Can You Lock in a Mortgage Rate? How Rate Locks & Float-Down Options Work

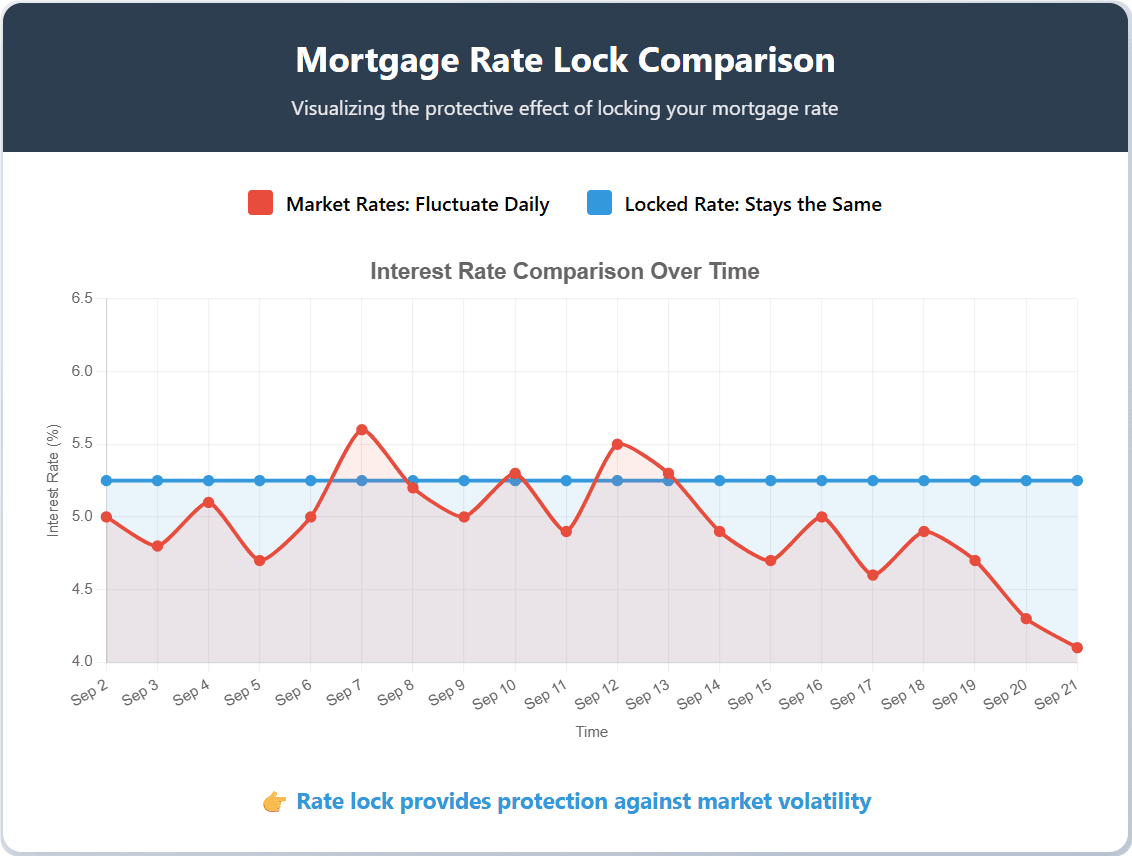

In the homebuying process, fluctuations in mortgage interest rates can have a major impact on your monthly payments and long-term repayment costs. To manage this uncertainty, many lenders offer rate lock agreements and float-down options. Understanding these two mechanisms can help you make smarter decisions in today’s unpredictable market.

What Is a Mortgage Rate Lock?

A mortgage rate lock is an agreement between the borrower and the lender that guarantees your interest rate will remain fixed for a specific period of time—typically 30 to 60 days—even if market rates rise during that window. This gives borrowers protection from rate volatility while their loan application is processed and the closing is completed.

