How Much Does a MIP Cost in 2025? FHA Upfront & Monthly Premiums Explained

Let’s be honest: When you’re wrestling with FHA loan paperwork, “MIP” feels like alphabet soup. But here’s the scoop upfront: Your Mortgage Insurance Premium (MIP) is the bodyguard FHA loans require to protect lenders. So, how much does a MIP cost? For most folks in 2025, it’s 1.75% upfront (rolled into your loan) plus 0.15%–0.70% annually — that’s $132–$175/month on a $300k loan.

But wait, why does your neighbor’s PMI sound cheaper? And what’s this “funding fee” people whisper about? Grab coffee — we’re slicing through the jargon jungle.

But wait, why does your neighbor’s PMI sound cheaper? And what’s this “funding fee” people whisper about? Grab coffee — we’re slicing through the jargon jungle.

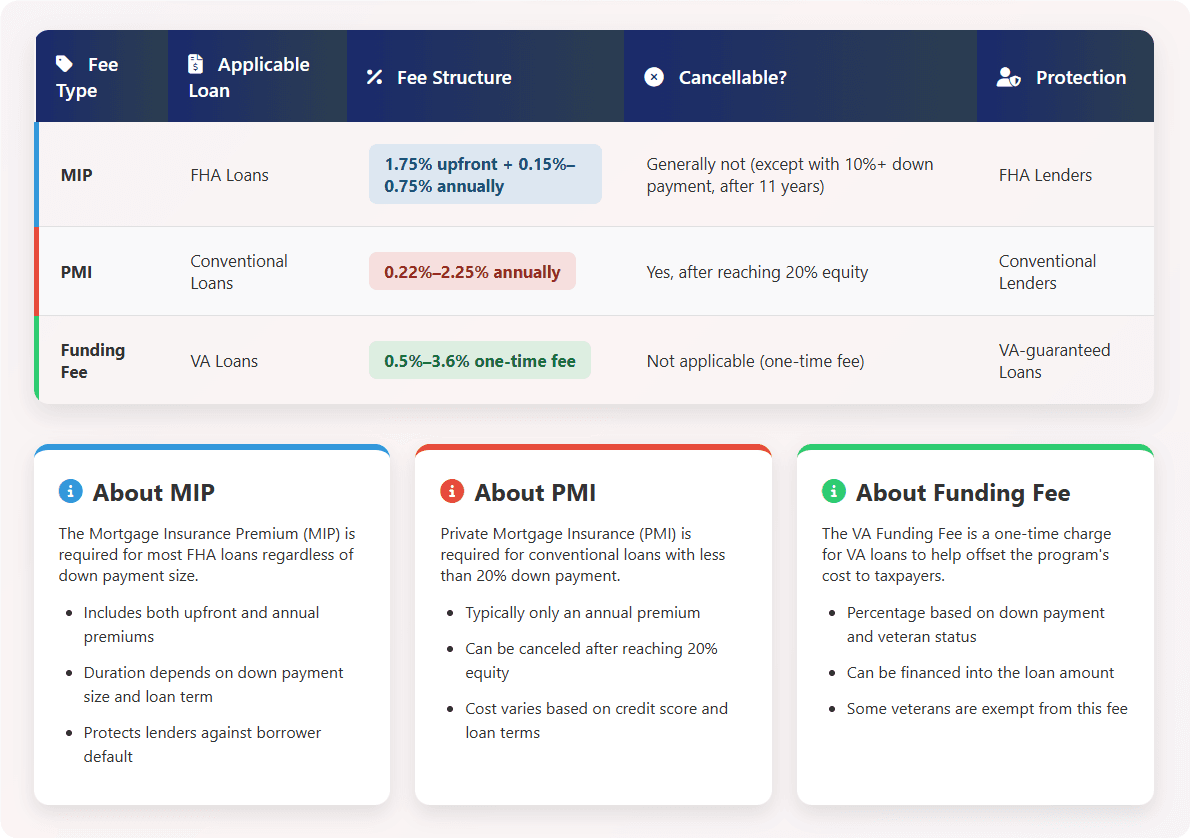

MIP vs. PMI vs. Funding Fee: Meet the “Loan Protector” Trio

(Hint: They’re Not Twins)

MIP is FHA’s mandatory mortgage insurance. PMI guards conventional loans, while VA funding fees back military loans. Think of them as cousins—related but with different rules.

