![6 Best Loan Origination Software for Mortgage in 2025 [Never Miss]](/_next/image?url=https%3A%2F%2Fdynamic-light-ab6e2536d6.media.strapiapp.com%2Fbest_loan_origination_software_banner_9adccbd2cc.png&w=3840&q=75)

6 Best Loan Origination Software for Mortgage in 2025 [Never Miss]

Like many people discussing what is the best loan origination software on Reddit, I'm sure that's what brought you here. A great helper certainly will help loan officers/brokers to tackle the whole process more smoothly and accelerate loan closes. Here are 6 top loan origination software for you to consider. Let's see which one suits you most!

What is Loan Origination Software?

First of all, what is loan origination software (LOS)? Also known as loan origination systems, they are digital platforms that automate the mortgage journey from initial application through funding. They centralize applicant intake, identity and credit checks, document collection, underwriting decisioning, disclosure generation, and investor delivery.

Modern LOS solutions reduce repetitive data entry, improve auditability, and speed processing by applying workflow automation and AI-assisted checks, while integrating with credit bureaus, appraisal services, and secondary-market systems. If you can choosing the right LOS, that ensures you smoother borrower experiences, fewer manual errors, and better scalability when volumes spike.

6 Top Loan Origination Software to Choose from

After testing a bunch of LOS in the market, here are the 6 best loan origination software for you to consider. Now, let's read on to grasp the ideas.

