Do I Need 20% Down to Buy a Second Home? The Reality Check

Let’s cut straight to the chase: While 20% down is often the preferred benchmark for second home mortgages, labeling it the absolute "standard" paints an incomplete picture. Lenders do favor that hefty chunk upfront – it slashes their risk on a property you won't occupy full-time and signals your financial muscle. But crucially, qualified buyers frequently secure loans with significantly less. That dream cabin or coastal escape might be within reach even without a full 20%. Buckle up, let's clarify the real landscape.

People Also Read

- Quick Second Mortgage Loan in 2025: Fast Home Equity Loans & HELOCs Explained

- 2nd Mortgage Rates 2025: The Complete Guide to Saving Money

- Second-Time Home Buyer Loans: Your Smarter Path to the Perfect Upgrade

- Apply for a Second Mortgage Online: Fast Approval, Paperless Process and Bank-Level Security

- Second-Time Home Buyer Mortgages: Requirements, Programs & Strategies

Why Lenders Love 20% Down (But It's Not Always Mandatory)

Think of 20% as the VIP pass at the lender club. Why the enthusiasm?

Dodging PMI (Private Mortgage Insurance): This pesky fee (typically 0.5%-1.5% of your loan annually) kicks in on conventional loans with less than 20% down. It protects the lender, not you. Hitting 20% erases PMI, saving you a small fortune over time.

Unlocking the Sweetest Rates: Lenders reward that big down payment with lower mortgage rates. More skin in the game equals less risk for them, translating to savings for you. Over decades, even a fraction of a percent difference is huge money.

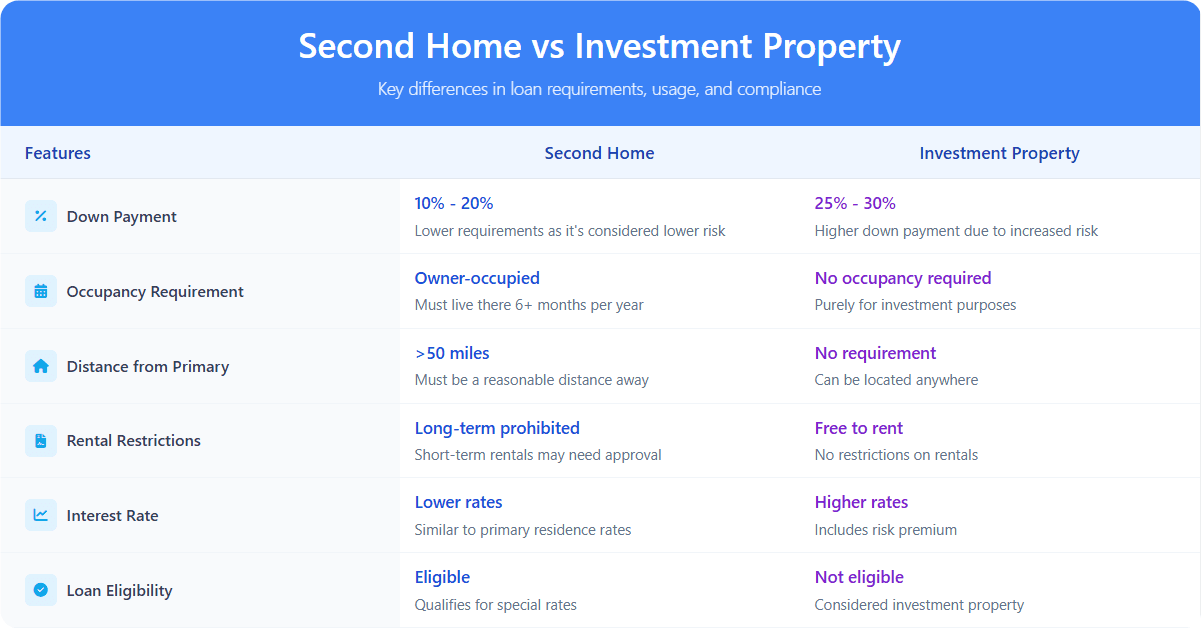

It also helps solidify your property as a true "second home" (owner-occupied vacation spot) versus an investment property, which often demands 25%-30% down. So yes, 20% down is the gold-plated, most cost-effective route. But is it the only route? Absolutely not.

