Difference Between MIP and PMI: Mortgage Insurance Costs & Cancellation Guide

Ever scratched your head wondering why your FHA loan forces that pesky upfront fee plus a monthly hit, while your buddy with a conventional loan just pays a monthly premium? You’ve stumbled into the classic difference between MIP and PMI – the twin gatekeepers of low-down-payment mortgages. Think of them as your loan’s mandatory safety net, but one’s government-issued (MIP) and the other’s privately run (PMI). Getting this wrong? That’s like paying for premium fuel in a scooter. Let’s crack this nut so your wallet doesn’t get cracked instead.

Mortgage Insurance 101: MIP & PMI Demystified

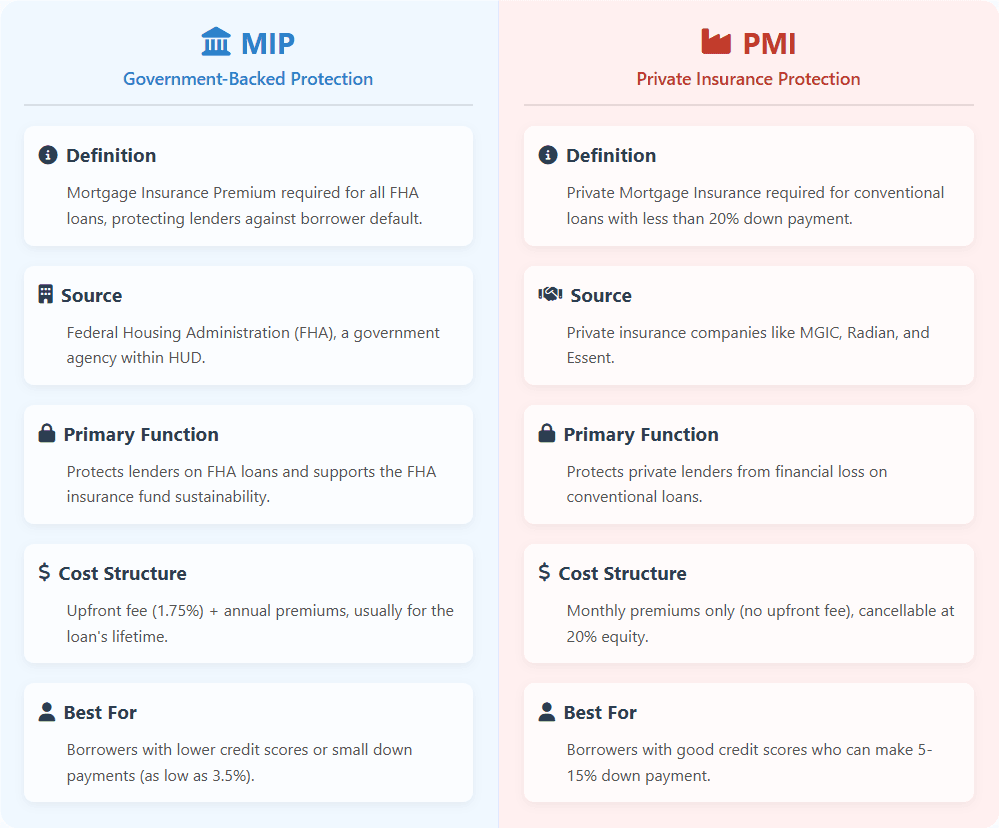

Okay, first things first. Both MIP (Mortgage Insurance Premium) and PMI (Private Mortgage Insurance) do the same core job: protect your lender if you bail on the loan. They’re not protecting you. Got it? Good. But who they protect, and how, is where the plot thickens.

PMI: Your Private Mortgage Bodyguard

Picture this: You want a conventional loan (not backed by Uncle Sam) but only have 10% saved up. Enter PMI. It’s insurance provided by private companies to reassure your lender they won’t lose their shirt if you default. Your credit score and down payment size directly influence its cost. The silver lining? PMI isn’t forever. Hit that magic equity threshold (usually 20%!), and you can kiss it goodbye. Phew.

