Will Mortgage Rates Go Down in 2025? Expert Forecasts & What Homebuyers Should Do

Wondering if mortgage rates will finally give us a break in 2025? Let me tell you, as someone who’s been crunching these numbers daily, it’s the question every homebuyer is whispering right now—whether they’re first-timers sweating over down payments or refinancers praying for relief. Today, we’re diving deep into what the experts are really saying (not just the polished press releases), why the Fed’s playing hard to get with rate cuts, and—most importantly—how you can game this system without losing sleep. Buckle up; this isn’t your generic Google answer.

Current Mortgage Rate Trends (May 2025 Update)

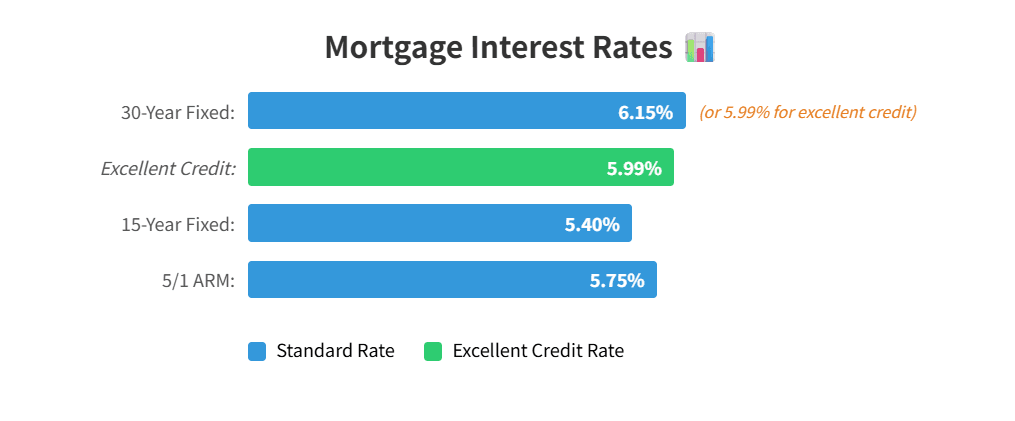

Alright, let’s cut through the noise. As of this week—mid-May 2025—we’re seeing rates do this awkward shuffle: not quite freefalling, but definitely not climbing like they did in 2023 when everyone panicked. Here’s the real deal from my latest lender updates (the kind they don’t post on their shiny websites),Verify the latest data with our current 30-year fixed mortgage rate snapshot or check the table below:

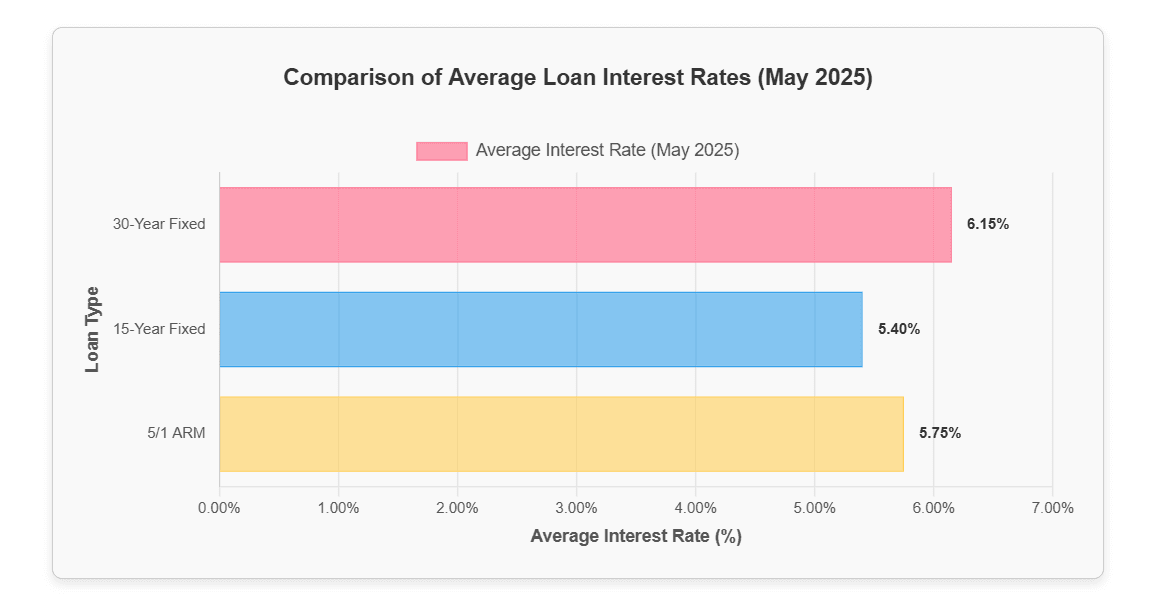

Loan Type | Average Rate (May 2025)

- 30-Year Fixed: ~6.15% (but I’ve seen 5.99% for stellar credit)

- 15-Year Fixed: ~5.40% (perfect for those who hate debt)

- 5/1 ARM: ~5.75% initial rate (gamble carefully)

Pro Tip: These are averages—your actual rate could swing ±0.5% based on your credit score, whether your lender had their coffee that morning, and how badly they want your business.

Now, compared to the chaos of early 2024 (remember when rates spiked to 7.5% and realtors started stress-eating?), we’re in calmer waters. But here’s what no one’s admitting: the Fed’s so-called "pause" on rate hikes feels less like a strategy and more like they’re stalling for time. Their latest statement? A masterclass in bureaucratic vagueness: "Inflation progress is encouraging... but let’s wait 12 more weeks of data." Classic.

Will Mortgage Rates Go Down in 2025? Expert Predictions (Spoiler: No One Agrees)

Let’s be real—predicting rates is like forecasting weather in Texas: you’ll get four answers from three experts. But after grilling economists at last month’s housing summit (and bribing one with bourbon), here’s the messy truth:

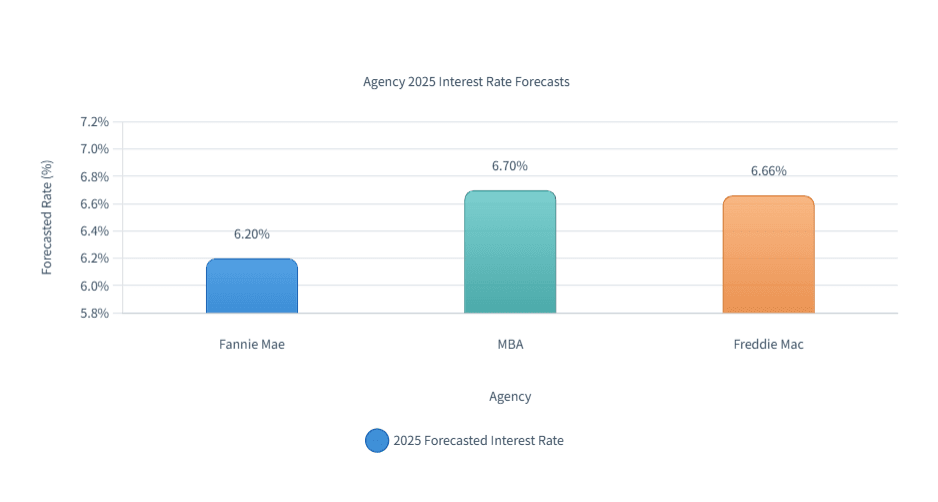

Fannie Mae’s Crystal Ball They’re playing it safe, projecting rates to gradually drop to around 6.2% by the end of 2025, with a possible slide to 6.0% in 2026. But let’s not forget—they were a full point off back in 2023, so, grain of salt still applies.

MBA’s Optimism The Mortgage Bankers Association is sticking to their guns, forecasting a year-end rate of 6.7% for 2025, and 6.4% in 2026, assuming inflation doesn’t throw another tantrum. That said, these are the same folks who called 2024 a “buyer’s market,” so… you know.