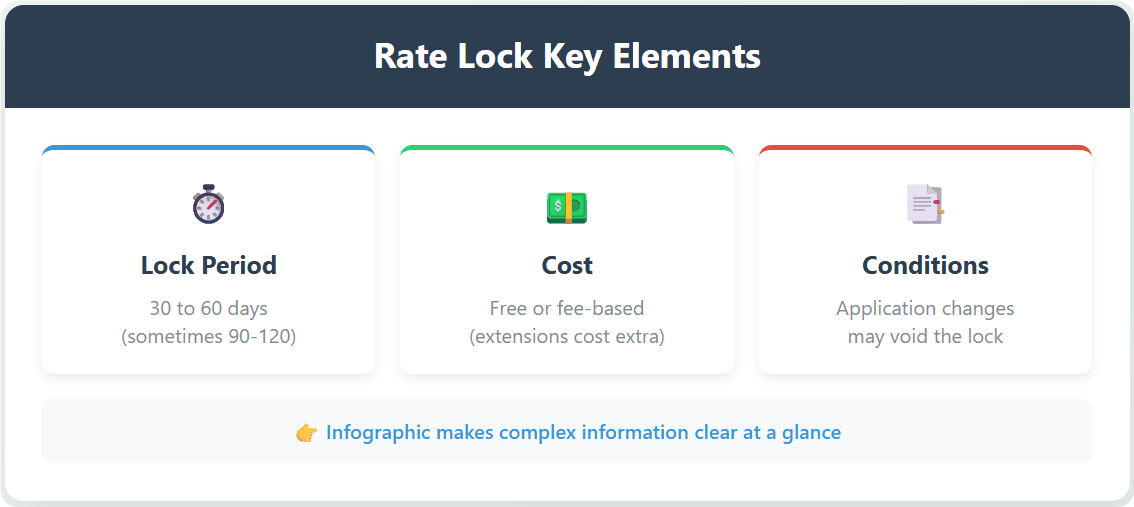

A rate lock generally comes with several key elements. First is the lock period, usually 30 to 60 days, depending on the loan type and the lender’s policies. Second is the cost: some lenders offer rate locks for free, while others charge a fee, especially if the lock needs to be extended. Finally, there are conditions: if significant changes occur in your loan application during the lock period, the agreement may become invalid.

The main benefit of a rate lock is that it shields borrowers from rising interest rates, keeping monthly payments predictable and making budgeting easier. However, it does have limitations. If market rates fall, you won’t automatically get the lower rate, and in some cases you may need to pay additional fees to extend the lock.

What Is a Float-Down Loan Option and What Does It Mean?

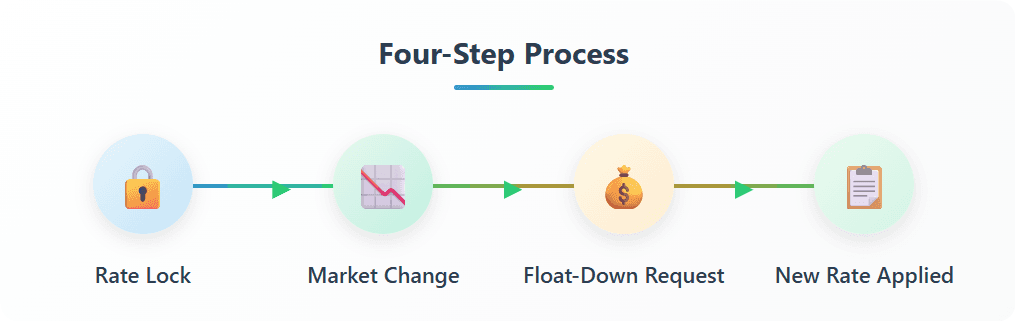

A float-down option allows borrowers who have locked in a rate to adjust to a lower one if market rates drop during the lock period. This feature gives homebuyers both protection from rising rates and the flexibility to take advantage of falling ones.

Here’s how it works: you first lock in your current rate to guard against increases. If rates decline while your lock is still active, you can opt to reset your loan to the lower rate. Usually, this option comes with a fee, and not all lenders offer it.

The benefit of a float-down option is clear: if rates fall, you could reduce your monthly payment and total loan cost, giving you more financial flexibility. But it also comes with limitations, such as extra fees and specific eligibility rules, so you’ll need to confirm details with your lender before committing.

How Mortgage Rate Locks Work and What You Should Know

Rate locks are a key tool in the homebuying process, helping borrowers gain stability in an environment where interest rates can change quickly. Understanding how they work, how long they last, and the circumstances that can affect them is essential for making smart borrowing decisions.

How Do Mortgage Rate Locks Work?

When you apply for a mortgage, your lender may give you the option to lock your interest rate. This means the lender promises that, for the agreed-upon lock period, your rate will not rise—regardless of what happens in the market. Typically, you’ll agree on the lock period with your lender and then submit your loan application and supporting documents. Most locks apply to fixed-rate loans, though details vary between lenders. With a locked rate, you can better plan your monthly payments and avoid unexpected costs from rate changes.

How Long Can You Lock in a Mortgage Interest Rate?