MIP: The FHA’s Mandatory Fee

Opting for an FHA loan? That government-backed beauty (hello, lower credit score acceptance!) comes with a catch: MIP. Think of it as the FHA’s membership fee. Unlike PMI, MIP is non-negotiable for most borrowers, regardless of your down payment size (even if you scrape together 10%!). It’s got two prongs: a hefty upfront premium rolled into your loan balance and a lifelong annual premium. Yep, you read that right. Lifelong (with rare exceptions). It’s baked into the FHA loan deal.

The 5 Crucial Differences Between MIP and PMI

This is where understanding the difference between MIP and PMI saves you real cash. Let’s break it down:

Who Needs It? (Loan Type Lockdown)

MIP: Married to FHA loans. If you go FHA, MIP comes with the ring.

PMI: The exclusive domain of conventional loans. No government backing here, just private deals.

Bottom Line: Your loan type dictates your insurance fate. FHA loan = MIP. Conventional loan = PMI possible.

The Sting: Cost & Payment Structure (Ouch!)

MIP Costs: Brace for a double whammy. First, a big upfront premium (1.75% of your loan amount – tacked onto your balance). Then, an annual premium split monthly, lasting usually the entire loan term. Think of it like a car lease with a big down payment and monthly payments that never end.

PMI Costs: Simpler (and often cheaper long-term). Just a monthly payment, typically 0.5% to 1.2% of your loan amount annually. No hefty upfront chunk. The cost dances to the tune of your credit score and down payment.

Bottom Line: MIP often costs more overall due to its upfront hit and longer lifespan. Is MIP or PMI more expensive? Usually MIP, thanks to that combo platter.

The Escape Hatch: Cancellation Policies (Can I Ditch This?)

PMI Cancellation: Your get-out-of-jail-free card! By law, PMI must automatically cancel once you hit 78% loan-to-value ratio (LTV) based on the original value. You can often request cancellation at 80% LTV. Building equity faster? You win!

MIP Cancellation: Mostly… you can’t. For most FHA loans (especially with less than 10% down), MIP lasts the entire loan term. The only escape? Refinancing into a conventional loan (once you have 20% equity) or paying off the loan. Oof.

Bottom Line: PMI is gloriously cancelable. MIP? Usually a lifelong companion. This is a HUGE difference between MIP and PMI.

What’s Actually Covered? (The Fine Print)

Both essentially cover the lender if you default, paying them back for losses. However, MIP has an extra layer: it directly supports the FHA insurance fund itself, which backs the loan. PMI is purely about protecting the private lender's investment. The practical coverage for the lender is very similar.

What Dictates Your Rate? (Pricing Puppet Masters)

PMI Rates: Your credit score is king here! A higher score = lower PMI rate. Your down payment size is the queen – more down means less risk, meaning lower PMI. It’s risk-based pricing.

MIP Rates: Set by the FHA. Your credit score? Doesn’t directly change your MIP rate (though it affects your base interest rate). The main factors are your loan amount and your LTV ratio (down payment size). Simpler, but often less flexible for those with great credit.

Bottom Line: PMI rewards good credit. MIP rates are more standardized.

MIP vs PMI: Show Me the Money! (Cost Examples & Calculators)

