Is a HELOC Better Than a Mortgage? How to Decide Which Works for You

What Is a Mortgage and How Mortgages Work

What Is a Mortgage?

A mortgage is a loan that helps a person buy a home without paying the full price upfront. The lender provides the funds, and the borrower repays them over time with interest, usually through monthly payments. The property itself serves as collateral, so if payments are missed, the lender can reclaim it through foreclosure. Mortgages make homeownership possible by spreading the cost over many years.

A mortgage is a loan that helps a person buy a home without paying the full price upfront. The lender provides the funds, and the borrower repays them over time with interest, usually through monthly payments. The property itself serves as collateral, so if payments are missed, the lender can reclaim it through foreclosure. Mortgages make homeownership possible by spreading the cost over many years.

How Mortgages Work

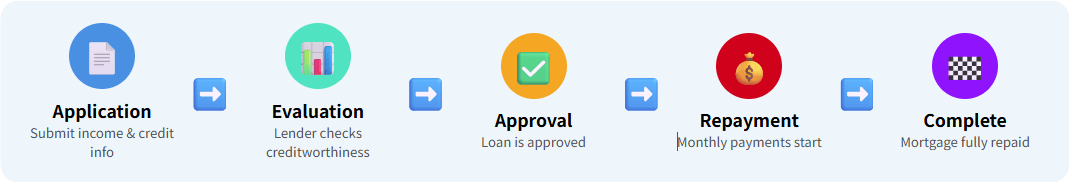

The mortgage process begins with a loan application. Borrowers must provide information such as income, credit score, and current debts. Lenders evaluate the borrower’s ability to repay and determine the loan amount accordingly. The approved loan amount typically depends on the borrower’s income, creditworthiness, and the lender’s risk assessment.

Once approved, the borrower begins repayment according to the contract. Common loan terms are 15 or 30 years, often using a fixed monthly payment that covers both principal and interest. Interest rates can be fixed or adjustable: a fixed-rate mortgage keeps the same rate throughout the repayment period, while an adjustable-rate mortgage changes according to market fluctuations.

Because a mortgage is a secured loan, the property acts as collateral. If the borrower defaults, the lender can reclaim the property. This underscores the importance for borrowers to ensure they can meet repayment obligations before signing the agreement to avoid potential financial loss.

What Is a HELOC and How Home Equity Loans Work

What Is a HELOC?

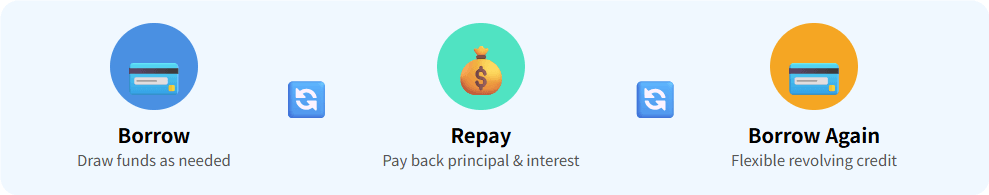

A HELOC, or Home Equity Line of Credit, is a revolving line of credit secured by the equity in your home. Unlike a traditional home equity loan, a HELOC offers flexible borrowing, similar to a credit card. During the draw period (usually 5 to 10 years), homeowners can borrow, spend, and repay funds based on their home’s market value, paying interest only on the amount actually borrowed.

For example, if your home is worth $300,000 and you have an outstanding mortgage of $200,000, and the lender allows borrowing up to 85% of the home’s value, you could borrow up to $55,000. This flexibility makes HELOCs ideal for variable expenses such as home renovations, education costs, or unexpected medical bills.

How a HELOC Works

A HELOC is based on home equity, which is the difference between the current market value of a home and the remaining mortgage balance. For instance, if a home is valued at $500,000 and the mortgage balance is $200,000, the equity is $300,000. Lenders typically allow borrowing 75% to 85% of the home’s equity, depending on creditworthiness and lending policies.