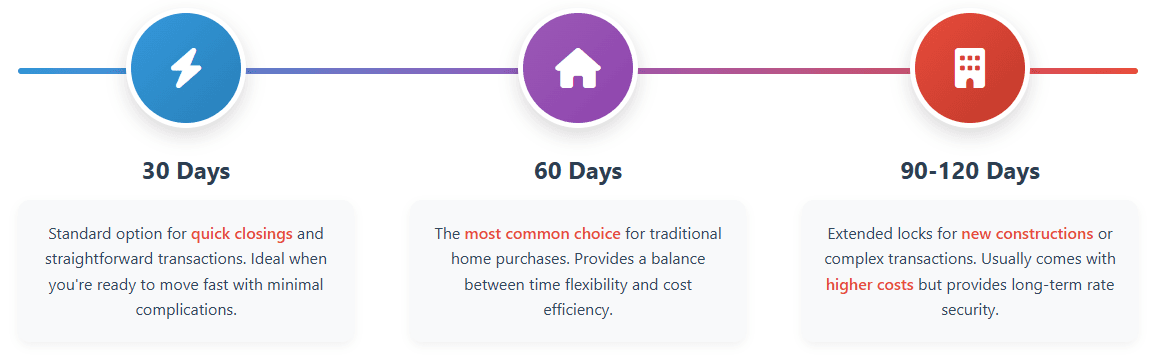

As mentioned earlier, the lock period is typically 30 to 60 days, though some lenders may offer longer periods, such as 90 or 120 days. The right length depends on your homebuying timeline and how long your loan approval and closing are expected to take. If your lock is too short and the process is delayed, you may need to pay extra to extend it. Choosing the right lock period helps you keep your rate stable while avoiding unnecessary costs.

What Happens if Market Rates Drop After Locking?

If rates fall after you’ve locked in, your locked rate won’t automatically adjust to the new lower rate. You’ll continue paying based on the rate you locked. Some lenders solve this with a float-down option, which lets you reset to a lower rate for a fee. But since not all lenders offer it, without this feature, you could miss out on potential savings if rates decline.

Could My Interest Rate Still Change?

Although a rate lock protects you from increases, certain situations can still cause your rate to change. If your loan application changes significantly during the lock period—such as the loan amount, your credit score, or your down payment ratio—the lender may reassess your risk and adjust the rate. Extending the lock period may also trigger extra costs or adjustments. In short, while locks provide strong protection, they’re not absolute, and you should understand the conditions upfront.

Does the Loan Type Affect the Mortgage Rate Lock?

Yes. Loan type affects how locks work. Fixed-rate mortgages usually qualify for standard locks, since the interest rate is consistent throughout the loan. Adjustable-rate mortgages (ARMs) may have different rules, often only locking the initial rate. Knowing how your loan type impacts lock terms is important when choosing the right protection for your situation.

Timing Your Rate Lock

Locking your rate at the right time is just as important as locking it at all. A rate lock protects you from increases and helps you plan your finances more confidently. Understanding when to lock, how to extend, and what happens if your lock expires can save you from unexpected stress and costs.

When Can You Lock in a Mortgage Rate?

Typically, you can lock your rate after your loan application has been approved. Some lenders even allow you to lock earlier, before the full application process begins. The best timing depends on market conditions and your homebuying progress. If rates are relatively low, locking early can secure a favorable deal. But if you’re still shopping for a home or waiting on inspections, it may be better to hold off so your lock doesn’t expire too soon.

Can You Extend Your Mortgage Rate Lock?

If your loan approval or closing takes longer than expected, you may need to extend your lock. Most lenders allow extensions, though usually at an additional cost. Extending keeps your original rate protection in place, but policies and fees vary. When locking in, ask your lender about extension options so you can adjust if needed.

What Happens if My Rate Lock Expires Before Closing?

If your lock expires before closing, the original rate may no longer apply, and your loan could be recalculated based on current market rates—potentially raising your monthly payment. Unless you extend or renegotiate beforehand, you risk higher costs or uncertainty. To avoid this, plan your lock period carefully and stay in close contact with your lender.

Costs and Terms of Rate Locks

Knowing the costs and conditions of rate locks is essential. While they provide protection, they also come with risks and potential fees. Understanding these details helps you make informed choices during your mortgage process.

How Much Does a Rate Lock Cost?

Costs vary by lender and lock length. Some lenders offer free locks, especially for shorter periods. But for longer locks or extensions, you’ll often pay a fee. This could be a flat amount or a percentage of your loan. Before committing, confirm the costs and how they’re calculated so you know the full financial picture.

