuition, medical bills, or just a financial cushion, the choice is up to you. Unlike some loans, you’re not locked into specific uses.

Second Mortgage vs. HELOC: Pros and Cons

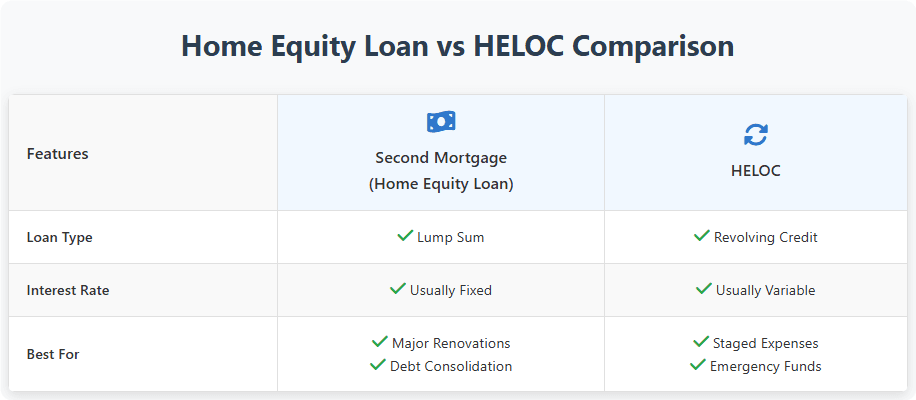

When tapping into home equity, homeowners often consider either a second mortgage (home equity loan) or a HELOC. Both have benefits and drawbacks.

Advantages of a Second Mortgage

- Provides a lump sum upfront.

- Typically comes with a fixed interest rate, so your payments are predictable.

- Works well for large, one-time expenses like major renovations or debt consolidation.

Drawbacks of a Second Mortgage

- Less flexible: once you’ve borrowed, you can’t re-borrow without taking out another loan.

- Some lenders charge prepayment penalties if you pay off early.

- Adds a fixed debt that could strain finances if your situation changes.

Advantages of a HELOC

- Highly flexible — borrow, repay, and borrow again during the draw period.

- Great for ongoing or unpredictable expenses, such as phased renovations or emergencies.

- Variable rates could mean lower borrowing costs if market rates drop.

Drawbacks of a HELOC

- Variable rates can also work against you, raising your payments if interest rates climb.

- Home equity can fluctuate, affecting how much you can access.

- Carrying the balance too long without paying down principal can lead to higher interest costs over time.

HELOC vs. Second Mortgage: Which Is Right for You?

Both options give you access to your home equity, but they’re suited to different needs.

- Choose a HELOC if your expenses will come in stages or you want flexibility — for example, ongoing home projects, tuition, or a safety net for emergencies.

- Choose a second mortgage (home equity loan) if you need a large, one-time sum and prefer fixed payments that won’t change.

At the end of the day, it comes down to your financial goals, risk tolerance, and how predictable your funding needs are.

When to Consider a HELOC

A HELOC can make sense when you have substantial home equity and want a flexible way to access funds without borrowing everything upfront. Since you only pay interest on the money you actually use, it can be more cost-effective than taking out a lump sum loan.

Common scenarios where homeowners use HELOCs include:

- Home renovations: Ideal for phased projects — redo the kitchen this year, the bathroom next year, and the basement later — without taking on one big debt all at once.

- Debt consolidation: Roll high-interest debt (like credit cards) into a HELOC with a lower rate to cut monthly costs and pay off balances faster.

- Emergency fund backup: Acts as a safety net for unexpected bills, car repairs, or job loss. If you don’t use it, you don’t pay interest.

- Education expenses: Spread out tuition payments over semesters or years, often at a lower cost than private student loans.

- Large projects with uncertain costs: Whether it’s building a home addition, medical recovery, or launching a business, a HELOC lets you borrow gradually as costs unfold.

FAQ

What is a HELOC?

A Home Equity Line of Credit (HELOC) is a revolving line of credit secured by your home equity. It works more like a credit card than a lump-sum loan, giving you ongoing access to funds during the draw period.

What is a second mortgage?

A second mortgage is any loan that uses your home’s equity as collateral in addition to your first mortgage. It may be a lump-sum home equity loan or a revolving HELOC. Because it’s “second” in line, interest rates are often slightly higher.

Is a HELOC a good idea?

It depends. If you need flexible access to money and are confident in your ability to manage repayments, a HELOC can be very useful. But if budgeting is tough for you, the variable rates could be a downside.

How does a HELOC work?

There are two phases: the draw period (usually 5–10 years), when you can borrow as needed and often only pay interest; and the repayment period (10–20 years), when you must repay principal plus interest.

Is a 2nd mortgage the same as a HELOC?

Not quite. A HELOC is one type of second mortgage. Another type is a home equity loan, which gives you a lump sum with fixed payments. The key difference: HELOCs are flexible, home equity loans are fixed.

Is a HELOC a first or second mortgage?

Most of the time, it’s a second mortgage since it comes after your primary mortgage. But if you own your home free and clear, a HELOC could technically be your first lien.

People Also Read

- 2025 California HELOC Guide: How to Lock in the Best Rates and Save Money

- Is a HELOC Better Than a Mortgage? How to Decide Which Works for You

- HELOC vs. Home Equity Loan: Your Friendly Guide to the Smartest Choice

- Best Home Equity Line of Credit Rates in California (2025): How to Get Under 6% APR

- Why Are HELOC Rates So High in 2025? Current HELOC Rates, Trends & Ways to Lower Your Costs