PMI, MIP, and the VA Funding Fee: Your Mortgage’s Not-So-Secret Costs

So, you found your dream home but your down payment’s under 20%? Get ready to meet the unavoidable trio: Private Mortgage Insurance (PMI), the Mortgage Insurance Premium (MIP), or the VA Funding Fee. They’re the price of admission for many loans, but boy, are they different beasts. This isn't just jargon – understanding PMI, MIP, and the VA fee could literally save you thousands over the life of your loan. We're breaking down the costs, the cancellation headaches (or lack thereof), and which loan types (Conventional, FHA, VA) play host to each. Let's crack this nut.

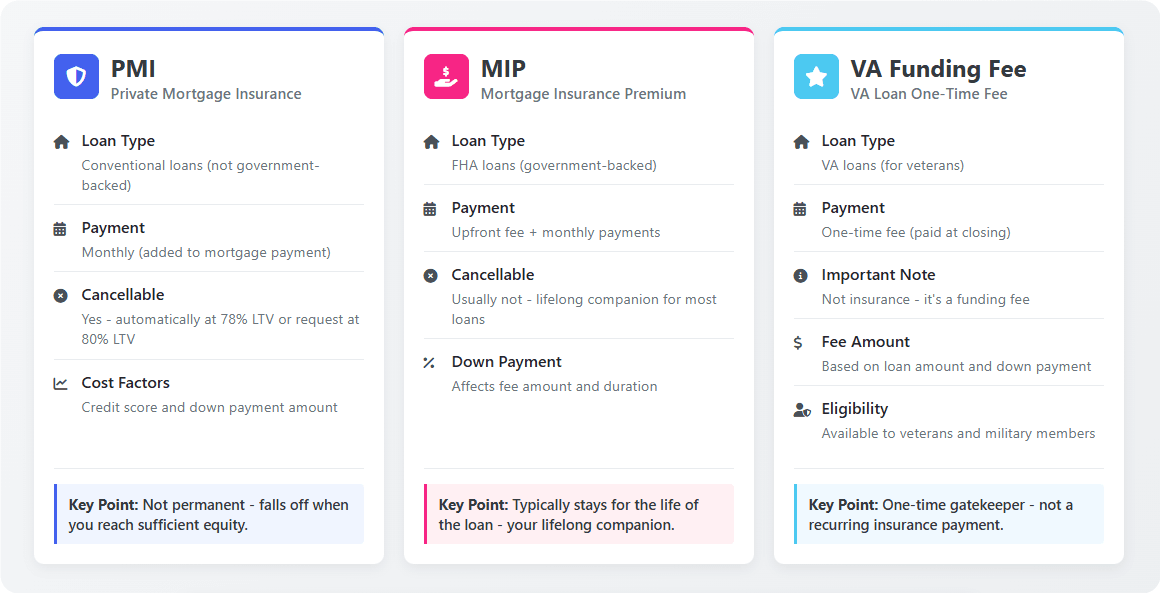

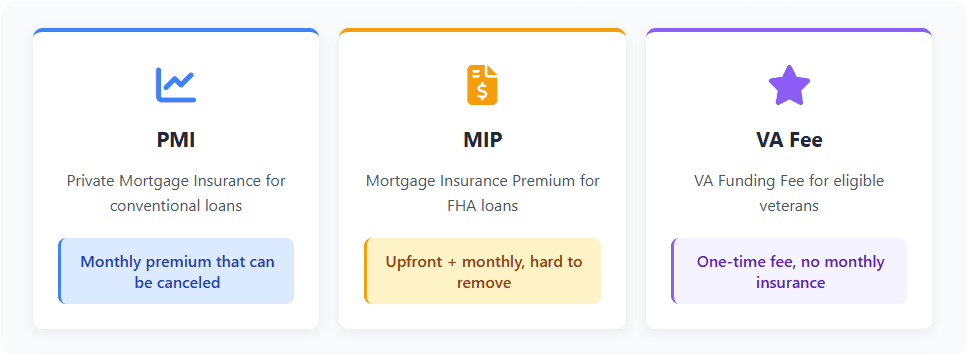

Meet the Players: PMI, MIP & VA Funding Fee - Quick & Dirty

Think of these fees (PMI, MIP, VA Funding Fee) as the unique personalities guarding the gates to homeownership with less cash upfront. Here's the lowdown at a glance:

PMI (Private Mortgage Insurance): The Conventional Loan Buddy

MIP (Mortgage Insurance Premium): The FHA Loan Lifelong Companion (mostly)

VA Funding Fee: The VA Loan's One-Time Gatekeeper (Not Insurance!)