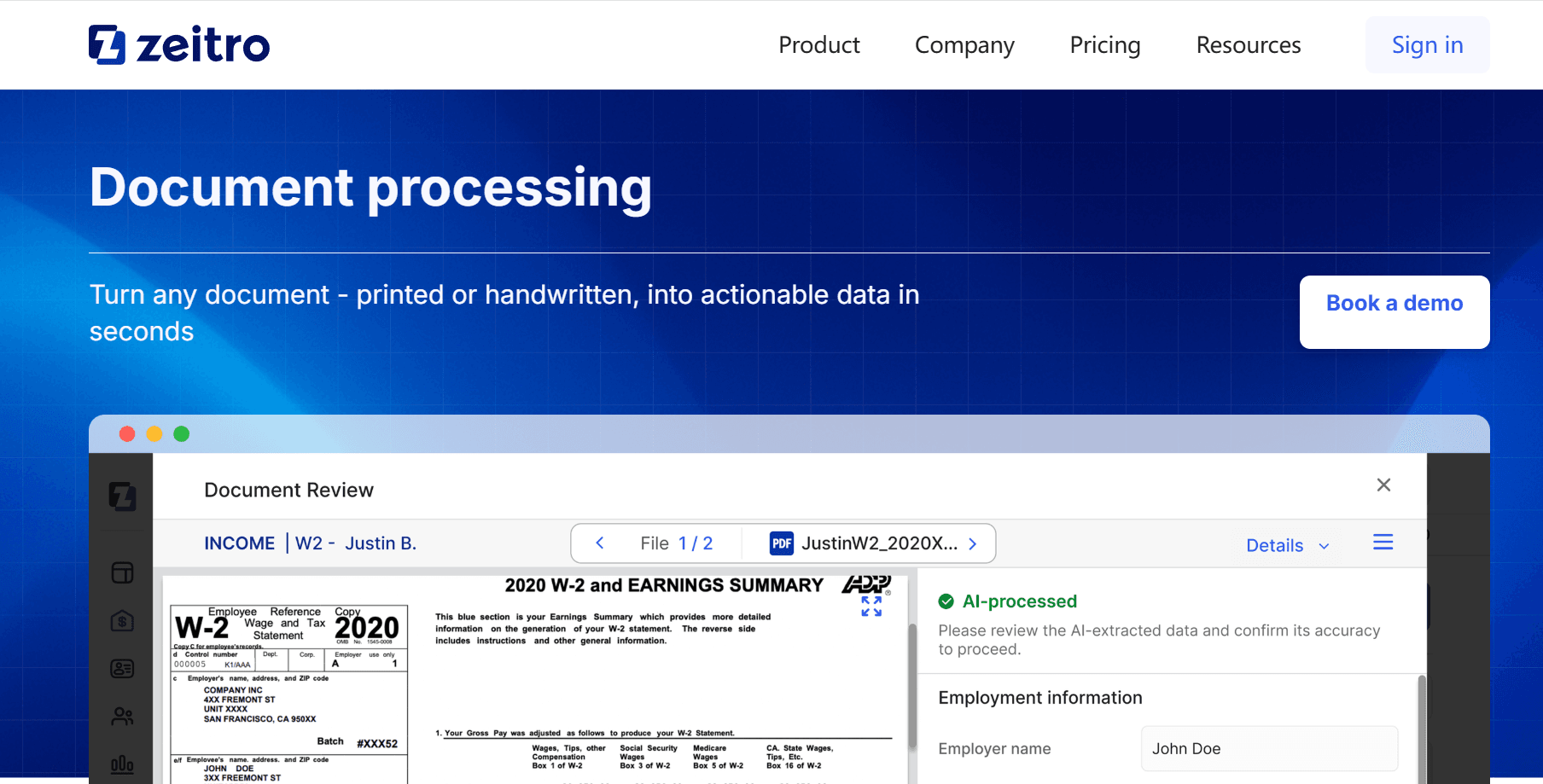

#1. Zeitro - Best for Efficiency Improvement

Zeitro is an AI mortgage platform built for U.S. loan officers, brokers, and small teams. The vendor positions the product as a single system combining POS/1003 automation, OCR document processing, a pricing engine, and an AI "GuidelineGPT/Scenario AI" assistant for guideline research.

It also publishes a freemium Explorer tier and paid plans (Individual $8/mo and Business $35/mo). After using this best loan origination software, it's estimated to improve 2.5x faster pre-quals, save 7+ hours per loan, and reach 90%+ completion. The platform supports a broad range of loan types and emphasizes source-backed guideline answers and FNM 3.4 exports for lender integration.

Explore More Features About Zeitro

-

AI-Powered Scenario Analysis: GuidelineGPT provides instant, accurate answers to complex lending scenarios across FHA, VA, Fannie Mae, Freddie Mac, USDA, and Non-QM guidelines with full source transparency

-

Intelligent Income Calculator: Achieves 85%+ accuracy using artificial intelligence to analyze tax returns and pay stubs, automatically calculating qualified income and DTI ratios

-

Automated Document Processing: OCR technology extracts data from borrower documents in seconds, organizing files automatically for underwriter review

-

Real-Time Pricing Engine: Delivers competitive rate quotes instantly across conventional, Non-QM, and private lending scenarios with customizable overlay adjustments

-

Digital 1003 Automation: Generates compliant loan applications with FNM 3.4 export capability, minimizing manual data entry and reducing errors

-

Integrated Credit Reporting: Runs instant borrower credit checks providing accurate pre-approval information in real-time

-

Personal Website Builder: Creates your microsites on MyMortgageRates, so borrowers can reach loan officers nearby and MLOs can gain more leads.

Pros:

-

Affordable freemium model with Explorer plan at no cost and Individual plan at $8/month makes entry accessible

-

Significant time savings of 7+ hours per loan file improve loan officer capacity without additional staffing

-

AI-driven tools deliver consistent accuracy across income calculations and guideline interpretation

-

Supports all major loan types from one platform, eliminating the need for multiple specialized systems

-

Quick implementation with minimal training required due to intuitive interface design

Cons:

-

Relatively newer platform compared to established enterprise solutions with decades of market presence

-

Require highly specific workflow configurations for advanced customization options for lenders