Risks of Taking on a Mortgage Rate Lock

While locks shield you from rate increases, the biggest downside is missing out if rates drop—you’ll still pay the higher locked rate unless you have a float-down clause. Changes to your loan application, such as the amount borrowed or your credit profile, can also cause your lender to adjust or cancel the lock. And extensions usually come with added costs. All of this should be factored in when deciding to lock.

Can You Negotiate Your Loan Terms at Closing?

Even with a locked rate, some aspects of your loan can still be negotiated before closing. For example, you might be able to reduce fees, adjust the loan amount, or tweak the repayment term. The lock mainly covers the interest rate, but other terms remain flexible. Staying in communication with your lender can help you secure better overall conditions.

How to Lock Your Mortgage Rate: Steps, Strategies, and Float‑Down Options

Locking in your rate is one of the most important steps in securing a mortgage. It can help you stabilize monthly payments and plan for the long term. Knowing the steps, strategies, and options like float-downs can make the process smoother.

Steps to Lock in a Mortgage Rate

The first step is choosing the right lender and loan product. Once you decide on the loan amount, interest type (fixed or adjustable), and lock period, you’ll submit your application and documents. After the lender approves, you can formally request a lock and confirm the rate and timeframe. Be sure you understand the fees and terms before committing. Finally, always get written confirmation of the lock so you’re protected throughout the process.

Mortgage Rate Lock Techniques

There are a few strategies that can improve your chances of getting a favorable lock. Watch market trends and aim to lock when rates are relatively low. Consider a shorter lock period if possible to reduce costs, but match it to your closing timeline. Compare policies across lenders, as some may offer more flexible or affordable lock terms. With the right strategy, you can protect your rate while keeping costs in check.

How to Include a Float-Down Provision in a Rate Lock

To add a float-down, you’ll need to request it upfront when locking your rate and confirm whether your lender offers it. Expect to pay an extra fee, and keep in mind there may be limits—such as only one adjustment or caps on how much the rate can drop. Always review the terms carefully before signing so you know exactly how it will work if rates decline.

Should You Lock Your Rate?

Every borrower eventually faces this question. A rate lock protects you from market swings, but whether it’s worth it depends on your goals, market conditions, and tolerance for risk.

Is a Mortgage Rate Lock Worth It?

The biggest benefit of a lock is certainty. When rates are volatile, locking ensures your payments remain stable during approval and closing. This is especially valuable for first-time buyers or anyone who needs predictability in their finances. A lock also shields you from sudden spikes that could add to your costs.

On the downside, some lenders charge lock fees, particularly for longer periods or extensions. And if rates drop, you might miss out on savings unless you’ve paid for a float-down. So, deciding if a lock is worth it depends on both the market outlook and your personal needs.

Should You Lock Your Mortgage Rate Today?

Deciding whether to lock right now comes down to a few factors. If rates are relatively low and likely to rise, locking sooner can save you money later. If your loan is already in progress but your closing date is uncertain, a lock with an appropriate term can provide peace of mind. Your own risk tolerance matters too: if you prefer stable budgeting, locking is safer. But if you’re willing to gamble on rates dropping, you might delay or choose a lock with a float-down option.

Ultimately, locking is about balancing risk and certainty. Buyers should weigh market trends, loan timelines, and financial priorities before deciding.

FAQs

Many buyers still have questions about rate locks, especially with new construction loans or in a shifting market. Here are some common ones:

When Can You Lock in a Mortgage Rate on New Construction?

For new builds, you can usually lock after your loan application is approved. Some lenders or builders allow you to lock once you’ve signed the contract or paid your deposit. Since construction timelines are often longer, choosing the right lock period becomes even more important. Coordinate with your lender to match the lock period to the expected completion date so you stay protected throughout.

Is It Smart to Lock in a Mortgage Rate?

That depends on market conditions and your personal risk tolerance. If rates are low and expected to rise, locking is usually a wise move. It guarantees predictable payments and simplifies financial planning. For first-time buyers or anyone who dislikes uncertainty, it’s a strong risk-management tool. But if you’re comfortable taking some risk and believe rates may fall, delaying the lock—or adding a float-down—might make more sense.

What Happens if I Lock in a Mortgage Rate and the Rate Goes Down?

If you don’t have a float-down provision, your locked rate doesn’t change when market rates fall. That means you could miss out on savings. Some lenders do offer float-down options, but they typically require extra fees or come with specific conditions. Without it, you’ll continue paying the original locked rate even if the market improves.

People Also Read