Can You Buy a Second Home With Less Than 20% Down? (Yes, More Often Than You Think!)

Breathe easy. That 20% figure isn't a brick wall. Doors do open for well-prepared buyers. How?

Conventional Loan Minimums: Lower Than You Might Expect

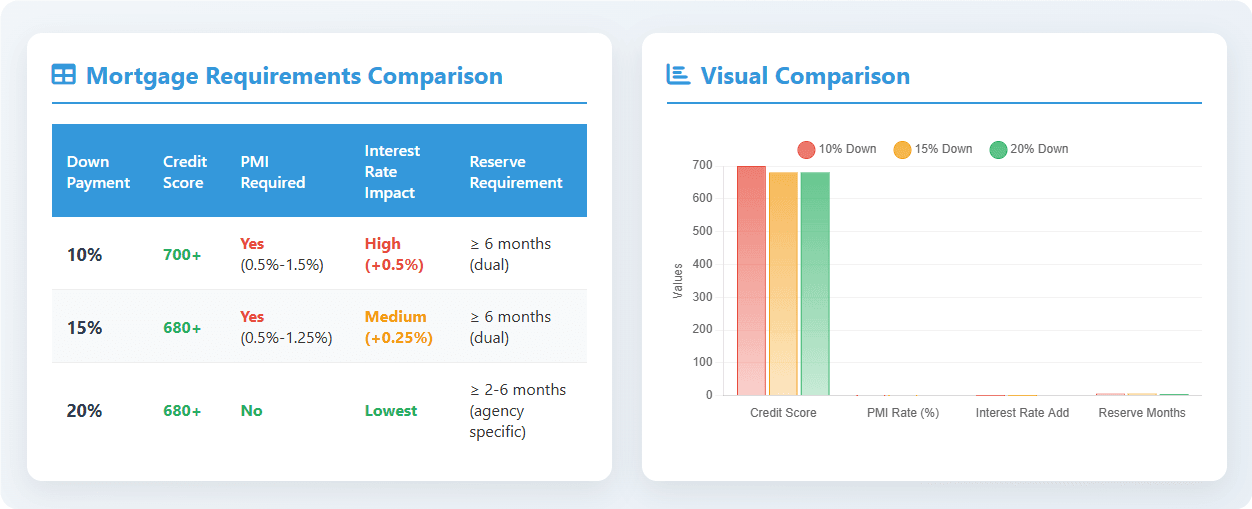

Here's where clarity is key: For conventional loans backed by Fannie Mae or Freddie Mac, the minimum down payment for a second home can be as low as 10%. Don't think of this as a rare "exception" – it's a viable, documented path for qualified applicants.

The Requirements: To land that 10% (or even 15% down) approval, you'll need strong credit (typically 680+ score), a disciplined Debt-to-Income ratio (DTI often under 36%), and crucially, the property must be a single-unit dwelling and you must occupy it personally. Forget rental plans upfront – this is about your enjoyment.

Automated Underwriting (AU): Systems like Freddie Mac's Loan Product Advisor (LPA) or Fannie Mae's Desktop Underwriter (DU) will assess your application and can approve loans with 10% or 15% down based on your overall strength. It's not about gaming a specific "finding" – it's about meeting the program criteria holistically.

Beyond Conventional: Flexible Paths for Lower Down Payments

If the big agency box feels tight, explore lenders with their own rulebooks:

Portfolio Loans: These lenders keep the loan "in-house." This freedom can allow down payments of 10% or 15% on second homes, sometimes with more flexible credit or DTI views. Trade-off: Expect higher interest rates to compensate for the lender's increased risk. Shop very carefully.

Gift Funds: Generous family can be a game-changer. They can gift you part or all of your down payment (even below 20%). Non-negotiable rules: It MUST be a documented, no-strings-attached gift (letter required!), from an acceptable source (usually family). You cannot borrow this money.