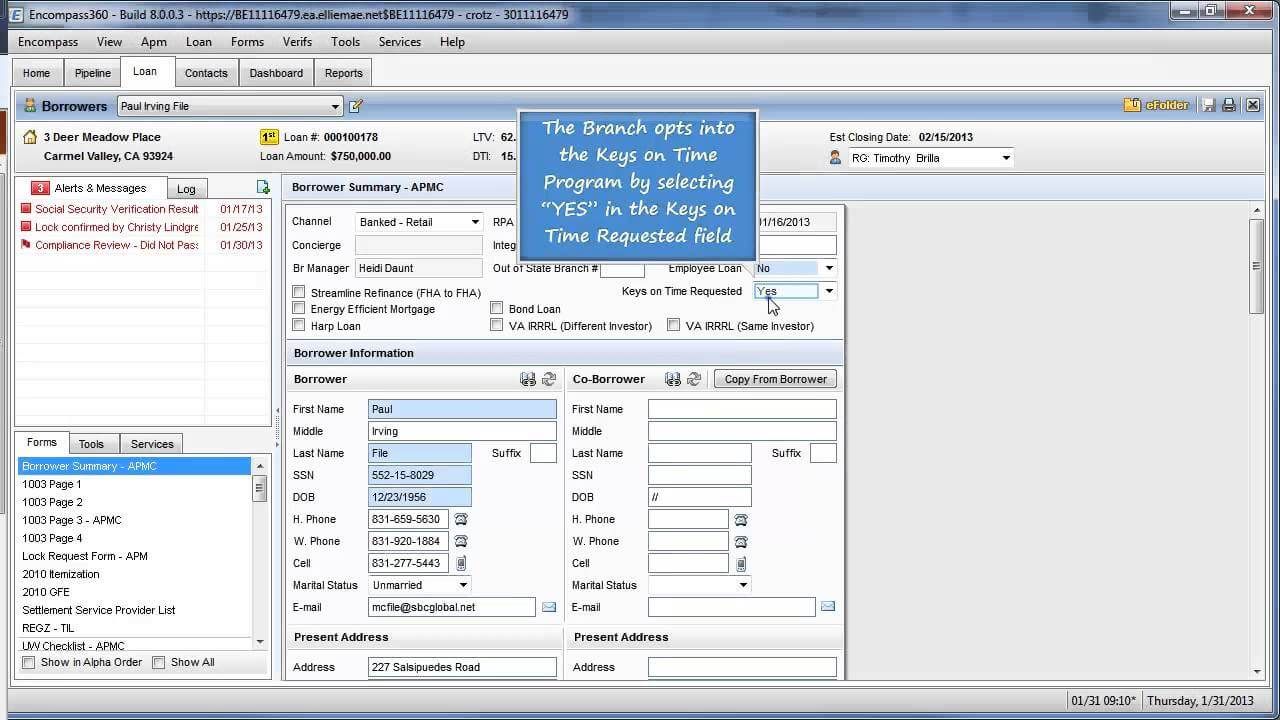

#2. Encompass - Best for Big Lenders and Institutions

Encompass (ICE Mortgage Technology) is an enterprise-grade LOS widely used by national banks and large mortgage lenders. It offers a comprehensive end-to-end system: borrower POS, workflow automation, integrated pricing (ICE PPE), investor delivery, secondary-market tools, and deep third-party connectivity.

This best loan origination software for lender is designed for scale, supporting distributed teams, complex channel models like retail, wholesale, and correspondent, and heavy transaction volumes, at the cost/complexity typical of enterprise platforms. For institutions needing broad integrations, enterprise reporting, and centralized compliance, Encompass is a proven choice.

Explore More Features About Encompass

-

Enterprise-Scale Architecture: Supports unlimited concurrent users with reliable performance handling thousands of simultaneous loan transactions

-

Comprehensive Workflow Automation: Configurable business rules automate loan manufacturing from application intake through quality control and investor delivery

-

Extensive Vendor Network: Connects to hundreds of third-party services including credit bureaus, appraisers, title companies, and settlement providers

-

Advanced Compliance Framework: Built-in TRID, HMDA, and QM verification tools maintain regulatory adherence with automatic updates for rule changes

-

Multi-Channel Support: Manages retail, wholesale, and correspondent lending from a unified system of record with channel-specific optimizations

-

Real-Time Analytics Platform: Data Connect provides actionable insights for performance optimization, trend analysis, and peer benchmarking

-

Integrated Secondary Marketing: Streamlines loan pricing, lock management, trade execution, and delivery to institutional investors

Pros:

-

Industry-leading market share ensures continuous platform development and long-term vendor stability

-

Unparalleled integration ecosystem reduces complexity of managing multiple disconnected vendor relationships

-

Highly configurable workflows accommodate unique institutional requirements and lending models

-

Comprehensive training resources and large user community facilitate knowledge sharing and best practices

-

Proven track record with major national lenders provides confidence in enterprise capabilities

Cons:

-

Premium pricing structure represents significant investment potentially exceeding smaller lender budgets

-

Complex implementation requires substantial time commitment and specialized technical expertise

-

Feature-rich platform can feel overwhelming for organizations with straightforward lending operations

-

Advanced customization often requires specialized consultants increasing total cost of ownership

#3. LendingDox - Best for Underwriting and Document Management

LendingDox focuses on document-first workflows and affordable LOS/POS for brokers and small lenders. It centralizes document repository, automated OCR extraction, status tracking, and borrower notifications. designed to act either as the primary LOS for smaller operations or as a complementary document management layer for larger LOS.