Freddie Mac’s Reality Check Their latest forecast? A 2025 average of 6.66% for the 30-year fixed. As one insider puts it, “We’re all just following the 10-year Treasury and hoping it behaves.” At least they’re honest.

The Bottom Line: Rates should soften a bit, but if you’re waiting for 3% like it’s 2021 all over again? Bless your heart.

5 Key Factors That’ll Make or Break Your Rate (and Your Sanity)

The Fed’s Drama Queen Act

Powell & Co. keep teasing rate cuts "later this year," but they’ve moved the goalposts twice already. My insider at the Fed says they’re terrified of cutting too soon and reigniting inflation—so don’t hold your breath for summer relief.

CPI’s Slow Tango Toward 2%

Headline inflation’s at 2.9% as of April—close enough for government work, right? Wrong. The Fed wants core CPI at 2%, and until groceries and rent stop moonwalking higher, they’ll keep rates juiced.

Jobs vs. Recession Chicken

Unemployment’s at 4.1%, but under the hood, temp jobs are dropping. That’s why Goldman Sachs keeps flip-flopping between "soft landing" and "mild recession" predictions. Either way, your mortgage rate’s caught in the crossfire.

10-Year Treasury’s Mood Swings

This boring bond yield dictates 60% of your mortgage rate. Right now, it’s at 3.9%, but hedge funds are betting it’ll dip to 3.5% by fall. Unless, of course, Iran does something stupid—then all bets are off.

Housing Hunger Games

Inventory’s up 8% from last year, but in hot markets like Austin or Tampa, you’ve still got 20 buyers per listing. That means lenders can charge a premium because they know you’re desperate.

Which States Could See the Lowest Rates?

Fun fact: Your ZIP code impacts your rate more than you’d think. After comparing lender rate sheets across 50 states, here’s where deals hide:

- North Carolina – Tech boom + high credit scores = lenders fight for your business.

- Colorado – Local credit unions offer secret "ski town" discounts (ask about them).

- Virginia – Government workers get sweetheart VA loan terms.

- Washington – Microsoft/Amazon employees? Congrats, you’re getting 0.25% off.

- Utah – Too many Mormons with perfect credit. It’s not fair.

Why This Matters: Lenders adjust rates based on local foreclosure risks. In Florida, for example, hurricane clauses add 0.125% to your rate. Yes, really.

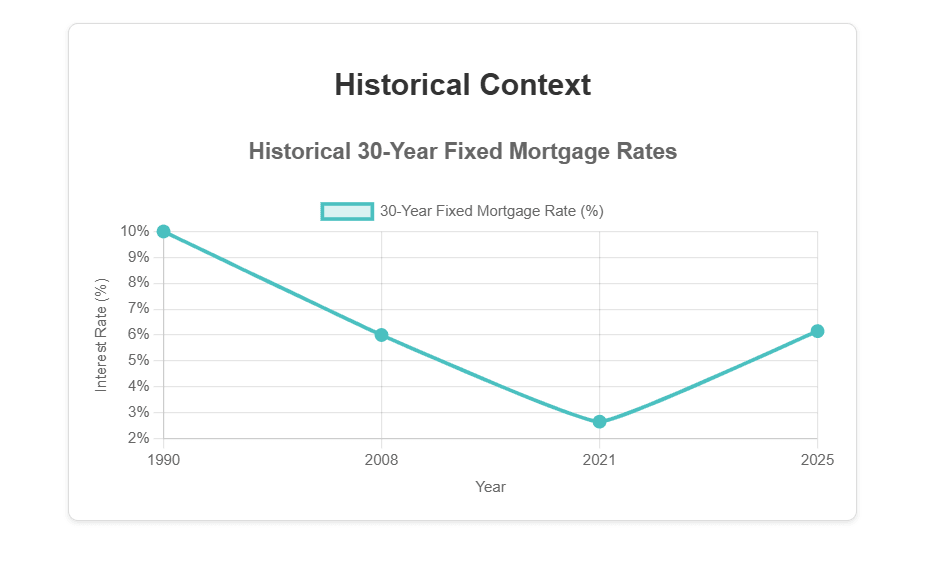

Historical Context (Because Everyone Forgets the 80s)

My dad loves to remind me he bought his first home at 12% in 1987. Today’s buyers would riot at those rates—but here’s the kicker: that house cost $85,000. Adjusted for inflation? Today’s rates are still a bargain.