Critical Requirements Beyond the Down Payment (The Real Hurdles)

Scraping together the down payment is step one. Lenders will dissect your entire financial life for a second home loan.

Credit Score & Debt-to-Income Ratio (DTI): The Gatekeepers

Credit Score: Forget primary residence minimums (like 620). For second homes, expect lenders to demand a minimum score of 680+, with 740+ for the best rates. Polish that credit!

DTI: Your total monthly debts (including the new mortgage) divided by gross income needs to stay firmly below 43%, often lower for optimal terms. High DTI is a major red flag.

Reserves: The stealth requirement: cash reserves. Lenders want proof you have liquid assets (cash, stocks) left after closing to cover 6 months of mortgage payments for BOTH your primary home and the new second home. This is your essential safety net, especially critical if putting down less than 20%.

Defining "Second Home": Avoid the Investment Trap

Misstep here, and you face investment property rules (25%+ down) or denial. Lenders have iron-clad criteria:

Personal Use: You must personally occupy the home for a significant portion of the year (commonly interpreted as more than 6 months annually). Be prepared to demonstrate intent.

Distance: The second home generally needs to be a reasonable distance from your primary residence (often at least 50 miles). That downtown condo 5 miles away? Unlikely to qualify.

Rental Restrictions: Long-term rentals are strictly prohibited for a true second home classification. Occasional short-term rentals might be possible with explicit, upfront lender approval and disclosure, but attempting to sneak rentals risks loan fraud accusations.

Costs & Risks of a Low Down Payment Second Home (Know the Price Tag)

Choosing less than 20% down comes with tangible costs:

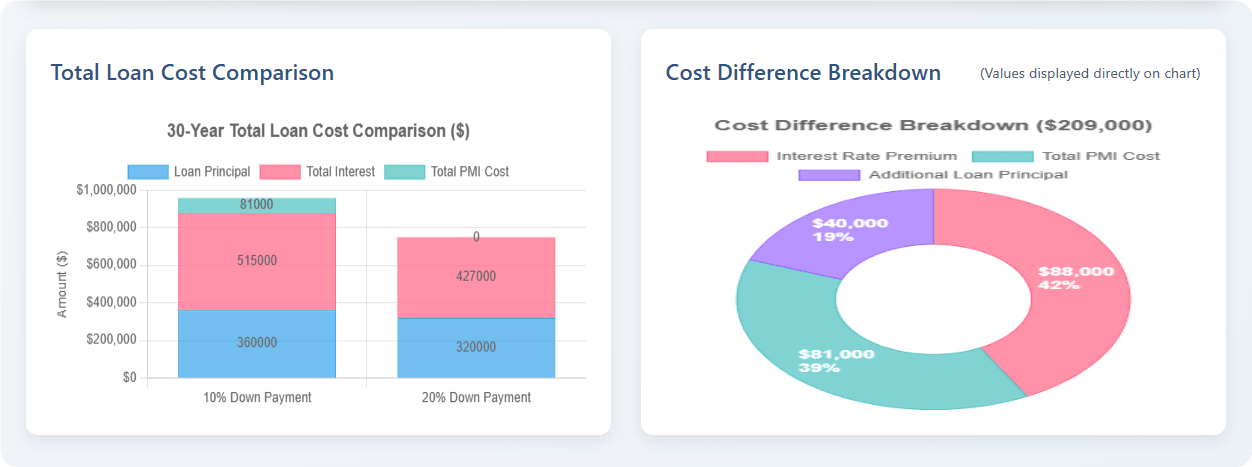

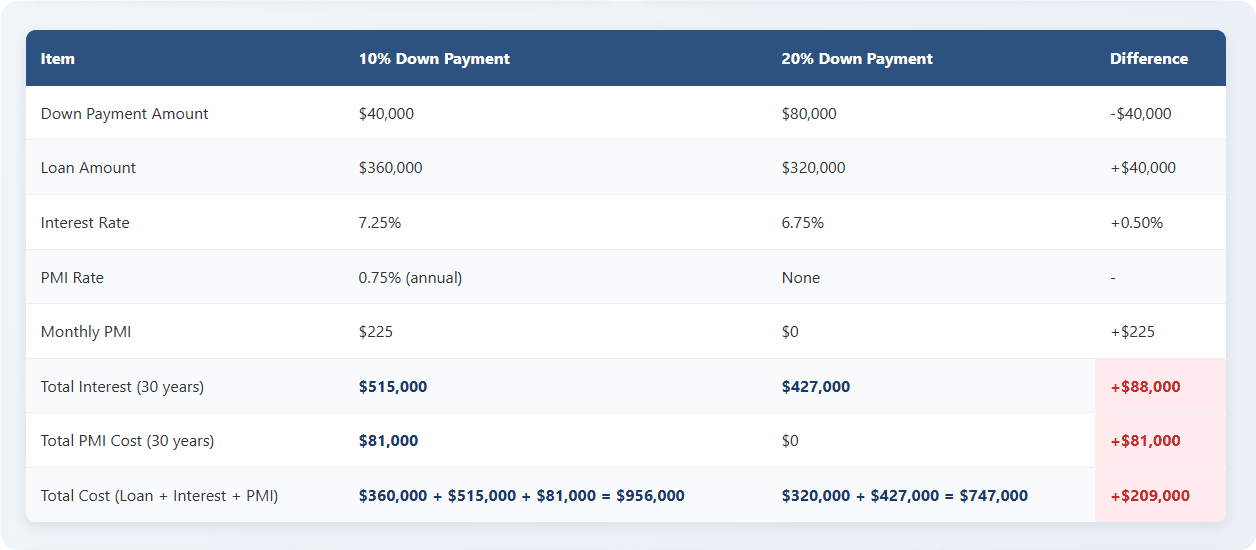

Mortgage Insurance (PMI): Putting down 10% or 15% means PMI. Expect monthly fees adding 0.5% to 1% (or more) of your loan annually. On a $400,000 loan, that's $167-$333+ extra every month, vanishing into thin air.

Higher Interest Rates: Lower down payments signal higher risk. You'll likely pay a rate premium of 0.25% to 0.5% (or more) compared to 20% down. This compounds massively over time.

Closing Cost Pressure: While not directly tied to down payment %, stretching cash thin upfront can make covering standard closing costs (appraisal, title, fees) significantly harder.

Pro Tips: Smart Paths to Your Second Home Mortgage

Strategize wisely, especially if 20% feels steep:

Strategy 1: Rent Your First Home to Fuel Affordability

Keeping your current home? Renting it out can be powerful. Documented rental income can offset the new mortgage, making you far more attractive to lenders – potentially easing the down payment burden. Crucial: Lenders require proof! A signed lease or landlord experience history is usually needed to count most (often 75%) of the projected rent as qualifying income. Plan early.

Strategy 2: The Future Primary Residence Route (Handle With Extreme Care!)

Is the "second home" truly your next main residence within a very short timeframe? FHA loans (3.5% down) become an option ONLY if you intend to occupy it as your primary residence within 60 days of closing and live there for at least one year. This is NOT a casual loophole.

Critical Requirements: You MUST have a documented, legitimate reason for the move (new job, family necessity) and a credible plan. Failure to meet the occupancy timeline constitutes loan fraud, with severe consequences. Only pursue this if the move is genuine and imminent. Disclose everything upfront.

The 20% Ideal vs. Your Achievable Path

Let's crystallize the answer to "Do I need 20 down to buy a second home?": Aiming for 20% down is financially savvy – it minimizes costs and maximizes lender love. But declaring it the universal "standard" is misleading. The reality? Qualified buyers with strong credit (680+), low debt (DTI < 43%), ample reserves, and a clear plan for personal use regularly secure financing with 10% or 15% down through conventional or portfolio loans.

The answer hinges entirely on your unique financial profile. Stop guessing. Get pre-approved. This reveals exactly what you qualify for (down payment, rate, terms). Crucially, shop multiple lenders – especially local/regional ones offering portfolio loans. Your dream escape might be far closer than that 20% figure suggests. Ready to discover your path?