This best loan origination software for small business publishes a transparent price point, which is $30 per active user/month with no installation fees. That makes it an economical option for teams that need robust document automation without heavy enterprise cost. Integrations to existing LOS and CRM systems are available so LendingDox often functions as a plug-in that reduces underwriting friction.

Explore More Features About LendingDox

-

Centralized Document Repository: Securely stores all loan files in one location with status tracking ensuring complete submission before underwriting

-

Automated Workflow Management: Reduces manual errors by automating document requests, approval processes, and borrower notification communications

-

OCR Document Processing: Extracts text and data from uploaded files automatically, eliminating tedious manual data entry

-

Real-Time Status Monitoring: Provides instant visibility into document collection progress with notifications for new submissions requiring attention

-

Compliance-Ready Storage: Meets regulatory standards with encryption, audit trails, and security protocols protecting sensitive financial information

-

Seamless System Integration: Synchronizes with popular loan origination systems and CRM platforms for unified workflow management

-

Transparent Pricing Model: Simple $30 monthly fee per active user with no hidden costs, installation fees, or minimum term commitments

Pros:

-

Dramatically reduces time spent organizing and verifying borrower documentation through automation

-

Affordable flat-rate pricing makes sophisticated document management accessible to smaller operations

-

Works alongside existing systems as enhancement rather than requiring complete platform replacement

-

Strong security and compliance features address regulatory examination requirements effectively

-

Real-time tracking improves communication with borrowers about outstanding documentation needs

Cons:

-

Specialized focus on documentation means it doesn't provide full loan origination system capabilities

-

Requires integration setup to connect with primary LOS platforms, adding initial configuration effort

-

May represent additional software investment beyond existing technology stack

-

Limited functionality outside core document management and organization features

#4. MortgageBot - Best for Banks and Credit Unions

Finastra's Mortgagebot (MortgagebotLOS + Originate Mortgagebot POS) targets community banks, credit unions and regional lenders with a cloud-native, compliance-focused platform. This commercial loan origination software emphasizes borrower point-of-sale, multi-channel origination, and integrations with many industry partners.

Finastra's materials report measurable efficiency improvements for customers. You can accelerate application workflows and reduce cycle times when Originate Mortgagebot is paired with MortgagebotLOS. The solution is positioned for depository institutions that prioritize relationship banking combined with modern digital origination.

Explore More Features About MortgageBot

-

Comprehensive Loan Type Support: Handles conventional, government, construction, home equity, VA, and non-traditional loan products from unified platform

-

Cloud-Native Architecture: Delivers secure, accessible platform requiring no on-premise infrastructure investment with reliable uptime

-

Advanced Compliance Tools: Scrutinizes applications for regulatory defects ensuring adherence to evolving state and federal lending requirements

-

Extensive Partner Integration: Connects with 100+ services including credit reporting, appraisals, flood certification, and secondary marketing platforms

-

Automated Underwriting Workflows: Rules API reduces approval time from days to minutes through intelligent automation and decision logic

-

Next-Generation AI Tools: Incorporates artificial intelligence for sophisticated credit assessment delivering lightning-fast approvals with enhanced accuracy

-

Borrower Point-of-Sale: Provides consumers with self-service application portal featuring document upload and real-time loan progress tracking

Pros:

-

Specifically designed for banking institutions' unique operational and regulatory requirements

-

Proven track record reducing origination cycles by 20% while accelerating applications by 40%

-

Cloud-based delivery eliminates infrastructure costs and maintenance burden for IT departments

-

Comprehensive loan type support accommodates diverse product offerings from a single platform

-

Strong compliance framework addresses examination requirements relevant to depository lenders

Cons:

-

May be less suitable for non-bank mortgage companies and independent brokers

-

Pricing information not publicly disclosed, requiring direct vendor engagement for cost evaluation

-

Advanced features may exceed the needs of smaller institutions with simpler lending operations

-

Some customization options more limited compared to enterprise platforms designed for maximum flexibility