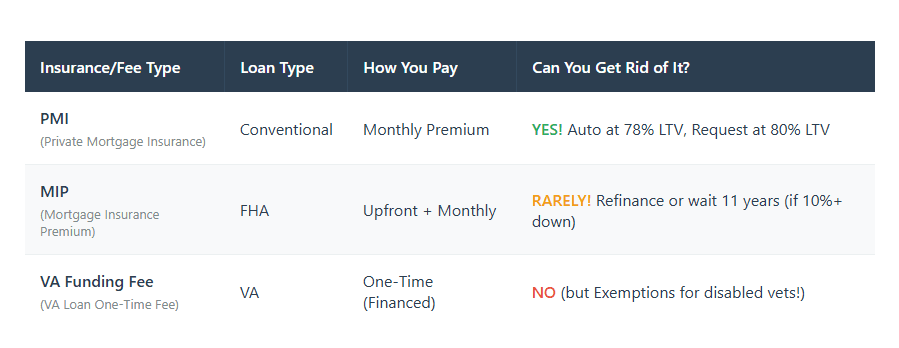

PMI (Private Mortgage Insurance) - For Conventional Loans

This private mortgage insurance (PMI) hangs out exclusively with Conventional loans (those not backed by Uncle Sam). You pay this PMI monthly, adding a little something extra to your mortgage payment. The good news? PMI isn't glued to you forever. You can ditch your PMI! Once you've paid down your loan so you owe 78% or less of your home’s original value (based on the amortization schedule), it automatically falls off. Get antsy? If you think your home's value has shot up, you can ask to cancel PMI when your loan-to-value ratio (LTV) hits 80% – you'll just need a fresh appraisal to prove it. Your credit score and how much you put down play big roles in how much PMI costs you monthly.

MIP (Mortgage Insurance Premium) - For FHA Loans

MIP is the constant companion for FHA loans (government-backed). Paying up involves two hits: a hefty Upfront MIP (currently 1.75% of your loan) rolled into your loan amount plus an Annual MIP (paid monthly, like a slice of that yearly cost every month). Now, the kicker: Shaking off the FHA MIP is notoriously tough. Your main escapes? If you managed a down payment of 10% or more, MIP might finally leave after 11 long years. For everyone else (which is most FHA borrowers), the realistic exit is refinancing out of the FHA loan into a Conventional loan once you have enough equity (LTV ≤80%) and decent credit. Your LTV and loan term dictate your MIP rates.

VA Funding Fee - For VA Loans (It's NOT Insurance!)

Exclusive to the awesome VA loan program for veterans and service members, this VA Funding Fee is a one-time charge. The biggest perk? Zero monthly mortgage insurance payments like PMI or MIP! You pay this VA fee upfront, but cleverly, you usually just finance it into your total loan amount, so you pay it off over time with the mortgage. How much? The VA Funding Fee rate depends mainly on your down payment and your military category (like if you're a first-time user). Big win: Veterans receiving VA disability compensation are completely exempt from paying this funding fee. Putting more money down also slashes the VA fee rate significantly.

Let's put real numbers on PMI costs, MIP costs, and the VA Funding Fee. Imagine a $300,000 loan. How does each fee stack up?

PMI Cost (Monthly):

Say your annual PMI rate is 0.8%. Calculation: ($300,000 x 0.008) / 12 months = $200 per month.

PMI rates dance between 0.46% to 1.50% yearly, heavily swayed by your credit score. Higher score = lower PMI. Simple.

MIP Cost (Upfront + Monthly):

Upfront MIP: $300,000 x 1.75% = $5,250 (added to your loan).

Annual MIP: $300,000 x 0.55% = $1,650 per year, which breaks down to $137.50 per month.

The Sting: Because MIP is so hard to remove, you could be paying that monthly MIP premium for the entire 15 or 30 years of your loan. That adds up fast and makes the long-term MIP cost potentially much higher than PMI.

VA Funding Fee Cost (One-Time):

First-time user, less than 5% down? VA Funding Fee Rate = 2.15%. $300,000 x 2.15% = $6,450.

The Win: You pay this VA fee once (financed), and then... nothing more. No monthly PMI or MIP payment. Zip. Nada.

So, Which Fee "Wins" on Cost? It Depends (PMI vs MIP vs VA Fee):

Short-term owner + Great Credit? PMI often comes out ahead. Your monthly PMI cost is likely lower, and you can cancel it relatively soon as your home appreciates or you pay down the loan.

Credit's a bit bumpy + Planning to stay put? FHA MIP (despite its cost) or a VA loan (if eligible) might be your ticket in the door due to easier qualification, even if the long-term MIP cost is higher.

Qualify for a VA loan? This is frequently the champion for lowest total cost. No monthly insurance premium (no PMI, no MIP) combined with typically lower interest rates is a powerful one-two punch. The VA Funding Fee is a hurdle, but often cheaper long-term than years of PMI or MIP payments.