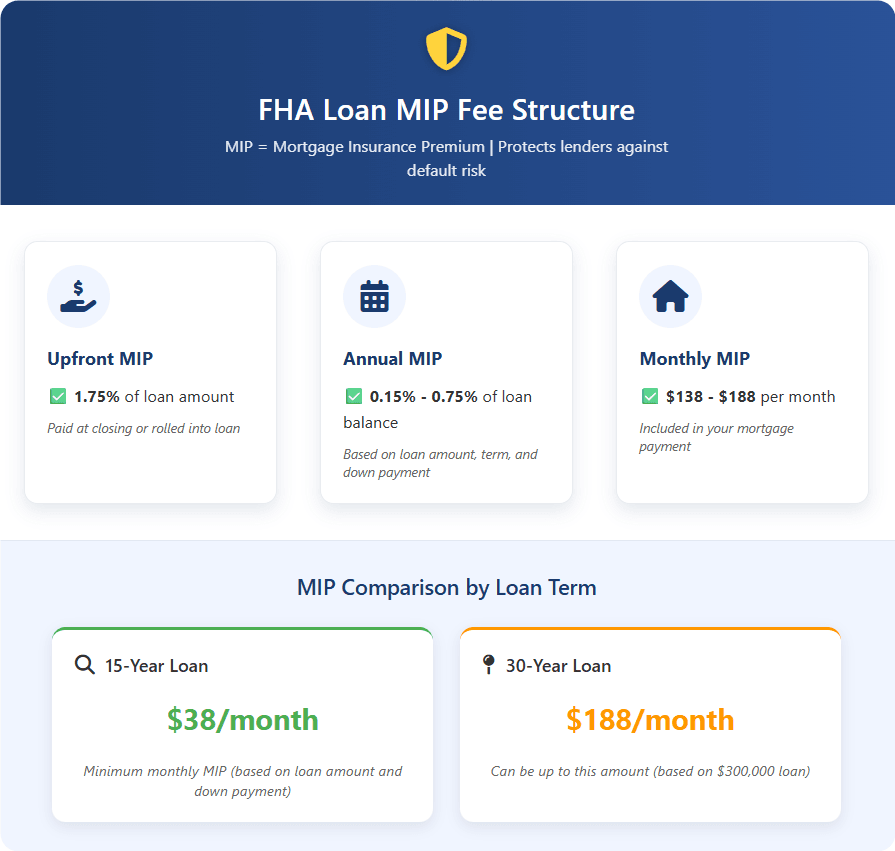

Your MIP Breakdown:

- Upfront MIP: A 1.75% “entrance fee” on your base loan. Example: $5,250 on $300k (tacked onto your loan).

- Annual MIP: Recurring 0.15%–0.70%, split into monthly bites. When asking ‘How Much Does a MIP Cost,’ remember this is where FHA loans often cost more than PMI.

Key Differences:

- PMI’s Edge? Cancel it at 20% home equity.

- MIP? Stubborn — it often sticks for the loan’s life (unless you put 10%+ down).

- VA Funding Fee? A VA loan exclusive (0.5%–3.6%). No overlap with MIP — they guard different loan types.

Takeaway: MIP = FHA’s non-negotiable shield. PMI = conventional’s flexible armor. Funding fee = VA’s military perk cost.