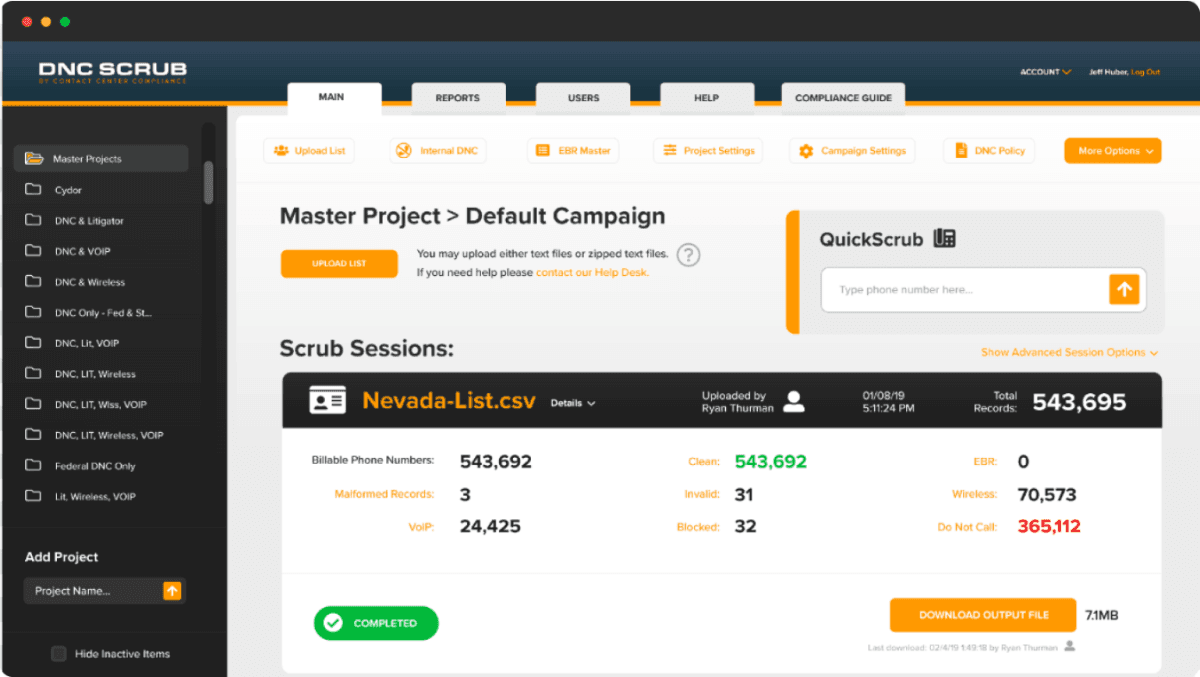

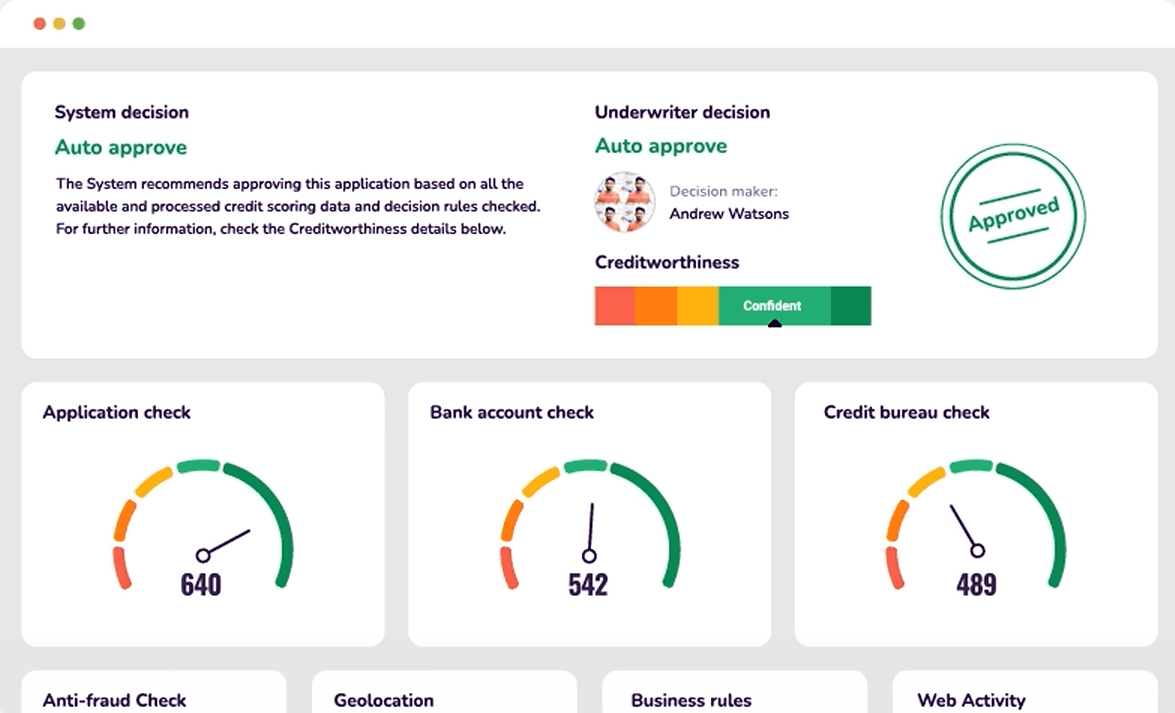

#5. TurnKey Lender - Best for Automation

TurnKey Lender is a global lending automation platform that advertises a powerful AI decision engine, configurable no-code application flows, and broad product coverage for consumer, SMB, BNPL, microfinance, and more). The vendor highlights near-instant decisioning and a large integraton library with dozens of third-party connectors.

This mortgage loan origination software is designed for lenders who want advanced automated credit decisioning and rapid product launches. Statements about ">90% automated origination" or sub-second processing reflect vendor positioning and should be validated against a buyer's specific rule sets and risk tolerances during pilot testing.

Explore More Features About TurnKey Lender

-

AI-Powered Credit Decisioning: Proprietary machine learning algorithms deliver instant, accurate risk assessments using traditional and alternative data sources

-

End-to-End Automation: Manages the complete loan lifecycle from application intake through servicing and debt collection with minimal manual intervention

-

Configurable Product Builder: Creates flexible credit products with complex fee structures, interest calculations, and payment schedules without coding

-

Comprehensive Underwriting Suite: Provides in-depth risk scoring, borrower evaluation, decision rule checks, and automated loan agreement generation

-

Intelligent Debt Collection: Automates collection workflows with AI-based delinquency scoring improving recovery rates through optimized communication strategies

-

Extensive Integration Network: Connects with 75+ third-party systems, including accounting platforms, credit bureaus, KYC/AML providers, and payment processors

-

Enterprise Reporting Analytics: Delivers configurable dynamic reports providing insights into portfolio performance, risk trends, and business metrics

Pros:

-

Industry-leading automation capabilities dramatically reduce operational costs and manual labor requirements

-

AI-driven decisioning improves both speed and accuracy compared to traditional manual underwriting

-

Highly versatile supporting diverse lending products and business models from a single platform

-

Continuous machine learning improves system performance over time based on actual loan outcomes

-

Rapid implementation with a platform ready in days rather than months for faster go-live

Cons:

-

Advanced automation features may exceed the requirements of lenders with simpler operations

-

Implementation success requires careful configuration to optimize automation benefits for specific use cases

-

Traditional lenders may be uncomfortable delegating credit decisions to algorithmic systems

-

Premium automation technology represents a higher investment compared to basic origination systems