Breaking Free: How to Cancel or Avoid These Fees (PMI, MIP, VA Fee)

Nobody likes extra fees like PMI, MIP, or the VA charge. Here’s how to fight back:

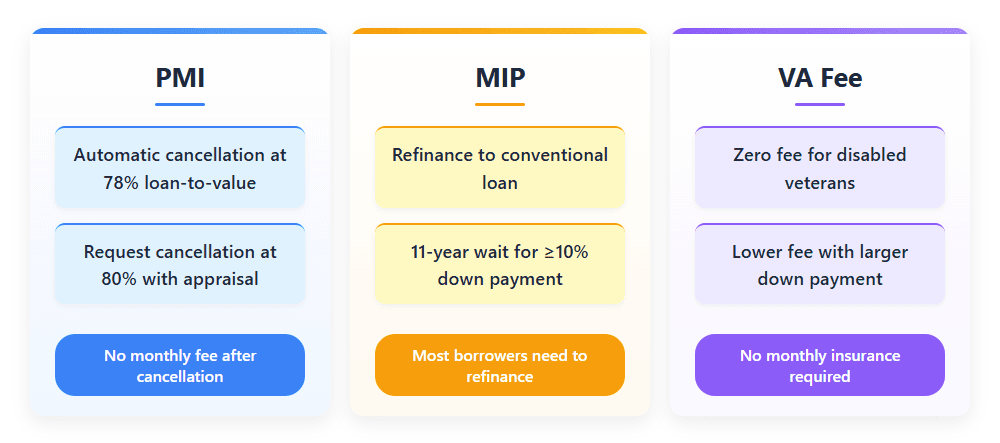

Kicking PMI to the Curb: Your Game Plan

The Automatic Exit: Keep paying on schedule. Once your principal balance hits 78% of your home's original purchase price (based purely on the payment schedule, not current value), PMI must vanish. No action needed.

The Hustle (Request PMI Cancellation): Think your home's value has jumped? When you believe your loan balance is 80% or less of your home's current market value, you can formally request PMI cancellation. You'll need to order a brand-new appraisal (you pay for it) proving the value, show you're current on payments, and likely prove there's no second mortgage messing with the numbers. Worth it to ditch that monthly PMI bill!

Escaping the FHA MIP Trap (It's Tough!)

Refinance: The Main Escape Hatch. This is how most people ditch MIP. Once your credit score improves and you have at least 20% equity (LTV ≤80%) in your home, refinance into a Conventional loan without mortgage insurance (no PMI needed). It costs money upfront (closing costs), but saves you the monthly MIP.

The Long, Long Wait (Rarely Used): If you somehow managed a 10% or larger down payment on your original FHA loan, MIP might finally disappear after 11 years of on-time payments. For the vast majority with smaller down payments? MIP sticks around for the full loan term unless you refinance. Ouch.

Trimming or Dodging the VA Funding Fee

Total VA Fee Exemption: If you're a veteran receiving VA disability compensation, you pay ZERO VA Funding Fee. Huge win.

Lower the VA Fee Rate: The less you borrow (i.e., the bigger your down payment), the lower your VA Funding Fee percentage. Putting down 10% or more slashes that fee significantly compared to minimal or zero down. It’s a direct trade-off: more cash upfront saves you on the VA charge.

Top 3 Burning Questions (PMI, MIP, VA Fee Answered!)

Q: Wait, is MIP just another name for PMI?

A: Nope! Don't let the similar acronyms fool you. PMI (Private Mortgage Insurance for Conventional loans) is the one you can usually cancel fairly easily. MIP (Mortgage Insurance Premium for FHA loans) is the clingy one that’s much harder to shake off and often sticks around for the life of the loan. Big difference between PMI and MIP!

Q: Do VA loans sneak in monthly mortgage insurance too (like PMI or MIP)?

A: Absolutely not! That’s a massive perk of the VA loan. You pay the one-time VA Funding Fee (which you can finance), and then you’re done. No hidden monthly PMI or MIP premiums lurking in your payment. Ever.

Q: Okay, WHEN can I actually cancel PMI or MIP?

A: For PMI: Get proactive when you hit 80% LTV (current value) or relax and wait for the automatic drop at 78% LTV (original value). For MIP: Honestly? For most folks, only by refinancing into a different loan type (like Conventional) once you hit 20% equity. The 11-year rule requires a big 10%+ down payment upfront, which isn't common. Plan on refinancing being your main exit strategy from FHA MIP.

People Also Read

- FHA Upfront Mortgage Insurance (UFMIP) Explained (2025): Cost, Payment, and Rules

- FHA Monthly Mortgage Insurance Rate (MIP) in 2025: Costs & Calculation

- How to Remove MIP from Your FHA Loan:Rules,Refinancing,Strategies

- Current FHA UFMIP Rate 2025 Explained: Upfront Mortgage Insurance, MIP Removal & Refund Guide

- How to Pay off Mortgage Faster? Pros, Cons, and 7 Ways for You