Your 2025 MIP Bill: Upfront + Monthly Costs Demystified

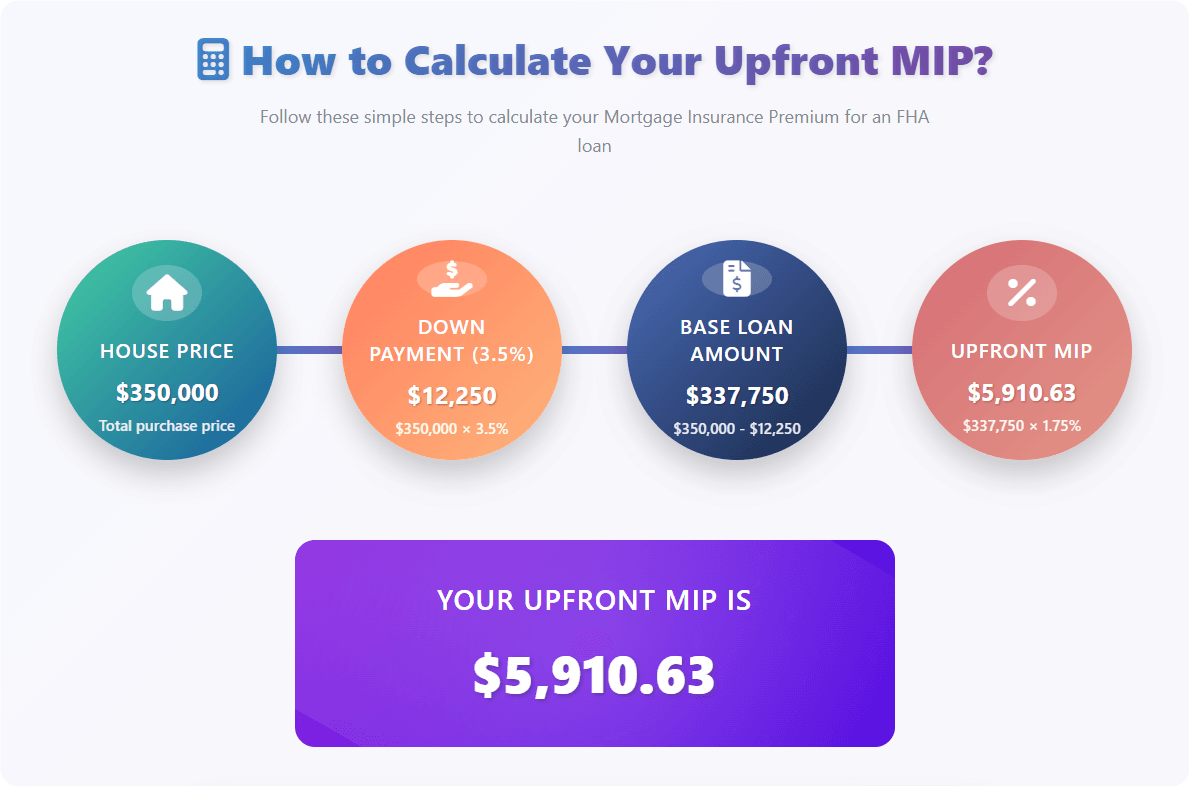

Upfront MIP: The “Lump Sum” (You Don’t Pay Cash)

It’s simple: 1.75% of your base loan amount. “Base loan” = home price minus down payment.

Real-life example:

- $350,000 home – 3.5% down ($12,250) = $337,750 base loan

- Upfront MIP: $337,750 × 1.75% = $5,910.63

Good news: You don’t write a check. It’s folded into your loan. Breathe easy.

Monthly MIP: Your Recurring “Guardian” Fee

This is where eyes glaze over — but stick with me! Your annual rate depends on two things:

- Your down payment (3.5%? 10%? 15%?)

- Loan term (15-year or 30-year?)

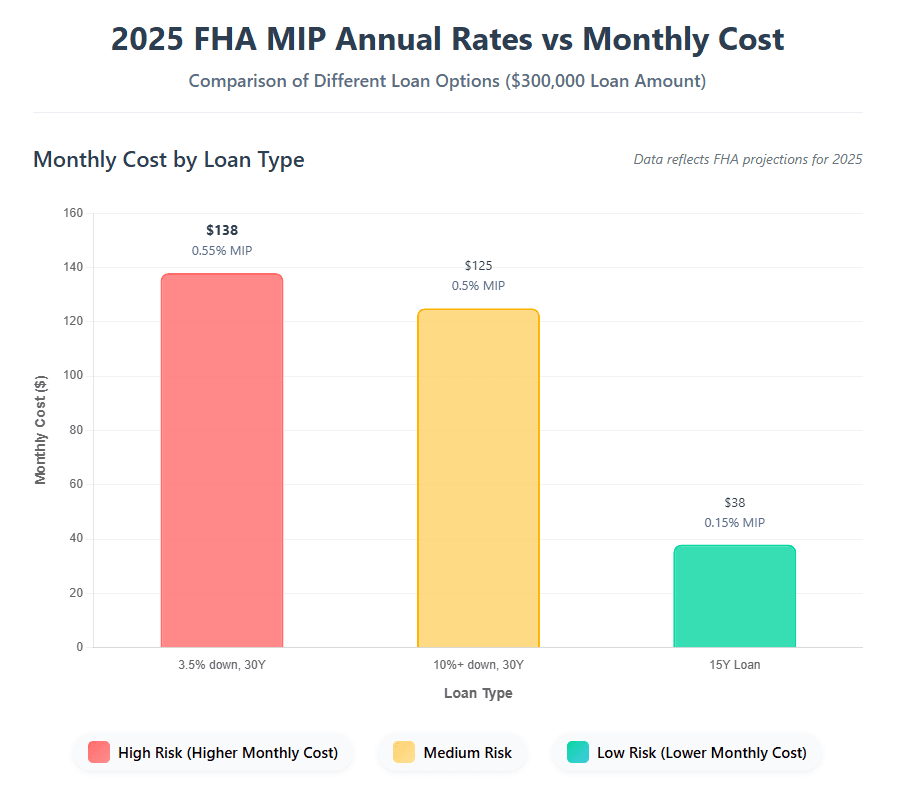

2025’s MIP Monthly Winners & Losers:

Golden Tip: Choose a 15-year FHA loan, and your monthly MIP could drop as low as $38! That’s a latte a day vs. a fancy dinner out.

Why Your MIP Costs More (or Less!) Than Your Friend’s

How much does a MIP cost for you? Factor 1: Down Payment= Your Bargaining Chip

- Minimum 3.5% down? You’re in the higher risk bracket (0.55%–0.70% annual MIP).

- 10%+ down? You get the lower risk discount (0.50%) plus escape hatch: MIP cancels after 11 years.