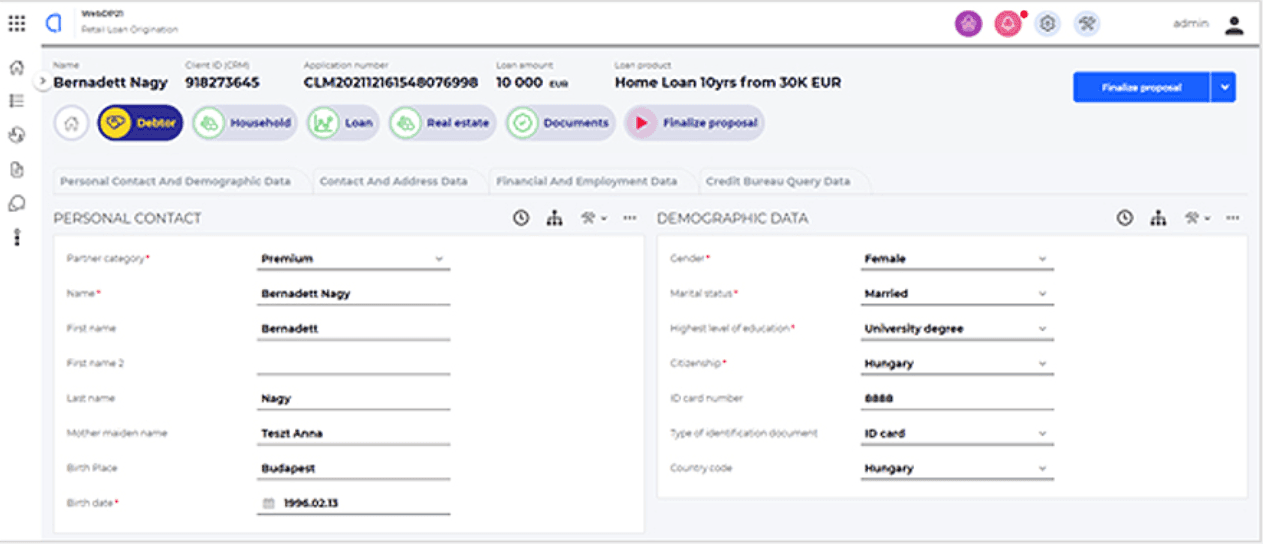

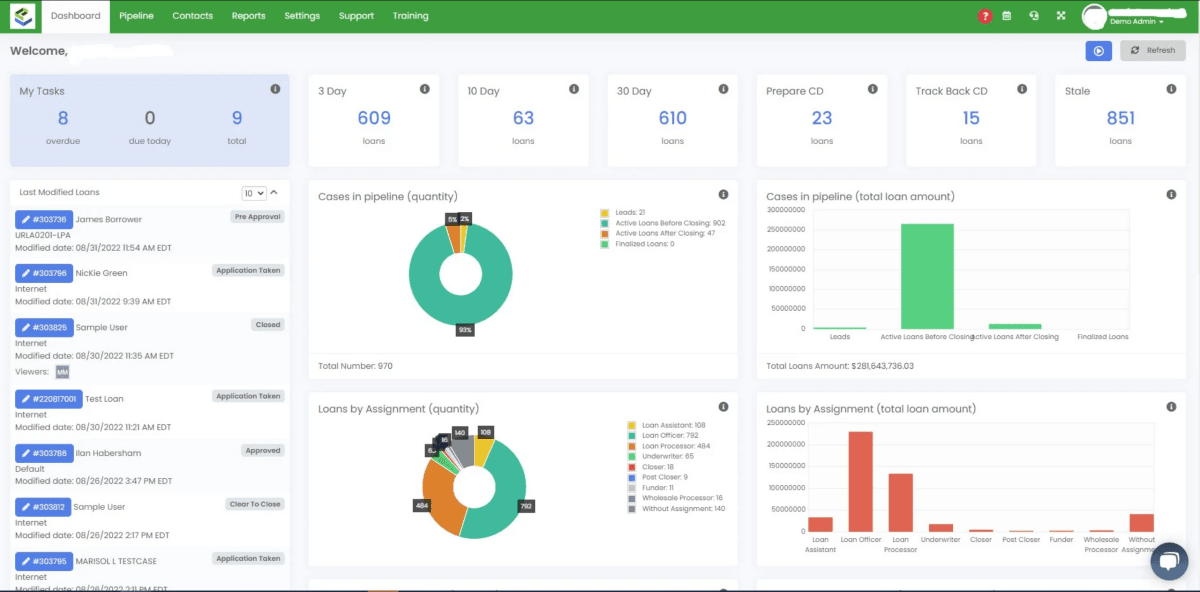

#6. LendingPad - Best for Real-time Collaboration

LendingPad is a web-based loan origination software for lenders and brokers who need collaborative, fast-to-deploy solutions. The platform emphasizes multi-user, real-time pipeline visibility, a borrower POS, and a marketplace of integrations for pricing, AUS, and vendor services.

LendingPad's broker and lender editions allow flexible user counts and role-based controls, making it suitable for organizations that require simultaneous access to the same loan file across processors, underwriters, and closers. Pricing tends to be mid-market and may be quoted per user or per edition depending on broker vs lender needs.