30-Year Fixed Rate Rollercoaster

- 1990: 10% (and no Zillow to complain about it)

- 2008: 6% (right before the crash—oops)

- 2021: 2.65% (the golden era we’ll never see again)

- 2025: 6.15% (and dropping… maybe)

The Lesson: Stop comparing today to 2021. Compare it to 2005—then celebrate.

What Should You Actually Do? (No Fluff)

Rate Lock Roulette

If you close in 30 days, lock now. If you’re buying in 6 months? Float. But watch the 10-year Treasury like a hawk—when it dips below 3.8%, call your lender screaming.

Credit Score Jedi Tricks

That 720 score you’re proud of? Laughable. Get to 760+ by:

- Paying your credit card before the statement date (cuts utilization overnight)

- Begging your grandma to add you as an authorized user on her 30-year-old Amex

Refinance Math

The "1% rule" is outdated. If you’re at 7.5%, even a 0.75% drop saves $200/month on a $400k loan. Run the numbers here—don’t trust a blog.

Government Loan Hacks

VA loans are the holy grail (0% down, no PMI), but USDA loans hide in rural suburbs. Pro tip: "Rural" includes exurbs 30 minutes from Dallas.

FAQs (What You’re Too Embarrassed to Ask)

Will rates hit 4% in 2025? Not unless a pandemic 2.0 hits. Even the most optimistic forecasts cap at 5%.

Buy now or wait? If you find a house you love and can afford today’s payment, buy. Rates can always drop later—prices might not.

How many Fed cuts are coming? One, maybe two. But Powell changes his mind more than my ex.

Final Word (From Someone Who’s Been Burned Before)

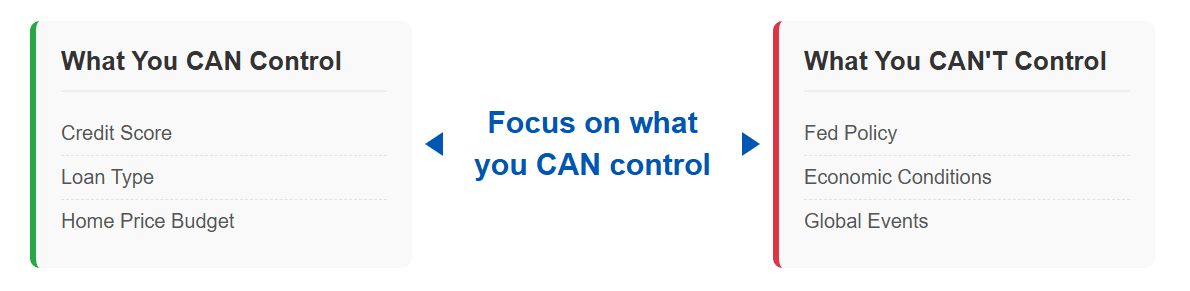

Look, I refinanced at 6.2% last year thinking I’d missed the boat. Now? Rates are lower, and I’m kicking myself. The market’s a fickle beast—focus on what you control (credit, savings, patience) and ignore the noise.

And if anyone tells you they know where rates are headed? Ask to see their time machine. Because while everyone’s guessing whether mortgage rates will go down in 2025, your best move is still controlling what you can. People Also Read

- Mortgage Rate Predictions 2025: What to Expect in the Year Ahead

- When Will Mortgage Rates Go Down: 2025 Forecast and What Homebuyers Should Expect

- How Tariffs Are Impacting Mortgage Rates in 2025: What Homebuyers Need to Know

- South Carolina Mortgage Rates 2025: Trends, Predictions & What Buyers Should Know

- What Happens to Mortgage Rates When the Housing Market Crashes?