Once approved, borrowers receive a credit limit. During the draw period, funds can be borrowed, repaid, and borrowed again, creating a revolving credit cycle. After the draw period ends, the HELOC enters the repayment phase (usually 10 to 20 years), during which principal and interest must be repaid, potentially increasing monthly payments.

Differences Between Mortgages and HELOCs

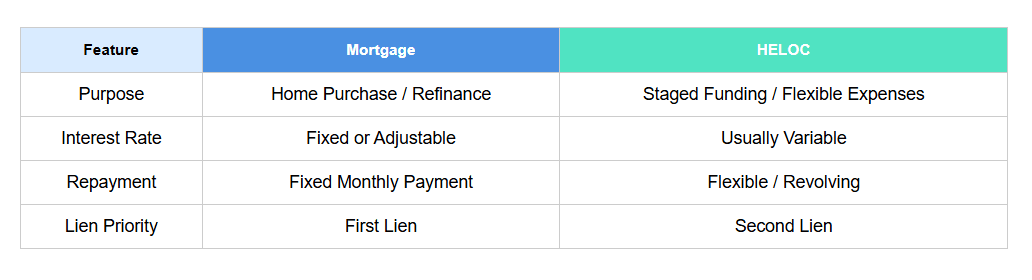

Mortgages and HELOCs differ mainly in purpose, disbursement method, interest rate structure, repayment flexibility, and lien priority.

A mortgage is typically used for home purchases or refinancing. The full loan amount is disbursed at once, usually with a 15- or 30-year term. Interest rates can be fixed or adjustable. Mortgages generally hold a “first lien” position, meaning the lender is paid first in case of default, which makes them more stable and usually lower-cost—ideal for borrowers seeking predictable monthly payments.

A HELOC is essentially a “second lien” revolving credit line. Funds are not disbursed all at once; borrowers can draw as needed within the credit limit, repay, and borrow again. HELOC interest rates are usually variable, tied to market rates, which introduces potential rate risk. Compared with mortgages, HELOCs are better suited for staged or temporary financial needs, such as home renovations.

From a tax perspective, if loan funds are used to purchase, build, or significantly improve a home, interest on a home equity loan or HELOC may be tax-deductible; otherwise, interest is not deductible.

HELOCs generally require higher credit scores and at least 20% home equity, while some mortgage products (like FHA loans) have more lenient credit and down payment requirements. In summary, mortgages are ideal for long-term stable financing with predictable costs, while HELOCs provide flexibility but carry more variable risks.