Explore More Features About LendingPad

-

Real-Time Multi-User Collaboration: Enables simultaneous file access across departments with instant updates eliminating coordination bottlenecks

-

Cloud-Based Platform Architecture: Provides consistent access from any location with reliable performance requiring no IT infrastructure investment

-

Integrated Communication System: Centralizes all loan-related messaging and task management, keeping conversations organized and searchable

-

Direct Wholesale Integration: Connects mortgage brokers seamlessly with wholesale lenders for pricing management, AUS findings, and rate locks

-

Comprehensive Borrower Portal: A Complementary point-of-sale system allows online applications, document uploads, and loan progress tracking

-

Extensive Partner Marketplace: Integrates with top industry service providers, including credit bureaus, appraisers, and title companies

-

Flexible Implementation Model: Fast setup process with scalable pricing, accommodating organizational growth without major reinvestment

Pros:

-

Exceptional collaboration tools dramatically improve team coordination and communication efficiency

-

Cloud-based delivery provides reliable access without infrastructure costs or maintenance requirements

-

Intuitive interface reduces training time and accelerates team adoption compared to complex alternatives

-

Flexible pricing accommodates various organizational sizes, from small brokerages to larger lenders

-

Regular platform updates continuously improve functionality based on user community feedback

Cons:

-

Integration marketplace is smaller than established industry leaders, though core connections are available

-

Advanced customization capabilities are more limited compared to enterprise platforms designed for maximum flexibility

-

Occasional performance issues are reported during peak usage periods, though generally reliable

-

Smaller company size compared to industry giants raises long-term stability questions for some users

How to Choose the Best Loan Origination Software?

Since all loan origination software is different in some ways, it's important to find the best pick that meets your needs. If you're confused how to choose, especially if you just became an MLO, you might as well check out the following.

Identify Your Need

Start by listing operational pain points, current monthly loan volume, and growth targets for the next 3–5 years. Match product types to your channel mix (retail, wholesale, correspondent) because each model requires different integrations and controls. Check technical readiness, data migration needs, and compliance obligations tied to your lending charters (state/federal rules, investor overlays).

Consider Core Features

They are key features to prioritize here: POS/app intake UX, document management + OCR, AUS interfaces (DU/DW/AUS, LPA), PPE/pricing engine, compliance audit trails, investor delivery, reporting, and mobile access. Test the borrower UX (completion rates, time to prequal) and validate reporting capabilities with a sample data export during demos.

Evaluate Integration Capabilities

Confirm native integrations for credit, appraisal, flood/title, AUS, and investor delivery, and verify whether integrations are native or require middleware. Ask for integration documentation and an implementation timeline, and list all recurring activation or per-integration fees.

Compare Pricing

Ask vendors for a fully itemized first-year cost: licensing, implementation/configuration, data migration, integrations, training, and support SLAs. Verify pricing models (per user, per loan, per company) and which features are add-ons. Calculate the 3- to 5-year total cost of ownership against projected efficiency gains. If you want to start with a free loan origination software, take a shot at Zeitro.

FAQs About Best Loan Origination Software

Q1. What is loan origination software used for?

The whole loan origination process is really complicated. LOS automates and coordinates the full mortgage lifecycle. application intake, credit ordering, income/asset verification coordination, appraisal management, AUS interaction, disclosure generation, and compliance tracking. It centralizes communications among borrowers, LOs, processors, underwriters, and third-party vendors while creating auditable records for QC and regulatory review.

Q2. What are the benefits of loan origination systems?

Benefits include faster processing, fewer manual errors, better borrower experience, improved scalability, lower regulatory risk through built-in controls, and consolidated reporting. Industry reports and vendor case studies commonly report substantial time and overhead reductions after LOS automation.

Q3. Which is the best loan origination software for small lenders?

Small lenders should favor straightforward, well-supported platforms that avoid enterprise complexity and high up-front costs. Options that often fit these needs include point solutions and cloud LOS that offer pay-as-you-grow pricing. You may consider web-based loan origination software like Zeitro, LendingPad, and MortgageBot. You should evaluate TCO, support responsiveness, and whether the vendor offers a free trial or low-cost entry tier.

Q4. What is TMO software?

TMO = Total Mortgage Origination software. An integrated platform that covers the end-to-end lending lifecycle (POS, LOS, underwriting, closing, and post-closing) as opposed to single-purpose point solutions (e.g., only document management or only pricing). Encompass is an example of a TMO with broad enterprise modules.

Conclusion

Selecting an LOS is a strategic decision that affects efficiency, borrower experience, and compliance posture. You may take a shot at these 6 best loan origination software and see which one meets your needs. If you want to start light and free, Zeitro could be your first choice to kick in.