Factor 2: 15-Year vs. 30-Year Loan Term

- 15-year loans = cheaper MIP (0.15%–0.40%). Why? Shorter risk window for lenders.

- 30-year loans = higher MIP but lower payments. Trade-offs, folks.

Factor 3: Base Loan Amount ≠ Your Home Price

MIP ignores your upfront fee. Example: On a $356,125 loan ($350k home + $6,125 UFMIP), you pay MIP on $350k — not $356k. Small win!

3 Clever Ways to Slash Your MIP Costs

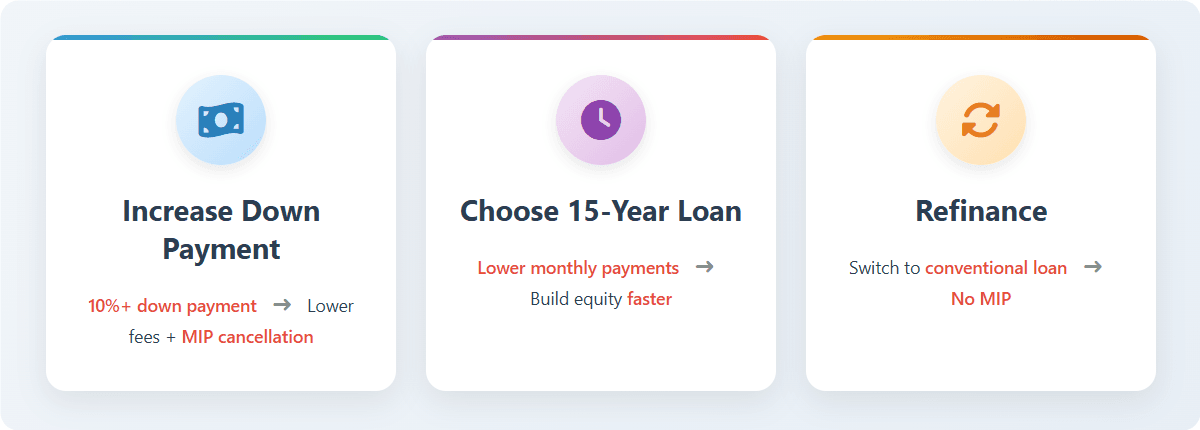

1. Boost Your Down Payment to 10%+

- The math: On $300k, 10% down = 0.50% MIP ($125/month). 3.5% down = 0.55% ($138).

- Annual savings: $156 + escape MIP after 11 years.

2. Choose a 15-Year Loan (If You Can Swing It)

- The shocker: Monthly MIP as low as $38 vs. $138+ for 30-year loans.

- Bonus: Build equity faster + automatic MIP cancellation at 78% LTV.

3. Refinance to Ditch MIP Entirely

- Hit 20% home equity? Refinance to a conventional loan and kiss MIP goodbye. Poof!

MIP Myth Buster:

“I can cancel it like PMI!” → False. Only with 10%+ down after 11 years (or via refinancing to PMI/funding fee alternatives).

MIP FAQs: Your “Wait, But What About...” Questions

“Beyond ‘How Much Does a MIP Cost,’ can I avoid it? Sadly, no.” Sadly, no. It’s FHA’s non-negotiable bodyguard. PMI (conventional loans) or funding fees (VA loans) are your alternatives.

“Did MIP get cheaper?” Yes-ish. While there’s no major MIP rate cut in 2025, the 2023 HUD cut (from 0.85% to 0.55%) continues to benefit borrowers this year.

“When does MIP vanish?”

- 3.5%–9.99% down? Stays life of loan.

- 10%+ down? Cancels after 11 years.

“Is MIP or PMI cheaper?” PMI usually wins. Why? Cancel at 20% equity. MIP often outlasts your pet goldfish.

The Bottom Line: Your MIP Game Plan (2025 Edition)

- So, how much does a MIP cost in 2025? Upfront MIP: 1.75% (financed, not paid cash).

- Monthly MIP: $38–$175 (based on down payment + loan term).

Slash Costs By:

- Putting 10%+ down

- Choosing a 15-year loan

- Refinancing later to conventional/VA (hello, PMI/funding fee alternatives)

Your Move:

Use a free FHA MIP calculator to plug in your numbers. Knowledge isn’t just power — it’s savings.

People Also Read

- FHA Upfront Mortgage Insurance (UFMIP) Explained (2025): Cost, Payment, and Rules

- FHA Monthly Mortgage Insurance Rate (MIP) in 2025: Costs & Calculation

- How to Remove MIP from Your FHA Loan:Rules,Refinancing,Strategies

- Current FHA UFMIP Rate 2025 Explained: Upfront Mortgage Insurance, MIP Removal & Refund Guide

- How to Pay off Mortgage Faster? Pros, Cons, and 7 Ways for You