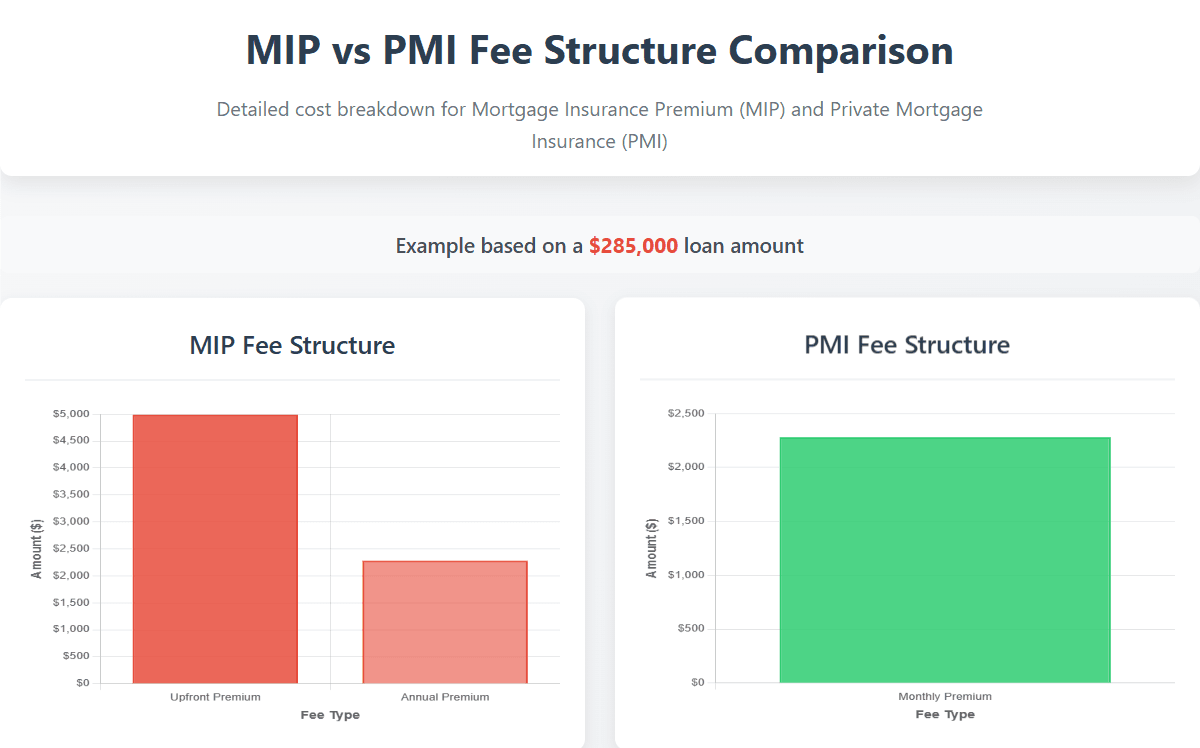

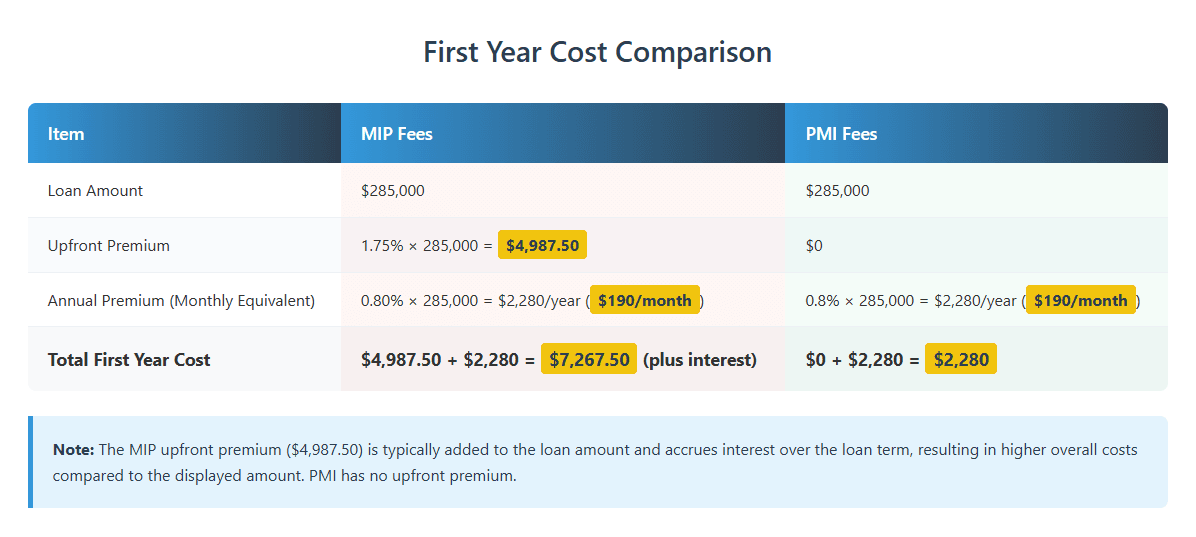

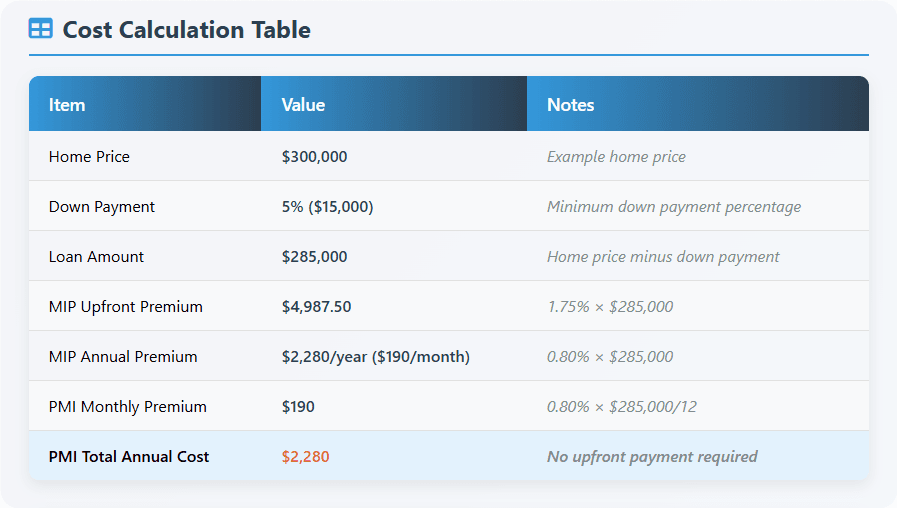

Let’s get concrete. Imagine a $300,000 home with 5% down ($15,000):

MIP Costs:

Upfront Premium: 1.75% of $285,000 = $4,987.50 (added to loan balance = you pay interest on this too!)

Annual Premium: ~0.80% of $285,000 = $2,280/year ($190/month) - for likely the loan's life.

Total First-Year Cost: ~$4,987.50 + $2,280 = $7,267.50 (plus interest on the upfront chunk!)

PMI Costs:

Upfront Premium: $0

Monthly Premium: ~0.75% of $285,000 / 12 = $178/month ($2,136/year) - until 78% LTV is hit.

Total First-Year Cost: $2,136

See the difference between MIP and PMI hitting your wallet? PMI calculators (like those on Bankrate or NerdWallet) and MIP calculators are lifesavers. Plug in your loan amount, down payment, credit score (for PMI), and loan type (FHA vs Conventional) to see your potential costs. Understanding MIP/PMI disbursement meaning is key here: MIP’s upfront fee is disbursed to the FHA and added to your loan, while its annual premium and PMI are disbursed monthly to the insurer.

MIP vs PMI: Your Burning Questions Answered (FAQs)

Q: Can I avoid MIP or PMI? A: Avoid PMI by putting down 20% on a conventional loan. Avoid MIP? Almost impossible with a standard FHA loan (unless you put down 10% and have it for 11+ years – rare!). Your main escape from MIP is refinancing later.

Q: Which is cheaper long-term, MIP or PMI? A: PMI is usually cheaper long-term because you pay it for fewer years (until you hit 20% equity) and avoid that big upfront MIP fee. Even if PMI's monthly rate is slightly higher, its shorter duration typically wins out. Refinancing an FHA loan later to ditch MIP is a common strategy.

Q: What does MIP insurance cover? A: Primarily, it covers the lender's losses if you default on your FHA loan. It also contributes to the FHA's mutual mortgage insurance fund, which ensures the program keeps running. It does not cover your losses as the borrower.

Q: How is MIP disbursed? What does "disbursement" mean? A: "Disbursement" just means how the money is paid out. The MIP upfront premium is typically disbursed (paid) to the FHA at closing – usually by adding it to your total loan amount. The MIP annual premium is disbursed monthly as part of your regular mortgage payment. PMI is disbursed monthly directly to the private insurer.