Pros and Cons of HELOCs and Mortgages

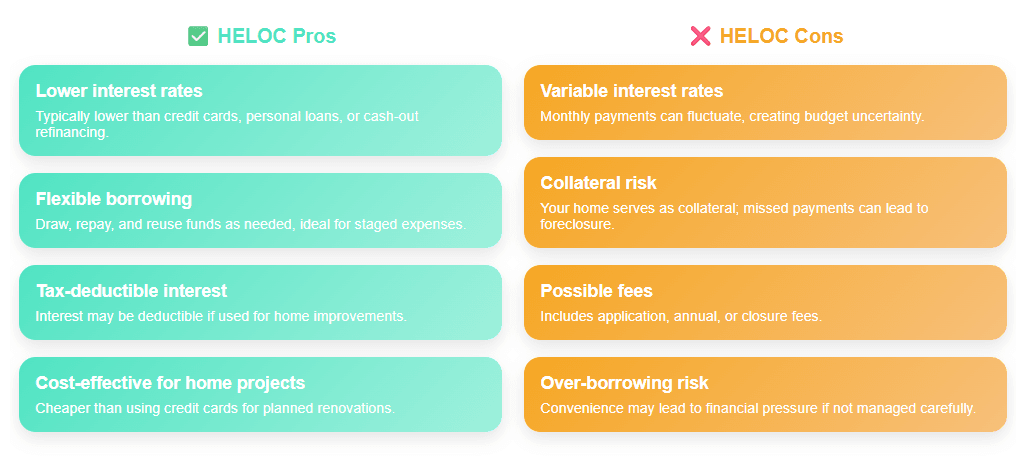

HELOC Pros and Cons

HELOCs offer significant convenience. Interest rates are typically lower than credit cards, personal loans, or some cash-out refinancing options, making them suitable for long-term or staged expenses. Borrowers can draw funds as needed, repay, and reuse the line, providing flexibility. If used to improve the home, interest may be tax-deductible, reducing borrowing costs. Many consider HELOCs a cost-effective alternative to credit cards for home projects.

HELOCs offer significant convenience. Interest rates are typically lower than credit cards, personal loans, or some cash-out refinancing options, making them suitable for long-term or staged expenses. Borrowers can draw funds as needed, repay, and reuse the line, providing flexibility. If used to improve the home, interest may be tax-deductible, reducing borrowing costs. Many consider HELOCs a cost-effective alternative to credit cards for home projects.

However, HELOCs carry risks. Floating interest rates mean monthly payments can vary, creating budget uncertainty. Homes serve as collateral, so missed payments can lead to foreclosure. Some HELOCs include fees, such as application, annual, or closure fees. Additionally, the convenience may lead to over-borrowing, increasing financial pressure. Reddit users often advise using HELOCs only for essential home improvements, not discretionary spending, to avoid losing the home.

Overall, HELOCs are a low-interest, flexible financing tool for borrowers with clear funding needs and stable repayment ability. Those prioritizing budget predictability may prefer fixed-rate loans or traditional home equity loans. Borrowers should weigh variable interest rate risks, repayment capacity, and collateral risks before taking out a HELOC.

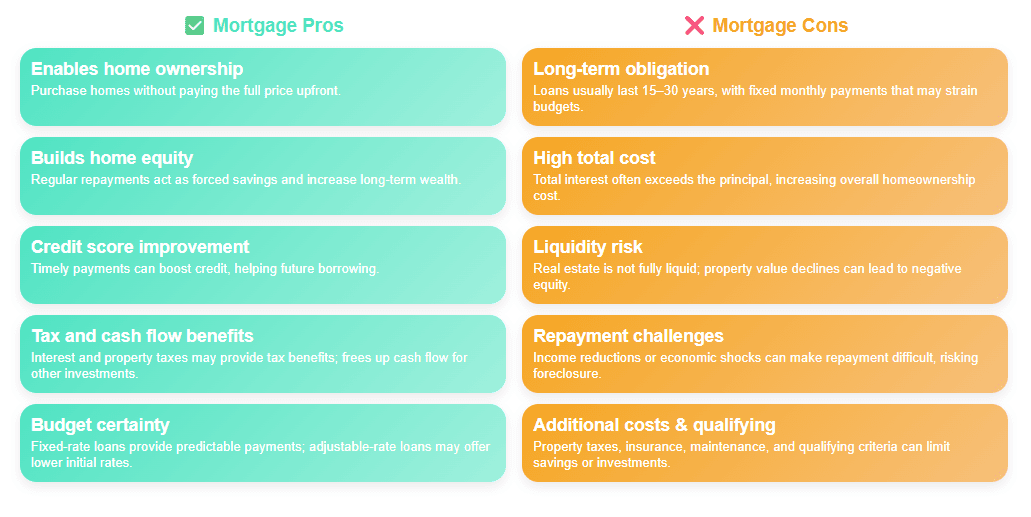

Mortgages Pros and Cons

Pros: Mortgages enable most people to purchase homes without paying the full price upfront. Regular repayments not only fulfill the debt obligation but also act as forced savings, gradually building home equity over time, contributing to long-term wealth accumulation. Timely repayments improve credit scores, which benefits future borrowing. In some regions, mortgage interest and property taxes may provide tax benefits. Mortgages also free up cash flow, allowing borrowers to invest or spend funds elsewhere. Fixed-rate loans provide budget certainty, while adjustable-rate mortgages may offer lower initial rates, suitable for short-term plans or refinancing in the future.