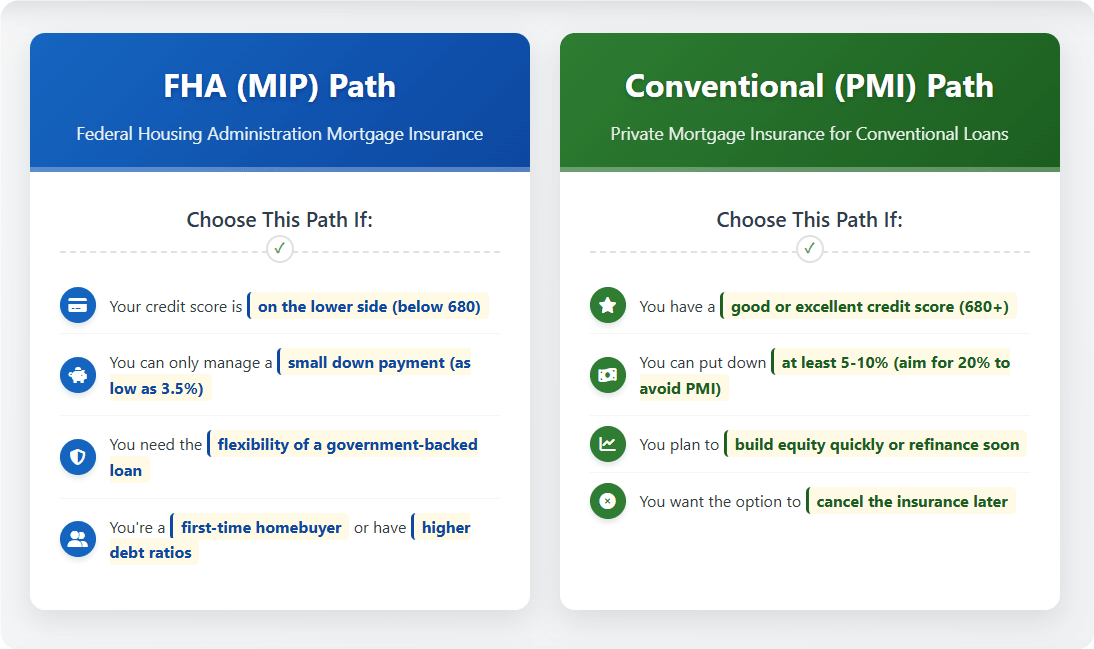

FHA (MIP) or Conventional (PMI): Which Path is Right For YOU?

So, which mortgage insurance monster should you tame?

Choose the FHA/MIP Path If:

Your credit score is on the lower side (think below 680).

You can only manage a small down payment (as low as 3.5%).

You need the flexibility of a government-backed loan.

Choose the Conventional/PMI Path If:

You have a good or excellent credit score (usually 680+).

You can put down at least 5-10% (aiming for 20% to avoid PMI altogether!).

You plan to build equity relatively quickly or refinance soon.

You want the option to cancel the insurance down the line.

The Bottom Line: Know the Difference, Save Your Dough

Let’s cut to the chase. The core difference between MIP and PMI boils down to this:

MIP (FHA): Government insurance. Usually lifelong cost (upfront fee + annual premiums). Less flexible cancellation. Credit score doesn't directly change the insurance rate.

PMI (Conventional): Private insurance. Temporary cost (monthly payments only, cancellable). Costs heavily influenced by your credit score and down payment.

PMI generally gives you an exit strategy; MIP usually doesn't. That upfront MIP fee and its long-term tail often make it the pricier option over time, especially if your credit is decent. Don't just look at the interest rate! Factor in the total cost of your mortgage insurance.

Ready to see exactly how much MIP or PMI will cost you? Use a mortgage calculator today, focusing on both FHA and conventional options. Or better yet, chat with a savvy lender who can walk you through the difference between MIP and PMI based on your unique credit score, down payment, and homebuying goals. Your future budget will thank you!

People Also Read

- PMI, MIP, and the VA Funding Fee: Your Mortgage’s Not-So-Secret Costs

- How Much Does a MIP Cost in 2025? FHA Upfront & Monthly Premiums Explained

- What Is an FHA Loan? A Simple Guide for First-Time Homebuyers

- Looking for a Second Mortgage? Your Complete Guide to Eligibility, Rates & Smart Borrowing

- 2025 California HELOC Guide: How to Lock in the Best Rates and Save Money