Cons: Mortgages are long-term obligations, usually 15–30 years, and fixed monthly payments can strain budgets. Total interest payments often exceed the principal, increasing the overall cost of homeownership. Real estate is not fully liquid; property value declines can result in negative equity. Income reductions or economic shocks may make repayment difficult, potentially leading to foreclosure. Borrowers also face property taxes, insurance, maintenance, and repair costs. Qualifying for a mortgage requires meeting credit, down payment, and debt-to-income criteria, which can be challenging. Even with approval, high monthly payments may limit savings or investments.

HELOC vs. Mortgage Rates: Is a HELOC Better Than a Mortgage?

Deciding between a HELOC and a mortgage depends on financial goals, repayment habits, and market conditions.

HELOCs offer flexibility: funds can be drawn as needed, ideal for phased home projects or emergency reserves. Recent HELOC rates have declined, sometimes making them cheaper than traditional loans in the short term. Borrowers may also choose to pay interest only during tight cash flow periods, easing repayment pressure.

However, HELOCs carry risks. Variable rates can increase future costs, and revolving borrowing without discipline may lead to long-term debt. Budgeting is less predictable compared with fixed-rate loans.

Traditional mortgages provide stability. Fixed rates guarantee consistent monthly payments, simplifying budgeting. They are suitable for borrowers needing large lump sums for renovations or debt consolidation. Mortgages also promote disciplined repayment since there’s no revolving credit feature.

Reddit users note that HELOCs may be cost-effective for short-term repayment plans (1–2 years), while traditional mortgages are safer for long-term debt. HELOCs are useful when cash flow is tight, as interest-only payments are possible, but banks may market them as long-term products, complicating repayment. For borrowers lacking financial discipline, fixed-rate mortgages are recommended to avoid risks from rate fluctuations or repeated borrowing.

In short, HELOCs suit borrowers needing staged funds or short-term repayment, whereas traditional mortgages are better for predictable payments and large, long-term financing needs.

FAQ

Why Use a HELOC Instead of a Mortgage?

A HELOC provides flexible access to funds, with on-demand withdrawals and interest-only payments, making it suitable for staged expenses or home projects. Traditional mortgages are better for large, one-time borrowing with fixed rates and scheduled repayments. HELOCs usually have variable rates and credit limits based on home value, and failure to repay may result in foreclosure.

What Is the Downside to a HELOC?

Risks include variable interest rates, potential foreclosure if payments are missed, home value changes affecting the credit limit, and additional fees like application or annual fees. Borrowers must assess their financial situation and repayment ability before applying.

Should You Get a Home Equity Line of Credit?

A HELOC is appropriate if you have phased funding needs, such as home improvements or other planned projects. Interest rates are generally lower than unsecured loans or credit cards, and interest may be tax-deductible if used to improve the home. Risks include variable rates, foreclosure if unpaid, credit limit tied to home value, and extra fees. Borrowers should ensure they can manage repayment and potential risks.

Is It Better to Pay Off a Mortgage or HELOC?

Generally, it’s advisable to pay off high-interest, variable-rate debt like a HELOC first, as it carries more risk. Mortgages typically have lower, fixed rates. However, individual financial situations, interest rate tolerance, and overall debt structure should guide decisions. Consulting a financial advisor is recommended. People Also Read

- 2025 California HELOC Guide: How to Lock in the Best Rates and Save Money

- Home Equity Loan vs. HELOC: Your Guide to Second Mortgage Options

- HELOC vs. Home Equity Loan: Your Friendly Guide to the Smartest Choice

- Is a HELOC Considered a Second Mortgage? Understanding How It Really Works

- Best Home Equity Line of Credit Rates in California (2025): How to Get Under 6% APR